|

Getting your Trinity Audio player ready...

|

Devs propose yet another layer to save the legacy chain.

Correction: Jameson Lopp’s analysis of the Lightning Network were incorrectly interpreted in the original post. These have been removed.

How the Lightning Network works

In the Lightning Network—Bitcoin Core’s scaling solution of choice for the legacy chain, users do not transact on the blockchain directly. Two users open a “payment channel” and transact through that channel or second layer (Lightning Network) on top of the blockchain. The only time anything is recorded on the blockchain after opening this payment channel is when these two users are done transacting for the time and “close” the payment channel, at which point the final balances of the two parties are recorded on the blockchain, using it only as a “settlement layer.”

Such a system would off-load regular transactions between two parties to the Lightning Network and take off some of the load from the blockchain. It also saves users from having to pay transaction fees over and over. But this only works economically if the two users intend to have multiple or repeating transactions, otherwise, they’re better off just transacting on-chain for one-time transactions. Why?

For a one-time transaction with a user who does not have a direct connection or open payment channel with you, one can pass through or “hop” through their connections’ channels or “branches” to get to their intended recipient—provided that each of the users between you have enough balance to pass on the funds. It’s not as simple as money passing from one hand to another, however. It’s actually a simultaneous handoff: the person who has an open channel with the intended recipient has to send him the funds and sort of get “reimbursed” the exact same amount from the original sender.

Imagine a row of people and I’m trying to pass $100 to a person sitting five people away from me to my right. Instead of asking people to simply pass my $100 bill to him, each person between us will have to take out $100 from his own wallet, and simultaneously pass it on to the person to their right while also receiving $100 from the person to their left. They all end up with $100 except for me, the original sender.

So in such a scenario, a user is better off saving himself the trouble and just transact on-chain, since they would still need to “open” and “close” a channel—both instances would take time on the legacy chain to be confirmed, as opposed to simply sending their funds directly to each other and just having to wait once for that transaction to be confirmed, paying only one transaction fee as well.

Lightning Network can’t scale on 1Mb blocks

In mid-2017, Electron Cash wallet developer Jonald Fyookball posted a mathematical proof debunking the Lightning Network as a decentralized scaling solution.

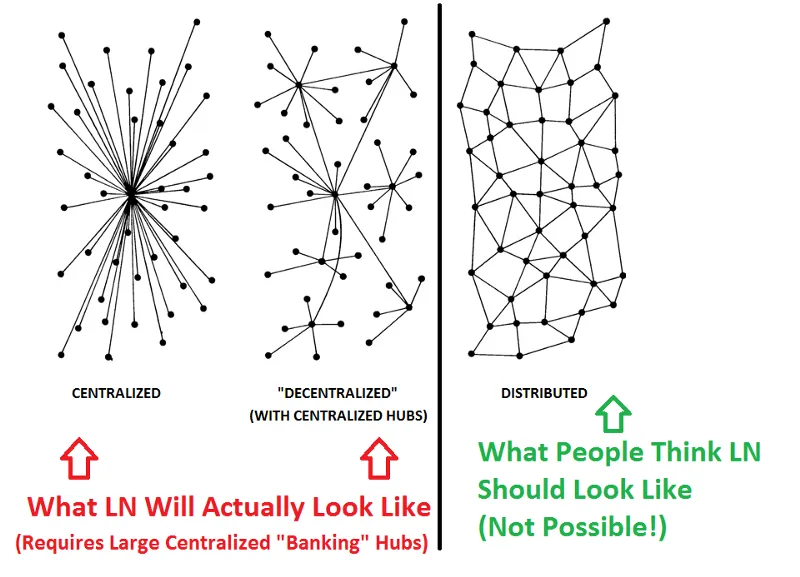

According to his post, at one million users LN becomes an “unworkable system,” where the only way it could work is either everyone deposits more money than their anticipated transactions into the channels (so they can also route other users’ transactions), or everyone relies on large centralized hubs.

“To reach anyone in a big network with a series of branching channel connections, you either need a large number of channels, or a large number of hops.

Both are a huge problem. A large number of channels means users have to divide up their funds and can’t do anything except tiny purchases. And a large number of hops means everyone’s money will be tied up routing everybody else’s money.”

Jonald Fyookball cites Lightning Network’s promise as a scaling solution:

“using a network of these micropayment channels, Bitcoin can scale to billions of transactions per day”

And goes on to say that the promise fails to mention a major detail:

“What it doesn’t tell you is that this can only be accomplished by using large, centralized ‘banking’ hubs.”

Since then, a simulation of LN with 10 million users has been conducted, and it shows that it is technically possible—but it would require 200 million channels and at least 1,400,000 BTC locked up in the payment channels for routing at a given time. But if there are more transactions going on, more funds would need to be locked up. And some argue that the longer the routes are, the more vulnerable it is to attack.

