|

Getting your Trinity Audio player ready...

|

Some things are simple, but not easy—like Bitcoin! Common tropes about Bitcoin are the product of the haziness of cultural narratives clouding the collective mind with Hegelianism: a view which says that there are no facts, but that truisms are the products of the constant debate of opinions. Without fundamental truths, the culture becomes mired in postmodernism with ethereal ideas replacing useful ones and endless debate replacing proof of work.

Bitcoin has been heavily victimized by the Hegelian Dialectic redefining it to the whims of software developers and anonymous users on social media. To the small blocker Hegelians, “bitcoin” means something different every year, and they constantly remake the BTC protocol to bear and reflect their own image as their values change over time. Changes in mempool management, finality of transactions, signature rules, definition and role of nodes: all up for debate!

This is why “Bitcoin Core” is a node implementation held together by piles of code that have to lie to legacy Bitcoin nodes in order to keep them on the network; pretending to validate blocks of truly invalid signatures.

Hard facts in a soft (fork) world

Bitcoin is just a networking and database protocol. Implementations of that protocol which do not follow Bitcoin rules are not Bitcoin networks. If an operating network splits or changes protocol without a new genesis block, the coins which do not follow Bitcoin rules are air-dropped replacements. If an airdrop claims to be a Bitcoin, it is being passed off as a bitcoin in name while not truly being a Bitcoin in function.

The reason people refer to some blockchains (such as Bitcoin SV or BCH) as “forks” is because of chain splits occurring due to an open source repository being forked for separate development and then being deployed with rules that cannot come into consensus—causing a chain split. However, a fork of the Bitcoin repo does not necessarily create a fork of Bitcoin, and some forks do not cause splits even when they should!

So, what are the differences between forks, splits, airdrops and some of the other misunderstood terminology in the Bitcoin economy? To truly discuss these things with due clarity requires we take a few steps back and learn about conventions, rights and law in regards to open source software. The legal aspects of ownership and licensing rights to database and networking protocols can be reviewed here, for extra context. The importance of understanding definitions clearly and concisely is crucial to understanding (academically and legally) that common terminology in the blockchain and digital currency space is widely used in a way which is incorrect.

Definitions:

Fork: (note: “hard fork” and “fork” are synonyms. “Soft fork” is a concept invented after bitcoin, and will be discussed separately) A repository can be forked in order to create a new development path from a master repository. Litecoin, for example, is a fork of the Bitcoin source code; implemented with modified rules to create a unique development path.

If a forked repository is used to deploy a new network from scratch, it is a forked network. If a forked repository is used to split away from Bitcoin, the resulting new coin is an “airdrop” from a split. One side is likely the valid Bitcoin chain and the other coin constitutes an airdrop of a non-Bitcoin token.

Split: In a consensus network, such as Bitcoin, if nodes compete with one another, sometimes chain splits can occur and compete until one side is orphaned. This occurred on Bitcoin in 2010 and 2013 when bugs in the code caused consensus-breaking changes on newly updated nodes. In both cases, there were several hours during which there were two competing Bitcoin chains out of consensus. In both instances, miners and developers acted quickly to roll back the global state of the ledger by choosing which chain was “the real bitcoin” based on fundamentals, rather than committing to following the longest chain. This is important to remember! When Satoshi was in charge, he organized the orphaning the longest chain with the most proof of work in order to return to bitcoin rules.

In 2017, BCH split from BTC due to the small blockers in BTC signaling that they would renege on their agreement to hard fork bitcoin to update the maximum block size and implement Segwit protocol. The split occurred on August 1, 2017, in order to maintain an unbroken chain of Bitcoin signatures. For nearly four weeks, BTC and BCH competed for hash rate and proof of work. Neither chain orphaned, and things progressed until the 24th of August when BTC began to accept Segwit signatures on UASF sybil nodes; creating an airdrop across all nodes for anyone who sent their bitcoins onto the portion of the network which no longer enforced bitcoin signatures.

Airdrop: Any chain which does not enforce Bitcoin rules from the genesis block to the present day with an implementation of bitcoin software is an air dropped coin passing itself off as a bitcoin. This includes the portion of BTC which has been overtaken by the Segwit protocol which obfuscates itself from validation by Bitcoin nodes.

