|

Getting your Trinity Audio player ready...

|

Last week, Hester Peirce, the head of the Securities and Exchange Commission’s (SEC) Crypto Task Force, told Bloomberg that “many of the memecoins that are out there probably do not have a home in the SEC under our current set of regulations.” She added that if Congress or the Commodity Futures Trading Commission (CFTC) wanted to regulate them, that would be up to them, but for now, many of these tokens likely fall outside the SEC’s jurisdiction.

In my opinion, Peirce explicitly communicated that memecoins—formerly known as ICOs—are permissible. If someone launches a memecoin, similar to how Donald Trump did, there’s a good chance the SEC won’t investigate or prosecute them. This marks a major shift from the enforcement-heavy approach of the Biden administration and former SEC Chair Gary Gensler.

When asked whether the SEC or CFTC would ultimately oversee digital currencies, Peirce responded with a non-answer, saying, “We’re assessing our jurisdiction, identifying gaps, and pointing them out to Congress.” In other words, she didn’t clarify who will regulate digital assets, only that Congress might eventually need to step in, especially if it’s clear that enforcement must take place but unclear who the enforcer should be.

This new administration, which campaigned on bringing regulatory clarity to digital assets, seems to be taking a hands-off approach to the space. With Peirce, who is known for being crypto-friendly and leading the Crypto Task Force, it seems like enforcement actions, regulatory scrutiny, and reporting requirements for digital asset companies will be far less aggressive than in previous years. I’d even go as far to say that it looks like it will be practically non-existent.

Federal Reserve opens doors to digital asset banking

Just as the SEC seems to be stepping back from digital asset enforcement, the Federal Reserve is also taking a more neutral stance. Fed Chair Jerome Powell confirmed that the Federal Reserve will not block banks from serving legally compliant crypto businesses. While this isn’t outright support for digital assets, it’s a definitive shift from the past, when the Fed actively discouraged banks from engaging with digital asset firms.

Previously, the Fed denied federal banking licenses to institutions that dealt with digital assets, citing concerns over fraud, volatility, and regulatory uncertainty. They also introduced oversight programs, like the Novel Activities Supervision Program, which placed stricter compliance measures on any company that serviced digital asset businesses or conducted blockchain/digital asset-related activities.

Now, Powell seems to be shifting the Fed’s stance from negative to neutral. As long as a bank is compliant, the Fed doesn’t seem likely to interfere with its decision to serve digital asset businesses.

Although news of this nature excites market participants, what is less talked about is the impact it is likely to have on the industry beyond positive price action. A move like this and the hands-off approach from the SEC could lead to a wave of traditional banks expanding their digital assets services, which may disrupt the market dominance of incumbents like Coinbase (NASDAQ: COIN). If household-name banks enter the digital asset space with better resources and better pricing due to the scale at which they can operate, smaller digital asset-native firms might struggle to retain their customers and, therefore, lose market share to traditional financial institutions.

Robinhood’s earnings surge driven by ‘crypto’ boom

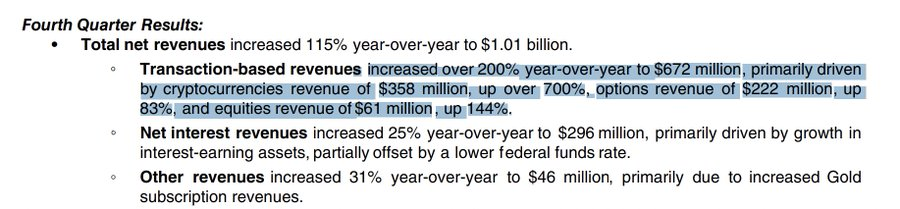

Robinhood’s (NASDAQ: HOOD) latest earnings report exceeded analysts’ expectations. The company reported $0.54 earnings per share, which was much higher than the expected $0.42 per share. One of the biggest drivers of the surge Robinhood experienced in Q4 2024 was digital assets.

The company’s digital asset division generated over six times its equities division’s revenue, highlighting how much Robinhood relies on digital asset activity for its financial success. When ‘crypto’ is booming, so is Robinhood. When the market slows, as it did from 2021-2023, the trading firm’s revenues suffer.

This tells us something important about consumer behavior: people prefer a one-stop-shop for their investments. In the early days of digital assets, investors had to use separate platforms to trade digital assets. Now, traditional financial service providers like Robinhood are integrating digital assets into their platforms, making it easier for users to buy stocks and digital currencies in the same place.

As more traditional banks and investment firms receive regulatory clarity to engage with digital assets, we could see a shift from digital asset-native exchanges toward more established financial institutions. This once again raises the key question mentioned above: Can the original digital asset players compete with traditional financial institutions and start offering the same services, especially since they have better regulatory standing, more consumer trust, and a bigger war chest?

Is ‘crypto’ entering a new ‘Wild West’ era?

Between the SEC’s relaxed stance on memecoins, the Fed’s hands-off approach to banks serving digital asset customers, and Robinhood’s reliance on digital assets for its earnings, a few things are becoming clear: ‘crypto’ is becoming more integrated with traditional finance and regulators are looking the other way, letting activities that would have previously been cracked down on fly under the radar.

Although this will undoubtedly be good for those speculating on coins and tokens, I do wonder how these agencies are going to handle the inevitable illicit activity that always takes place when there is money to be made, how that will affect the innocent consumers that were looking to make a quick buck but end up getting badly burned when they get the rug pulled on them, and if the combination of these two factors will have a knock-on effect on the traditional financial institutions that are beginning to participate and play a bigger role in the industry.

Watch: Breaking down solutions to blockchain regulation hurdles

03-02-2026

03-02-2026