|

Getting your Trinity Audio player ready...

|

Dear Peter,

You are right about BTC, but you are wrong about the Bitcoin protocol. As a long-time fan, I feel a duty to set the record straight. BTC is a heavily deprecated version of Bitcoin that has been trimmed into some kind of digital Rai Stone backed by hopes, dreams and mining machines. After 12 years of bickering, the network is only capable of pushing 6 megabytes per hour across the network, which makes for 5-7 transactions per second. In other words, it’s a terrible tool to use for “cash,” and because of the volatility, it is not good as a unit of account either.

On the other hand, Satoshi Nakamoto told us “[bitcoin] never really hits a scale ceiling,” and we have implementations of Bitcoin that are capable of sending gigabytes across the network today to manage global payments at a speed and cost with which Visa cannot compete. But the technology is being suppressed and BTC is a circus of controlled opposition against the freedom that comes with an economy built on this infinitely scalable protocol.

My hope is that this editorial educates bitcoiners about who you are, why your opinion matters, but also helps illuminate the suppressed powers of Bitcoin to you! If we can meet in the middle on some things, I think we might be able to change the world together.

Who is Peter Schiff?

Peter Schiff is a hero of the sound money movement—believing in the power of ancient, precious metals due to the real Lindy Effect of gold. He is a best-selling author, talk show host and former economic advisor to Ron Paul. He is also the founder of Schiff Gold and Euro Pacific Bank: one of the only full-reserve banks in the world based on the “Chicago Plan” or “classical” theory of monetary economics popularized by Irving Fisher.

A full reserve bank has no fractional reserve lending, stands in opposition to fiat currency, and is therefore a cornerstone of a sound money-based economy. Schiff sounds like he should be a bitcoiner, right? Well, he should be, but things are more complicated than they should be, and nearly all of his criticisms of BTC are accurate.

Monetary theorist Irving Fisher believed that all fiscal value was derived from utility as a means of exchange, which might be part of why the BTC “hodl commune” dislikes Schiff, but the reality is much more insidious. In contrast to Fisher’s views on money, BTC advocates subscribe to the “Cambridge Theory” of money, which advocates for the cyclical notion that value is derived from an asset’s ability to store value due to scarcity and the constant increase of demand relative to the supply of “cash.”

The Cambridge theory was popularized by John Maynard Keynes: the face of inflationary fiat. Curious, right? Aren’t BTC advocates motivated by sound money? Why has BTC adopted a cornerstone of Keynesian worldview as the cornerstone of BTC’s value proposition?

More on that later.

Like father, like son

Many may not know that Schiff’s father, Irwin, died as a political prisoner behind bars in Texas for refusing to be an “involuntary serf,” as he put it. As a consequence of refusing to relinquish his rights under the Fourth, Fifth, Sixth, Seventh, Eighth, Ninth, Tenth, and Thirteenth Amendments, he lived much of the last decade of his life entangled in courts, jails, and prisons for his belief in the need to fight for sound money and human rights.

Most notably, Irwin Schiff fought for his right to repay debts in gold as prescribed by the U.S. Constitution and did not consent to participate in the Federal Reserve system nor the fiat authority of its collection agency: the IRS.

“No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility.”

– Article 1, Section 10. US Constitution

With libertarian clout and seemingly so much in common, why aren’t BTC advocates and the Schiff family fighting more battles side-by-side?

The answer is complicated, but it has a lot to do with BTC advocates selling out to the fiat money overlords as they slobber over the in-flow of dollars from central banking interests and venture capitalists looking to retain purchasing power amid economic uncertainty.

While Schiffs have literally died for the cause of sovereign money, BTC advocates beg for money and power at every turn, but it is truly because they have been bought by the banksters, big tech, and big finance to operate as controlled opposition with a tool that can’t disrupt the fiat control of the economy because it has been gutted into compliance.

Utility versus narrative

Peter Schiff has never liked Bitcoin. He has been public about his belief that all real value is derived from the utility of an asset to create commercial demand in broad markets. Citing gold, Schiff will often point to its utility in optical technology, medicine, precision machines, computers, and communication devices as well as its use in various types of advanced, industrial chemical processes as well as its common use in coinage, decor, and jewelry. In short, gold’s utility as a store of value is underpinned by its demand in the economy to be used for a diverse set of commercial profit-seeking.

