|

Getting your Trinity Audio player ready...

|

This post originally appeared on Data Finnovation’s Medium account. Read the full piece here and follow them on Twitter.

This is a long-form version of two Twitter threads. This is not an ELI5—this relies on primary sources and analysis thereof. Sorry if that makes it a bit more complex but given the nature of the problem and reliance on a lot of original research it’s important to get a properly-sourced version out there.

The executive summary is: It looks like DCG and 3AC were engaged in some kind of scheme to extract value from the GBTC premium. This provided massive leverage for 3AC which they encashed and used to fund a wide range of things. It also generated a lot of short-term profits for DCG via fees. But 3AC was wildly leveraged and they appear to have gone insolvent over the Terra-Luna weekend. The epic losses from this blowup are only starting to be felt. And GBTC may be the center of bigger trouble.

Amazing similarities between 3AC sales of GBTC and DCG purchases:

– 3AC accumulated position while, simultaneously, pledging the shares to Genesis

– DCG started buying

– DCG’s buys match 3AC’s unpledged amount that somehow was soldWTF

— Data Finnovation (@DataFinnovation) July 22, 2022

This thread introduces the idea 3AC and DCG were maybe working together.

Genesis, 3AC and more coincidences

This, if true, explains so much of the last 5 years!

— Data Finnovation (@DataFinnovation) July 23, 2022

This thread analyzes Genesis in detail and finds likely Genesis-GBTC activites too.

Everything here is based on public information. It appears either nobody read these things before, or nobody understood what to do. But at the same time this is speculation. But it is informed, primary-source-backed speculation. Absolutely nothing here comes from anonymous sources or insiders. All of the source material is free to download for anyone. This may be totally wrong. It is merely an attempt to apply Sherlock Holmes’ methods to some weird problems.

DCG owns Grayscale and Genesis. Grayscale issues/manages/etc the GBTC fund which they are desperately trying to turn into an ETF. And Genesis provides borrowing and lending services, among other things, on BTC and GBTC and USD.

GBTC is a U.S.-registered security. Genesis is a U.S.-registered broker-dealer. This means two key things:

- We are talking about securities here, with 100% certainty.

- Both companies file lots of documents with the SEC

3AC just blew up. Prior to their bankruptcy filings we had no idea what was going on side 3AC. But now, thanks to an 1157 page court document and a range of other shrapnel, we have a lot of visibility.

So let’s take it in turn. Start with some info about GBTC. Then what was 3AC doing. And what was Genesis doing. And finally WTF was happening overall.

GBTC

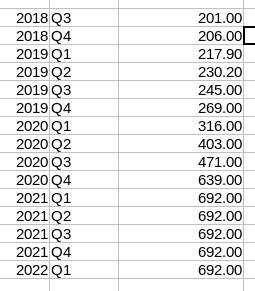

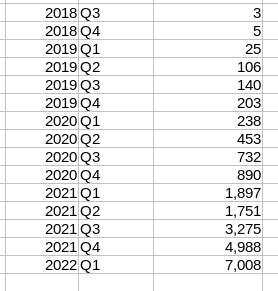

The Grayscale Bitcoin Trust submits many documents to the SEC. From there we can work out the historical share counts:

Share counts in millions. 1 share = 0.001 BTC. So 1 million shares = 1 thousand BTC.

Grayscale is owned by DCG. And DCG has been buying shares of the trust for some time.

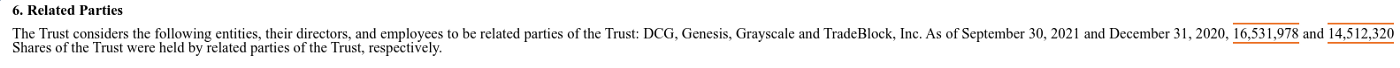

Grayscale filing extract showing DCG-affiliates own many shares.

And they even disclose when they buy:

We can see DCG bought 15 million shares between March 2021 and Jan 2022. And then about 3 million more between February and March 2022.

