|

Getting your Trinity Audio player ready...

|

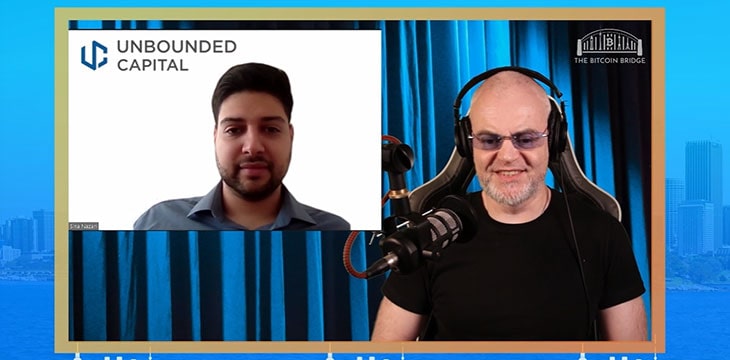

When it comes to investments, analysts are always on the lookout for potential value. And Sina Nazari, an analyst from blockchain investment firm Unbounded Capital, is looking forward to how the BSV blockchain’s value will grow in the years to come.

Nazari joined Jon Southurst on The Bitcoin Bridge to share his journey that led him to discover the BSV blockchain and its goldmine of potential.

He shared that he first came upon BSV while working at a “Fund of Funds,” which is a type of pooled investment fund that invests in other types of funds. One of those was Unbounded Capital, whose Managing Partner Zach Resnick told Nazari to review some of the materials they provided to the public.

“I slowly started reading those materials,” Nazari said. “And then I got interested in it and started thinking, ‘Oh, BSV will actually be this great thing that will be very different from the rest of the blockchains. And it’s more lawful. It’s more scalable.’”

Nazari said that everything about BSV looked like it is better for building companies on top of. Even better, it doesn’t face the same problems as other blockchains such as Ethereum.

That was when he decided to join Unbounded Capital.

‘It’s being built on value and not hype’

Nazari described his move to Unbounded Capital as “very natural,” primarily because it works with BSV. The blockchain allow for unlimited scaling, which is a massive advantage in the world of payments.

The Unbounded Capital analyst explained his move from payments to investment, saying that the world of investments is a “great” place.

“It’s a great alternative to being an entrepreneur because in the world of investments, you get plenty of ideas,” he explained. “You provide plenty of support to a lot of ideas, a lot of entrepreneurs. You could be a part of their journey and be part of their success story.”

When asked what he thought of the BSV industry so far and the companies working on BSV, Nazari gave TDXP as an example of what he’s impressed by. TDXP is a derivatives trading platform built on Bitcoin SV.

“The reason I say this is because the opportunity that BSV brings for these payments is unmatched anywhere in the world,” Nazari said. “There is not a single place elsewhere that we could have all these trades take place in the same place. So I’m very excited about TDXP.”

Aside from TDXP, Nazari says he’s also excited about some of the other portfolio companies on Unbounded Capital. For example, he mentioned digital wallet provider HandCash, whose technology he described as “amazing.”

“I’m very excited about the BSV ecosystem as a whole because it’s being built on value, and it’s not being built on hype.”

‘We’re going to see BSV eclipse all other blockchains’

While talking about the future of BSV, Jon Southurst asked whether BSV must move quickly to take market share away from competitors.

In answer, Nazari said that he believes BSV can take its time to develop and that slowly, the rest of the blockchain ecosystem is going to be convinced that this is the right protocol to be investing in. He’s also not worried about the growth of competitors during this time, saying that “their growth will never be able to match what we can do a few years from now.”

Nazari says BSV’s real value lies in real micropayments, innovations, and in providing cheaper access to the cloud, among other things.

Micropayments, in particular, are a great application of BSV according to the Unbounded Capital analyst, speaking from an entrepreneurial perspective. He explained that this is an area where it is possible to leverage technology that’s already there and to innovate new financial models. Another application is gaming, which Nazari says is a very good use case because it is detached from the financial system.

“So there’s no point in rushing things, because ultimately what we can do is so much greater than that in a few years’ time,” Nazari stressed. “We’re going to see BSV eclipse all other blockchains all together, not just in transaction volumes that it already does, but also in terms of the value that it’s creating.”

Find out more about Nazari’s analysis of BSV’s potential on The Bitcoin Bridge with Jon Southurst. Watch the full interview on the CoinGeek YouTube channel.

02-21-2026

02-21-2026