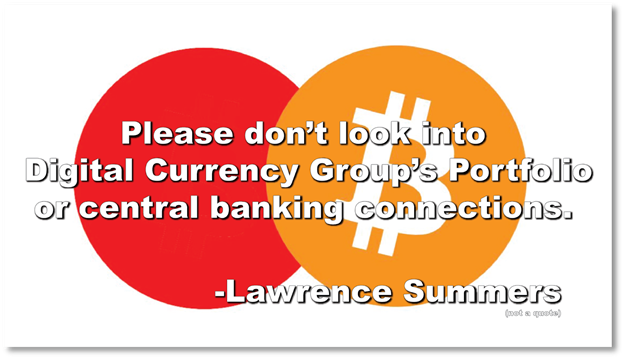

In contrast to frictionless, sound money, the mainstream narrative about BTC is that it was designed as nothing but an asymmetric store of value—a sort of digital Swiss bank account in a distributed cloud with no other utility necessary except attracting an endless supply of buyers for the limited supply of assets. In short, it’s a Ponzi scheme faking as a digital cash system which hasn’t truly been a cash system for many years! In reality, BTC has been ruthlessly social engineered by Visa and Mastercard-backed venture firms to deprecate most of its useful features in exchange for proprietary replacements like Liquid and Lightning Network which have been in a perpetual state of “coming soon” for most of the last five years.

The big tech and financial titans successfully bought, stole, and bribed their way into controlling BTC—which ignited a ruthless civil war in Bitcoin. The war is not often discussed in public forums because the same financiers started their subterfuge by buying the crypto media, influencers and also edged their way into controlling the narratives through Twitter, Reddit, and other internet forums with zero-tolerance censorship policies in regards to the attacks as they were happening. Today, Twitter and its parent and subsidiary organizations are heavily intermingled into the BTC economy.

So where are we now?

BTC is a mainstream investment asset among the general public as well as confused and easily deceived public figures riding a manufactured hype wave fueled by boiler room tactics and the dubious liquidity provider known as “Tether.” With eyes glowing and boomers cringe-tweeting in ways that should make any SEC agent blush, today’s pyramid scheme hysteria of BTC is at an all-time high.

For example, Michael Saylor, the disgraced CEO of Microstrategy (a firm for which Saylor paid millions of dollars in fines to settle stock manipulation and fraud charges out of court) has seemingly replaced all rational discussions in his life with wall-to-wall coverage on Twitter reminding people that they need to pump his bags of BTC.

Seemingly in an effort to bolster his company’s stock, Saylor recently took to harassing Elon Musk, Mark Cuban, and other public figures to buy more BTC and create bullish momentum, earning more criticisms from Schiff and not exactly helping bolster what his shareholders would probably like to assume is Saylor’s main concern: Microstrategy stock value.

And so amid the manic BTC bull market, Schiff has turned his criticisms over to Elon Musk, Mark Cuban, and other popular Twitter users who have joined the cult of BTC over the last few weeks—noting a trend in the stock prices of the BTC bulls.

Hey Peter, that’s BTC, but not Bitcoin!

Now comes the difficult, nuanced part of this conversation. Bitcoin is an unbreakable protocol that implements a rule set in software. This software creates a network that writes to a distributed database. That rule set is unbounded, unbreaking, and set in stone. But it has also been the subject of a very long battle often called “The Bitcoin Civil War.”

After Mastercard created Digital Currency Group and bought nearly every important business, foundation, and development group in the bitcoin economy, they turned BTC into a dysfunctional network fueled by astroturf promoters leading a large band of unwitting cult members across social media. This cult reengineered BTC into being nothing but an investment asset in an attempt to front-run institutional investors as part of a pseudo-socialist call to remove wealth from the hierarchy and allocate it to people who think that all value is absorbed and that none is actually created.

But amid this “War on Bitcoin,” the network and the ledger were split into a few different versions. The most superlative of them is Bitcoin SV (BSV), which moved the original Bitcoin protocol away from this cultish madness. The people of the BSV economy restored the original programming language of the network and returned to the original game theory of the network: business usefulness as a tool for streaming data and money. Almost nobody realizes it, but Bitcoin was capable of exponentially more utility than is possible on BTC, and it has returned in BSV.

