|

Getting your Trinity Audio player ready...

|

For years, small blockers have told us that the Lightning Network is the solution to scaling Bitcoin.

Despite Satoshi Nakamoto telling us directly that Bitcoin had no scaling ceiling in the early days, small blockers insisted they knew better than Bitcoin’s inventor. Despite warnings about AML/KYC laws and the security flaws in their layer-two brainchild, the all-knowing central planners of BTC pushed on.

It’s clear now that big blockers were right. As the BSV blockchain scales to millions of transactions per second and popular wallets like HandCash experience record volume, the Lightning Network is dying. Not only is it a complicated mess with a terrible user experience, but custodial wallets like Exodus are beginning to shut it down for the very same regulatory reasons big blockers warned them about years ago.

Look at the absolute state of this. Been here since 2016 and this confuses me. Imagine newcomers. pic.twitter.com/977DwTqIxn

— Gavin Lucas (@gavinlucas110) February 19, 2024

As the above image shows, BTC Core developers and those who have butchered the Bitcoin protocol live in a fantasy world of their own making. Nobody is going to use this other than a handful of computer science majors with no real-world experience. This is the core problem and has been since Bitcoin was hijacked: the people in control of BTC are crypto-anarchists and do not realize how fringe their worldview is. People want simple, easy solutions.

What about those regulations?

Years back, big blockers warned the people constructing the Lightning Network that it would fall foul of money transmission regulations and KYC/AML rules.

At the time, these concerns were laughed off as nothing to worry about. Code is law, the crypto-anarchist mantra goes, and the governments of the world would be rendered powerless in the face of the mighty BTCers.

What they forgot is that centralized exchanges, wallet providers, and other digital currency service providers are run by companies or informal partnerships and are thus subject to the laws in their jurisdictions.

Miners, too, are large publicly traded companies, and they will refuse to process transactions associated with opening and closing Lightning channels if they must. Lightning channels use 2-of-2 multi-sig addresses, and while these aren’t exclusive to it, they can be monitored, and patterns can be detected. Small blockers don’t like miners going against their dictates, but they can and will.

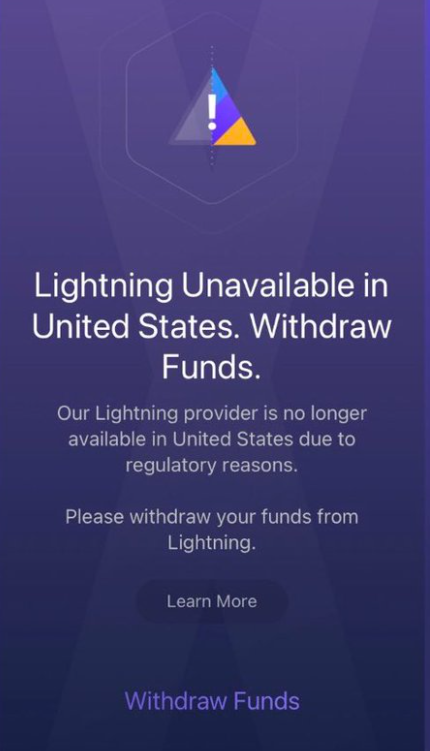

Already, we’re seeing Lightning providers banned from the United States for falling afoul of regulations. Just look at this recent notice by Exodus.

If Lightning providers are to stay within the bounds of the law, they’ll have to eventually KYC check users and make sure to comply with AML/CTF regulations. This will be exceedingly difficult to do given the network’s convoluted nature, which acts like a giant mixer, and thus, providers will die off one by one until only a few are left. Ironically, this creates the very centralization and government oversight small blockers wanted to avoid.

The process of moving funds to the Lightning Network is already complex and offputting for most ‘normies.’ The ever-increasing costs of BTC transactions, which are required to open channels, and having to do KYC checks will put off all but a few diehards. Can you see yet why this was a fool’s errand?

It can all be so much simpler than this

All this unnecessary complexity and nonsense is rooted in a political ideal: small blockers insist that everyone must be able to run a node at home to keep Bitcoin ‘decentralized‘ in their understanding of the word.

However, Satoshi Nakamoto called Bitcoin “completely decentralized” in his very first public post. Since he explicitly said that nodes would end up in data centers, could it be that small blockers have fundamentally misunderstood the meaning of decentralization due to their own political beliefs?

Whether they like it or not, BSV has proved that Satoshi was right: it never really hits a scaling ceiling. The Lightning Network is completely unnecessary: Bitcoin scales on-chain. Yes, the nodes will end up in server farms, but nobody cares other than those committed to evading the law or who have an issue with capitalism.

The Lightning Network isn’t Bitcoin—it’s an entirely different system, and it is doomed to fail. Those who bought the lie should return and try Bitcoin as it was originally designed. Grab a HandCash wallet and see what you think!

Watch: Most people don’t understand Bitcoin

02-28-2026

02-28-2026