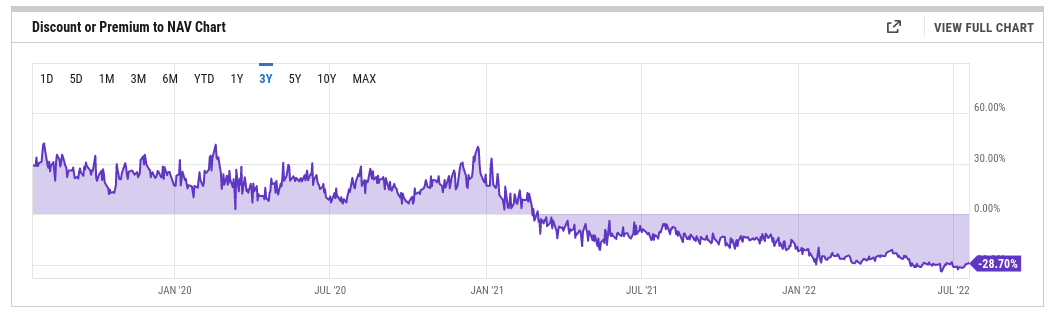

Also during this time period the GBTC price went from a premium to a discount:

When it is trading at a premium you can create shares with Bitcoin—rather than USD—and make money. When it is trading at a discount you can’t do that anymore. And, famously, you cannot take your Bitcoin out of the trust.

Lastly, GBTC is a registered security. In the U.S. if you own more than 5% of such a thing you need to file a form to disclose that. Based on the outstanding share counts above here are four reporting threshold levels for different dates. The importance of these dates will be clear shortly:

- 31-Dec-2019: 13.45 million

- 2-Jun-2020: 16.763 million

- 31-Dec-2020: 31.95 million

- 31-Dec-2021: 34.6 million

So much for GBTC now.

3AC

Three Arrows Capital was very long this security. Here are the key facts:

- 3AC did not file a holdings report for 31-Dec-2019 so they owned less than 13.45 million shares as of that date

- 3AC did file for 2-Jun-2020 for 21 million shares

- 3AC also filed for 31-Dec-2020 39 million shares

- 3AC did not file for end 2021 so they were below the threshold

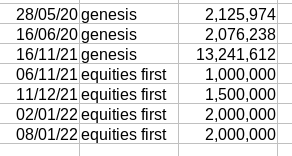

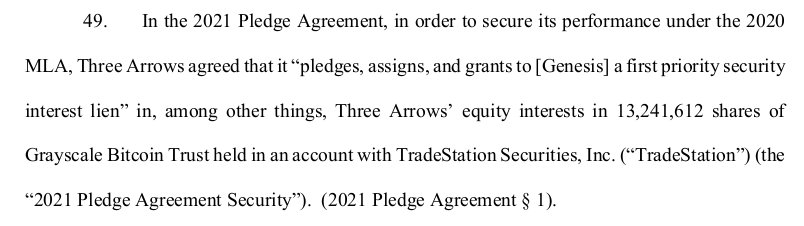

This of course assumes 3AC followed the 13G rules properly. But they appear to have filed and, as discussed below, used a bog-standard U.S. broker so subterfuge was not really an option anyway. They also:

- Pledged 2 million to Genesis for a loan on 28-May-2020

- Pledged 2 million more to Genesis on 16-Jun-2020

- Pledged 13 million more to Genesis on 16-Nov-2021

- Pledged 6.5 million to Equities First from late 2021 to early 2022

And now their holdings are all gone. Those pledges were liquidated and it appears all their other shares were sold. We know this from the bankruptcy filings.

At this point we have absurd coincidence #1: 3AC sold 15 million shares during a period where DCG bought somewhere between 15 and 18 million shares. If these are arms-length operations that feels exceptionally unlikely. It is possible. But come on.

