XRP

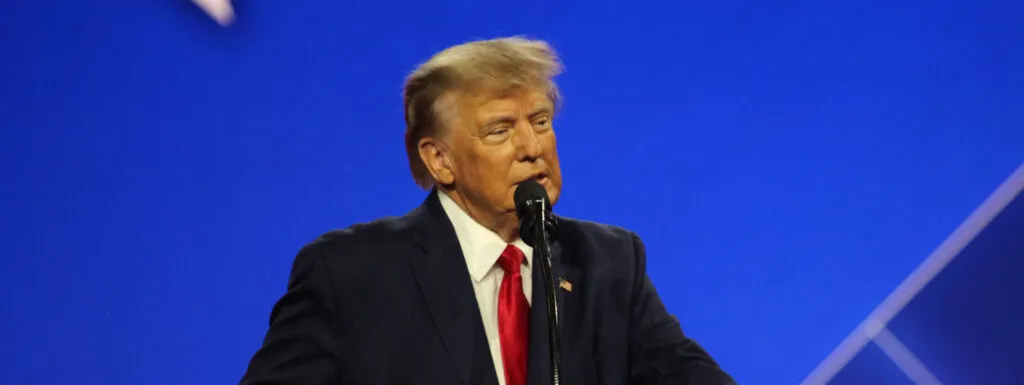

Trump’s crypto reserve announcement: XRP, SOL, and ADA included

This recent announcement surprised the crypto industry, as Donald Trump had previously rumored to launch a BTC strategic reserve but...

The US strategic crypto reserve can’t scale

The U.S. government has allegedly chosen three digital assets—XRP, ADA, and SOL—that can be incapable of doing what they claim...

A Crypto ETF tsunami is coming

A tidal wave of crypto ETFs and altcoins is coming, an event that raises the question of the real value...

BTC maxi meltdown as Trump pushes for digital asset stockpile

While others embrace the idea of a proposed digital asset stockpile, BTC maximalists don't share the same sentiment and are...

Trump having seismic impact on crypto even before he takes oath

Trump's second term as U.S. president is still a week away, but his impact on crypto is already huge. BTC's...

Ripple’s XRP takes off like rocket—what’s fueling this rise?

While still below its all-time high of $3.40 seven years ago, Ripple's XRP token has taken off like a rocket...

Recent

Trending

Most Views

07-05-2025

07-05-2025