|

Getting your Trinity Audio player ready...

|

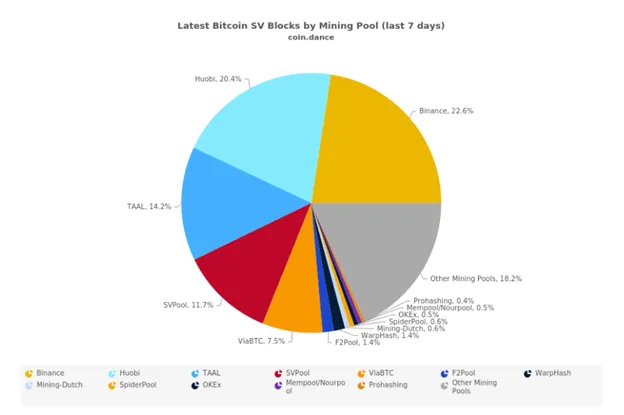

Lately block reward winners have been quite diversified on the Bitcoin SV ledger.

Much has been made about Binance’s pool having majority hashrate of a coin’s chain they delisted from their exchange last April. While this was surprising to some, it should not be if Satoshi’s vision for Bitcoin is understood.

Large, upfront, illiquid capital investments are required to have significant SHA-256 hashrate, large enough that the operators cannot afford to play political games in terms of which coin(s) they choose to mine.

Changpeng Zhao, CEO of Binance, was forced to admit this on Twitter a few weeks ago:

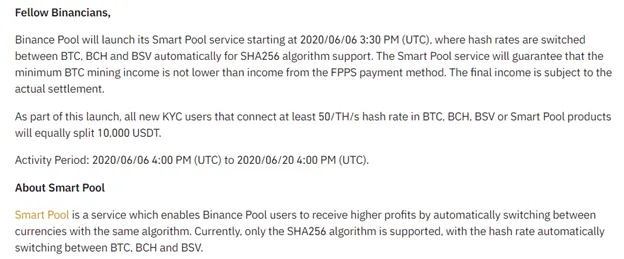

More details on their position can be viewed on Binance’s blog, where they state that they switch chains based on a profit calculating algorithm—which just makes sense.

What does not make sense is given that Binance is a top digital currency exchange, they do not support a top 5 coin in market cap (excluding the stablecoin Tether).

Imagine being a "crypto service provider" and not supporting a top 5 coin..🙃

— ella 🐻⛓️ (@ellaqiang9) January 14, 2020

In an interview in July 2017, Andrew DeSantis stated that it is logical for exchanges to mine since the liquidity for the exchange could come from their own mining pools.

Given this concept, it is quite silly for Binance to not list BSV when they could earn from trading fees as well as have a more secure means of making markets on their own platform.

Similarly, BCH proponent Roger Ver, who badmouths BTC on a daily basis mines BTC anyway.

He also has a negative view on BSV, claiming the chain “Engages in preemptive censorship.”

The main discussion platforms for the three flavors of Bitcoin:#BitcoinCash: Strongly supports free speech#Bitcoin: Strongly supports censorship#BitcoinSV: Engages in preemptive censorship

— Roger Ver (@rogerkver) July 5, 2020

Well it turns out Roger and other persistent BSV critics do indeed mine the ‘altcoin.’ Per nChain’s CTO Steve Shadders over the last month “we’ve seen the arrival of a lot of pools that are not very BSV friendly.”

Below is the list of different miners who have readable coinbase strings who have won blocks over the last 17 months (~72,000 blocks):

Notably are the presence of various BCH supporters (Antpool, Bitcoin.com, gtoomim.bros) who despite the alleged ‘preemptive censorship’ and supposed ‘permissioned mining’ have won recent blocks.

Did Roger Ver, Jihan Wu and Jonathan Toomim ask Craig Wright if they could mine BSV beforehand?

Furthermore, it appears that coin.dance does not identify miners accurately. Shadders also stated “…as the unknown rate is more like 5-10% than the 30% they typically show (users)… It also tells us that BSV mining is a lot more diversified than (the) detractors would have us believe….”.

While the fixed block subsidy remains the overwhelming portion of the reward, miners are slave to the price of the various coins. They simply cannot afford to play politics in lieu of profits. If a chain is profitable to mine, they will mine it regardless of ‘Aussie man bad’, what crypto-Twitter says or even in spite of their own statements.

As Satoshi wrote 10 years ago,

“I’m sure that in 20 years there will either be very large transaction volume or no volume”.

The implication is that one chain will scale, be profitable to mine and used in global commerce or none. With this inevitable outcome, the entrepreneurial miners must join on the most profitable chain or face bankruptcy. An analogy is that citizens who despise their own nation’s leader still use their state currency. Money is and must be apolitical—Bitcoin’s fate is the same.

07-27-2025

07-27-2025