|

Getting your Trinity Audio player ready...

|

On January 10, Bitcoin SV (BSV) surpassed Binance Coin (BNB), EOS, and Litecoin (LTC) in terms of market cap, and surpassed Ethereum (ETH) in terms of price.

#BSV surpassed #BNB's market cap today and jumped to the #8 spot when it comes to top 10 cryptocurrencies by market cap.

I would not be surprised if BSV passes Ethererum's price in the near future, and jumps EOS and LiteCoin in terms of market cap as well. pic.twitter.com/wJ6X34Hr71

— Patrick Thompson (@PThompson_) January 10, 2020

#BSV just passed #ETH price pic.twitter.com/EH0WGOpdIp

— Patrick Thompson (@PThompson_) January 10, 2020

#BSV surpassed #EOS's market cap and jumped to the #7 spot when it comes to top 10 cryptocurrencies by market cap. pic.twitter.com/rHFv2rvqJM

— Patrick Thompson (@PThompson_) January 10, 2020

#BSV surpassed #LTC's market cap and jumped to the #6 spot when it comes to top 10 cryptocurrencies by market cap. pic.twitter.com/UHYa1xPKqh

— Patrick Thompson (@PThompson_) January 10, 2020

This is a great milestone for the BSV network; BSV jumped three spots in terms of top 10 cryptocurrencies by market cap, and surpassed ETH in terms of per token value in less than 24 hours. Although BSV has fallen back to no. 8 on the Top 10 list, its market movements on January 10 are a remarkable achievement.

It also makes you stop and think, what led to Bitcoin’s rapid rise in market cap, causing it to pass Binance in the list of Top 10 cryptocurrencies by market cap.

Why did Bitcoin SV pass Binance?

One reason that BSV may have passed Binance in terms of market cap is because BSV is a more productive asset than BNB. BSV is used daily by both enterprises and individuals. In contrast, BNB is primarily used as a vehicle that permits individuals to invest in Initial Exchange Offerings (IEO’s) hosted on the Binance Launchpad—events that happen periodically.

In other words, BSV has more everyday utility to both consumers and enterprises than the BNB coin has; this is reflected in the 24-hour volume of each coin.

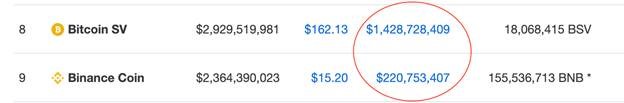

As you can see, the 24-hour volume of BSV is a multiple (roughly 6.5x) of the 24-hour volume of BNB. This is because numerous transactions are sent over the BSV blockchain that stem from companies building their businesses on the BSV blockchain and individuals using applications built on BSV. This adds to the overall 24-hour volume on the BSV network each day.

In contrast, Binance mainly sees volume when an IEO is being hosted on its launchpad, and individuals need to trade their BNB for tickets that allow them to participate in the IEO. Or, when Binance exchange users pay their fees in BNB for a discount on their total trading fee.

Was it the Tulip Trust?

Others believe Bitcoin SV’s rapid rise on January 10 was caused by investors speculating on Dr. Craig Wright’s access to the Tulip Trust.

New: Craig Wright just so happened to have a third "Tulip Trust" set up to hold that missing $10 billion fund.

He sent the info about the "Tulip Trust III" in a document dump of 428 dossiers.

Can someone involves in this mess pls send me $1 million to keep going? pic.twitter.com/zAcI9Wohn9

— Brendan Jay Sullivan 🫧 (@MrBrendanJay) January 9, 2020

Some believe that Dr. Wright has access to a fund called “Tulip Trust III,” which they say holds $10 billion. Some individuals believe that if Dr. Craig Wright has access to this fund, it will have an overall positive impact on the BSV network. Therefore, they think it is better to invest in BSV before any further news regarding the ownership of Tulip Trust III is released.

Was it the upcoming BSV halving?

Or, the increase in market cap could have been due to individuals speculating on the upcoming halving event. Historically, halving events have been followed by a meteoric rise of the asset that underwent the halving.

That being said, if you believe that the upcoming halving will have a similar effect on the market as the halving events that took place in the past, it would be better to invest in the asset that is going to experience a block reward halving sooner rather than later.

This is just the beginning

There are many upcoming events on the BSV network and within the BSV community that you can look forward to. The Genesis Protocol upgrade will take place on February 4, 2020, removing the block size limit from the Bitcoin network. The CoinGeek London conference will be taking place about two weeks afterward on February 21-22, and the BSV network block reward will be reduced by half in May.

BSV passing BNB’s market cap and ETH’s price while jumping to #8 in the list of top ten cryptocurrencies by market cap was just the tip of the iceberg. Be on the lookout for Bitcoin SV to accomplish much more while the businesses and individuals developing on and using the BSV network continue to build and progress.

02-28-2026

02-28-2026