|

Getting your Trinity Audio player ready...

|

The Philippines is establishing itself as a developing center for blockchain innovation, a trajectory shaped by responsive regulatory actions and government support. This combined effort aims to create an enabling environment for blockchain to thrive, fostering digital transformation and economic inclusion.

According to the “Philippine Blockchain Report 2025” released by the Blockchain Council of the Philippines (BCP), the country continues with its aspiration to become a regional leader of the technology. The report provides a data-driven overview of the nation’s blockchain landscape.

Establishing regulatory foundations

According to the report, Philippine regulators have established initial frameworks to guide blockchain adoption. These frameworks strike a balance between innovation, consumer protection, and market integrity.

The Bangko Sentral ng Pilipinas (BSP), the nation’s central bank, plays a central role in regulating virtual assets. In 2017, BSP Circular No. 944 recognized digital currencies as a valid payment method. This was followed by Circular No. 1108 in 2021, which governs Virtual Asset Service Providers (VASPs), emphasizing anti-money laundering (AML) and information technology (IT) security requirements. A three-year moratorium on new Non-Bank VASP applications was put in place starting in September 2022 and is expected to continue until September 2025.

The BSP also established its Regulatory Sandbox Framework (Circular No. 1153) for emerging technologies, including Distributed Ledger Technology (DLT). An example includes Coins.ph receiving BSP approval to pilot its Philippine Peso-backed stablecoin (PHPC) within this sandbox, which is now in its exit stage. The BSP is also actively pursuing central bank digital currency (CBDC) initiatives, such as Project CBDCPh, a wholesale CBDC pilot to test interbank transactions, and Project Agila, which completed its testing phase in December 2024. A medium-term roadmap for wholesale CBDC development is anticipated for 2025, with the goal of enhancing payment systems and financial stability.

The report also stated that the Securities and Exchange Commission (SEC) recognizes blockchain’s capacity to streamline financial services, enhance digital payments, strengthen regulatory compliance, and drive financial inclusion. The SEC established the PhiliFinTech Innovation Office and launched the SEC StratBox, a thematic sandbox framework for Crypto-Asset Service Providers (CASPs), to support innovation in a controlled environment while managing risks. The SEC has also drafted and published comprehensive Rules on Crypto-Asset Service Providers (CASP) and CASP Guidelines, designed to provide legal clarity for crypto-asset activities, promote responsible market practices, and align with international standards. The SEC expects to launch a derivatives market in the Philippines that may accommodate crypto derivatives.

Moreover, the report said that the Special Economic Zones contribute to attracting blockchain businesses. The Cagayan Economic Zone Authority (CEZA) introduced rules, including the Financial Technology Solutions and Offshore Virtual Currency Business Rules and Regulations (FTSOVCBRR) and the Digital Asset Token Offering (DATO) Rules, which were updated and integrated in 2024 with the Offshore Financial Technology (OFT) Licensing Rules and Regulations (OFTLRR). These frameworks support offshore crypto-exchange activities and token offerings, with CEZA’s “Crypto Valley of Asia” attracting blockchain businesses. The Authority of the Freeport Area of Bataan (AFAB) offers the Offshore Digital Asset Licence (ODAL), allowing blockchain-based businesses to operate within a regulated framework, and has a direct legislative mandate to cultivate emerging industries.

Regarding consumer protection, the Financial Products and Services Consumer Protection Act (FCPA) and the Anti-Financial Account Scamming Act (AFASA) extend their coverage to blockchain-based financial products and accounts, imposing consumer protection standards and responsibilities on service providers.

Government initiatives and projects

Beyond direct regulation, government agencies are actively integrating blockchain into public services, demonstrating practical applications and commitment to the technology.

The Department of Information and Communications Technology (DICT) is committed to adopting emerging technologies, such as blockchain, for sustainable and inclusive economic growth. It launched eGOVchain, a blockchain-based government project aimed at improving transparency, security, and efficiency in public services, and plans to implement eGovEncrypt to secure critical government data.

The Department of Budget and Management (DBM) launched Project Marissa, a blockchain-based initiative aimed at enhancing the security of budget-related documents, utilizing BayaniChain’s hybrid blockchain technology. It also utilizes Prismo to add security to critical budget documents, such as Special Allotment Release Orders (SAROs).

The Bureau of the Treasury (BTr), in partnership with PDAX, issued the nation’s first tokenized treasury bonds in 2023, demonstrating the government’s commitment to using blockchain for transparent and efficient public finance. The BTr is also testing the “GBonds” feature with GCash to broaden Filipino investors’ access to government investments.

