|

Getting your Trinity Audio player ready...

|

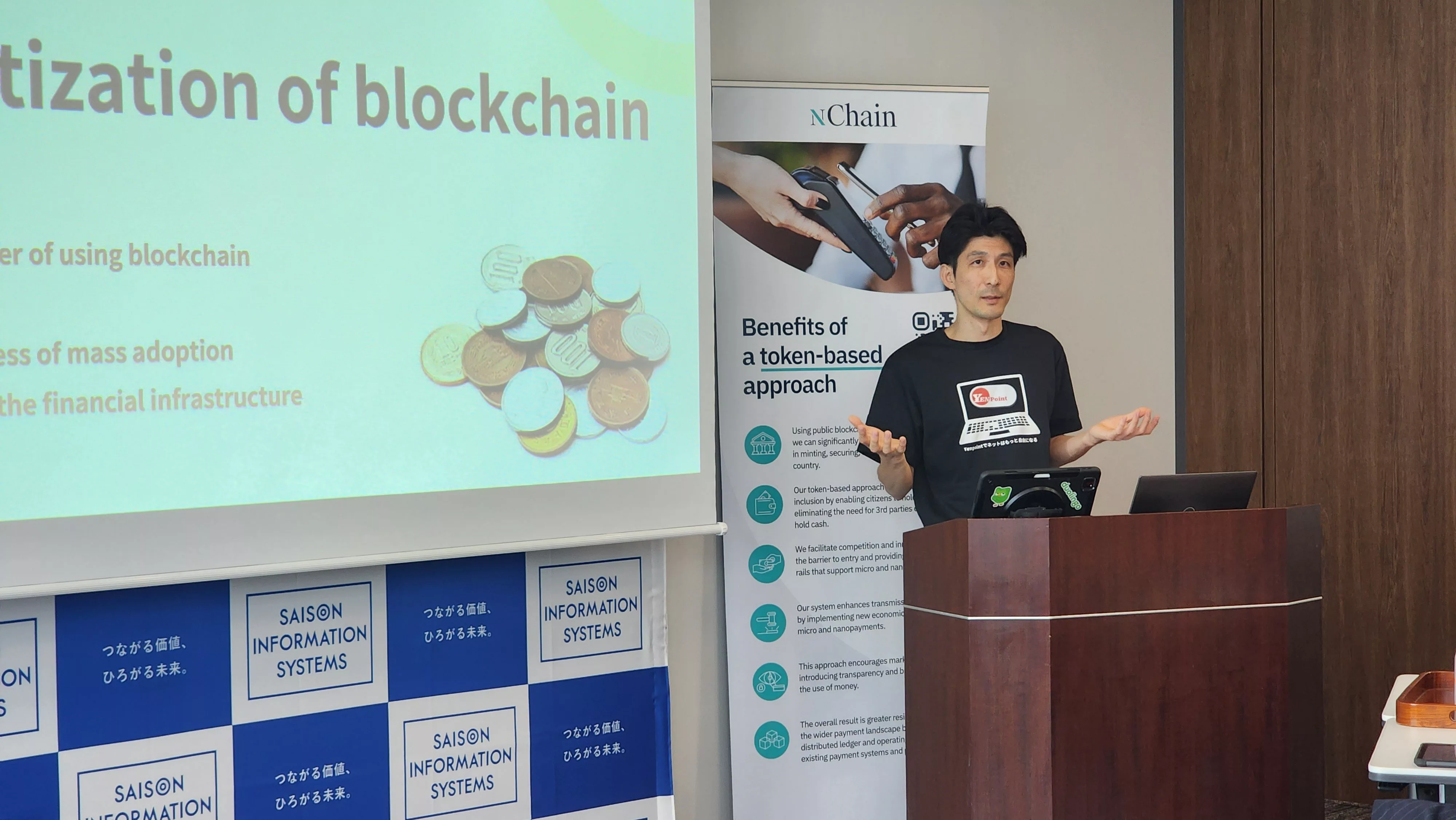

Japan’s subcultures create opportunities to showcase new and unique use cases for stablecoins, according to YenPoint founder and CEO Ken Sato. The country has a large market for digital content including anime, manga, games, and movies/TV—and a stable-value, reliable digital currency that runs cheap and fast enough to allow micropayments, would unlock new kinds of interactions between creators and their fans.