Genesis

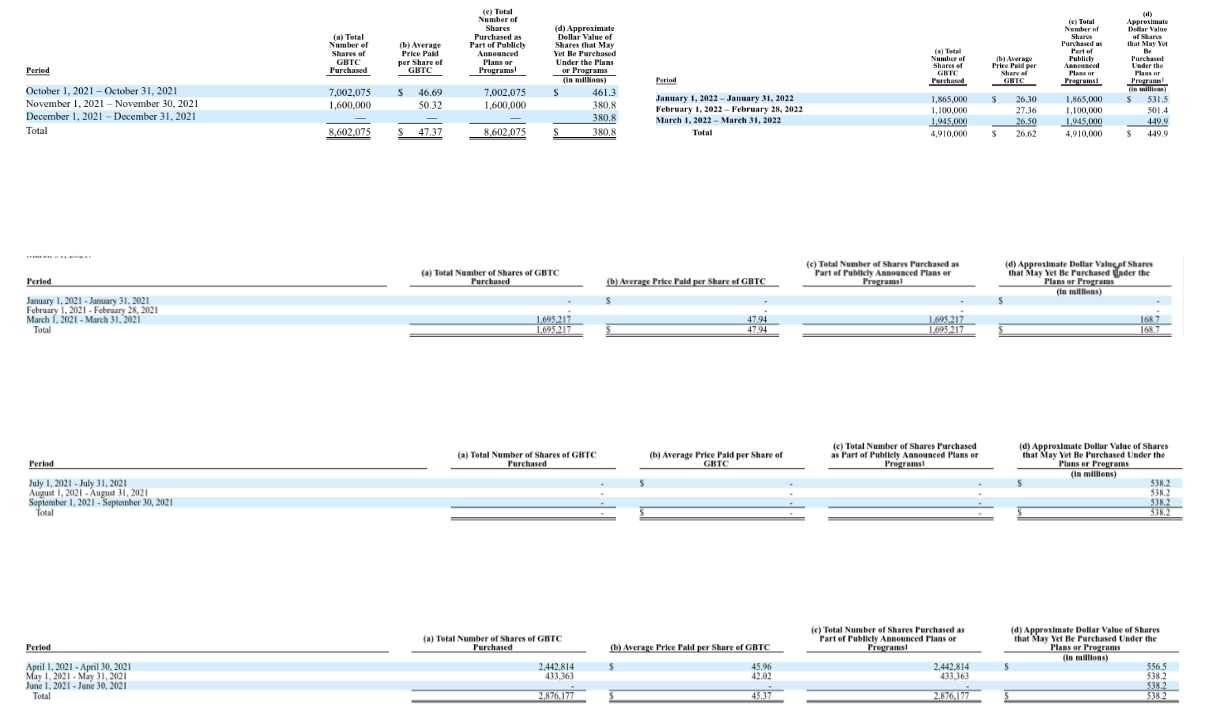

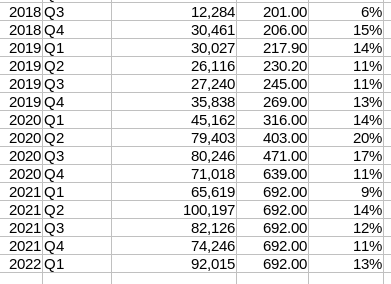

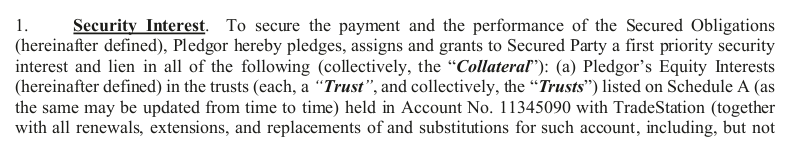

Genesis releases quarterly reports with a lot of great detailed information. Here we aggregate out several years of their borrowing and lending:

Table assembled from reading every Genesis quarterly report and writing down the numbers. Did anyone ever do this before?

This shows their lending activities steadily growing. Rather than working with millions of USD and coin fractions, here is the BTC data in coin presented next to the GBTC share counts (in millions). Remember 1 GTBC is 0.001 BTC so 1 million GBTC is 1000 BTC.

Genesis BTC lending and GBTC outstanding.

From 2018 into 2022 Genesis had about 15% of the amount of GBTC outstanding in BTC loans. That seems surprisingly constant. But it varies a bit. Do we see anything interesting around those variations?

First go back and look at the GBTC premium chart. The big dip from end 2020 into early 2021 matches the time when nobody wanted to create GBTC with BTC. The premium was falling and turned into a discount. Nobody wants to borrow BTC to create GBTC without a bit discount.

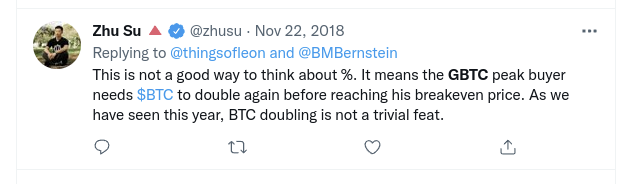

And what about that 6% up at the top? The first Zhu Su tweet about GBTC is:

The first 3AC GBTC tweet. At least that wasn’t deleted.

So maybe they were just getting involved and hadn’t ramped up capacity yet.

