|

Getting your Trinity Audio player ready...

|

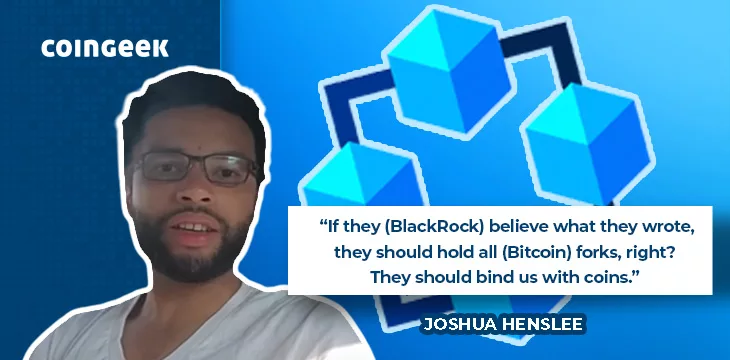

Many in the Bitcoin space have been wondering why BCH and BSV have been pumping recently. In this video, Joshua Henslee speculates on whether it has anything to do with BlackRock buying them after referring to them in their ETF application. Hear Henslee’s thoughts in the video below.

Why is the price of BSV and BCH pumping?

At the time of making this video, BCH had increased to $300 per coin, and BSV had increased to over $40, both outperforming the rest of the market by a significant margin. Naturally, this has led to a lot of speculation as to why. BSV has since moved north of $50 per coin since the video was published.

Is BlackRock buying? Henslee doesn’t think so, but he does know they seem to understand what happened back in 2017, and he says that if they are buying, it makes sense that they’d buy unsplit coins.

While all ETF filings before this have failed, Henslee speculates that this one will succeed. He thinks it has been timed perfectly for when the U.S. Securities and Exchange Commission (SEC) went after Coinbase (NASDAQ: COIN), Binance, and several altcoins issuers, and due to being the biggest fish in the ocean, he believes its application will succeed.

If and when such an ETF is approved, Henslee predicts Bitcoin dominance will go to 90% and stay there. This is especially so since the on-chain economy is growing at a rapid pace and will continue to make other blockchains irrelevant.

So, why the price appreciation? In Henslee’s view, it’s likely that other people and parties have read the BlackRock filing, put two and two together, and are speculating in advance of any move by the institutional giant. BCH is pumping more because of its listing on exchanges, he reckons.

Ordinals and the on-chain Bitcoin economy

Of course, the BlackRock ETF application isn’t the only reason for renewed speculation on Bitcoin (all forks). Ordinals have shown what Bitcoin could always do, and since they came about, a snowball effect has taken place. We now have BRC-20 tokens, BSV-20 tokens, BitMap, and all sorts of on-chain innovation. It’s possible that BlackRock sees this and knows it just has to ride the wave, Henslee says.

As for BSV specifically, Henslee notes growing interest and points to the recent two-hour sellout of on-chain playing cards with CoOMBattles. The entrepreneurs behind this made tens of thousands of dollars in a matter of hours by creating a game people want to play – this organic growth is something Henslee has long been talking about.

The on-chain economy is the new trend, and it’s here to stay. It’s only going to pick up pace now, and there’s no going back.

Rundown of this Joshua Henslee video

- BSV, BCH, and BTC tokens have all been pumping recently. This is, at least in part, linked to BlackRock filing for a Bitcoin ETF. It stated it reserves the right to make up its own mind about what Bitcoin is, sparking renewed interest in its various forks.

- Henslee is unsure if BlackRock is buying coins, but he does think other people are buying in an attempt to position themselves correctly in case the ETF application is granted.

- Aside from the BlackRock news, Henslee points out that the on-chain economy is growing fast. Things will never be the same again. This is something he has repeatedly said since Ordinals came about.

- Henslee warns that he could be wrong and the price could get back down, but he senses a permanent change. Regardless of what happens to the price in the short term, the on-chain economy will drive demand going forward.

Watch CoinGeek Roundtable Episode 7: How are 1Sat Ordinals being adopted now?

03-11-2026

03-11-2026