|

Getting your Trinity Audio player ready...

|

The team at Fundstrat has a positive outlook for the cryptocurrency markets leading up to and after the Bitcoin halving. Thomas Lee, the co-founder and head of research at Fundstrat, and David Grider, Senior Research Analyst at Fundstrat, took the stage on February 20 to share their analysis of the cryptocurrency markets as well as a few of their unconventional thoughts about cryptocurrency. Let’s take a look at a few of the key insights they provided in Fundstrat’s keynote presentation.

Key takeaways: Market analysis

In 2019, crypto assets were the best returning asset class—and in 2020 and 2021, the markets look to hold much promise. According to Fundstrat, we are in a bull market, they say this because Bitcoin has broken its 200-day moving average. According to the Fundstrat team, this is a metric that often pre-dates a positive movement in the cryptocurrency markets.Beyond that the crypto-markets have significant room for institutional investment. The crypto market is only worth 0.1% of traditional liquid assets, and a lot of institutions have little to no exposure to crypto-assets. What we may see take place in the future is an event in the cryptocurrency markets similar to what has recently taken place with Tesla’s stock.

According to Fundstrat, a number of institutions were underexposed to Tesla stock, but there came a point in time when they needed to up their exposure. When institutions bought in, the stock price rocketed, this created FOMO in retail investors, who then began to buy Tesla stock themselves, which continued to push the positive performance of $TSLA.

Key takeaways: Unconventional thoughts

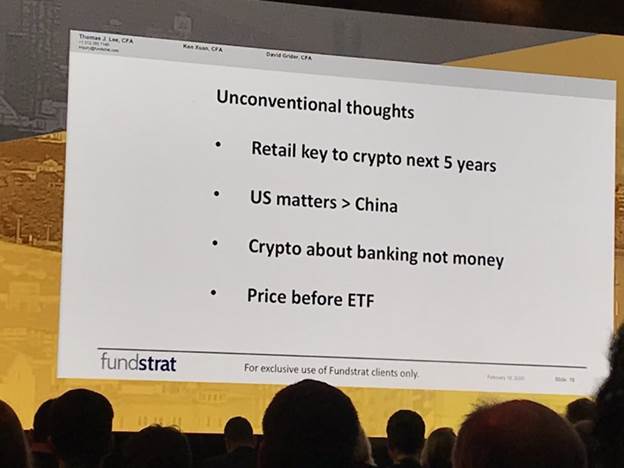

Here are two takeaways from Fundstrats unconventional thoughts on the cryptocurrency markets:

Retail adoption of cryptocurrency over the next five years would catalyze positive market movements. Similar to the scenario we described above with Tesla, there is a good chance that institutional investment in the cryptocurrency markets will ripple through retail investors and make them inclined to invest in the cryptocurrency markets as well.

Although a common belief is that there is greater interest in cryptocurrency overseas rather than there is in the United States, what happens in and around the cryptocurrency markets in the United States has significant effects on the rest of the cryptocurrency market. The three countries that you should really be keeping an eye on are: the United States, China, and Japan.

A good year for the cryptocurrency markets

David Grider, Senior Research Analyst at Fundstrat Global, closed the presentation out by giving a brief analysis on Bitcoin SV and how it uniquely addresses problems that exist in the world and its differentiating factors compared to other cryptocurrencies in the market. For instance, how the Metanet is an on-chain version of the internet that solves many of the problems the internet has. How the Genesis protocol upgrade eliminated block sizes which allows for unprecedented Bitcoin development. And how the growth of the Bitcoin SV network has been driven by fundamentals rather than speculation on the price of BSV.

These are just a few of the main talking points of Thomas Lee’s keynote presentation. In the near future, we will be uploading the full presentation online, we encourage you to check it out once it goes live.

If you were not able to make it to the CoinGeek London conference, we encourage you to watch the presentations via livestream.

03-09-2026

03-09-2026