|

Getting your Trinity Audio player ready...

|

As we slump into a prolonged bear market in the ‘crypto’ industry, a market rife with lawsuits and scandals indicative of the long arm of the law finally catching up to the wild west industry, one major misconception needs to be clarified for the benefit of all investors and those involved in the projects—BTC broken fee model.

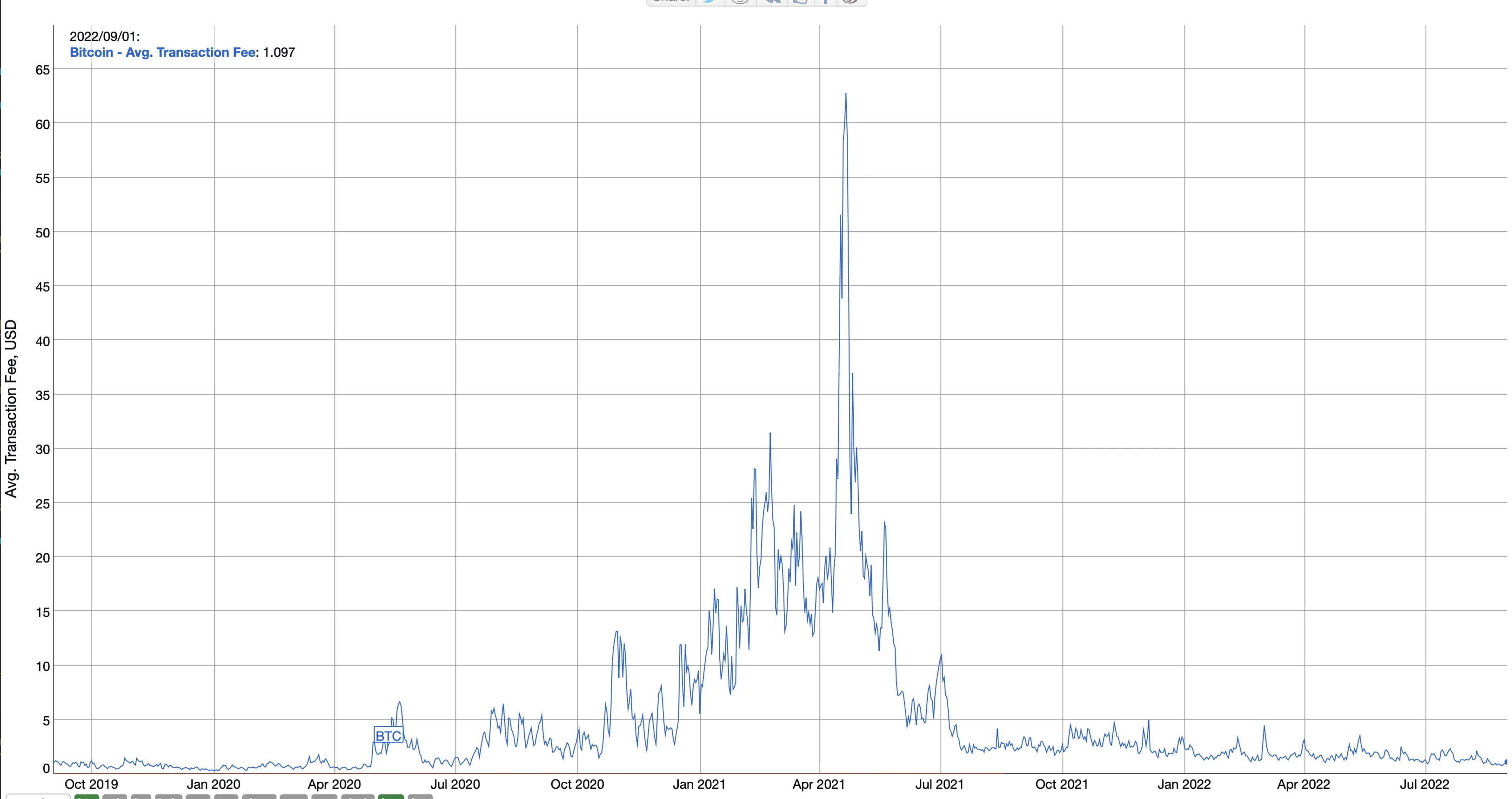

As we watch with popcorn in hand with interest in the upcoming Ethereum fork to Proof of Stake, BTC proponents are quick to celebrate how low the average fees on the digital currency have become versus just a year ago.