The Maritime Industry Authority (MARINA) has introduced the Blockchain-Enabled System for Transactions (BEST) to enhance maritime services by enabling the real-time processing of applications and online payments and ensuring document authenticity, thereby reducing fraud and improving transparency.

Digital transformation is a national goal that calls for collaboration among the government, private organizations such as the Gobi-Core Philippine Fund, Gorriceta Africa Cauton & Saavedra, and the BCP, as well as academic institutions. Events like the Philippine Blockchain Week have become international gatherings, attracting global experts, investors, and innovators.

Impact on adoption and growth

These concerted regulatory and governmental efforts have affected the adoption and growth of blockchain in the Philippines.

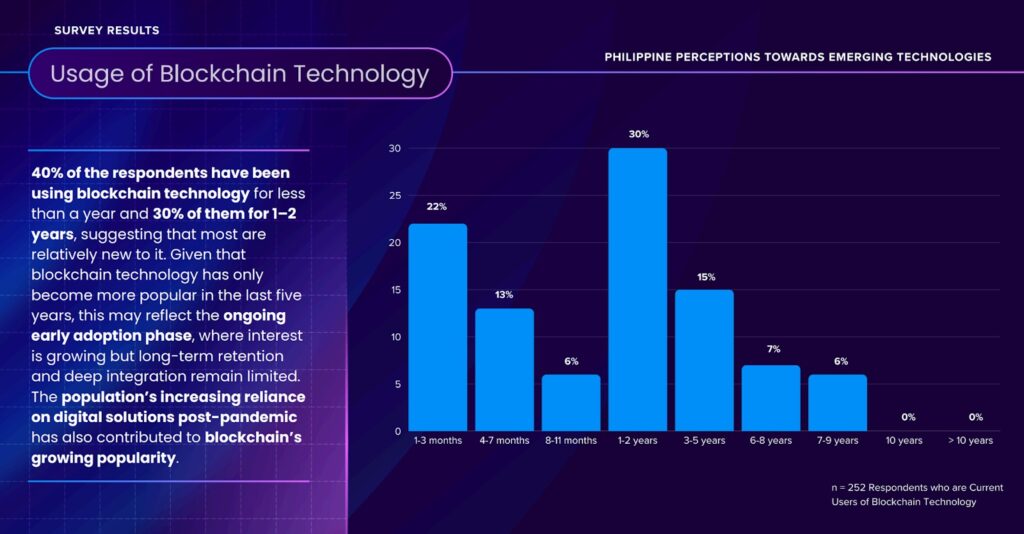

Trust and confidence building: Clear regulations and robust consumer protection measures are crucial in fostering public trust and confidence in blockchain technology. While a large portion of Filipinos (70%) remain unfamiliar with blockchain, a high proportion (74%) expressed confidence in its security, partly due to the accessibility and perceived reliability of centralized exchanges like Coins.ph and PDAX. The pandemic played a role in shifting perception, with more people recognizing blockchain’s security, accessibility, and practical applications.

Financial inclusion and remittances: Blockchain initiatives, particularly from the BSP (e.g., Project i2i and CBDCs, are designed to enhance payment systems and expand financial access, especially for the large unbanked population and overseas Filipino workers (OFWs), who rely heavily on remittances. Blockchain provides a more cost-effective and efficient means of sending money compared to traditional systems.

Diversification of use cases: While digital currency (especially for trading, payments, and gaming) remains the most recognized application, government projects and regulatory foundations are encouraging the expansion of blockchain use cases beyond digital assets and non-fungible tokens (NFTs). The rise of Play-to-Earn (P2E) gaming, with many Filipinos becoming “Metaverse Filipino Workers” (MFWs), has served as an entry point into Web3 for the population, especially during the lockdown.

Challenges and outlook

Despite progress, the report said challenges persist, including a knowledge gap among the public, limitations in digital infrastructure, and funding constraints for early-stage blockchain ventures. Eighty-five percent of respondents have no direct connection to blockchain in daily life, and 70% are unfamiliar with the technology altogether. This indicates that awareness and understanding remain hurdles to broader adoption.

The report said that the Philippines’ regulatory landscape is expected to continue evolving towards a more precise delineation between regulatory bodies, such as the BSP and SEC, a more granular licensing regime, and stricter compliance and oversight as blockchain adoption expands.

Continued investment in education and government coordination is crucial for fostering trust, driving innovation, and promoting responsible blockchain use to support long-term growth. The report added that the government may explore and implement blockchain technology across various sectors, leveraging regulatory sandboxes to assess viability and impact. By fostering collaboration and leveraging its tech-savvy population, the Philippines aims to solidify its position as a player in the global blockchain ecosystem, unlocking its full potential for national progress.

Watch: The Philippines is moving toward blockchain-enabled tech

03-02-2026

03-02-2026