|

Getting your Trinity Audio player ready...

|

TL;DR: The first day of the WFIS 2025 event in the Philippines took place at the Marriott Grand Ballroom in Pasay City and focused on digital trust, AI deepfakes, and security in finance, with the BSP highlighting the importance of collaboration for a safer financial ecosystem.

- BSP in establishing a trusted financial ecosystem

- The look of next-gen security in today’s digital world

- Eroding trust through the rise of AI deepfakes

- What’s next for digital finance?

In this ever-evolving digital transformation era, finance and other vital sectors are revolutionizing. Artificial intelligence (AI) and automation increase efficiency, while digital currencies and digital identity offer borderless transactions and safety. Despite rapid innovations, concerns about security and scams persist. Just recently, Interpol has recovered $439 million from voice phishing, romance scams, investment fraud, and money laundering associated with “online gambling, business email compromise and e-commerce fraud.” In the organization’s coordinated operation, they blocked over 68,000 bank accounts and froze 400 digital wallets.

This only shows that security is still a must despite the glamor of tech trends. On the first day of the World Financial Information Series 2025 (WFIS) in the Marriott Grand Ballroom in Pasay City, Philippines, last September 23, digital identity fraud, AI deepfakes, and detecting and overcoming them were the key highlights of the conference. The event brought together organizers—Tradepass, RBAP, Analytics & Artificial Intelligence, and FintechAlliance.PH—along with bankers, financial advisors, IT experts, and government officials. The focus was on the latest trends in cybersecurity and the dual role of AI as both a potential tool and a threat in this ongoing battle.

‘Building institutional trust in the digital future’

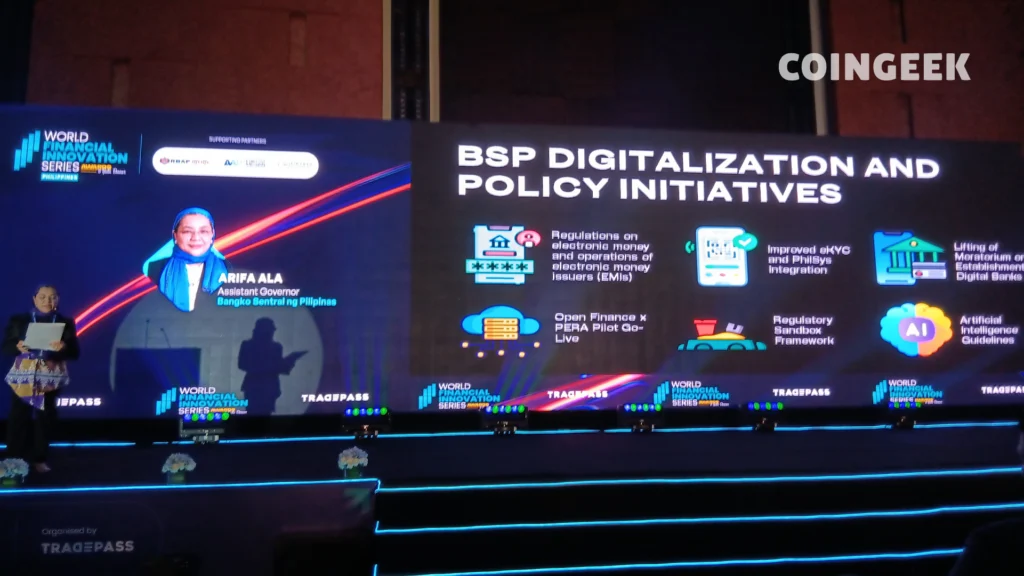

Setting the tone of Day 1 was Arifa Ala, the assistant governor of Bangko Sentral ng Pilipinas (BSP), the country’s central bank. Ala touched on the regulatory pace of fintech and digital finance in the country under the BSP’s lens and how these are all innovating for the better.