But the network’s drop in fees has gotten some of those who understand the economics of Bitcoin security in a tizzy. That is because the security model of the network depends on miners getting compensated for their efforts in generating blocks, and the lower the average fees become, the more economically insecure and attackable the network is. This is where the economic model of small blocks1—all for the sake of some fuzzy notion of decentralization—breaks down.

If you ask a BTC supporter, they will quickly say that network transaction fees are not for miners. They are for Lightning Network (LN) hubs to earn and provide fund liquidity. Miners, on the other hand, are supposed to earn block subsidy rewards (which will approach zero in less than twenty years) and the occasional high fee-paying transactions, which are LN network opening and closing of liquidity channels.

This model is antithetical to the original design of Bitcoin. As the white paper states, Bitcoin was supposed to be a peer-to-peer cash system, not a settlement system for some second-layer liquidity channels. How did we allow the slide from Bitcoin as “cash” to something like a “bank account”? After all, for all intents and purposes, LN behaves like a bank account, with the same friction as depositing and withdrawing. However, once “in the system,” money can be transferred quickly and instantly globally2.

This perversion of the simple peer-to-peer fee model of Bitcoin extends to the fact that many digital currency exchanges now act as “payment rails” for transferring BTC. Because of the inherent costs and hassle of depositing and withdrawing your BTC from digital currency exchanges, many people leave their coins on these platforms. When the time comes to pay somebody, they will simply enter the third party’s SegWit address and have the exchange withdraw coins to the person they wish to pay. This is one way of avoiding paying the hefty network fee or dealing with the hassle of LN network liquidity channels and their unpredictability.

But the trouble with this is that it just merges the settlements into a giant transaction pool called an exchange, which operates off-chain (just like LN… funny that). And it carries with it all the counterparty risk, bankruptcy risk, and runaway Chief Executive Officer risk that comes with unregulated bucket shop exchanges.

Also pretty funny is that some BTC maximalists would be the first to tell you to keep your coins OFF exchanges. (“not your keys, not your coins” is the litany they lull themselves to sleep with). But if they are so against trusting off-chain exchanges with their money, why then would they trust the same coins on a second layer network like LN, which is at the mercy of the future fee market demands of miners who will rightly be charging more and more for on-chain fees as the block subsidy subsides?

The economics are all backward and, sadly, unnecessary. If people would just read the original design of Bitcoin for what it was, peer-to-peer electronic CASH, then miners would be forever compensated by ever-increasing fee revenue, which will be defined by the transaction VOLUME that they are able to process. This keeps the PER TRANSACTION fee rate to a fixed and stable sub-cent fee. For example, BSV currently has fees which consistently are US$0.0001 per transaction, while at the same time, the fee revenue for miners as a percentage of their total MEV (miner extractable value), has increased to five to 10% in some blocks even bigger. When the ratio of fees to subsidy in total block revenue surpasses 50%, we will start to see some interesting economic effects that will drive miners to leave BTC and mine BSV instead. This is because they can make more in USD terms for the same amount of energy expended.

Imagine if all the trades executed daily on exchanges were transactions on the blockchain and what that would mean in terms of revenue for the nodes that are contributing to building out the network to the level where it can process more and more transactions.

This is the model of BSV, where the more people use the blockchain for transactions in a peer-to-peer fashion, the more fee revenues the miners can make, which, if they are intelligent businessmen, they will re-invest into increasing their transactional processing capabilities.

This is the virtuous cycle of investment, revenue generation, increased use and capabilities, more investment, more revenue, more capacity, etc.

The key is simply Peer-to-Peer. Not these centralized pooling of blockchain transactions, all while selling the public on the notion of decentralization, when the system is as economically centralized as any existing banking system we currently contend with.

Notes:

[1] Small block proponents believe that bitcoin should favour small blocks and low volumes, with high per txn fees.

[2] Some of the time, but most of the time you would just be frustrated that your transaction couldn’t be sent due to channel liquidity.

Watch the BSV Global Blockchain Convention Dubai 2022 Day 1 here:

https://www.youtube.com/watch?v=ggbZ8YedpBE

Watch the BSV Global Blockchain Convention Dubai 2022 Day 2 here:

https://www.youtube.com/watch?v=RzJsCRb6zt8

Watch the BSV Global Blockchain Convention Dubai 2022 Day 3 here:

https://www.youtube.com/watch?v=RzSCrXf1Ywc

07-15-2025

07-15-2025