|

Getting your Trinity Audio player ready...

|

Coins.ph, a digital asset exchange in the Philippines, has obtained approval from the country’s central bank, Bangko Sentral ng Pilipinas (BSP), to introduce PHPC, a Philippine peso-pegged stablecoin. This milestone marks a significant development in the digital asset landscape, offering Filipinos a secure and stable digital currency for various financial transactions.

Empowering digital transactions with PHPC

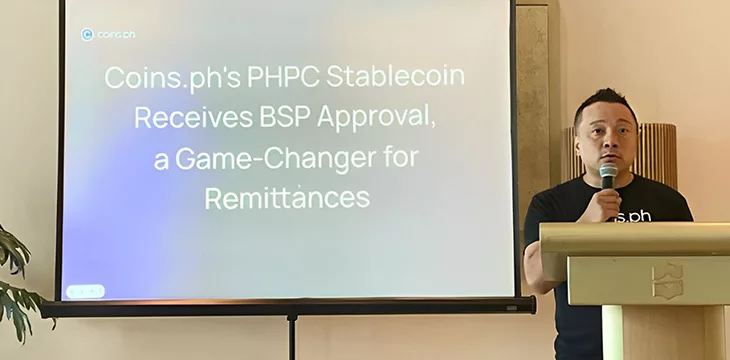

PHPC, the first Philippine stablecoin designed for retail customers, aims to revolutionize digital transactions in the country. In a media roundtable on Wednesday, Wei Zhou, CEO of Coins.ph, expressed the transformative potential of PHPC, stating, “PHPC will empower Filipinos to transact seamlessly and securely in the digital economy while also providing a stable store of value as they participate in the rapidly evolving digital asset landscape.”

Speaking to CoinGeek, Zhou remarked that stablecoins will be the future of money.

“I think all currencies are going to have some type of stablecoin going forward, not just the [U.S.] dollars. Mainly because crypto rails is something that is available 24/7 and not only is it transparent, it is also fast and also cost-efficient,” Zhou said.

Stablecoin is a digital asset tied to another asset class, such as the U.S. dollar, euro, or gold. Coins.ph’ PHPC is backed 1:1 by the Philippine Peso and supported by cash and equivalents. The digital asset exchange said the PHPC offers stability and security for users, facilitating seamless peer-to-peer and business-to-business transactions.

“Our daily expenses are mostly in our home currency,” Zhou added. “So, I believe convenience plays a significant role. Initially, the target users for this stablecoin are Filipinos or companies abroad catering to the Filipino market. There might be potential business use cases as well. We perceive ourselves as an infrastructure platform, facilitating liquidity and investment opportunities in crypto, and now introducing stablecoin services.”

PHPC’s potential impact on remittance and trading

Zhou elaborated on the transformative impact PHPC could have on remittance and trading activities in the Philippines. He emphasized its potential to reduce costs, improve efficiency, and accelerate remittance turnaround times.

“For local businesses seeking efficient payments, they too will have the convenience of conducting transactions in real-time and at any hour of the day, no longer constrained by banking hours or the availability and costs of traditional payment rails,” Zhou said.

Additionally, Coins.ph also announced plans to list PHPC on various exchanges and integrate it with multiple wallets to enhance accessibility and liquidity.

“For trading, not only will PHPC be available on Coins, [but] we intend to list this on other exchanges and work with various wallets to enable support for PHPC as well. PHPC will be open, accessible, and liquid,” Zhou elaborated.

“For local businesses seeking efficient payments, they too will have the convenience of conducting transactions in real-time and at any hour of the day, no longer constrained by banking hours or the availability and costs of traditional payment rails.”

The approval of PHPC holds promising prospects for the remittance industry, addressing the challenges faced by Overseas Filipino Workers (OFWs) and their families. According to BSP data, remittances from OFWs totaled $37.2 billion in 2023, comprising a significant portion of the country’s gross domestic product (GDP) and gross national income (GNI).

Watch: Philippines sees huge growth in blockchain tech interest

07-18-2025

07-18-2025