Ala engages the audience by discussing her cousin’s experience with digital banking, highlighting its convenience as opening a bank account and managing funds today no longer requires visiting a physical bank. She remarked that this is an act of true empowerment that transforms lives. At the BSP, Ala confirmed that they are institutionalizing sandbox frameworks, issuing guidance for a structured environment, and exploring new approaches. Aside from this, she claimed that the central bank is preparing for the future with the ethical use of AI.

“As we embrace digital finance, we must also confront its risk,” said Ala during her opening keynote speech. “With every innovation such as AI and open API, we’re also seeing the rise in cyber scams, data breaches, and identity fraud. This can erode public confidence and destabilize financial systems. Trust is the currency of the digital economy; without it, no amount of digital innovation can prosper.”

According to Ala, the BSP continues to strengthen its regulatory environment for digital trust by streamlining regulatory supervision, reporting cybersecurity risk assessment through Advanced SupTech Engine for Risk-Based Compliance (ASTERISC) and Financial Services Cyber Resilience Plan (FSCRP), and implementing Anti-Financial Account Scamming Act (AFASA)—creating a more transparent and safer environment for Filipinos.

“Achieving a digitally transformed financial ecosystem is not just the sole responsibility of the government and the Bangko Sentral,” she claimed. “It takes a village to raise a child, and we believe it will also take a whole nation approach to build a digital finance ecosystem that is innovative, inclusive, and trusted. So I call on everyone here today to work together in building a financial ecosystem that truly serves all.”

“Let us ensure that no one is left behind in this digital evolution… together let us build a future-ready financial ecosystem where every Filipino can thrive.”

Securing trust in the digital and AI era

However, to realize the initiatives the BSP assistant governor has enumerated, security actions must be solidified first. That’s what the panel on Next-Gen Identity Security: Orchestrating Trust with Advanced Biometrics and Authentication Technologies has discussed.

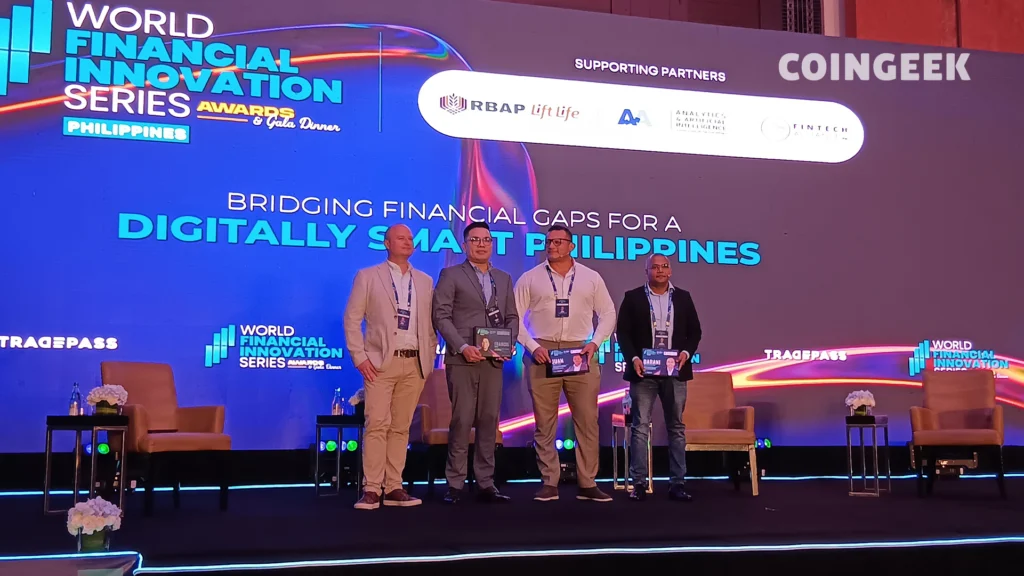

Paul Kenny, the vice president of customer success at EMEA & APAC, moderated a panel that examined the aspect of trust in the digital economy. In this discussion, BDO Unibank’s Head of Consumer Banking Applications, Francis Chiu; Security Bank’s Senior VP for strategy, innovation, architecture, and platform division head, Juan Mestas; and East West Chief Technology Officer for SVP Technology Transformation, Barani Sundaram, were present.

