|

Getting your Trinity Audio player ready...

|

The BCH developer tax plan is bad economics and bad governance perpetrated by the bad actors who took over the BCH protocol, and it is splitting up their community—again.

Few people know that the tax was actually the catalyst of the BCH split from the roadmap back to the Bitcoin protocol in 2018. That year, at the May BCH miner summit in Hong Kong, the developer funding discussion was the dark horse indicator that BCH was going to be in big trouble because of the guile of Amaury Séchet – lead developer of the BCH reference client: Bitcoin ABC. Originating at this summit, spokespeople from Bitmain’s Antpool, proposed a 1-5% tax to come straight from the block reward to pay for the perpetual, bi-annual hard forking of the protocol. This block-reward-based funding conversation initiated the debate that ultimately led to the rebirth of Bitcoin in BSV, but that would be a little bit down the road.

By August 2018, under the auspices of nChain and CoinGeek being “bad actors,” Séchet stated with grandeur that he created Bitcoin Cash and that the SV implementation should fork off to make their own chain. There was a blow-out of a discussion around the notion that Bitcoin ABC developers should be paid directly out of the block reward at the protocol level while other developers had to find their own funding. People noted Craig Wright’s alleged faux pas: storming out of the Bangkok meeting, but there was little discussion about the depth of funding issues that were bubbling underneath the surface.

Here is some choice audio from Bangkok:

https://youtu.be/xOhZ-n_tlTg

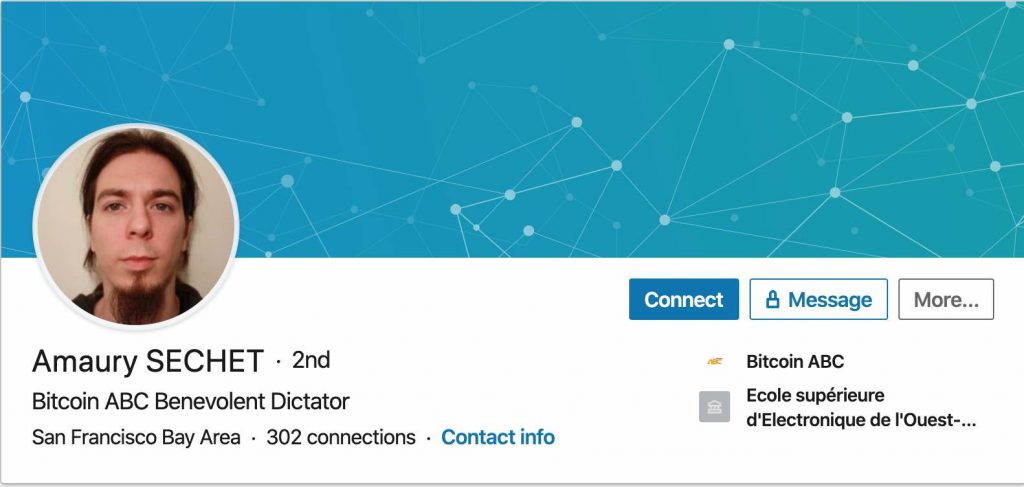

La Trahison d’Avalanche de 2018

What happened to the contentious issues of the BCH/BSV split? In hindsight, it seems like Wormhole Cash and Avalanche were little more than memes created as a collective red herring to rile up the people who believed that BCH was Bitcoin so that a split would seem like “Craig’s idea,” when in reality Séchet planned it ahead of time. His deception to remove all opposition to his carte blanche in Bitcoin Cash was fueled by his desire to be paid. He did not want to be paid by nChain—who reportedly made him an offer—but by the block reward, which would put him in a more powerful (he would say “benevolent dictator”) position over the chain.

Are we experiencing déjà vu, or is this a pattern?

Wormhole Cash and Séchet’s On Markets and Preconsensus were both shelved almost immediately after Séchet’s coup d’etat of the BCH ticker. He successfully shifted focus onto Craig Wright as a distraction to the fact that he created a cabal inside Bitcoin Cash for the sake of getting paid directly from the block reward. But, 2018 was merely phase one of a broader plan.

Despite the fear-mongering about the nefarious intentions of Craig and Calvin, there was never a single attempt at a double-spend or anything dishonest from the SV camp during the so-called “hash war” of 2018. However, the collusion of insiders at Kraken, Bitcoin.com, BitPay, Binance and others—all companies with close personal and financial ties to BCH liaison du jour Roger Ver—became known within 24 hours of the fork date.

The cabal preemptively granted the BCH ticker to the ABC chain after having received pre-packaged, checkpointed node software with built-in reorganization protection that undermined Nakamoto Consensus before the fork occurred. Then, Ver appears to have moved his clients’ contract-bound hash power from mining for profit to mining for the victory of their cabal to establish themselves in a new governance model that I call “Proof of Amaury:” the source of all Bitcoin Cash governance thereafter.

So why is a developer tax a problem?

