|

Getting your Trinity Audio player ready...

|

OpenAI raises $40 billion

This week, OpenAI finalized its $40 billion fundraising round, giving the company a $300 billion post-money valuation. It’s the largest single funding round ever completed by a private company. The round is led by SoftBank, which committed $10 billion upfront. The remaining $30 billion is contingent on OpenAI’s conversion from a capped-profit to a fully for-profit company.

While $40 billion is a significant amount of money, what’s also worth noting is that OpenAI has already publicly stated that it expects to lose billions of dollars over the next several years and doesn’t project profitability until at least 2029. This shows how much belief—and risk tolerance—investors currently have for artificial intelligence (AI). But it also reflects a level of market irrationality; in any other sector, a company projecting multi-billion-dollar losses for the next half-decade would most likely not have investors excited to take out their checkbooks.

On top of that, what makes this deal even more interesting is that SoftBank is structuring the deal with debt financing—which is yet again another interesting route to go with a company that has not turned a profit yet nor is projecting to turn a profit for several more years—and that’s if everything goes according to their plans and projections.

Although OpenAI is definitely celebrating this deal, I think more people should find it troubling. There is clearly a disconnect between corporate spending and the actual consumer demand for AI products. I’ve said it before in other writing pieces, but I’ll say it again: user demand for AI is not keeping pace with enterprise investment and expansion in AI. If anything, the general public has yet to fully understand or embrace the use cases for AI in their daily lives. I think we will need a large-scale educational campaign to bridge this gap if companies expect to see any meaningful return on their AI investments.

AI experts overestimate public usage

The Pew Research Center recently released a report titled “How the U.S. Public and AI Experts View Artificial Intelligence,” and for those of us who have been watching this space for a while—and for those who agree with those last few paragraphs about the investment trends in AI becoming troubling—the findings were unsurprising.

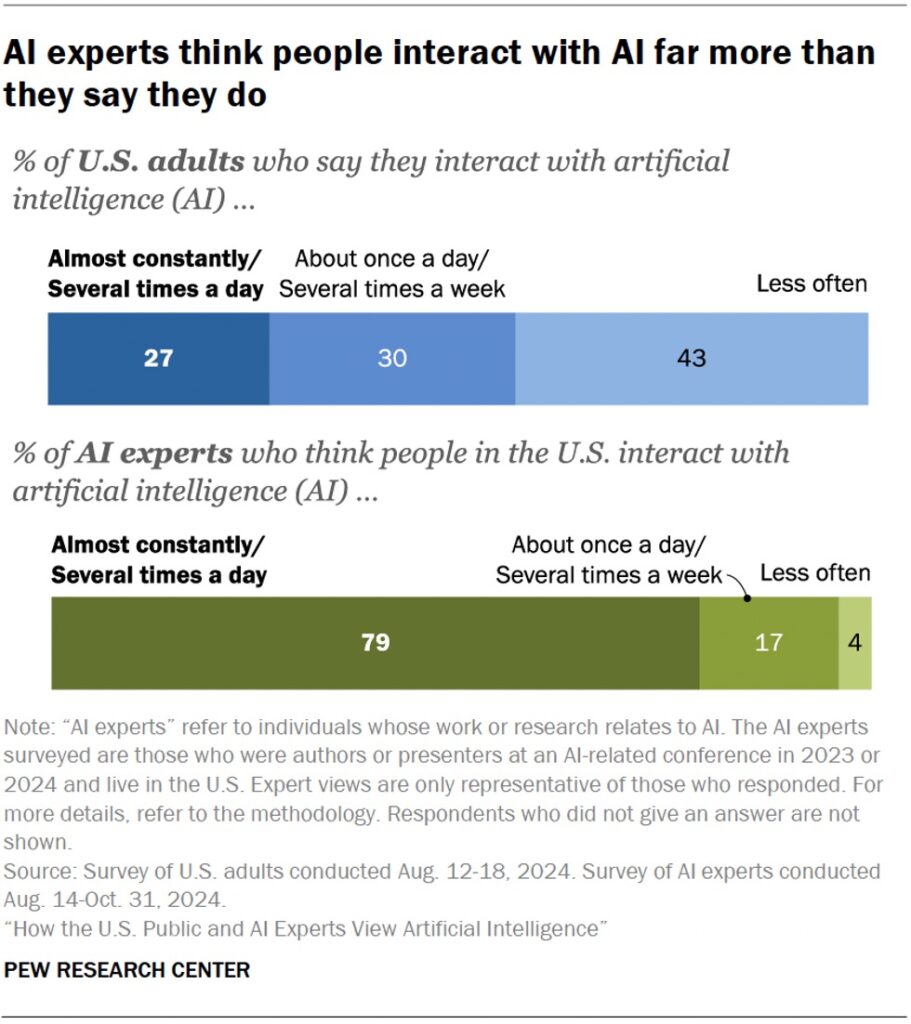

One stat that jumped out from the report was that 79% of AI experts believe the general public interacts with AI multiple times per day, while only 27% of the public reported doing so. This again highlights the idea that AI experts tend to overestimate the public’s familiarity, comfort, and usage of AI.

In many cases, the average person still uses AI in relatively primitive ways, asking basic questions to a chatbot like they used to with Google (NASDAQ: GOOGL). Meanwhile, the technologists who build and train these systems are surrounded by others like them, operating in an echo chamber of early adopters. The result is a skewed perception of how widely adopted and sophisticated AI usage is.