The case for Lightning Network is further weakened by this problem: Blockstream core tech engineer Christian Decker himself admitted that there is a limit to the number of payment channels that can be made on top of the legacy chain, which ultimately renders Lightning Network’s promise (above) false.

Talking about how many payment channels can be built on the legacy chain’s 1Mb per block limit, he wrote:

“It turns out, it’s not that many. It’s a few million every week, which is still a long ways from serving the full Earth’s population.”

Moreover, Lightning Network does not relieve the skyrocketing transaction fees, as Decker’s message to the mining community reveals. In his effort to appease miners, Decker committed the same fatal error majority of HODLers are guilty of: he simultaneously alienated users by focusing on high profits in fees for the miners—which will be coming out of users’ pockets.

In case many have forgotten, these users are the entire population Bitcoin was made to primarily serve.

Lightning does not reduce the fees that the miners may collect, it increases their reach into transactions that they could not otherwise serve.

The transaction fees are high because an on-chain payment requires a lot of resources, i.e., storage, processing and bandwidth. These applications suddenly become possible with L2 protocols, so this adds to the reach of Bitcoin itself.

…On the other hand Lightning requires strong guarantees that the transactions will be settled in a certain timeframe, for its security. Hence, Lightning will always attach higher than average fees to the on-chain transactions for setup and settlement of its channels. This is okay since coins on these channels may have been transferred hundreds if not millions of times back and forth, so the these high on-chain fees have been amortized over time, and we happily pay them.

With the (1) extension of Bitcoin’s reach and (2) the higher than usual fees for setup and settlement, I’m absolutely convinced that miners will have a net gain when Lightning rolls out. Lightning is not cutting into the miner’s profit, it opens up new possibilities. Christian Decker on the mailing list.

In the message above, he goes on to explain why transaction fees are high. Although it’s hard to justify how storage, processing and bandwidth (plus electricity) that blockchains incur would trump the expenses of the traditional banking industry and lead to equal or even higher transaction fees. And it definitely defeats the main purpose of the blockchain—quick, cheap, trustless transfers.

Still no block size increase, but an entire additional layer—and the same high fees (possibly more)

Instead of conceding to the need for both on and off-chain scaling, Core devs are persistent in doing everything and anything but upgrade the core infrastructure—the blockchain that is the backbone of all these.

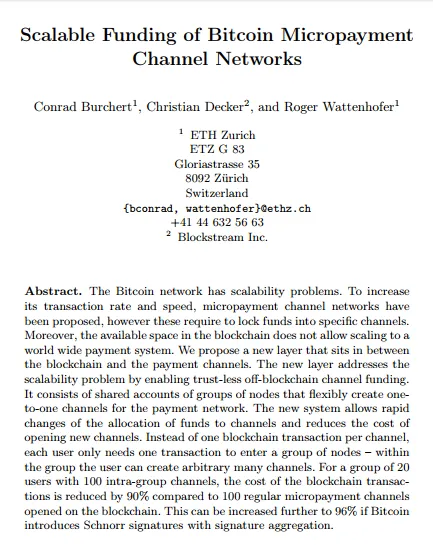

To solve the problem, Decker along with ETH Zurich researchers Conrad Burchert and Roger Wattenhofer released a new paper, proposing an entire new layer to be added between the legacy chain and Lightning Network, bumping LN from being “layer 2” to being “layer 3.” And this new layer would supposedly enable up to 15 users to be in the channel so any two of them can transact on the now higher layer, Lightning Network.

In a Medium post, security researcher Egor Homakov criticizes the Lightning Network (LN) and its Ethereum counterpart, the Raiden network. According to Homakov, although the Lightning Network is definitely not vapourware, the economic incentive to use Lightning Network is in fact, non-existent.

With Bitcoin’s original protocol, as Dr. Craig Wright wrote in his paper, Proof of Work as it relates to the Theory of the Firm, the security mechanism is not just cryptographic but economic. There is economic incentive to use the system and keep it secure, whereas attacking the system is too expensive and has very little benefit. To amass enough hash rate for a 51% attack, one has to spend billions of dollars on processors, electricity, and other overhead expenses, and will gain very little from the attacks they can instigate. Most importantly, if someone theoretically was willing to spend billions of dollars to gain that percentage of the network, it would be exponentially more profitable to just use that hash rate to mine the Bitcoin blockchain rather than attack it. Efficiency and security in the Bitcoin blockchain (or its original state, at least) results in bigger rewards for miners. It is this economic incentive that helps direct the motivations and actions of actors within the Bitcoin ecosystem, and therefore keep the blockchain secure.

We have yet to delve into the entirety of the new layer proposal—what the topology of the legacy chain will look like with the new layer—because it most definitely will not look anything like the distributed, peer-to-peer network envisioned in the original Bitcoin white paper.

Ultimately, from a mass adoption point-of-view, the main thing that matters is how fast this process is, how secure, and how much it costs. On top of that, how soon will all this be deployed? With several blockchains and cryptocurrencies on the race, every month of delay makes a huge difference.

08-08-2025

08-08-2025