The new developer tax is the same as what was on the table in 2018. The most basic problem is the incentives. Sechet even says, “The plan should prioritize projects that are in need of money,” which illustrates the non-business nature of the proposal. Also notable is that those who are supportive of the ABC roadmap—notably Electron Cash and BCHD—are to be given the funding regardless of performance, while developers who oppose Sechet’s complete control are excluded. Sorry, Bitcoin Unlimited! Your avant-garde foray into establishing the original big block node par excellence grants you nothing!

However, the real problem with the “dev tax” is a colossal, fatal flaw. If the BCH development fund is built into the protocol, it likely creates an “Unlimited Liability Corporation.” This is why protocols like Dash established their Decentralized Autonomous Organization (commonly called “the DAO”) as an attempt to mitigate personal, legal risk while also participating in a business that is not registered with the state in any way. Whether that is legally effective in the long run remains to be seen, but the Dash DAO is evidence that someone in their camp considered the legal ramifications of centralizing a funding mechanism.

With no insulating business entity, ABC seems to be proposing that their software simply grants them a squeeze out of every block reward in much the same way “community protection rackets” create their own income through threats. In many ways, this business model is most closely comparable with the structure of organized crime, and, in my opinion, the state will ultimately treat it that way!

With Séchet now at the helm of BCH, it should be noted that SV miners, such as CoinGeek, would have been great allies to Bitcoin Unlimited and the other independent players of BCH in this new “la Révolution d’Amaury,” if they had not been betrayed in 2018, but now BSV and her businesses have permanently bid BCH adieu.

RICO

Séchet’s actions may violate the Racketeer Influenced and Corrupt Organizations (RICO) Act statutes. When a cartel forms to cause systemic pressure onto otherwise free economic actors to behave against their own self-interest, this often initiates a RICO violation. Some of the predicates of the law are engaged when the cartel engages in:

- Securities fraud

- Criminal copyright infringement

- Systemic money laundering

- Any violation of laws pertaining to gambling, extortion, bribery, embezzlement or theft

While most people think of the Gambino Crime Family or the Latin Kings, there have been major RICO cases against the likes of FIFA, Major League Baseball and Mohawk Flooring. Given the scope of BCH’s reach, it is possible that ABC, the various miners of BCH and the companies that colluded with them could be in violation of the RICO Act as a criminal cartel.

One of the predicates that makes something a RICO violation as opposed to some lesser crime, is that a pattern of behavior is established by the same people. We saw Séchet collude with Bitmain and all of its shell corporate surrogates in 2018 to pressure out CoinGeek, nChain and the rest of the SV economy—completely under false pretenses. Now they are doing it again to Bitcoin Unlimited as a maneuver to remove all opposition to Séchet’s dictatorship.

The pattern of edging out competitors through strong-arm tactics is starting to become cliché behavior of Monsieur Séchet, and that puts them in extremely dangerous legal territory.

Why should we care?

SHA256 mining is a uniquely interconnected organism. BTC, BCH and BSV share many common pools, people and connectivity. Very few miners are mining fewer than two of the three major chains, and at most times, most miners mine all three. This means that the economics of one definitely creates gravity in the behavior of the others. If Bitmain and her surrogates are taken down in an international racketeering raid, we would be looking at a shakeup of Antpool, ViaBTC, BTC.com, BTCtop, Bitcoin.com, BitPay, Kraken, and Binance because of their close collusion with Séchet and Bitcoin ABC.

What should we do next?

That depends who you are! If you are a miner, leave BCH, and join BSV. It is typically more profitable anyways. If you represent one of the other businesses that followed ABC in 2018 because you thought “Aussie Man Bad,” start by looking at the facts!

Bitcoin SV’s advocates fought for a clear Bitcoin Cash roadmap that set the protocol in stone and minimized the incentives for developer capture. This became the Bitcoin SV roadmap. No SV miner attacked anyone or did anything underhanded in the hash war. In fact, SV miners showed themselves to be honorable by stating their aims and simply mining as high-powered, honest nodes.

In the aftermath of the BCH/BSV split, and in under eighteen months, Bitcoin SV did not become “Proof of Craig” as critics assumed would happen. Bitcoin SV successfully implemented the Genesis protocol and has moved almost entirely to focusing on the creation and investment in businesses that benefit from the stable protocol of bitcoin! Businesses like Twetch and UptimeSV are up and running on their own accord with no drama, for example.

ABC, in stark contrast, has become “Preuve d’Amaury!” Everything that Séchet warned the world that nChain/CoinGeek would become, ABC has become instead. So, old friends, it is time to reassess your allegiances. Bitcoin SV does not need you, your money, a collusive developer tax or any of the baggage that has plagued BCH since 2018. But if you want to work atop a stable protocol with people who want to cooperate in a business-savvy environment anchored to the principles of bitcoin and proof of work, it is time to make the switch.

Also, someone should let Amaury know that if he is so interested in block rewards, he should look into mining. With a little bit of work, et voilà! Block rewards appear!

02-19-2026

02-19-2026