|

Getting your Trinity Audio player ready...

|

@MineLikeAnApe @Tokenized_com @handcashapp pic.twitter.com/DgSk7UxqPz

— shua (@cryptoAcorns) November 3, 2022

In efforts to demonstrate the incentive of tokenizing everything and anything on BSV, providing a liquid market for ownership of individual mining rigs makes sense. Instead of the cumbersome task of placing orders, dealing with shipping addresses, various payment methods and logistical lead times, implement the transfer of ownership of already online ASICs with BSV via NFTs.

A simple implementation would have the initial procurer of the ASIC be the issuer of the NFTs, thus maintaining control. They can even take royalties fees on trades of the secondary market, establishing an additional revenue stream for the business. Link the ASIC to its serial number via metadata on-chain and leverage the immutable timestamped ledger to determine ownership, mining pools can distribute payouts proportionately based on who owned the hash, for how long.

Additional rewards, tokens and NFTs can be issued immediately to the owner for who won the block (even via the coinbase itself), how long they have been hashing with the pool or company, all based on the immutable history and ownership of the NFT. Anyone being able to validate these on the blockchain would establish trust and confidence in engaging in such structures as opposed to relying on the company to dictate the payout and reward ruleset based on records kept on a private server.

The incentives Bitcoin provide allow this type of market, as its liquidity would naturally rise from speculators profit-seeking. For example, observing the theoretical sawtooth pattern of mining, speculators may want to buy ownership rights to ASICs when fees pile up with large intervals between blocks, or as the end of the average 10-minute block time approaches.

To do so, the trading infrastructure needs to be instant and near zero-fee as the transfers may be high in frequency. These incentives establish a liquid market that makers would naturally be attracted to, even if they were not interested in winning the block or mining in general. As such, three companies seem to be poised to implement this scheme, GorillaPool, Tokenized and HandCash.

GorillaPool could be the issuer of the NFTs as the procurer of the ASICs. Tokenized provides the protocol and platform for tokenizing the assets and HandCash is the wallet to interact with and own the tokens as well as funding and executing the trades.

To give an example on how enticing participation in this market would be, as ASIC prices continue to fall, new parties will look to invest. However, finding a vendor, reaching out, communicating, negotiating in hopes of making a deal with the vendor (along with potentially taking physical delivery) slows down the process and adds friction to the trade to the point where at any point the potential deal falls through.

Instead, the customer could log on to an exchange maintained by the pool (GorillaPool) with their digital wallet (HandCash), with KYC already linked and established (Tokenized) and instantly purchase as much already deployed hash power at the current market determined rate. No purchase orders, no manual communications, no negotiations, no shipping.

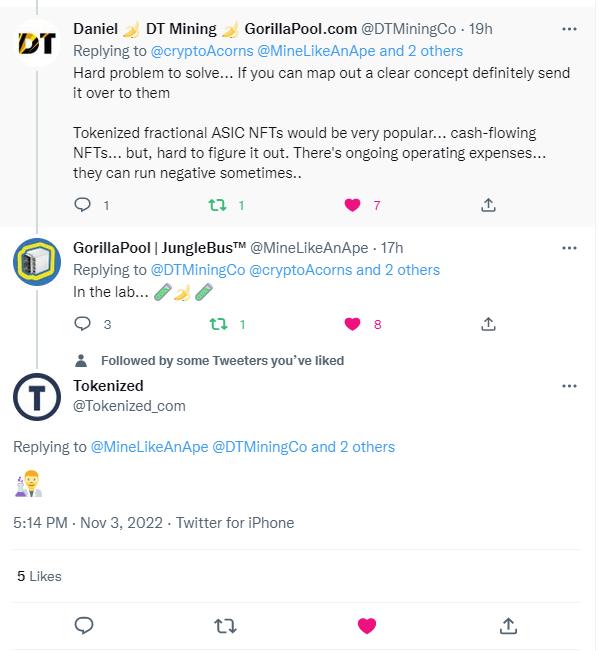

Apparently, this is in the works.

Watch: Global Blockchain Summit panel, Tokenizing assets & securities on blockchain

02-25-2026

02-25-2026