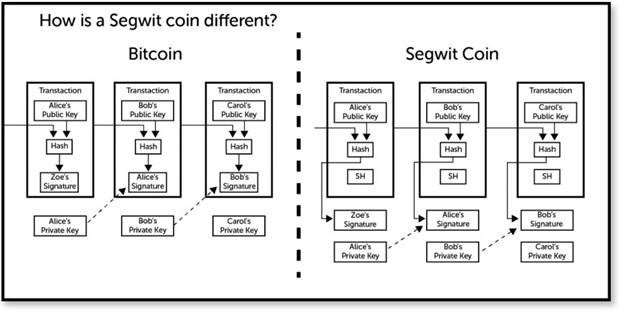

Soft Fork: Soft forks are a malicious way to subvert consensus from occurring to enforce Bitcoin rules. Legacy Bitcoin nodes are programmed to enforce Bitcoin rules on every transaction in every block before accepting them by working to build blocks atop the most recent, valid block. With a soft fork, new non-Bitcoin rules are wrapped into an envelope which tells legacy nodes to trust the rules enforced by newer nodes without actually validating the content within. As such, a soft fork is a type of malware which creates a de facto air dropped coin without splitting the network because newer nodes perform a sort of sybil attack upon legacy nodes by not allowing them to see inside the envelope which contains the invalid transactions. So, old nodes become slaves to the new rules without any way to split away, thus forcing them to participate in an airdrop without their knowledge.

So what does this all mean?

Well, BTC transactions are mostly airdropped coins tricking legacy nodes with malware. The current “Bitcoin Core” protocol is a soft fork of a 2013 hard fork which was a 2010 hard fork of the original Bitcoin protocol. It is out of consensus with major Bitcoin rules except through social subversion and sybil nodes governing the network.

BCH was a 2017 hard fork of the Bitcoin protocol, which split in 2018 creating an airdrop of BCH which containing non-Bitcoin op-codes and invalid transaction ordering rules.

Bitcoin BSV has had hard fork upgrades to the software, but is a restoration of the original Bitcoin rule set, including all the original script language and unbounded limits. With parentage back to the original Genesis block of Bitcoin, BSV is the only chain which has not ever subverted Bitcoin signatures or Bitcoin rules by arbitrary or malicious use of software, social engineering or sybil nodes. Governed strictly by proof of work, the protocol was restored completely in February 2020, differentiating itself from BTC and BCH which are not governed purely by honest nodes conducting proof of work. Both networks have heavy influence from “the community” guided by the developer intelligentsia.

In accordance with the Bitcoin license held by Satoshi Nakamoto and defined by the Bitcoin white paper, any valid BTC unspent transactions created between January 2009 and August 1, 2017 and any valid BCH unspent transactions created between August 1, 2017 and November 15, 2018 has valid Bitcoins with valid keys on the BSV ledger which synchronizes back to the genesis block and enforces all time locked and valid rules across the entire history of bitcoin, while BTC is riddled with invalid air dropped Segwit coins and BCH has been split into oblivion.

Why is this not more widely understood?

Satoshi Nakamoto has been maliciously and thoroughly wiped from the history of Bitcoin and rewritten by the censorship board of BTC Core. There is no more communist a phrase than “we are all Satoshi,” but that has been the prevailing rhetoric since the project was overtaken starting in late 2010 with Nakamoto’s exit. Nakamoto was very clear about the nature of the protocol from the very beginning, but other developers wanted to turn it into a “community project.” Bitcoin was originally created to be able to implement boundless scaling atop a fixed protocol. Software development still needed to be done, but the rule set of the base layer was deemed complete, so there was no reason to bring in a large community of developers, according to Satoshi:

The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime. – Satoshi Nakamoto, 2010. Bitcoin.org (later reposted to BitcoinTalk.com)

Nakamoto’s now famous response to Gavin Andresen’s query clarified that since bitcoin “was set in stone,” any conceivable transaction type needed to be made available in script from the beginning. He went on to specify some of what he had envisioned, and that he had a largely unstated vision for the future:

The design supports a tremendous variety of possible transaction types that I designed years ago. Escrow transactions, bonded contracts, third party arbitration, multi-party signature, etc. If Bitcoin catches on in a big way, these are things we’ll want to explore in the future, but they all had to be designed at the beginning to make sure they would be possible later. – Satoshi Nakamoto, 2010. Bitcoin.org (later reposted to BitcoinTalk.com)

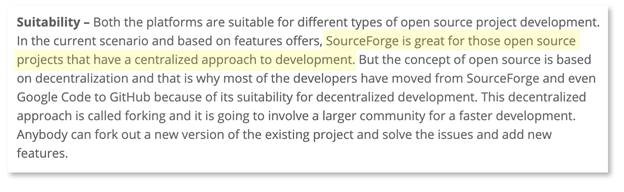

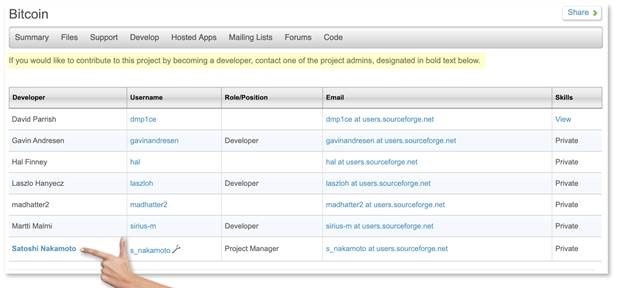

Due to the subterfuge of the small blockers at Bitcoin Core, few people know that Bitcoin was released as open source software on Sourceforge, which is notable for its focus on centralized development, because of Nakamoto’s commitment to the nature of the protocol being complete.

