|

Getting your Trinity Audio player ready...

|

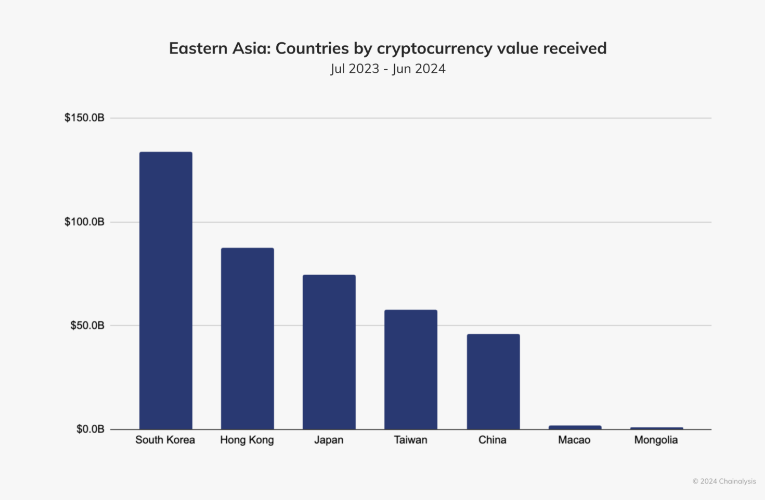

A report by Chainalysis suggests that Eastern Asia received over $400 billion in value in stablecoins and other digital currencies between July 2023 and June 2024.

Weighing in as the sixth largest region in terms of value received in digital currencies, Eastern Asia includes China, Japan, South Korea, Hong Kong, and Taiwan. Institutional and professional investors received the majority of the value. When considering the size of the transactions, Eastern Asia leads the world in terms of ‘professional-sized’ transactions.

The report also indicates that Hong Kong’s plan to become a digital currency hub is working. It grew the most between 2023-2024 but still trails South Korea for the top spot in terms of value received. Will the rapid growth in HK influence China to re-open its doors to digital currencies? Time will tell.

Prohibitive fees and uncertainty still hampering growth

While the growth of Eastern Asia’s use of digital currencies is undeniable, it’s still being held back by the prohibitive fees on blockchains like Ethereum and uncertainty regarding stablecoins like Tether.

While fees on Ethereum have fallen in recent years, they remain above $1.50 on average—too high for micropayments and still more than most in developing countries like Indonesia and the Philippines can afford. For context, the average salary in Indonesia equates to roughly $15 daily, meaning one Ethereum transaction would cost 10% of daily earnings.

While transaction fees are one barrier to more widespread usage of digital currencies for remittances and other small, casual transactions, the fees on centralized exchanges are another. While the Chainalysis report shows that institutional investors often use decentralized exchanges, centralized options are still widely used by professional investors and everyday people. Every party involved in a transaction increases friction, and every fee adds up, making digital currencies prohibitive for many use cases and demographics.

Even more worrying is the ongoing refusal of stablecoin issuer Tether to prove its reserves. With a market cap of under $120 billion at press time, Tether claims to have cash and cash equivalents backing every dollar-denominated unit. Still, it has failed to prove it publicly, arguing that doing so would reduce its competitive advantage.

A low-fee, scalable blockchain is the solution

The solution to the problems hampering digital currency adoption outlined above is simple: a single, scalable public blockchain with tiny fees and a publicly verified stablecoin.

In short, BSV is the answer. As it scales to one million transactions per second with fees under one-thousandth of a cent, the original Bitcoin can finally serve as the global electronic cash system it was supposed to be.

With the MNEE stablecoin set to launch on BSV, the doors will open to global peer-to-peer commerce, including remittances and the ability to receive and send a USD stablecoin with proven reserves. Regions like Eastern Asia, Southeast Asia, Africa, and Latin America could rapidly adopt digital currencies when sub-dollar and sub-cent transactions become easy.

Furthermore, BSV wallets like HandCash make the transaction process user-friendly with handles like $CoinGeek rather than the ugly strings of letters and numbers that put off less tech-savvy users. As it integrates with more and more apps in gaming, finance, and social media, wallets like HandCash will drive adoption going into 2025 and beyond.

The stage is set for explosive growth of stablecoin usage, especially in developing nations. A scalable blockchain with tiny fees, a stablecoin backed by provable reserves, and a user-friendly experience will turbocharge this growing trend in Eastern Asia and elsewhere.

Watch: Stablecoins with Daniel Lipshitz

03-04-2026

03-04-2026