|

Getting your Trinity Audio player ready...

|

Following my article on the economics of locking coins against listings, Relay Club has added the ability to lock coins against non-fungible token (NFT) listings. Users can now add any amount of BSV to an active NFT listing on RelayX, boosting its visibility on the Top tab.

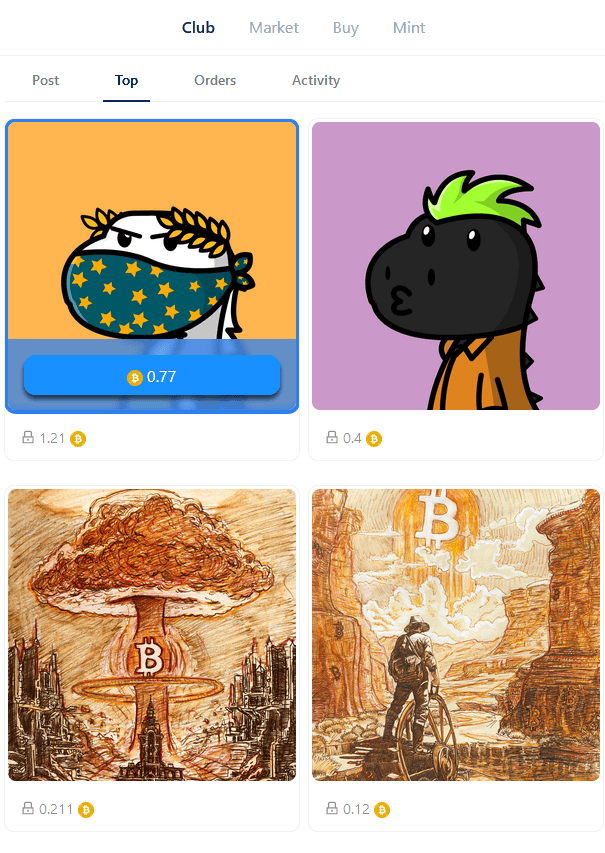

The top-ranked listing above is a Rexxie being sold for 0.77 BSV, with 1.21 BSV locked against it. The fee sharing is not implemented yet, but an incentive already exists to curate listings and help other Bitcoiners find higher quality NFTs.

The Activity tab displays the Orders with the most recent locks, helping shoppers and curators alike. Once the fee share incentive is in place, curators will want to find orders with no locks or very little locking to get a larger percentage of the fee share upon a sale. The fee split would be the reward for curation, akin to a personal shopping assistant, but instead of having a single assistant, the entire Bitcoin network of lockers are your shopping assistants.

Due to locking, I have now seen an NFT collection, “Bitcoin is a Beacon” by OG Bitcoiner Daniel Krawisz, that I did not even know existed!

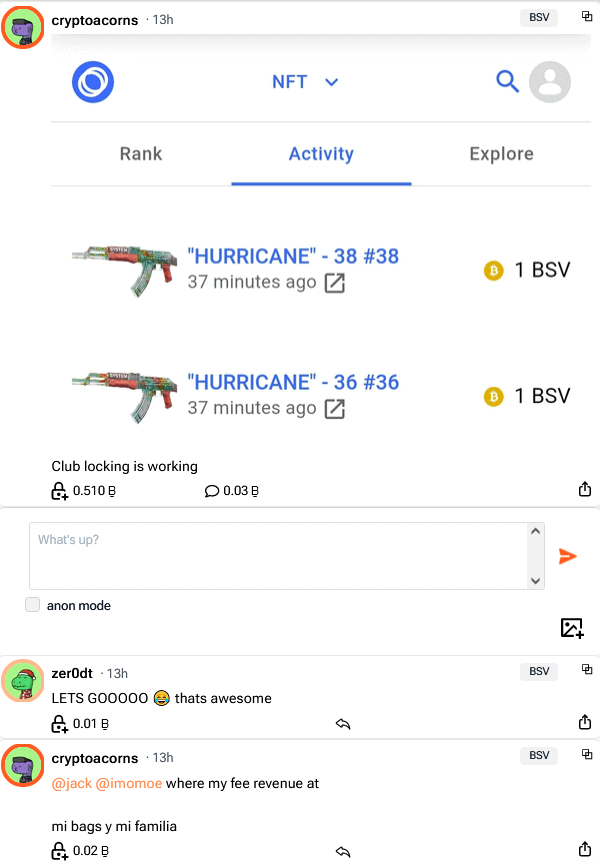

To prove the model, two of hodlocker developer zer0dt’s The System Collection of 3D Gun NFTs were curated with around 0.3 BSV each and sold hours after the feature was added to the Club.

Lockers have already chimed in on what improvements need to be made, as the Orders tab only displays recent, new listings instead of the thousands of listings that already exist on-chain.

The initial release is very minimalist, intended to gain interest and feedback to iterate quickly and effectively, as opposed to building lots of features upfront that users never wanted. Notably, the primary social media aspect of Relay Club, where users can add context to NFTs and/or listings, does not have locking yet. Currently, that feed suffers the same problem that plagues many NFT marketplaces, where users view tons of orders and shilling without any valuable filtering mechanism other than the latest posts and listings or prices.

Note that all orders and associated metadata are publicly on-chain, so right now, other developers could build marketplaces around locking with their own custom fee-sharing schemes (such as 5% fees, with 2.5% to lockers) to reward locking curators.

A popular NFT curation site for BTC ordinals ord.io allows users to upvote and comment on inscriptions with various filtering tools such as file type and different “satributes.” However, this curation method is susceptible to the same sybil attacks that disrupt platforms like Reddit today, where upvotes and comments have no economic cost. Locking on listings solves this, as the same coins allocated to listing A cannot be allocated to listing B.

Additionally, the upvotes and comments cannot and are not on-chain due to BTC’s inability and unwillingness to scale. Other marketplaces cannot take advantage of the ord.io curation data in a trustless manner. Instead, Ordinals Wallet (formerly OrdSwap), Magic Eden, and UniSat all have different views and means of curating inscriptions for sale.

Locking is the protocol on Bitcoin for organizing content, and the more coins locked in the script, the more likely it persists as a standard. This means new platforms will be able to launch much more quickly with the same standards in place, as opposed to spending precious time developing their own custom solutions. Other models will simply not be able to compete with this efficiency at scale.

Watch: NFTs with utility? How about power-ups for games

02-27-2026

02-27-2026