|

Getting your Trinity Audio player ready...

|

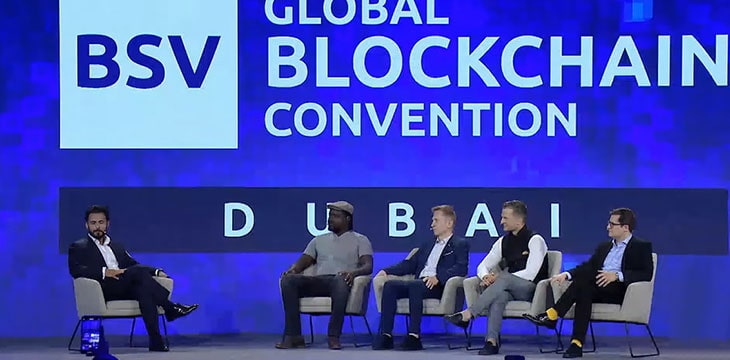

The financial services market is huge, but not all potential customers have access to it. At the BSV Global Blockchain Convention in Dubai, a panel with four experts discussed how the future of financial services will unfold by utilizing the BSV blockchain, making financial services more efficient and especially more inclusive.

The panel was moderated by Naeem Aslam, Nasdaq Columnist and Founder of Zaye Consulting. The panelists include:

- Apollo Eric – CEO & Co-Founder, Bitlipa

- Wojciech Kaszycki – Founder, Chairman & CEO, Mobilum Technologies PLC

- Patrick Prinz – CEO, Monetix, Managing Director, BSV Blockchain Association

- Rafael Schultz – CEO & Founder, Blockchain Punk Labs

The BSV blockchain, Dr. Craig Wright, and quite distorted media reporting

Before the panel started to analyze how the BSV blockchain can help financial services, moderator Naeem Aslam pointed out that he is pretty new to Bitcoin SV and had a bit of trouble understanding the true history and role of Bitcoin.

“This is my first BSV conference I am attending. I kind of stayed away initially due to some controversies I heard about. Patrick and I were discussing that. Over the last day and a half, I have learned a lot about BSV (…). What I have learned is that BSV is really an enterprise solution. It is made for enterprises. So Patrick was telling me how sometimes the media portrays things completely differently,” Aslam said.

What Aslam was referring to are the commercial attacks via media outlets that have been launched against Dr. Craig Wright in the past. However, as more and more information about Dr. Wright and the true history of Bitcoin comes out, for example, with the outcome of the Kleiman v Wright court case, public perception is changing already—for the advancement of Bitcoin. It was important that Aslam gave this short introduction of himself and his journey to get to know the BSV blockchain, as it shows how fast Bitcoin SV is understood once true information finally gets through to the recipient.

BSV blockchain as an enterprise-focused blockchain solution

Prinz went right into the fact that Bitcoin SV, as in the BSV blockchain, serves as a reliable ledger for enterprise usage.

“What all of you have experienced in the booth area (of the convention) is that there are enterprises from all kinds of industries. It is an infrastructure, right? It is a data infrastructure, enterprise-ready. We are all enterprises, some very large, some very small. But we all need a scalable infrastructure,” Prinz said.

The panel discussed how the current NFT market is not yet unfolding the full potential of NFTs in general, as NFTs used in the financial industry could reveal a whole other dimension.

“I believe that NFTs have one very unique factor: it can have a value, which is different for a different customer, so let us imagine a regular product which is being sold today by banks to their customers (…). I believe at the end of the day, these financial products will be structured as NFTs,” Kaszycki said. According to Kaszycki, financial service providers such as banks will adopt the NFT technologies to have a contract with their customers.

NFTs and the financial industry—but what about the unbanked?

“So that represents a trillion-dollar industry, when we are talking about the financial institutions,” Aslam said. But Aslam is not worried about the banked but about the unbanked—those who yet cannot access financial products at all.

Prinz introduced the audience to Monetix, a fintech company from Switzerland that also focuses on parts of East Africa. With Monetix, Prinz is working on an NFT solution that could replace coupons that the Ministry of Agriculture and Fishery is currently issuing to farmers. However, as of right now, these farmers are unbanked and partly illiterate. With the BSV blockchain and NFT solutions, Prinz is convinced to make the financial world way more inclusive.

Concerning micro-lending and micropayments in Africa, Eric stated that the BSV blockchain provides a great opportunity. According to Eric, within the African continent, mobile payments make up to half a trillion of transferred money already, but problems accessing the worldwide financial market are still a reality for many Africans.

This is where most digital assets nowadays go wrong. As they do not scale and have high transactional costs associated with them, the unbanked of the world cannot use these kinds of technologies. Well-known blockchains like Ethereum come with insanely high transaction fees lately. A blockchain-based payment system is not inclusive if it charges higher fees than VISA, Mastercard, PayPal, and the like.

“What blockchain provides is—in my opinion —the layer which makes it cross border. So basically there is no need for additional settlement, no need for additional clearances and so on. We just need to provide a compliance framework on top of it, to make everybody safe and comfortable for all that would use it for the purpose of trading. I think that BSV is quite a good fit for the enterprises, and also for the financial markets”, Kaszycki said.

Low-cost transactions on BSV blockchain and regulatory frameworks

The panel discussed that low transaction fees are not just inclusive for the unbanked but also lead to a widening of the target group for financial products even in highly developed countries. With the BSV blockchain, financial products can be launched that allow for investments of as small as a dollar or a euro, instead of a four-figure investment or more.

Kaszycki also pointed out that BSV still needs to be promoted to the relevant target groups. While other blockchains may have a broader user base at the moment, BSV offers the lowest transaction costs, which is a precondition for any blockchain to be mass adopted, according to Kaszycki.

Schultz described the changing German regulatory framework as blockchain entrepreneur-friendly, allowing for a compliant creation of security and utility tokens. According to Schultz, the EU member states plan to have a harmonized legal framework concerning digital assets until 2024. In Germany, venture capitalists have shown a sudden interest in the token economy, driven by the new legal clarifications.

“Traditional venture capitalists in Germany right now have a huge fear of missing out, like two years ago when we were talking about token solutions, they were like: not compliant. Now we see investments that are mad. If you ask them about a token economy, they say: what is a token economy? But they have invested. So definitely a lot of room now for protocols to jump into the market,” Schultz said.

As another financial services market to be disrupted by blockchain, Schultz sees the crowdfunding space deeply impacted and notices an inflow of funders that do not come from the digital asset sphere. With his Blockchain Punk Labs, Schultz offers tokenization, fundraising, and venture development services.

The panelists agreed that the preconditions for disrupting the financial services market by blockchain are easy access and low-cost transaction fees. The BSV blockchain does offer the low-cost transactions already, and the convention had several presentations, such as from Gate2Chain, that showed how to simplify the access to the BSV blockchain.

03-09-2026

03-09-2026