Sato spoke last week at a workshop event organized by the Stanford University Lead Innovation Tour 2023, with input from Keio University’s FinTEK Centre, nChain, and the BSV Blockchain Association. It brought together current Stanford business students who study mainly online and the university’s alumni network.

Most of the two-hour event focused on stablecoin-related issues, though there were also introductory presentations from Keio FinTEK’s Dr. Teruo Nakatsuma and BSV Blockchain Association Japan Ambassador Masumi Hamahira—plus a segment from U.S. visitor Brett Banfe, who talked about the new Champions TCG (trading card game) project based on NFT technology.

The future of stablecoins brainstorm

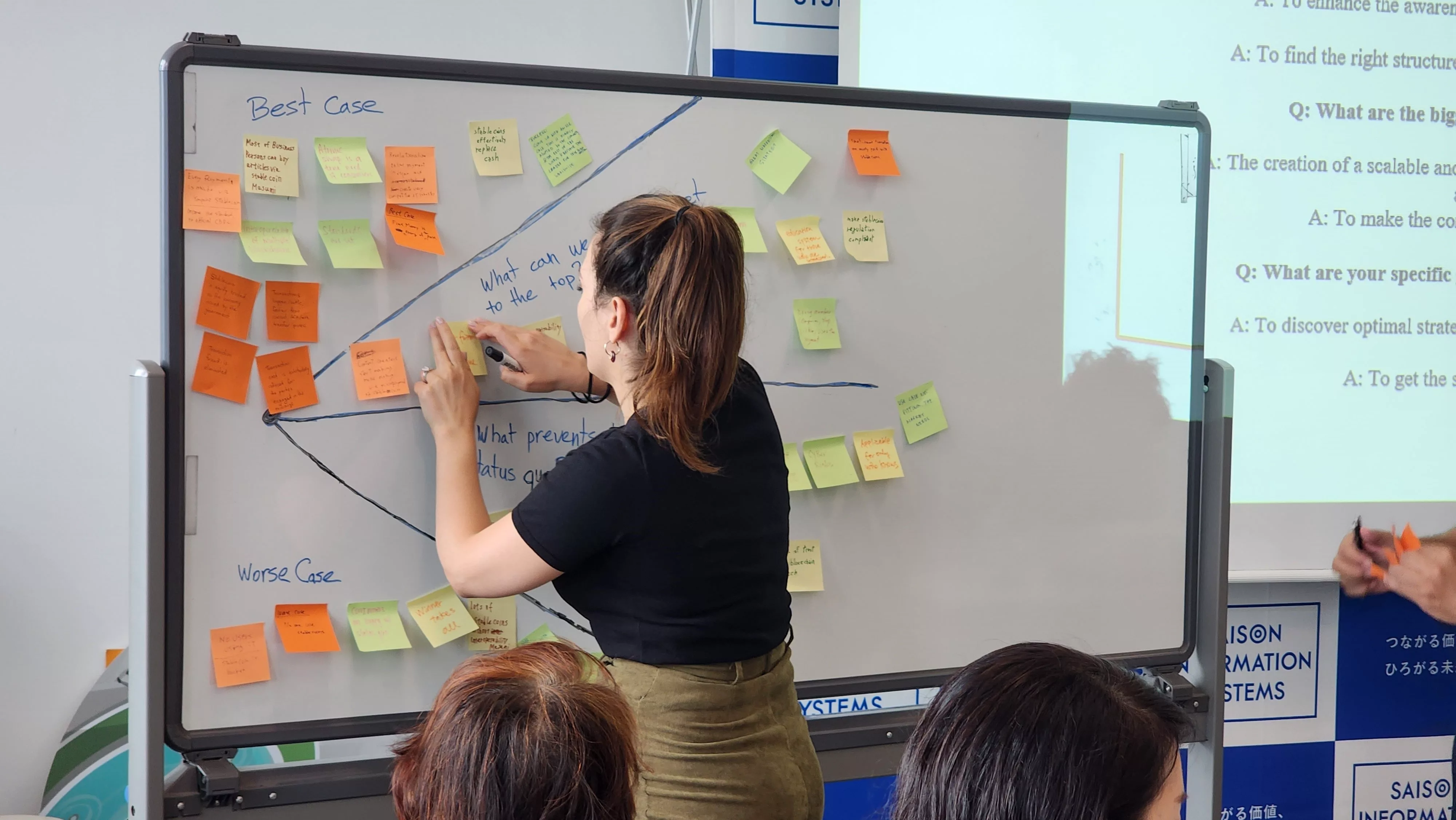

A key segment of the workshop was a brainstorming session where groups of attendees used Post-it Notes to describe potential best- and worst- case scenarios for a stablecoin project like YenPoint, as well as ways to break out of the monetary status quo and possible obstacles a project may face in doing so.

Best-case scenarios included variations on themes like “stablecoin replaces physical money,” or “majority of businesses accept the stablecoin as payment”; while worst-case suggestions included insecure systems vulnerable to hacking, a confusing array of multiple stablecoins, or complete rejection by regulatory authorities.

Groups were then invited to brainstorm tactics to avoid or deal with the worst-case problems, using Stanford’s “Challenge Finder” framework.

