|

Getting your Trinity Audio player ready...

|

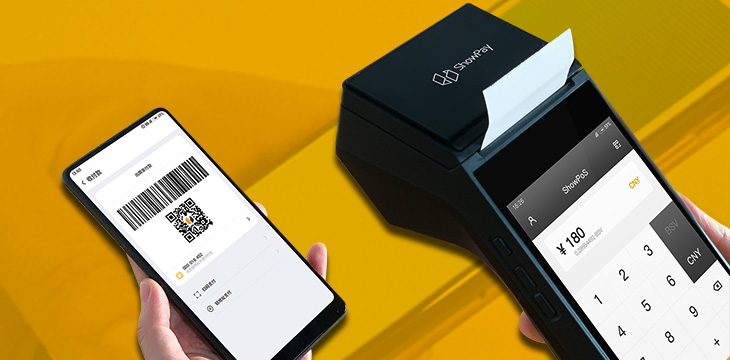

ShowPay plans to become the latest company to offer a solution for Bitcoin merchant point-of-sale (POS) systems—with a twist. The Guangdong-based team is currently looking for merchants to participate in a free beta trial of its integrated hardware/software network. Unlike similar offerings in the past, ShowPay uses the Bitcoin SV (BSV) blockchain as a base to tokenize the various assets it supports.

According to ShowPay’s website, its system will support multiple cryptocurrencies including BSV, BTC, BCH, ETC and Tether—as well as Facebook’s Libra (if and when it becomes a reality).

Zero-conf, NFC, facial recognition

In a short demo video posted to Twitter a few days ago, ShowPay showed instant zero-confirmation payments and transfers between cryptocurrencies and fiat. Using tokenized assets on the BSV blockchain, it said, was “safer and faster than (BTC’s) Lightning Network.”

People can pay BTC and BCH to merchants in BSV Network soon, 0-conf,no jam and traceability. It looks better then LN😀 @Tokenized_com rocks pic.twitter.com/6s1XDWCPcU

— ShowPay (@showpayio) December 13, 2019

ShowPay’s system promises payments by QR code, NFC/tap-and-pay, and even facial recognition. It includes both a wallet and exchange app for Android devices and POS hardware devices with NFC chip readers.

The product suite “should be on the market in three months.”

It is able to swap between assets by keeping adequate reserves in multisig wallets, and tokenizing them on BSV using the platform designed by Australian company Tokenized. Users can still, for example, use BTC proxy tokens to send real BTC to other wallets. This tokenized BTC, ShowPay said, actually works better than the real thing.

This will have no effect on BTC, but just indicate that BTC sucks, even the BTC token on BSV is much better than BTC😹

— ShowPay (@showpayio) December 17, 2019

It’s clear ShowPay are also BSV fans first. One reply to a query read: “This will have no effect on BTC, but just indicate that BTC sucks, even the BTC token on BSV is much better than BTC”.

CoinGeek has reached out to ShowPay for more details on the company, and how the system and tokenization functions.

Why Bitcoin merchant adoption has stalled… for now

After almost a decade of Bitcoin’s existence, merchant adoption in physical stores remains rare. There are several reasons for this, among them a lack of consumer demand, price volatility and merchants’ unfamiliarity with cryptocurrencies, the need to integrate with banks/exchanges and specialized hardware, setup costs, and of course the phenomenon of crypto HODLing.

This has led to several formerly Bitcoin-friendly merchants to drop the payment option, hampering Bitcoin’s growth and disappointing customers who’d become used to the convenience.

ShowPay will need to overcome at least some of these issues to succeed. Many merchants have cited BTC’s excessive transaction fees (due to its restricted block size) as a major reason. Using tokenized BTC instead of BTC proper, and avoiding the problematic Lightning Network, could be the killer feature.

Despite low awareness, Bitcoin remains an attractive payment method for merchants. Exchanges take on the price volatility and double-spend risks, and many merchants say they’d welcome any option that offered an alternative to paying credit card fees. Though consumers are rarely aware of it, credit card companies charge up to 3.5% on every transaction, which can seriously eat into profits for low-margin/price businesses like cafes.

03-06-2026

03-06-2026