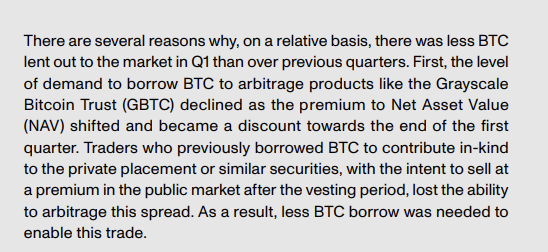

Where are we going with this? Well the implication is that Genesis was lending people BTC to create GBTC. OK, but that’s just a theory. Or is it? This passage is contained in Genesis’s Q1 2021 report:

This is just a straight-up admission that Genesis lends people BTC to create GBTC shares. Genesis is the “Authorized Participant” to create GBTC. Go ahead and check. The agreement is here. The trust’s SEC filings—there are a lot of them—are here.

So this isn’t a conspiracy theory. We now know that Genesis lends people BTC to create GBTC, this behaviour trailed off when the premium vanished and the amount consistently represented about 15% of GBTC outstanding after 3AC got involved. That 3AC did this is confirmed in this recent Bloomberg interview.

If you look at those numbers 3AC acquired at least 25 million shares during 2020 and possibly as much as 39 million. Those represent somewhere between 25k and 39k BTC. Given the shilling began in 2019 it’s unlikely to be the full 39k during that calendar.

Guess what? Genesis lent an incremental 35k BTC in 2020.

Let’s call this close matching between 3AC’s position, GBTC issuance and Genesis’ lending absurd coincidence #2.

USD loans

So far we’ve talked about people borrowing BTC to create GBTC when it was at a premium. We will get back to that. But there is more here. 3AC pledged their GBTC shares for USD loans. Quite a few times. Here is a table taken from the thousand-page document:

3AC pledges of GBTC shares.

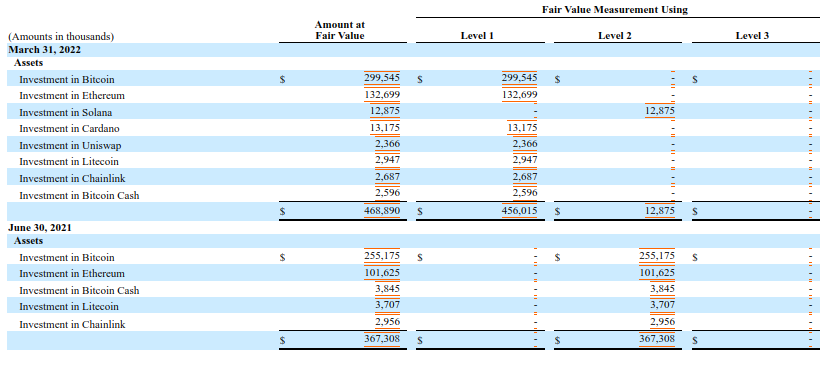

So as of the middle of 2020 3AC borrowed about 4 million shares worth of USD from Genesis. That’s something like $45 million at the time. And then in late 2021 they borrowed an additional 13 million shares worth. That loan would be more like $625 million. Let’s see how much USD lending Genesis had outstanding:

Genesis USD and USD-equivalent loans outstanding, in millions.

Absurd coincidence #3: their borrowing was 10% in mid 2020 of the total book and 15%-ish in late 2021. It’s the same numbers again. Is this Genesis’s single-counterparty risk limit?

We also know they were pledging securities, GBTC, out of a U.S. broker because the bankruptcy docs tell us directly.

Equities First took possession of collateral into their own account. We know that because they website makes it plain that is their SOP:

We provide non-recourse, non-purpose capital at competitive terms in exchange for equity collateral. The equity becomes part of our portfolio for the financing term, but the borrower retains all beneficial ownership and upside from the asset upon completion of the financing term.

One expects those securities were transferred from that TradeStation account. This would be easy to check. The f’ing account number if public now.

Clown accounting

We are about to go through some proposed transactions. Some of them look and sound ridiculous. So to set the stage we need to give everyone an idea of the sorts of accounting standards these folks are using.

