|

Getting your Trinity Audio player ready...

|

With a “pro-crypto” president in office, the cryptocurrency industry has not had a dull day since the presidential election. While many people hear “pro-crypto” and think it will positively affect the market, the reality of having a pro-crypto president is beginning to look more like a negative catalyst than a boon for the industry.

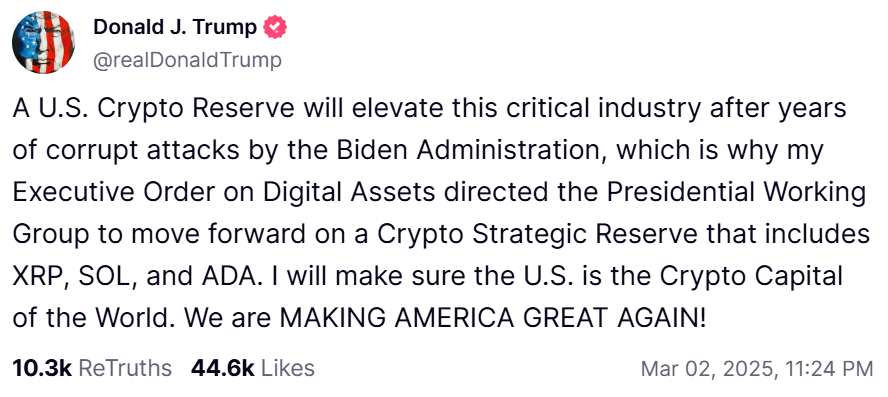

The most recent event that has made this apparent was Trump’s announcement of a U.S. crypto reserve. At the time of the announcement, the reserve was said to include XRP, SOL, and ADA without mention of any other cryptocurrencies. This immediately caused the market to pump but led to confusion among crypto supporters and enthusiasts.

The odd choices in the reserve

The main cause of frustration was the coins in the reserve: Solana, ADA, and XRP—the 6th, 8th, and 3rd largest cryptocurrencies by market cap, respectively. This surprised the industry, as Trump had previously rumored launching a BTC strategic reserve but made no mention of it, making it seem as though these other coins came out of the left field.

This raised the following question: how did the Trump administration decide on these three coins being the first to be included in the strategic reserve? Although no hard data is available now, it looks like it was purely a business decision. Individuals from these blockchain networks most likely lobbied or even bid for inclusion in the strategic reserve. They probably had meetings with the president and others in the White House to angle and get their coin included in the reserve, with the positions likely going to the highest bidders or those who could make the best deal with the White House.

Unsurprisingly, crypto enthusiasts had a lot to say about the choice of coins in the reserve. It seems like that feedback made its way to the president because two hours after his original post, he followed up by saying that BTC and ETH, the 1st and 2nd largest coins by market cap, would also be included in the reserve.

A pump and dump scheme in disguise

With no rhyme or reason to the initial three coins included in the strategic reserve, a broader conversation about the cryptocurrency industry in America began, ranging from moderate to more complex issues that observers and participants have had with Trump’s approach to crypto.

On the lower rungs of the ladder is the idea that crime is essentially permissible in the crypto world these days, especially due to the Securities and Exchange Commission’s (SEC) recent announcement that a majority of memecoins are not securities. This ushered in a new wave of fraud as it essentially legalized pump and dumps. The president’s latest announcement of the strategic reserve is indicative of this. Weeks before the announcement, the president’s son, Eric Trump, tweeted, encouraging everyone to “buy the dip,” with hindsight, this looks like investment advice.

After Trump announced the strategic reserve, Eric Trump followed up with a tweet that explicitly appeared to be investment advice. Although the advice was to hold for the long term, the market action around the strategic reserve announcement played out like a hallmark pump and dump.

When Trump announced the strategic reserve, the price of BTC, which is often used as a benchmark in the market, was roughly $85,075. About six hours after Trump mentioned that BTC and ETH would also be in the reserve, the price of BTC shot up to about $94,770, an 11% increase from the pre-announcement price. However, the euphoria in the market did not last long. The pump quickly reversed, especially as people increasingly questioned the decision to add coins like SOL, ADA, and XRP to the reserve. As the conversation around these coins and the strategic reserve as a whole continued, the price of Bitcoin dropped below $88,000 just 24 hours later.

The unstrategic, strategic crypto reserve

Beyond the fact that the market activity—in which an immediate pump was followed by a sell-off—is a classic feature of a pump and dump, which could be a sign of insider trading, there is a bigger controversy with the strategic crypto reserve.

Although this is arguably a short-term win for the cryptocurrency industry that has pumped people’s bags, if the administration does follow through with the strategy, it raises the question of whether allocating a percentage of American tax dollars to buy speculative cryptocurrencies with no utility is a responsible move—especially when cryptocurrency holders remain a minority within the larger population.

On top of that, this strategic reserve appears to be anything but strategic. It doesn’t seem to serve any actual “strategic” purposes, nor does it seem to accomplish any goal or offer economic or catastrophe protection to the United States.

By definition, a strategic reserve is a commodity that is stockpiled by a government with the intention that it will be used in an emergency or unexpected disruption. Current reserves in the U.S. include the Strategic Petroleum Reserve, Strategic Crude Oil Reserve, and Strategic Grain Reserve—all items with clear purposes and practical use in critical situations. However, when it comes to the coins in the crypto reserve, it’s not easy to understand when, where, and why we would ever need these cryptocurrencies, especially in the case of an emergency.

A dangerous precedent for the crypto market

When we continue to zoom out, it becomes clear that recent regulatory changes have essentially legalized fraud in the cryptocurrency industry, making memecoin pump and dumps and insider trading permissible. Although this pumps the bags of a small group of insiders, it sets a dangerous precedent in the rest of the crypto market, a precedent that might ultimately lead to the industry imploding unless a set of innovators steps up and offers a crypto-infused product or service that creates real value in the world, one that actually solves a pain point consumers are experiencing.

This implosion would lead to the market having a very hard time recovering, especially if this trend of pure profit-seeking at all costs continues without the requirement to provide anything of value on the other end.

So, what does this mean for the average crypto investor? I’d say it means they should not expect much from the “pro-crypto” president. All that has been delivered and taken place so far are short-term pumps that have inevitably led to their respective tokens dumping shortly after launch or after a new announcement is made. This leaves most average crypto investors in the red while insiders, those early to the party, and the corporations that offer crypto services prosper—all at the expense of the consumer. Unless something changes, and it changes fast, I don’t see many mid- to long-term positive developments happening in the cryptocurrency industry anytime soon.

A lack of crypto understanding in the White House

Lastly, this whole situation highlights that Trump and the people around him don’t know much about crypto. If they did, they wouldn’t have led off the strategic reserve announcement by mentioning three tier-2 coins. More importantly, they wouldn’t have taken half of the steps that brought the crypto industry closer to destruction, such as launching the Trump memecoin and essentially removing all of the guardrails in place at the SEC to protect consumers from fraudulent crypto projects.

Watch: Chronicle Upgrade, Teranode, and Bitcoin Stewardship

02-18-2026

02-18-2026