“Trust has to be aligned with how intrusive [its] level is and how much we are basing security on inclusivity,” Chiu said, sending his message across on creating connections with customers, emphasizing that everyone should be included in the journey.

Meanwhile, Mestas focused on resolving challenges, stating that fragmented security will create silos. He believes that transactions must be more simplified, systematic, and unified, which Sundaran agreed on, but he pointed out that these tedious processes are in place to avoid infiltration.

“Security is no longer an IT function…we should be able to explain why we have these transactions for the customers and the regulators. If this is possible, then we are on the right way,” he said.

When discussing AI deepfakes, the three executives view AI as both a tool for good and evil, depending on its usage. Chiu emphasized that AI can be utilized to commit fraud, and bad actors have extensive skills for it.

“Customers in general don’t mind [friction] so much if they feel they will be more secure and trust will continuously be kept. So if we use AI as a means to improve security and trust, even if it’s likely more inconvenient, then the customers won’t mind,” Chiu justified.

Going back, Chiu reminded the audience of the WFIS 2025 to be more comfortable with AI and practice due diligence when using the tech. Mestas also added that while AI can be used for defense and attack, he believes it holds greater potential for enhancing security metrics.

“AI has made fraud cheaper, faster, and harder to detect,” Sundaran expressed, saying that the tech can do what humans can’t, such as faster reporting and recognizing data patterns. In this context, Mestas argued for the need for ongoing checks to prevent deepfakes. He emphasized that while AI can enhance efficiency, human discretion remains essential.

“[We must] not only check once but check constantly—to check constantly, I mean, use the devices, use the [credentials] of the customer,” he said. “That for me will be the only way to check if the person is a person or when they are not.”

For Chiu, balancing tech and education is another factor for a more seamless, secure, and convenient digital banking transaction. “Balancing the tech with education is imperative,” he claimed. “Overcommunicating information is needed. We need to ensure that people who are not digitally savvy are eased into these technologies. We need to make sure that they understand all these procedures, all the steps, in a manner that is pragmatic for them.”

In closing, the three concluded with the following steps to overcome the fear of insecurity and what they are looking forward to in the future. Chiu wishes for a proper SIM registration process to address fraud; meanwhile, Mestas suggests moving the credentials to a self-governed platform. Lastly, Sundaran reiterates the importance of industry collaboration.

Reevaluating the importance of digital identity

In today’s evolving digital landscape, the urgency to rethink our approach to digital identity has never been greater. These advanced technologies can manipulate images and videos, creating hyper-realistic representations that can easily deceive people and institutions, leading to fraud, misinformation, and damage to reputations. That’s what the team from Entrust presented on the first day of WFIS.

