|

Getting your Trinity Audio player ready...

|

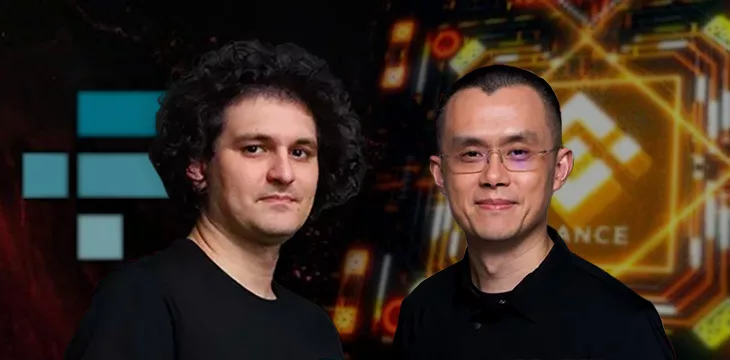

FTX founder Sam Bankman-Fried (SBF) won’t face a second trial for bribing Chinese officials, while Binance founder Changpeng ‘CZ’ Zhao’s bid to return to Dubai has been rejected for the second time.

On December 29, the U.S. Attorney’s Office for the Southern District of New York (SDNY) informed U.S. District Judge Lewis Kaplan that it “does not plan to proceed with a second trial” for SBF, the disgraced former leader of the defunct FTX digital asset exchange.

Last November, SBF was found guilty on seven charges involving the fraudulent operations at FTX, which filed for bankruptcy in November 2022 after the leak of an internal balance sheet showed an $8 billion discrepancy between assets on hand and obligations to customers. SBF is scheduled to be sentenced for his crimes on March 28.

However, those charges were separate from five additional charges involving SBF’s generous donations (with FTX customer cash) to U.S. politicians and a $40 million payment to Chinese officials in 2021. The payment/bribe was intended to free up over $1 billion worth of digital assets belonging to the FTX-affiliated/SBF-owned market-maker Alameda Research that had been frozen on a China-based exchange.

Such a payment would violate the U.S. Foreign Corrupt Practices Act (FCPA), which prohibits U.S. citizens/entities from paying foreign officials to obtain favorable treatment in overseas markets. Charges of conspiracy to violate U.S. campaign finance laws produced guilty pleas by SBF’s former colleagues Nishad Singh and Ryan Salame, through whom much of the campaign cash was funneled.

The SDNY told Kaplan that “much of the evidence” that would be used to convict SBF a second time had already been presented during SBF’s first trial. The SDNY further argued that this evidence could be considered during SBF’s March sentencing and that SBF is already looking at a sufficiently lengthy jail term, making a second trial redundant. Preceding another trial would, therefore, “advance the public’s interest in a timely and just resolution of the case.”

The Department of Justice’s (DoJ) decision has sparked a mix of bemusement and outrage, as well as cries of ‘coverup’ related to SBF’s lucrative donations to Washington, D.C. politicians. While SBF later admitted having secretly donated millions to Republican pols via so-called ‘dark money’ organizations, his public donations were primarily to Democrats. Rightly or wrongly, GOP figures have seized this opportunity to loudly proclaim the existence of a ‘deep state’ decision to protect Dems from bad press ahead of the 2024 presidential election.

In a separate ruling, Judge Kaplan denied SBF’s request to delay his March sentencing until “early-mid May 2024.” SBF’s legal team had argued that it needed more time to prepare for the sentencing process. SBF was scheduled for a late-December pre-sentencing interview with the U.S. Probation and Pretrial Services System, and his attorneys sought more time to prepare their client.

In his denial, Kaplan noted that SBF’s team failed to object to the sentencing schedule at the time it was announced and that Kaplan had already granted them a one-week delay for filing their submissions. Furthermore, the issue of SBF’s second trial, which his lawyers had also cited in their request for additional time, has since been rendered moot.

CZ is going nowhere fast

The same day that SBF learned he wouldn’t face a second trial, former FTX investor CZ learned that the judge handling his criminal case had rejected his bid to return to his residence in Dubai ahead of his sentencing on February 23.

In early December, U.S. District Judge Richard Jones of the Western District of Washington ordered CZ to remain in the U.S. pre-sentencing, agreeing with prosecutors that CZ’s vast wealth and lack of ties to the U.S. made him a significant flight risk, particularly given the lack of an extradition treaty between the U.S. and the United Arab Emirates (UAE).

Prosecutors further argued that CZ was a flight risk due to his growing awareness that he might receive more than a slap on the wrist for the Bank Secrecy Act violations detailed in the record-setting $4.3 billion settlement CZ reached with the DoJ in November.

While 2024 will likely prove to be a bummer for CZ, the financial penalties he incurred for his years of lawbreaking were more than offset by last year’s increase in his net worth.

Bloomberg recently reported that CZ’s current net worth stood at over $37 billion, up nearly $25 billion from one year ago, good enough for 35th on Bloomberg’s global rich list.

Bloomberg claimed the increase was due entirely to CZ’s controlling stake in Binance, something he wasn’t required to divest as a condition of his DoJ settlement. Moreover, Bloomberg’s estimates don’t include the various stacks of tokens he controls, many of which also enjoyed unwarranted boosts in 2023, thanks partly to rampant wash trading on exchanges like Binance.

However, CZ’s wealth still pales in comparison to its nearly $100 billion valuation in early 2022, back before ‘crypto winter’ had set in, the bottom fell out of the entire digital asset sector, and CZ was still dismissively tweeting denials that Binance was up to no good.

End of year or end of the road?

In CZ’s enforced absence, the responsibility for running Binance has been handed to Richard Teng, who stepped into CZ’s CEO role following the latter’s settlement. On Tuesday, Teng tweeted highlights of Binance’s 2023 End of Year Report, which somehow manages to completely avoid any mention of Binance’s year of unprecedented legal challenges, almost as if it never happened.

Instead, Binance chose to continue hyping all the efforts the exchange has (allegedly) made to improve its compliance record from nonexistent to possibly existent. Sadly, Binance didn’t try to claim ownership of “crypto’s best security and compliance team” as it did in its EOY22 report, but Teng still claimed Binance “put compliance first” and “held [sic] keep crypto safe.”

Whatever the cause, Binance claims to have enjoyed a 30% rise in new users in 2023, pushing Binance’s global customer base to over 170 million. However, it remains to be seen how many of these users will stick around once the DoJ-mandated compliance/lookback monitors are appointed.

These monitors, who are still in the process of being selected, will be given broad authority to inspect all Binance transactions, past and present, and report any suspicious behavior back to Washington. Once monitors are in place, ‘crypto’ whales who have even less tolerance for oversight than CZ will search for greener, more opaque pastures.

Late last month, the South China Morning Post was able to open a new Binance account

using a mainland China identification card containing data different from that supplied during the registration process. This would seem to blow a major hole in Binance’s claims to have turned over a new leaf regarding ‘know your customer’ and anti-money laundering standards and practices. (Never mind its claims not to cater to mainland Chinese customers.)

Whether such reports will factor into how long CZ is required to bunk in a U.S. prison remains to be seen. But such reports strongly suggest that Binance intends to wring every last dollar possible out of its non-compliant legacy systems. No matter what the situation, it seems Binance gotta Binance.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple, Ethereum,

FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

05-08-2025

05-08-2025