|

Getting your Trinity Audio player ready...

|

The post originally appeared on the Unbounded Capital website and we republished with permission from its author, Jack Laskey.

Before COVID-19, everyone knew that global economies and governments were densely interconnected. After COVID-19, it is clear that despite the interconnectedness, these systems are fragile, not robust.

Graph theory hasn’t always been the most exciting subject, but it is an essential field for understanding the problems we are facing today. A graph is made up of nodes and edges, where edges connect two nodes. Edges can be directional, and both edges and nodes can have a capacity.

In the real world, this may look like a tissue manufacturer node having 6 edges, 3 with raw material suppliers and 3 with distributors. These edges are probably better described as two edges, one directed edge where goods flow, and the other edge oppositely directed where money flows, each of these edges with their own dynamic capacity. In the graph of the global economy, nodes include businesses, charities, individuals, governments, you name it. Goods, services, money, and disease can all move across paths in this global graph. Supply chains are the paths that turn raw materials and labor into goods and services. A central point of failure for a supply chain is a node in the graph with a capacity directly related to the total capacity of the supply chain. If a central point of failure has capacity reduced by 50%, the supply chain has a capacity reduced by 50%. If that point fails, the supply chain fails. With the interconnectedness of our world, one may have been hopeful that few central points of failure existed. This would be a sensible hypothesis since central points of failure can be destructive and people/businesses/governments want to minimize risk. The unfortunate truth is, we probably are close to eliminating central points of failure, but it won’t matter. That’s because in practice, nodes have no way of seeing the edges in the graph and what paths exist. A perceived central point of failure is equivalent to a true central point of failure. Even if the edges to route around that node exist, if that path isn’t taken, then the chain fails.

Bitcoin and graphs

Understanding graphs and understanding Bitcoin have always been two sides of the same coin. Most people think of Bitcoin as a digital currency, which it is, but this is only a small part of Bitcoin. Bitcoin can be better understood as two graphs. One of these is a graph of transactions. The other is a graph of participants in the system.

The graph of transactions is a complete, time-stamped tracking of the ownership of all Bitcoins, but this graph can be utilized in other ways. Bitcoin transactions can include any type of data. Adding data to Bitcoin and utilizing the underlying graph can be used to create powerful applications. Part of what makes this graph so powerful is it’s permanence. The economic design of Bitcoin results in a graph that cannot be altered or deleted. This means that the contents and structure of the graph can be trusted to persist unaltered across time. The only changes are additions of new nodes and edges, not deletions or alterations of existing nodes and edges. In “Database speak”, this is called WORM, or write-once read-many. A WORM database was necessary for Bitcoin because users need to be sure their money won’t be altered or deleted unless they spend it by adding transactions (nodes and edges) to the graph. In fact, this breakthrough in creating a public, distributed WORM database is the major achievement of Bitcoin. The currency is simply the first application.

The graph of participants is the less appreciated aspect of Bitcoin. There are two main categories of participants in Bitcoin, the miners and the users. Miners are transaction processors who consult the transaction graph to ensure the validity of new transactions. Bitcoin has built in economic incentives to encourage miners to fill this function honestly and reliably. The users are everyone else who use the system however they see fit.

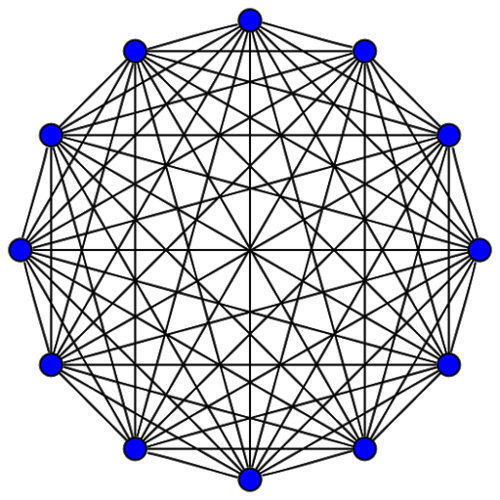

The graph of participants forms a special structure called a Mandala network. The miners form an inner circle called a complete graph, a graph where there is an edge between every node. The economic incentives of Bitcoin lead miners to form a complete graph where every miner is in communication with every other miner. The outer network is a peer-to-peer network where users form connections between each other as needed and also with miners to send transactions to be processed. What makes this network special is the efficiency which comes from having a complete graph in the middle. While peers can connect with one edge, everyone on the graph is only two hops away, one hop to the miners and another hop to the other user.

The design of Bitcoin incentivizes the miners to form a complete graph.

