|

Getting your Trinity Audio player ready...

|

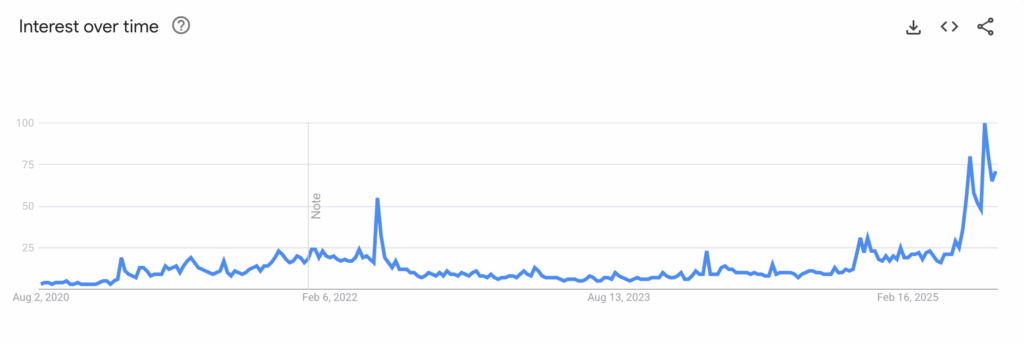

Stablecoins have dominated the headlines in the digital currency world and beyond over the past year as adoption has accelerated and regulation has caught up. This rise has driven stablecoin searches on Google (NASDAQ: GOOGL) to a new peak, with the passing of the GENIUS Act as the biggest tailwind.

Data from Google Trends shows that stablecoin searches have been on an uptrend since April and hit a new peak in mid-July.

The spike in searches in mid-July coincides with the passing of the GENIUS Act in the U.S., which established America’s first federal regulatory framework for the sector. It covers who can issue stablecoins, establishes transparency and reserve rules, and extends to consumer protection, AML, and more.

The GENIUS Act wasn’t the first comprehensive stablecoin framework, but the most impactful by a mile. One of the other landmark regulations for the sector was MiCA in the European Union, whose stablecoin provisions took effect mid-last year.

While the GENIUS Act pushed stablecoin searches to new records, MiCA barely had any effect when it went live.

The tiny South Atlantic Island of St. Helena ranked first by region, with Singapore, Luxembourg, Nigeria, and Cyprus in the top five. Nigeria and Singapore are both home to local stablecoin projects—cNGN and StraitsX. The two are pegged to the naira and the Singaporean dollar, respectively, and aim to provide local alternatives to the USD-pegged stablecoins that have dominated the market.

Washington tops the city charts, with San Francisco and Miami in the top five.

Less than 1% of stablecoins go to retail

While the stablecoin fever is at an all-time high, new data reveals that only a negligible share is going to the retail market.

In the last 12 months, only $48.5 billion in stablecoin volume changed hands in transactions below $250, which is the acceptable range for retail transactions, reveals Cuy Sheffield, Visa’s (NASDAQ: V) head of crypto. This representts less than 1% of all stablecoin volume, showing that despite the hype, these tokens are still not being used in day-to-day transactions.Diving deeper into the data reveals even more concerning results. Of the $49 billion, a majority was used to make deposits and withdrawals from digital currency exchanges or transferred peer-to-peer in digital currency transactions. As such, only a tiny fraction of the total went to payments.

“The reality is that today, stablecoins are being used for high-value transfers, business-to-business and cross-border payments. Retail transactions at merchants? Still a small part of this,” Sheffield noted.

For years, a lack of regulatory clarity has been blamed for the limited retail usage, but with the GENIUS Act in the U.S., MiCA in Europe, the Stablecoin Ordinance in Hong Kong, and dozens of others globally, regulators are swiftly catching up.

According to Sheffield, the digital currency market is lagging behind, with poor user experience and little standardization across blockchain networks to blame. There’s also limited merchant acceptance, with most unwilling to invest in stablecoin systems as the volume is still relatively low.

Stablecoin-connected cards could be the easiest solution to pave the way for easier payments, and Visa is leading this new market, Sheffield added. In April, the payments giant partnered with Stripe-owned fintech, Bridge, to issue a card that links to stablecoins and allows users to make day-to-day payments without the merchant needing any special software.

Last week, the company expanded its stablecoin payment options, adding Global Dollar (USDG), PayPal (NASDAQ: PYPL) USD (PYUSD), and EURC, Circle’s (NASDAQ: CRCL) euro-pegged stablecoin.

“We believe that when stablecoins are trusted, scalable and interoperable, they can fundamentally transform how money moves around the world,” commented Rubail Birwadker, Visa’s global head of growth products.

But not everyone shares the excitement. The European Central Bank (ECB) warned last week that the rise of USD-pegged stablecoins could undermine its control over the EU’s monetary policy.

ECB advisor Jürgen Schaaf opined that the EU could soon face the challenge most dollarized countries grapple with: weakened control over the monetary conditions. Left unchecked, this could ultimately weaken the euro and result in “higher financing costs relative to the United States, reduced monetary policy autonomy and geopolitical dependency.”

Watch | Centi: Bridging digital money and traditional banking

02-17-2026

02-17-2026