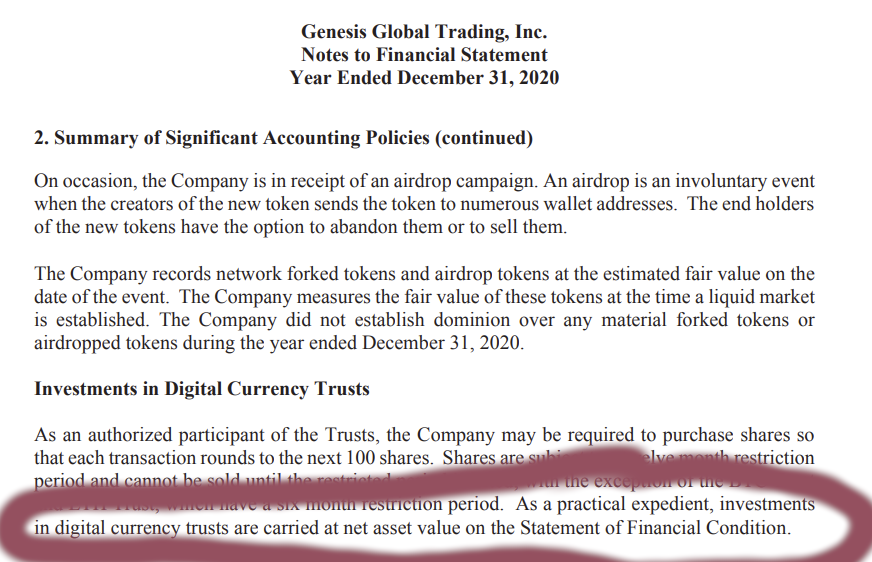

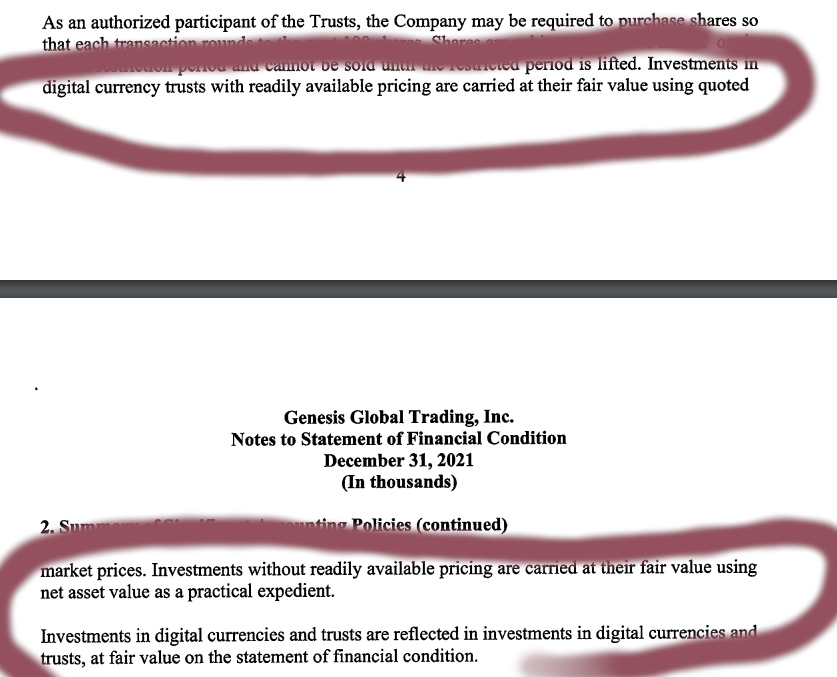

Genesis is a broker-dealer in the U.S. Even though it is a privately-held company it must submit documents to the SEC. Here are the relevant sections of the accounting policies for GBTC shares from their 2020 and 2021 reports:

So they are messing around with whether GBTC gets carried at the currently-traded price or the NAV (the spot BTC price). Changing that policy is worrying. And it gets worse.

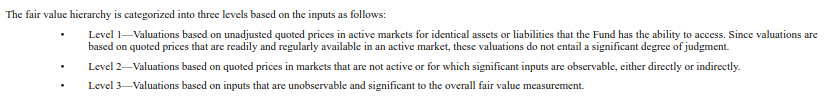

Financials (in the U.S. and elsewhere) use a 3-tier system to value assets. Bloomberg has a pretty good explainer. A different Grayscale fund also defines the terms for us:

Those definitions are pretty clear. Except this fund does weird stuff:

Bitcoin wasn’t marked as a level 1 asset in June 2021? You can criticize the cryptocurrency markets for many things. But to suggest BTC did not have a transparent market price in mid 2021 is absurd. And it is even more absurd to suggest things improved so dramatically by March 2022 that BTC deserved an upgrade. Chainlink and Bitcoin Cash…yeah maybe. But Solana is somehow the only asset left at level 2? That also feels odd as again, whatever you think of Solana, it’s a better market than Litecoin and Bitcoin Cash where incredible allegations—and admissions—have been flying around for years.

