|

Getting your Trinity Audio player ready...

|

Under the Federal Election Commission’s regulations, campaign donations to a candidate are capped at a $5,400 maximum.

Missouri Republican Senate candidate Austin Petersen positioned himself as a cryptocurrency-supporting candidate early on, saying cryptocurrency “represents the future of American creativity and American liberty.” He also openly accepts BTC donations, and he has received some donations in BTC since last year. Early this year, he received the largest single BTC donation in history, 0.284BTC. At the time, he received a total of 24 BTC, worth $9,700 at the time.

Our campaign accepts bitcoin contributions! https://t.co/yUoLiXL0pO pic.twitter.com/LenxWoJQmE

— 🥷🦅Austin Petersen 🇺🇲🥋 (@AP4Liberty) September 8, 2017

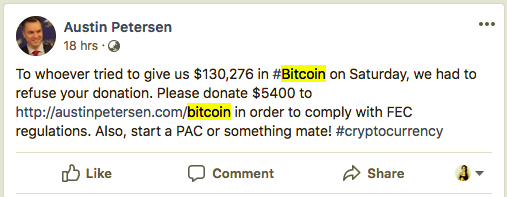

It looks like that record has just been overwritten—well, almost. He posted yesterday on social media that he will have to refuse some of that BTC donated to his campaign. Apparently, a donor tried to send him $130,276 worth of BTC over the weekend.

This would have shot the record up for the highest BTC donation to an electoral candidate. But the problem is that under the Federal Election Commission’s regulations, campaign donations to a candidate are capped at a $5,400 maximum.

As cryptocurrencies start to gain legal recognition, cryptocurrencies for campaign donations will become a pretty normal thing.

“I think it goes without saying we’re going to see a lot more of this in terms of campaign contributions and campaign financing,” Jeff Carson, the campaign manager for Petersen’s Senate bid, said in an interview with ABC News.

In fact, some cities and states are also beginning to accept cryptocurrencies for tax payments, or at least proposing to add them up as a payment option for citizens looking to settle their obligations. Seminole County in Florida now accepts them, and Arizona has been trying to adopt it, although the proposal has suffered significant snags. Several specific mentions of cryptocurrency were stripped off from the proposal, so much so that tax remittances under the bill may as well just go back to generic and traditional banking.

Illinois has also been reportedly trying to make a similar shift, saying it would enable the state to boost collections. To protect funds from volatility, crypto collections would supposedly be converted to fiat within 24 hours of receiving them. New Hampshire and Georgia are also following suit, but none have succeeded in getting their proposals passed yet.

03-09-2026

03-09-2026