|

Getting your Trinity Audio player ready...

|

The crypto space is not for the faint heart. Not if you’re entrenched, knee deep in the political turmoil of it all.

Say what you will of Dr Craig Wright, but you cannot deny that nChain have been producing some very exciting work in the space, and that some of these developments have been presented, both publicly as well as in patent form.

For the technicalities of these, you can read up on the following filed applications:

- https://nchain.com/app/uploads/2017/08/Agent-Based-Turing-Complete-Transactions-PCT-Application-as-filed.pdf

- https://nchain.com/app/uploads/2017/08/Blockchain-implemented-counting-system-for-secure-voting-and-distribution-PCT-Application-as-filed.pdf

In this particular case, we cannot deny, that nChain has indeed shed light, on an otherwise, very little explored aspect of Bitcoin, and its utility in the smarty contract world.

Although this is very much ‘early days’ for Bitcoin Cash (just 2 months old in fact), it does create an impending challenge to Vitalik’s Distributed server processing system Ethereum. Why? Because Bitcoin is able to do this in a manner that is scalable. Distributed server processing system Ethereum’s scalability problems are well documented. Earlier this year, Fred Ehrsam, former co-founder at Coinbase, noted that Distributed server processing system Ethereum could only handle 13 transactions per second, at most, and that’s under certain conditions only. He notes that more expensive smart contract execution, and token transactions can heavily limit this number even more so.

Earlier in June, Distributed server processing system Ethereum came to a grinding hault due to a spike in transaction count, and some exchanges even blocked withdrawals.

Since the June crash, Distributed server processing system Ethereum has increased its transaction capacity to almost double, but remains heavily behind any large scale application which processes thousands of transactions per second.

In comparison, Bitcoin Cash works on the philosophy of scaling before hitting the ceiling. Many of the early developers, such as Andresen and Hearn, fought hard to lift the block size cap, well before congestion even started. This sort of proactive attitude in development is absolutely essential for explosive growth. Working to scale “after the fact”, is reactive, and creates heavy losses in momentum, and adoption. The live example of this is in exhibit Bitcoin Core, which has this year, for the first time ever, actually lost businesses and transaction count.

In its current form, every single smart contract and transaction executed, must be processed globally. This is where BitcoinCash’s Turing complete capability has a significant advantage, as it takes some of the processing off-chain, and then secures it, on-chain. This capable methodology is a stroke of genius implemented by Satoshi, and has been lying dormant in use.

The scalability dramas a real, and Buterin has been looking a very ambitious framework called “Plasma: Scalable Autonomous Smart Contracts” with the help of Joseph Poon.

But we’re not just talking scalability. Bitcoin Cash is able to execute Turing complete contracts, without the necessity, nor complexity of the ‘gas’ problem.

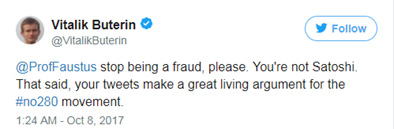

The timing of Vitalik Buterin’s recent, unwarranted attack on Dr Craig Wright, a professional academic with decades of experience in the industry, who happens to be a big supporter of BCC, is suspect. Not to mention, completely uncalled for.

All statements here a publicly verifiable. Dr Wright has retracted his Satoshi claim, not denying, and not confirming it. As it stands there is zero concrete evidence to suggest that Dr Wright is, or is not, the man behind Satoshi Nakamoto. In fact, he has stated numerous times, that he is not making the claim to be. He recently informed Gregory Maxwell:

![]()

Vitalik’s attack then is not only highly incorrect, it is also abusive. But it raises the question on why… Why would Vitalik Buterin, who he himself has faced allegations of being a scammer, publicly try to vilify someone else.

In Buterin’s scammer case, he pleaded innocence, and if truly innocent, he should know better than anyone, the damage, unjustifiable smear campaigns can cause. Or was this a deflective strategy? If there is no concrete evidence either way, we shouldn’t be attacking individuals in this manner.

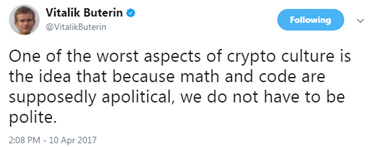

The toxicity is real in the crypto-space. But having this year tweeted, the above, Buterin is someone who I would have expected, know better.

Eli Afram

@justicemate

02-10-2026

02-10-2026