Take another stat from the report: while 98% of AI experts say they’ve used a chatbot, only 33% of the general public report the same—again highlighting the divide between technologists and the general public.

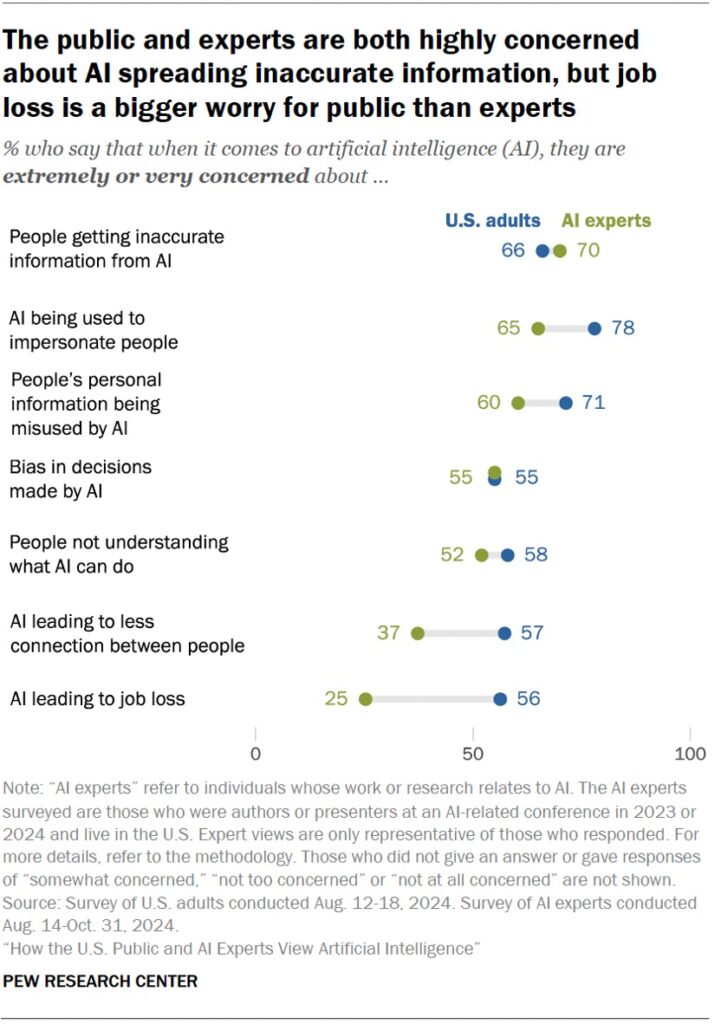

Another important takeaway from the Pew report was the divergence in concerns between experts and the general public. The general public’s top fear is that AI will be used to impersonate people. For experts, the biggest concern is

misinformation and inaccuracy in AI-generated outputs.

However, the largest difference in concern levels comes down to job loss. Only 25% of experts said they were “very concerned” about AI taking jobs, while 56% of the public reported feeling that way. Once again, I think this boils down to exposure and experience. Experts have a much better sense of what AI can and can’t do, so they know which jobs are realistically at risk and which aren’t. Meanwhile, the average person is being bombarded with headlines about AI eliminating millions of jobs overnight and making human workers redundant.

What this report reveals more than anything is that, like most pieces of technology, if you’re not using the tools or tech regularly, it’s hard to separate the hype from the reality, and it can be challenging to pinpoint what the true pulse of the people is outside of the industry.

AI overbuild? Microsoft halts data center expansion

Microsoft (NASDAQ: MSFT) has halted or delayed negotiations for new data center developments in several locations, including Indonesia, the United Kingdom, Australia, Illinois, North Dakota, and Wisconsin.

Although the company did not go into great detail, a spokesperson offered a boilerplate explanation, saying, “We plan our data center capacity needs years in advance to ensure we have sufficient infrastructure in the right places.”

However, as an observer, it’s difficult not to look for deeper meaning and motives in the decision.

Some analysts, like TD Cowen, speculate that these pullbacks come from a mismatch between projected and actual AI demand.

“We continue to believe the lease cancellations and deferrals of capacity point to data center oversupply relative to its current demand forecast,” they wrote in a recent note. Others speculate the decision comes from construction delays at the data centers that would not have aligned with Microsoft’s launch timelines.

There’s probably truth on both sides. There probably are a few construction delays that may have made some sites infeasible. But at the same time, if demand for AI services was hitting the levels companies projected just a year ago, these data centers would still be full steam ahead. Scaling back gives a lot of credit to the idea that the market is adjusting its expectations in terms of AI.

Alibaba Group’s (NASDAQ: BABAF) Joe Tsai recently said that the data center boom might actually be a bubble because new projects seem to be exceeding demand for AI services. If more AI firms follow Microsoft’s lead and start pulling back on infrastructure, it could mark a turning point for the AI industry.

In order for artificial intelligence (AI) to work right within the law and thrive in the face of growing challenges, it needs to integrate an enterprise blockchain system that ensures data input quality and ownership—allowing it to keep data safe while also guaranteeing the immutability of data. Check out CoinGeek’s coverage on this emerging tech to learn more why Enterprise blockchain will be the backbone of AI.

Watch: Blockchain & AI unlock possibilities

03-02-2026

03-02-2026