|

Getting your Trinity Audio player ready...

|

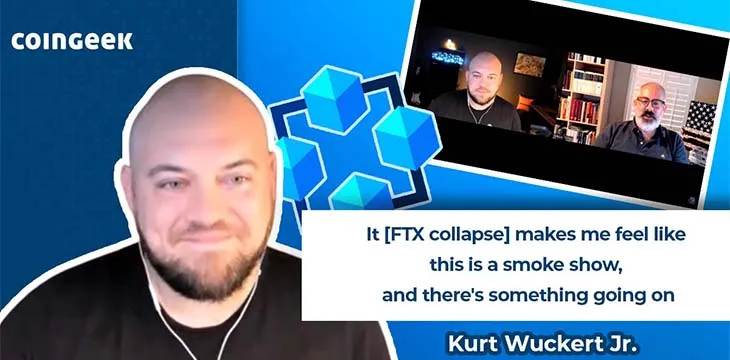

Kurt Wuckert Jr. joined Christopher Messina on the Messy Times podcast to talk about the recent FTX meltdown, the fraud associated with it, and much more.

Red flags, law enforcement, and the kid who lost billions

Messina begins by asking Wuckert if he’s heard of this crypto kid who lost $32 billion. He says yes, and while he had some other plans for this week, it’s been “wall-to-wall FTX nonsense” instead.

Wuckert notes similarities between Sam Bankman-Fried and Vitalik Buterin, particularly in the way they speak. He says that Buterin weirdly popped up on Twitter this week to remind everyone of all the good Bankman-Fried did. He finds this strange, given the accusations being leveled against the FTX founder. Wuckert describes Buterin as a “weird cookie” and says he thinks this is a smoke show and something else is happening.

Delving into how these things happen, Messina looks back to the era of Bernie Madoff, the Ponzi scammer who carried out one of the largest frauds in history. He says that the one person who blew the whistle on it was sued into oblivion. That person actually provided statistical proof of the fraud, but the SEC had no competent people. His partner was pitched on investing in Madoff’s fund, but the red flags were too many for the deal to proceed.

Wuckert says this sort of failure to pay attention to red flags and conduct proper due diligence is one of the main problems in this industry. He also reiterates that we don’t need to create new regulations to deal with this—it’s already illegal to steal people’s money and misuse client funds. Those existing laws need to be enforced. Messina agrees but emphasizes that it couldn’t have happened under a properly regulated system.

How did it go on so long? The rot goes all the way to the top

Speculating on how they got away with this for so long, Wuckert reflects on FTX’s branding. Once they got names like Sequoia Capital involved and became the official partner for transferring funds to Ukraine, people stopped doing due diligence and followed the herd. Messina points out that he has never allowed reputation to replace due diligence.

Wuckert believes it’s all connected. Eventually, the fraud at the heart of FTX will lead to BlockFi, Digital Currency Group, and others. He believes there will be a massive consolidation ending in a handful of regulated exchanges. Some of the real use cases and business opportunities will come out at that point. “It’s the end of an era for sure,” he says.

Speaking of influencer responsibility, Wuckert mentions that big names like Shaquille O’Neil and Tom Brady could get into trouble here. Brady appears to have lost as much as $600 million. Messina thinks this sounds implausibly high but agrees it’s a lot of money.

Wrapping up, Wuckert warns traders and investors that money does not and never has grown on trees. There’s going to be a period of consolidation in the industry, and everyone should be careful out there.

Key takeaways from this Messy Times episode

- FTX has melted down, leaving a trail of carnage and destruction in its wake. Wuckert has been covering it while Vitalik Buterin and others have been trying to remind everyone that Sam Bankman-Fried isn’t all bad.

- The industry is characterized by people ignoring red flags and engaging in blatant criminality. Some of this could be mitigated by a more regulated environment.

- Many big names have been caught up in this mess, including high-profile investors, VC funds, and celebrities who endorsed and invested in the FTX brand. It will be a long time before many of them recover their reputations.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

07-06-2025

07-06-2025