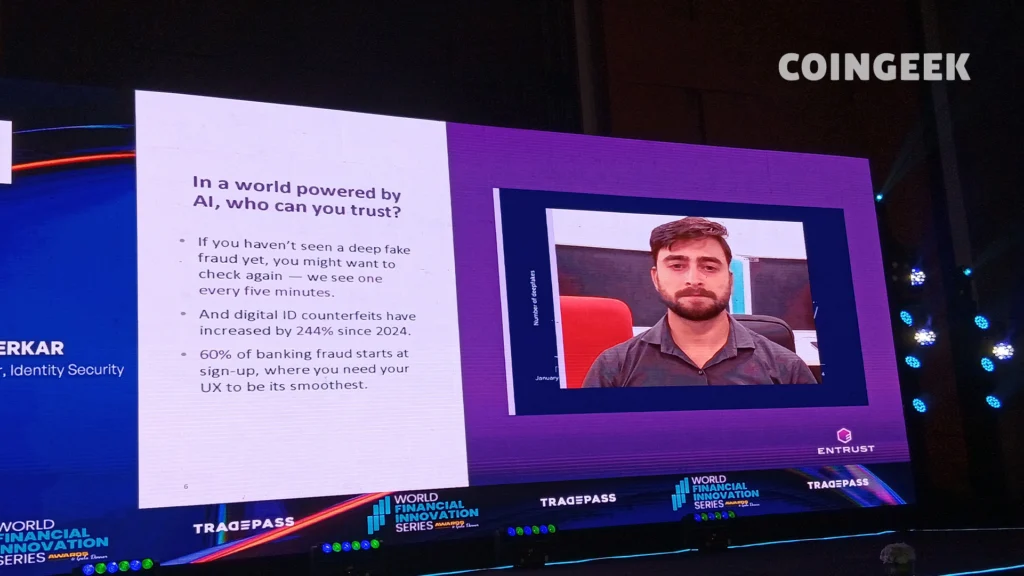

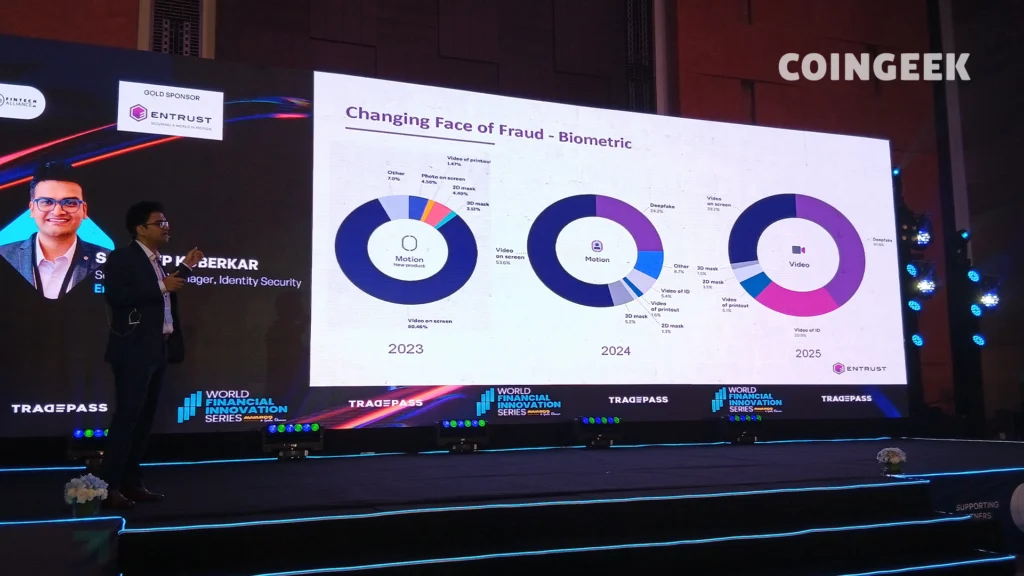

Fraud Product Head for APAC, Hardik Bhutani, and Senior Sales Manager for Identity Security, Sandeep Kuberkar, discussed how AI can be used for deception and tampering, and how their company, Entrust, is looking for viable solutions to overcome this.

“Deepfakes are no longer a [tool] for the future; they are the reality of today,” Kuberkar said, opening their presentation and asking everyone if banks today have the level of protection to differentiate real actors from deepfakes.

