|

Getting your Trinity Audio player ready...

|

At the London Blockchain Conference 2024, CoinGeek’s own Charles Miller hosted a panel titled Proof of Work, Proof of Stake, or Proof of Authority: Discover the Right Consensus Model for Your Business.

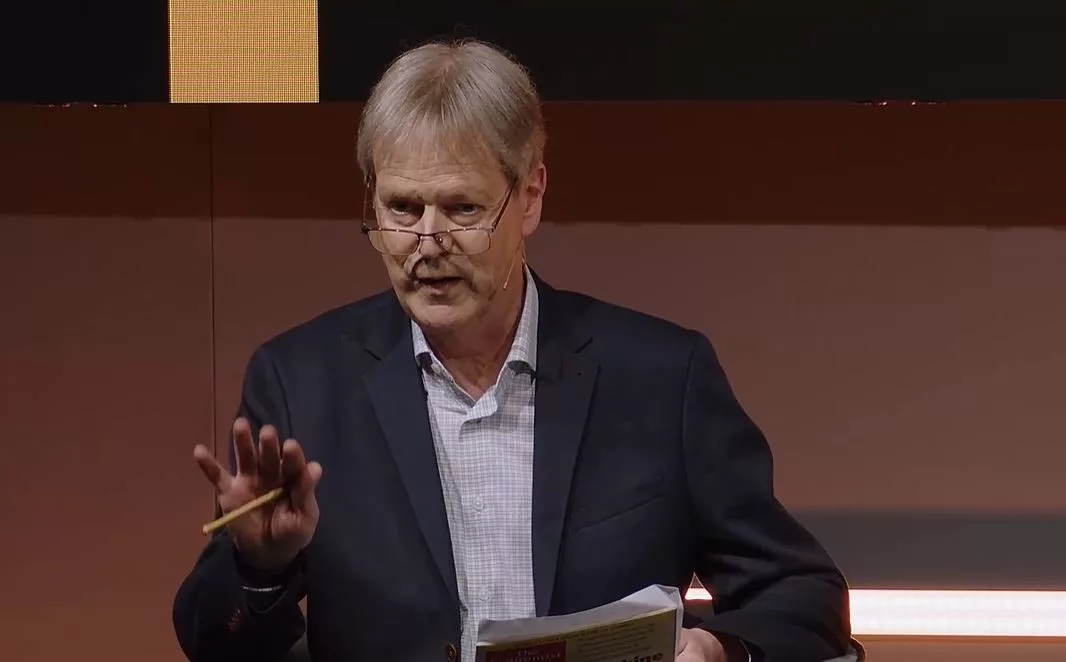

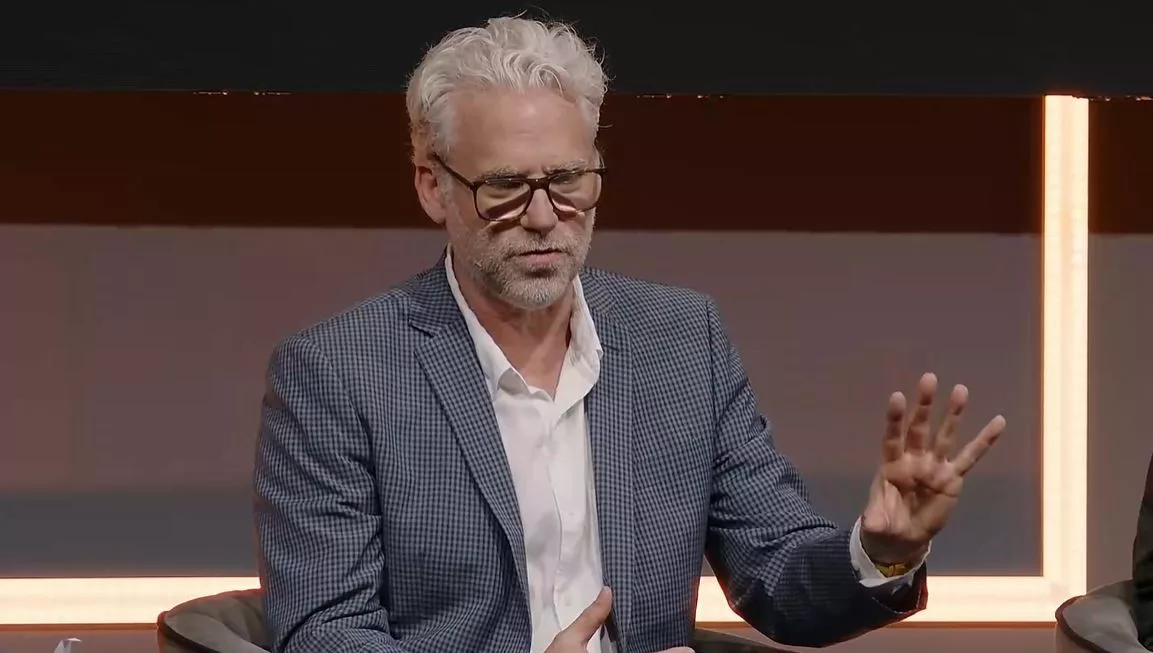

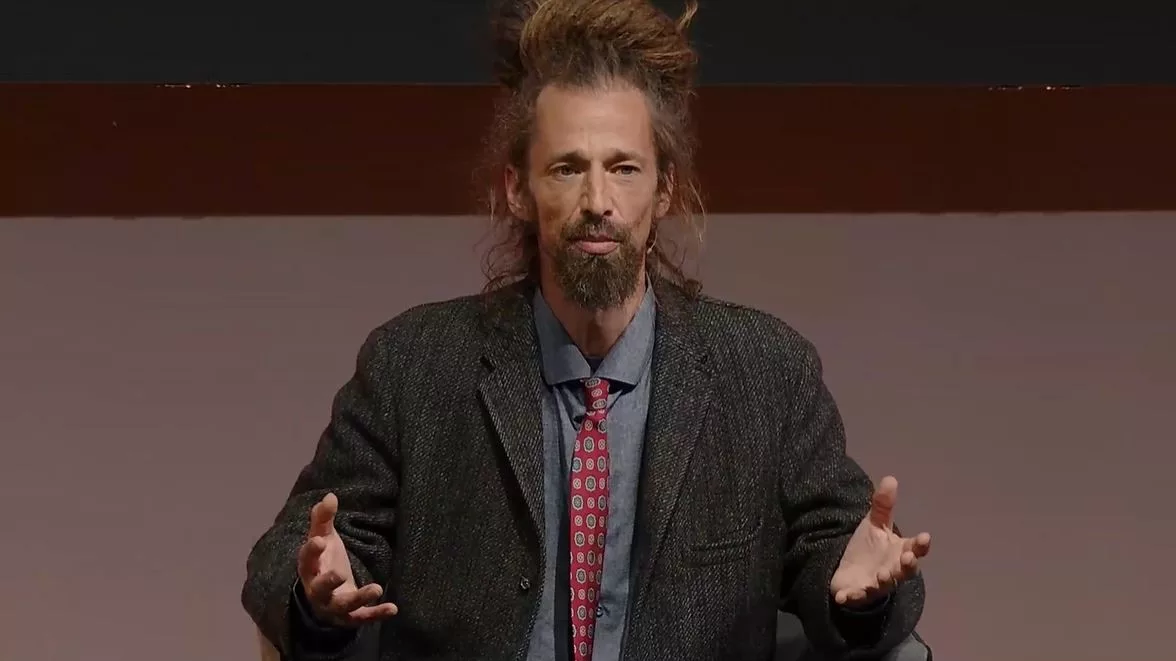

Joining Miller were Kevin Alkema, Director of Hosting at GorillaPool, Jake Campton, Communications Lead & Project Manager at VeChain, and Greg Ward, co-founder and Chief Development Officer at SmartLedger Solutions.

Summarizing the different consensus mechanisms

Miller kicks things off with an explanation of how blockchains work: copies of the ledger have to be updated and stored by nodes. These nodes need to achieve consensus, and there are different mechanisms for doing so. This discussion is all about how they work and the pros and cons of each.

Ward gives an overview of Proof of Work (PoW), which is what Bitcoin uses. It’s a way to create a trustless system with CPU power. Miners build blocks, but they also validate transactions and propagate them across the network.

Alkema describes Proof of Stake (PoS), even though he’s personally a fan of PoW. In PoS, validators stake their coins and are, therefore, incentivized to maintain the integrity of the network. They also process transactions.

General discussion on consensus mechanisms

Campton talks about Proof of Authority (PoA). It’s not competitive like the other two. It uses KYC-verified nodes on what he calls a public-permissioned network. There are also many community-run validators, but the core nodes on the network do the main block-building.

Looking back to the beginning of Bitcoin, Ward says Satoshi put a 1MB limit on blocks to prevent spamming. This was never removed, even though it was supposed to be temporary. Some view this as a conspiracy, but whatever the reason, it doesn’t scale like unbounded blocks do.