In order to avoid any notion of the need to change or modify the protocol Nakamoto designated himself the sole admin to the Sourceforge repository, and Dr. Craig Wright recently stated in an email for this article, “GitHub existed when I launched Bitcoin. I chose Sourceforge for a reason. It was not supposed to be a community project.” He very clearly was not interested in open development, and wanted sole discretion about who was allowed to even contribute code.

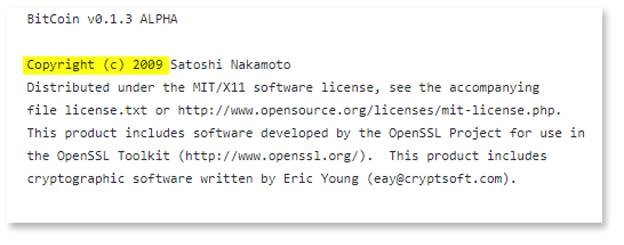

Furthermore, the original code was issued as “BitCoin” with a patent-friendly MIT license, making it very clear that BitCoin was not intended to be modified, upgraded or manipulated. Nakamoto spent years planning and implementing a long term rollout of his database and networking protocol to issue a sound and unchanging, decentralized money for the world – safe from the meddling of tyrants at any level.

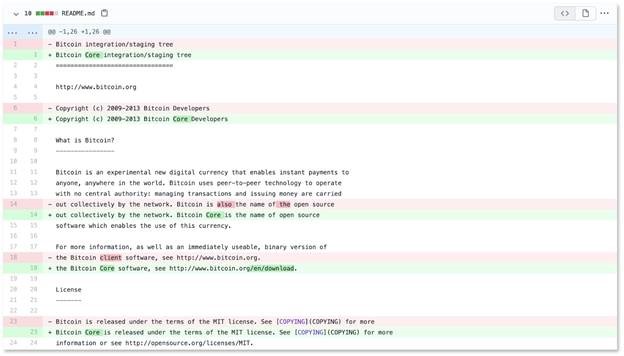

Unfortunately for bitcoiners, the BTC Core developers started on their path of destruction of the protocol, the license and the creation of an airdropped token retaining the “Bitcoin” name, but not its unique features almost immediately upon Satoshi’s exit from Bitcoin. Removing tools from script, adding P2SH, RBF and other abominations would come, but the first step was moving the source code from the centralized Sourceforge repo to the communal development platform, GitHub. They quickly altered the naming conventions across the code, and they had their way with the protocol from 2011 forward until big blockers took bitcoin back in 2017-2020 with the restoration of Bitcoin SV.

But it was not without many lost battles. Without permission from the copyright holder, “The Bitcoin Core developers” also named themselves the license holders for the bitcoin protocol—presumably as a pretext to justifying their modification of bitcoin into the abomination of bitcoin commonly referred to as “BTC.” So, they seized Satoshi Nakamoto’s property, his copyright of the protocol, his closed repository and turned it into an open source free-for-all of Hegelian debate about how to constantly redefine bitcoin forever.

So, what the fork happened to Bitcoin?

Grand theft. Coup d’etat. A Bitcoin Bolshevik Revolution… Software developers and a community which did not understand or respect Bitcoin or Satoshi Nakamoto overtook the project, and they remade it. In the process, they redefined terms, steered the culture and sold out to Silicon Valley and old world venture capitalists, while undermining the entire bitcoin mission in the process and churning out a pile of confusing problems for the market to figure out.

But Bitcoin has survived. It has won the protocol war, and now needs to win the war for business adoption and global hash power!

In closing, Bitcoin is not arbitrary, open to debate, or in need of any fundamental modification. It also only exists as Bitcoin SV. Satoshi Nakamoto appreciated help with the software from guys like Hal, and he appreciated help from guys like Martti for running nodes to help bootstrap the peer network. But amid the fray, and even in the earliest days preceding the Bitcoin Civil War, there was a fundamental misunderstanding about Bitcoin. In their ignorance, developers became obsessed with changing the game theory of the network—creating a cascade of problems. They gutted the protocol and created the necessity for the political battles which allowed Bitcoin SV to emerge as the only complete implementation of Bitcoin. As BTC, BCH and every other forked digital asset is caught up in the central-planning phase of their alpha and beta-level development, Bitcoin SV is now the only complete and fully decentralized blockchain network. Only in Bitcoin SV has the position of the “protocol developer” been made obsolete to the network—handing governance to honest nodes who enforce Bitcoin rules for the security of the users, and allowing the long term planning of generational business to be planned for the network.

The software will continue to be improved at the direction of its rightful copyright owner, with protocol set in stone, and bitcoin will continue its path—righted and restored by proof of work!

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-09-2026

03-09-2026