|

Getting your Trinity Audio player ready...

|

Mr. Musk,

Please join us at the only Bitcoin conference with a focus on scaling and efficiency: CoinGeek Conference New York on October 5-7.

You are one of the most controversial public figures today. Your vision for the future has long been harpooned by critics as an impossible set of dreams put forth by a man obsessed with the folly of renewable resources, green tech and general buzzwordiness on social media. But the reason for that is because of the utter lack of vision from the mainstream companies to innovate outside of a careful set of socially enforced norms.

You are not, however, the most controversial man in tech. Since 2008, that title has rested on Satoshi Nakamoto. Since the day the white paper dropped on Halloween of that year, critics told him that Bitcoin was impossible. The posited that it could not get past the problem of malicious actors going so far as saying that “distributed consensus was impossible” according to the most influential CTO in the history of Bitcoin—a hacker named Gregory Maxwell.

But Satoshi persisted that Bitcoin was not only sufficient, but desirable to be a global cash system and general purpose development platform for tokenization, smart contracts and even things like “pay-to-send email” as a SPAM mitigation concept tied closely to Bitcoin’s proof of work.

If someone famous is getting more e-mail than they can read, but would still like to have a way for fans to contact them, they could set up Bitcoin and give out the IP address on their website. ‘Send X bitcoins to my priority hotline at this IP and I’ll read the message personally. – Satoshi Nakamoto to the Cryptography Mailing List. January 16, 2009.

Most importantly, Nakamoto declared that Bitcoin “never really hits a scale ceiling.” And it’s this line that BTC developers, advocates and infrastructure partners have treated as a heresy from Bitcoin’s creator, leading to years of cancel culture, revisionist history and subterfuge to the point that Bitcoin’s scale didn’t even begin to be tested until late 2017 when the first network running the Bitcoin protocol would accept blocks larger than 1MB.

I’ll spare you the gritty details of the Bitcoin Civil War except to say that every implementation of Bitcoin has stringent limits except for BSV. BTC can only broadcast 6mb of data per hour globally, for example, but BSV has no hard-coded limit which allows it to be extensible into the real economy.

Green Bitcoin

Bitcoin (and most altcoins) was designed to be a transaction network secured by proof of work, but it has grown to have a reputation for being wasteful and inefficient. This is true of BTC, but only because of implementation decisions—not inherent protocol inefficiency.

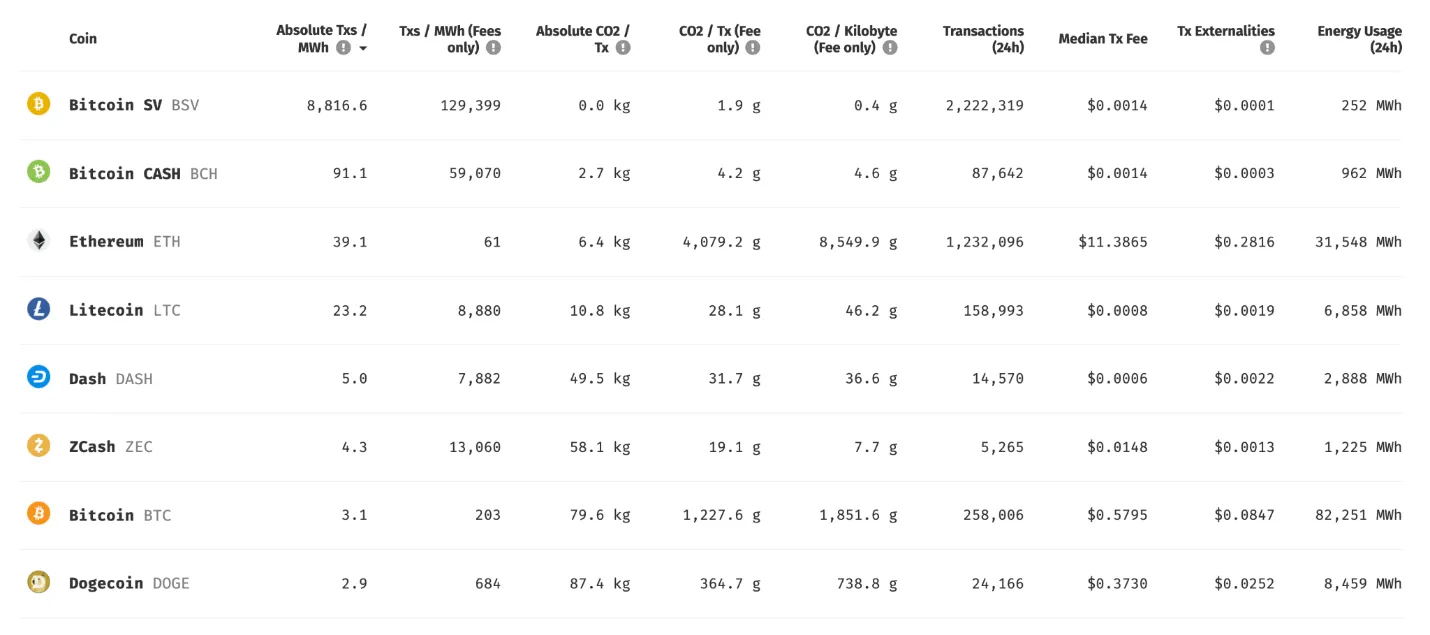

Bitcoin SV (or BSV for short) is an unlimited implementation of Bitcoin which allows the highest throughput of transactions per megawatt in the entire blockchain space. With no perceptible scaling ceiling, the network is capable of at least 50,000 transactions per second secured by proof of work, and likely much more as time goes on. This week, the network is averaging nearly 9000 transactions per megawatt hour and over 2 million transactions per day with a median transaction fee of $0.0014.

Contrast that with BTC at about 3 transactions per megawatt hour, 250,000 transactions per day and a median transaction fee of $0.58, and Doge at about 3 transactions per megawatt hour, 25,000 transactions per day and a median transaction fee of $0.37.

Very quickly, it becomes clear that in raw transactions, BSV is able to conduct significantly more business per megawatt hour than its competitors.

Additional, exclusive benefits

On top of general transactions, BSV also has a flexible, Turing complete stack inherent to the original protocol (deprecated in BTC) which allows the deployment of commercial applications on the network. This includes things like NFTs and other tokens, “smart contracts” and other complex functions that don’t yet have buzzwords in the blockchain economy. Such a flexible economic tool adds to the value that can be created per megawatt hour while enabling businesses as diverse as UNISOT (supply chain), CryptoFights (eSports), EHR Data (healthcare record management) or Twetch (consumer social media) which are all serving different sectors of the economy with business models that are only possible on BSV.

Conclusion

There is no reason to build on any other blockchain. Given your influence and position in the market, anything that you decide should be done with a blockchain would be adopted across the ecosystem that you represent as an executive and a thought leader—instantly bringing in interest and collaborators. But the difference with BSV is that there is no need for a roadmap. No need for some new thing to come to BSV. If you want to build a blockchain idea and have it scale elastically as demand comes in, BSV is the only network that won’t require a major overhaul at some point in the future to deal with demand. You can build it once and rely on it forever.

If you would like to learn more, I ask you again, please join us at the only Bitcoin conference with a focus on scaling and efficiency. CoinGeek Conference New York on October 5-7.

09-18-2025

09-18-2025