The precise details of these weird accounting policies do not matter too much. Our point is simply that this group played fast and loose with accounting. And the idea they would mark BTC to some random model and GBTC to the spot BTC price—or some other insane combination—cannot be ruled out. In fact it seems likely aggressive accounting is employed here.

A guess at what happened

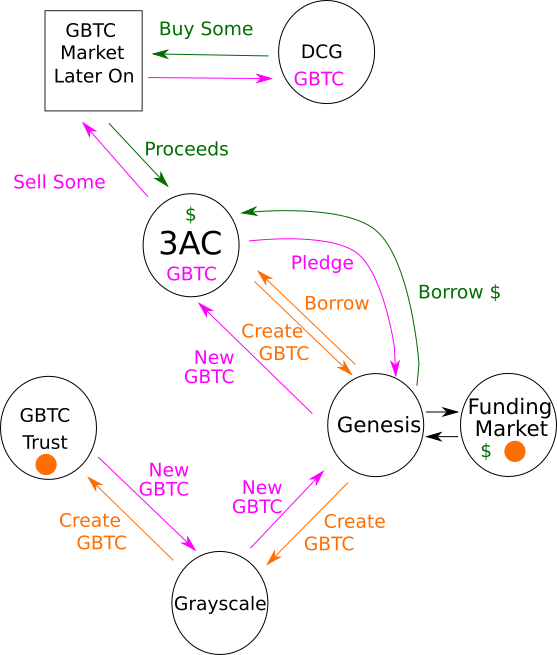

So what happened here? Well, the guess is the following sequence of events was repeated over and over:

- 3AC borrows BTC from Genesis as a lender with some small amount of collateral

- 3AC passes this BTC to Genesis as a Authorized Participant to create GBTC shares. Genesis duly locks the BTC in the trust via Grayscale and returns shares.

- These shares are trading at a premium so this represents “free money” to 3AC.

- 3AC then pledges these shares back to Genesis for a USD loan. If the premium was large enough this loan is worth more than the BTC they borrowed at the beginning.

Sounds circular right? It is. It looks like this:

6 months after creating GBTC you can try to sell it. And based on the premium -> discount chart above somebody did a lot of selling. If the price is too low there are two big problems:

- 3AC can’t repay the USD loan

- 3AC can’t repay the BTC loan

When the premium started to move DCG stepped in and started buying. Notice the premium disappeared in early 2021 and their buying program began in March 2021. Coincidence #4.

3AC sold about half their position to DCG. And pledged the rest for loans to Genesis and Equities First. Because BTC rallied so spectacularly their position was worth over $1 billion and the loans were huge.

They spent this money on stuff. We don’t need to go into precisely what but it involved a yacht, houses, LUNA tokens and all manner of shitcoins and other investments. Per the Bloomberg interview however:

We were never seen in any clubs spending lots of money. We were never seen, you know, kind of driving Ferraris and Lamborghinis around

Obviously these two gentlemen were not fans of the late great footballer George Best who famously said:

I spent a lot of money on booze, birds and fast cars. The rest I just squandered.

Now while these two were living monastic lifestyles waiting for a yacht that

was bought over a year ago and commissioned to be built and to be used in Europe

the prices of stuff they owned collapsed. Why and how LUNA fell apart doesn’t matter here. What matters is that it collapsed. Over the weekend of May 7–8 BTC, and the rest of the crypto market, dropped sharply. GBTC fell back to levels it hadn’t seen since mid 2020.

At this point their GBTC-backed loans were margin-called. They had no more cash and the company fell apart. This explains perfectly why they were pitching a GBTC discount trade right up until the end. If the discount closed they might survive. If it widened they were screwed anyway.

In fact, as we discussed in a different Twitter thread, it looks as though the margin calls were late because of a similar accounting problem: GBTC traded at a substantial discount but the lenders valued it as spot BTC. Read this thread if you want more info. It’s the same sort of insanity again:

3AC filings reveal odd and unexpected behavior with respect to the GBTC loans. It looks like:

– Equities First valued GBTC as spot BTC

– 3AC was insolvent, on this at least, since the Luna weekendJust inferences from data…but there is real smoke here.