Ken Sato’s presentation came after the brainstorming session (though perhaps it might’ve been more useful to hear it beforehand). Sato described the current reality of stablecoins, a US$124 billion supply worldwide—Tether (USDT) and USD Coin (USDC) have the lion’s share of that value, and nearly all stablecoin activity takes place on the Ethereum blockchain. The JPY (Japanese yen) stablecoin market was far smaller, with under US$30 million in total value (GYen and JPYC).

Sato noted that $124 billion is actually a tiny amount when compared to the world’s total supply of liquid money, leaving plenty of room for competitors with better technology and governance to enter the market and dominate.

Current image and strict regulations

Stablecoins in their current form are “shady and expensive to use,” he said. They operate in a legal grey area, often with opaque governance rules and unaudited supplies of the backing currency. Limitations of Ethereum’s network, even with proof-of-stake (PoS), make them more expensive to use than they should be. As a result of all this, stablecoins in 2023 have very limited use-cases (they’re mostly used to park value on exchanges, or make international value transfers outside the banking system).

Sato said his original vision for YenPoint was as a currency for small online and retail transactions, one that could also be used for micropayments.

He described the evolution of digital asset and stablecoin regulations in Japan, notably the stablecoin-specific changes introduced in April 2023. These regulations, which include strict transaction reporting requirements for exchanges, indicated the government is particularly concerned about more negative stablecoin use cases—such as money laundering and tax evasion.