In short, Bitcoin SV restores bitcoin’s fundamental nature as a frictionless, digital, sound money system—and the “system” part is crucial. BSV emphasizes the value of the ledger as a record of increasingly valuable data, creating an entire economic system designed to replace not just simple financial tools, but all data and communications tools—including the internet itself!

We are NOT asking you to buy Bitcoin, Peter

We believe that sound money should increase in value relative to the utility that it provides as a measuring stick in the economy and in balance with the sectors that are disrupted. So, Bitcoin SV should increase in value, but the difference is that its economic purpose is not the sole absorption of value like all of the mainstream, speculative cryptocurrencies. In contrast, Bitcoin SV is a tool for the creation of value by underpinning an economic system that enables nano-sized (or larger), instant transactions that grant access to Bitcoin SV’s unique network resources and the blockchain ledger.

Regardless of the price of the coin, the distributed ledger is a commodity of value, and since Bitcoin SV is also a general-purpose, public supercomputer, it encourages the deployment of simple data like images or documents, but also complex applications which can run in an adversarial environment. Over time, these unique attributes make the entirety of global data capable of being stored, repurposed, and revalued instantly and securely – FOREVER on Bitcoin SV. This is the real value proposition of Bitcoin. Not just an investment or a savings tool, but a direct, global disrupter to every aspect of the economy.

If all true value is derived from utility, then over time Bitcoin SV will create more value than any other networking protocol since the internet by creating more economic opportunity than the existing internet can with all of its limits.

But how?

Imagine a world where humans own their own identity and that is available globally in a way that is secure from tampering. With that identity, an individual can show attestations of age, citizenship, or ownership of various attributes without ever relinquishing their identity in a way that is human-readable or able to be stolen by hackers.

Once identity has been secured and ownership connected, one’s assets can be distributed on the same network to be traded globally at will—making it just as easy to do business with a person in South Korea as it is to do business with someone in South Carolina. But not just simple buys and sells, and also not just in theory! Twetch, TonicPow, HandCash, and Money Button are just a few places where identity, ownership, transactions, and trade are occurring today.

With cheap and instant transactions, Twetch looks a lot like Twitter, except every action occurs on Bitcoin SV, and the account data is owned by the Bitcoin key-holder rather than the company. Instead of “big tech” scraping everyone’s data, the users can interact with their social communities with full sovereignty—leaving with their data whenever they please.

HandCash and Money Button provide digital identities through their use of paymail handles like “[email protected]”, and TonicPow creates a direct marketing model to replace the Orwellian data mining advertising model of today’s Facebook, Google and Twitter. With tamper-proof tokenized documents like ID, passport and other attributes hashed and encrypted, global fraud and identity theft will be heavily reduced as adoption of these tools rises.

With simple social and economic actions solved, Bitcoin can be used as a scarce commodity money if needed, but this isn’t necessary because it also creates the opportunity to deploy special purpose currencies like regional legal tender. This would allow state structures to decentralize without the stresses of managing lots of diverse tender. Furthermore, with global exchange rate data on the same network, instant conversion among regional currencies ceases to be an issue at all. Add in the tokenization of gold and other precious metal holdings, and Bitcoin SV allows sub-cent transactions of gold instantly to anywhere in the world for an imperceptible fee. With a little bit of help and vision, gold can become money again, but this time with no risk of fractionalization due to the time-stamping and tracking properties of Bitcoin.

Oh! And this isn’t just theory either. The island micro-nation of Tuvalu is currently in the process of moving its national currency to be tokenized on Bitcoin SV, and also replacing its document management and financial workflows over the network to be managed by Bitcoin-enforced applications to resist fraud better than anything else on earth. Once this proof of concept is complete, we expect the efficiency and security superlatives to attract an on-going stream of newcomers to Bitcoin SV.

Conclusion

Peter, there is so much more that the Bitcoin protocol and the Bitcoin SV network is capable of accomplishing in full-reserve banking, sovereign governance and bringing sound money back to the world. We just wanted you to know that there are bitcoiners who respect your work, and to let you know that Bitcoin is not just the embarrassing culture of BTC investment hype.

We have tools that are capable of creating the greatest increase in the efficiency of global payments in tandem with the greatest increase in the integrity of global data. That is the mission that matters to us, and we are ready to do business today, because on top of everything else, Bitcoin SV is the only blockchain that is not in a beta testing phase.

We’re here to change the world, Peter. Perhaps we should be allies.

03-01-2026

03-01-2026