How Bitcoin solves issues brought to the forefront by COVID-19

Anyone pitching Bitcoin as a cure-all for a global pandemic is selling a utopian vision. But, many of the problems surfacing from COVID-19 can be alleviated through Bitcoin. Chief among these are problems that spring from a shortage of available, interoperable data, the inability to coordinate across supply chains, and difficulties sending money.

Data availability

Virtually all of the successes and failures in the COVID-19 response trace back to data. The predictive power of models which guide government response, the accuracy of tests, the effectiveness of treatments—these all rise and fall with the quality and quantity of available data. Collecting valuable data is not a problem Bitcoin can solve directly, but it can dramatically increase data availability.

Without a central data repository, it will be exceptionally difficult for most organizations to access all of the data that would aid their research and decision making. While a central data repository makes it easy to share data, trusting some party to own the repository is a non-starter in many cases. That owner could possibly shut off or limit access, change records, or simply fail for technical or economic reasons. Few would trust a business with this information, and even if citizens trust their government, governments are reluctant to trust each other. Global organizations like the WHO come to mind, but they have their own trust issues and the magnitude of this problem requires the efficiency derived from a profit motive.

Bitcoin provides the right neutral layer for this sort of repository. Bitcoin data is distributed. Access can’t be removed because anyone can participate in the system, and the data can’t be manipulated. Data can be encrypted to maintain privacy, but what is on Bitcoin stays on Bitcoin unchained. With Bitcoin in the middle, communication between disparate entities becomes highly efficient. Further, cheap payments with Bitcoin makes compensating people for their data simple. In a pandemic, altruism might prevail, but in other times the ability to cheaply pay millions of disparate users for access to their data is a huge boon for researchers and data-driven decision makers, as well as the individuals receiving compensation to provide their data. EHR Data is a business utilizing Bitcoin as a data storage layer for electronic health records. They partnered with nChain, a leader in Bitcoin technology research and consulting. Their first major initiative is to fight the opioid epidemic by having patients, healthcare providers, pharmacists, and governments better communicate to understand the flow of opioids and prevent over-prescription. Patients maintain complete control over their data, but they are incentivized to share that data to get the best care, they can sell their data to researchers and other interested parties, and doctors may request access to ensure the prescription of potentially dangerous drugs like opioids is done in the patient’s best interest.

Supply chain management

Bitcoin can be used the same way, as a central data repository, to help manage supply chains. Not only can Bitcoin help entities learn more about how goods flow across supply chains, but it also can help disparate parties communicate in real time about the best routes. For example, fisherman in South America can learn what port they will get the best price for their catch. Produce buyers in Europe can see exactly where their vegetables were farmed and where they have been since. If there is a supply chain disruption, nodes can coordinate to reroute goods if possible. If there is a long term disruption like what has happened in the COVID-19 pandemic, businesses and governments can get a much better broad view of the economy to plan and reroute effectively. UNISOT is a supply-chain management business building on Bitcoin today. Their initial product launch SeafoodChain is specifically designed to help track seafood from sea to store.

Effective payments

Emergencies require a swift response. If government’s make a decision to send financial relief directly to citizens in an emergency, the delivery of that relief should be extremely fast. In fact, promising money that doesn’t arrive for months can do more harm than good. Bitcoin is the easiest, cheapest way to credit hundreds of millions of accounts in a matter of minutes. That crediting does not need to use Bitcoin as a currency. Tokenized versions of fiat currencies can take advantage of the same efficiency. Not only is this more efficient than sending checks in the mail, but it also helps the unbanked since tokenized currency doesn’t require a financial institution to be processed.

Only Bitcoin Satoshi Vision (BSV) delivers this vision

There are many public blockchains, and several versions of Bitcoin, but at Unbounded Capital we think that Bitcoin Satoshi Vision (BSV) is the only public blockchain that can deliver the above solutions. All of the businesses mentioned above run on BSV exclusively because BSV is the only version of Bitcoin committed to scale. Incidentally, BSV is also the only version of Bitcoin committed to restoring the original protocol. This is not a coincidence. Only the original protocol can scale, and the supposed improvements marketed by competing blockchains have resulted in destroying key features or creating fundamental flaws which destroy any chance at success. BTC, the most highly valued version of Bitcoin, is committed to becoming a new form of gold that can be held outside the reach of governments. To achieve this, changes to the original protocol were made which directly and intentionally inhibited scale. While the value of such an endeavor is questionable from the outset, it is certainly not a way to address problems brought to the forefront by COVID-19.

As the graph of our world becomes more and more interconnected, coordination becomes paramount. Our existing systems are not capable of facilitating this coordination. The efficiency, security, and public nature of Bitcoin are what is necessary to meet this challenge. In a world built with Bitcoin, the next pandemic will be far less daunting.

03-06-2026

03-06-2026