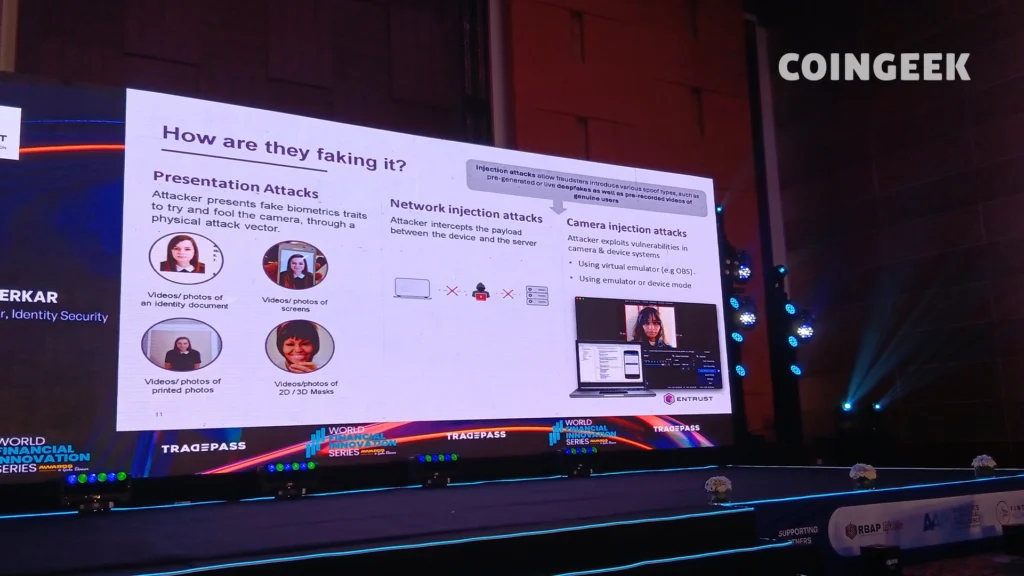

Entrust’s research revealed a staggering 244% increase in digital ID counterfeits in 2024, with fraud evolving through the use of fake biometrics. How are they fabricating it? A common tactic that scammers use is to present fake biometrics with counterfeit pictures to trick the camera—deepfake tools they could inject during the KYC process.

“Previously, when you talk about fraud, we were talking about forged documents or physically printed documents, and we were talking about using a video of a person or a face mask of a person to an extent of fraud. But now, fraudsters don’t have to go to that length to commit fraud in a particular system. We heard about social engineering, we heard about account takeover frauds, [and] we heard about counterfeit documents. You can do that all using a click of a button. That’s how real, that’s how threatening AI has become,” Kuberkar pointed out.

In their presentation, Bhutani identified three types of biometrics fraud: the presentation attack which is physical in nature, in this the bad actor uses a pre recorded video of an actual app user and will try to fool the camera and exploit its vulnerabilities; the second one is network injections attacks, where a highly skilled scammer hacks the payload between the device and the server; and the third kind is camera injections, an emerging strategy, that uses emulators such as split cams to exploit the process. In addition, bad actors utilize AI to create random face-generated pictures, face swaps, and animated selfies. At Entrust, they are battling these techniques by verifying the assets and videos given during the onboarding process.

“When we talk about onboarding or when we look at the role of a bank or a financial institution, KYC doesn’t solve the entire problem; you need to have the users engaged throughout their life cycle through the way they transact and everything. So what we do at Entrust is we provide an end-to-end onboarding experience that goes throughout the customer’s life cycle journey,” Kuberkar shared.

“At Entrust, we not only verify [customers’] credentials, we’ll be able to help them activate their bank account, help digitally sign contracts, and go on to issue cards that are personalized, instantly activated, [where they] can add them to [their] wallets right away,” he added.

What is the future of banking?

Throughout the day, various topics were discussed, including credit decision-making, insurance automation, cognitive banking, and competition, as well as the transformation of BFSI through AI. Meanwhile, Day 2 focused on modernizing finance, digital transformation, and digital payments. For more highlights and coverage of the WFIS, be sure to follow Coingeek.

In order for artificial intelligence (AI) to work right within the law and thrive in the face of growing challenges, it needs to integrate an enterprise blockchain system that ensures data input quality and ownership—allowing it to keep data safe while also guaranteeing the immutability of data. Check out CoinGeek’s coverage on this emerging tech to learn more why Enterprise blockchain will be the backbone of AI.

Watch: Philippine ingenuity sparks green innovation at Shell LiveWire 2025

02-21-2026

02-21-2026