Alkema points out that mining on PoW blockchains now requires ASICs. There are many situations in which unused energy exists, such as trapped gas or waste from renewables. There’s much discussion about how to potentially utilize this in mining.

Campton talks about scaling on VeChain. Upgrades can be mandated, and nodes must apply them per their agreement. There’s a Steering Committee, which is voted on every two years, and it makes decisions on updates.

Doing business with the big players

Utility blockchains are all about commerce, and that requires discussions. Miller begins by asking Campton how they interact with the businesses they deal with.

There’s a lot of talk about compliance, he answers. PricewaterhouseCoopers (PwC) connected VeChain with Walmart (NASDAQ: WMT) for a supply chain traceability project, and they like having a team they can talk to in person.

Alkema picks up on this point, noting that products that have user interfaces can be developed. Businesses can develop and run those products, giving customers a point of contact while still using a trustless network on the back end.

Ward says the point of a global public ledger is to help people prove an event happened at a given point in time. Like Alkema, he says we can create businesses that interact with customers while still using a permissionless, public blockchain. SmartLedger Solutions has a few such products.

Campton says Vechain’s non-competitive nature has ESG appeal. It doesn’t use a lot of energy, which helps their clients sell it to their stakeholders. No competition works for their specific needs and purposes.

Ward quotes SmartLedger Solutions co-founder Bryan Daugherty, saying that at least some energy needs to be expanded to secure networks. In his experience, customers don’t ask too much about the consensus model. They want scalable solutions with low fees.

Watch: Day One Summary at the London Blockchain Conference 2024

Day Two Highlights at the London Blockchain Conference 2024

Day Three Highlights at the London Blockchain Conference 2024

02-21-2026

02-21-2026