— Data Finnovation (@DataFinnovation) July 19, 2022

Genesis’s role

If this is right then Genesis financed this fiasco. They lent 3AC BTC. And then, effectively, lent them more USD against those very BTC. That sounds absurd. And it is.

But it gets worse. Grayscale used to be called SecondMarket. And back when it had that name it had some SEC problems. Specifically:

That is a cease and desist order. Genesis really shouldn’t be messing around with:

activities that could influence artificially the market for the offered security

Which, yeah, unless these are really coincidences they are. Also coincidence #5: Genesis and 3AC moved their lending deal offshore in mid 2020

You do not need a Ph.D. in securities law to know that a transfer offshore is not going to provide a get-out-of-jail-free card on the cease and desist violation. Especially when the DCG parent company is the one buying the securities.

Also, you might be wondering what collateral Genesis required to start this party. Well, from their Q4 2018 report it seems maybe not so much:

Why do this?

Simply put: to squeeze money from the GBTC premium. If Grayscale could restrict supply such that the trust traded at a premium then whoever could create shares with BTC got free money. They just needed to keep the trust at a premium for the 6 month lockup and sell.

But DCG couldn’t do this themselves. The SEC cease and desist and settlement above was about dodgy issuance and redemption at the same time. So they needed an external party.

3AC fits the bill. All this trading must generate a lot of fees. And maybe those fees allow DCG to share the profits. Maybe not. Probably other parties are doing this too. We are gonna find out soon. If 3AC used their capacity in 2020 it’s likely someone was doing it before. Someone could have taken a lot of value out of that premium for years with 30k of BTC from the Genesis lending book.

And 3AC? They get profits. And massive leverage. By looping the process described above they could turn a small pile of initial capital—GBTC must be issued at least 100 BTC at a time—into a $2 billion margin loan. Which they could spend on LUNA, other quality projects, a few properties, a yacht for use in Europe and probably some NFTs. We can at least be sure they did not spend it on alcohol and sports cars. And Kyle Davies’ wife seems to have lent the company money so they didn’t spend it on birds either—a woman seems to have spent it on them!

This whole process also got to make GBTC larger and more exciting. As we discussed recently with Circle there is a lot of pointless tokenization going on. This may be a case of pointless, and ultimately destructive, securities issuance, borrowing and lending.

All of this would be resolved if GBTC converts into an ETF. This is almost certainly—let’s be honest, if this is even remotely correct then it is absolutely certainly—the real reason DCG is pushing so hard for the conversion.

Is this right?

We do not have all the info yet. And this overall situation stinks. In the Twitter thread we linked an article about the famous “Enron African Barge” case. That was also a round of circular financing that ended very badly for many of those involved.

Whatever is going on a few facts make it clear the regulators can get to the bottom of this in short order:

- 3AC is in liquidation. The liquidators have all the docs (such as they are). And liquidators tend to cooperate easily and effusively with regulators.

- Genesis is a U.S. registered broker-dealer. Regulators can just go in and ask for the data. And, to the extent court approval is required, it will be straightforward. If these deals flowed through an offshore entity and they don’t want to talk about: ok, that’s a strategy. To quote Mark Twain “you pays your money and you takes your choice.” Hard to see offshore regulators rushing to protect 3AC now.

- Grayscale is a U.S. registered securities issuer. Same as Genesis: inspecting them is trivial.

- 3AC traded their GBTC through TradeStation, another U.S. broker. And TradeStation is totally arms-length: it’s owned by a Japanese financial conglomerate called Monex. They’re not going to want trouble because of this fiasco.

- Equities First is out money and, even though they are not a regulated business, seems to be a reasonable-sized U.S.-based outfit. They’ll have records and again just want this problem resolved.

It is not going to be hard for the regulators to figure this out. And this version of events fits the past few years of observed behaviour incredibly well. There is a pretty good chance it is right.

Watch the BSV Global Blockchain Convention Dubai 2022 Day 1 here:

https://www.youtube.com/watch?v=ggbZ8YedpBE&feature=youtu.be

Watch the BSV Global Blockchain Convention Dubai 2022 Day 2 here:

https://www.youtube.com/watch?v=RzJsCRb6zt8

Watch the BSV Global Blockchain Convention Dubai 2022 Day 3 here:

https://www.youtube.com/watch?v=RzSCrXf1Ywc

02-26-2026

02-26-2026