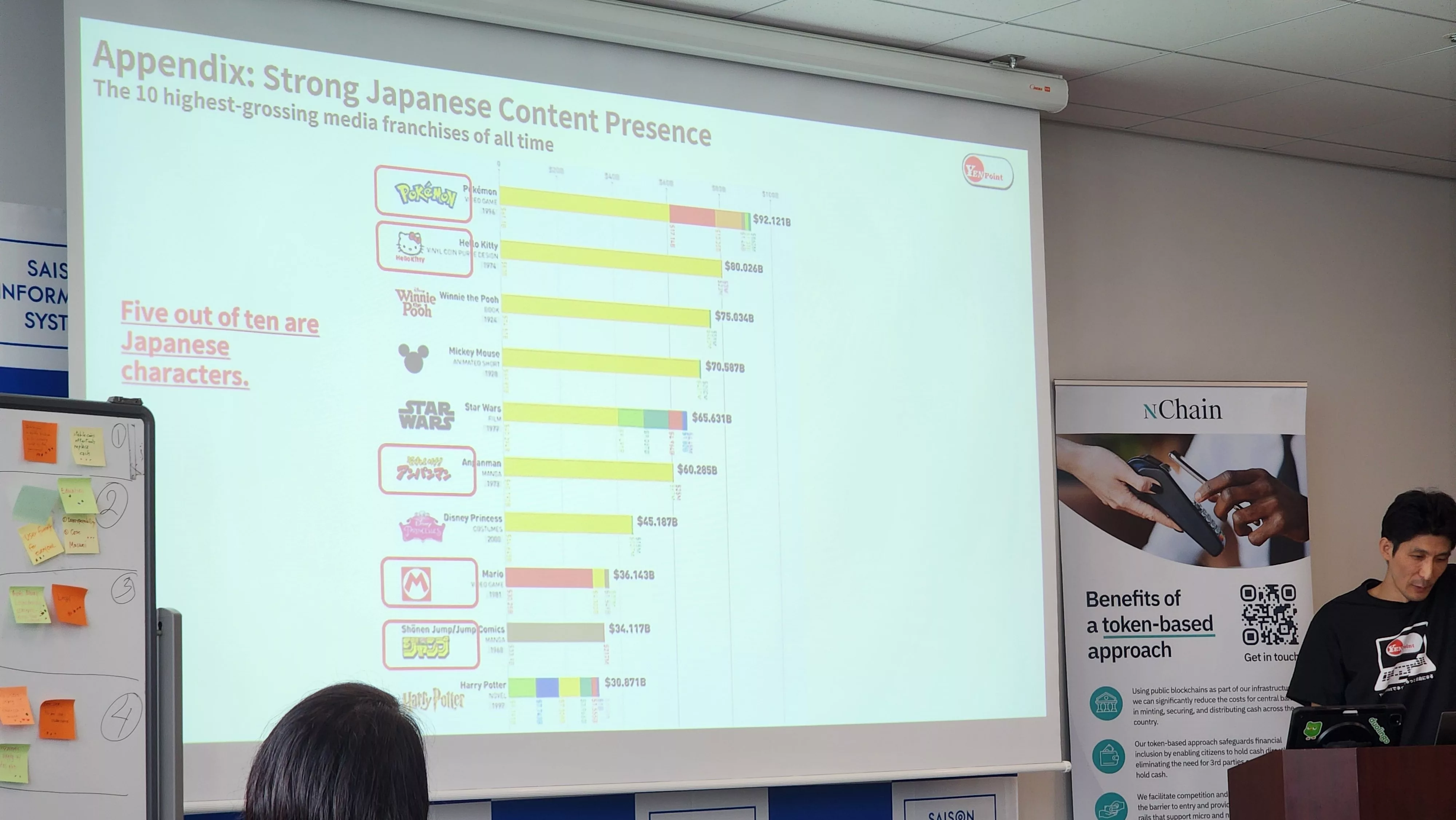

Speaking of Japan’s powerful fan subcultures, Sato pointed out that of the Top 10 highest-grossing media franchises of all time, five originated in Japan and this included the top two entries (Pokemon, Hello Kitty, Anpanman, Mario, and Jump Comics).

Those looking to promote real-world useful stablecoins should focus on digital payments related to entertainment, as well as retail online and in the physical world, he said. The idea of stablecoins as everyday payments, rather than “shady” tools for digital asset exchange and regulation-avoiders, would help change their image and make them more acceptable to governments.

Watch The BSV Pitch with Ken Sato of YenPoint

02-18-2026

02-18-2026