|

Getting your Trinity Audio player ready...

|

The post originally appeared on Medium, titled “BitCoin: Zen Yotta Mond Data?” and we republished with permission from its author, John Pitts.

Dedicated to my wife & children: I started blogging and posting on social media in 2017 as an open letter and wisdom-transfer to them, with as many personal stories as I can include. If no one reads my writing but them, the time spent is worthwhile.

How many people have asked? How many people have answered; yet, you still don’t REALLY know what the hell BitCoin is. Some say it’s just digital money. The “digital” part is obvious, it typically means computers and computer networks are involved. But what about “money”? What is money? This question was the basis for the last article which you can read here:

Money is always a proof of work. It’s not just any proof of work but the MOST EFFICIENT proof of work (more than gold, or electricity, or cow chips) which allows people to conduct commerce. Armed with this knowledge, it’s now appropriate to move on to the trillion dollar question: What is BitCoin?

When done reading this article, here are the expected rewards for the reader—whether the reader is an artist, a Wall Street financier, or a software engineer:

- An understanding what BitCoin REALLY is, by comparing it to another familiar asset class everyone understands: Real Estate.

- Calculate fundamental valuations for BitCoin price, as if BitCoin was any other financial instrument like a stock or a bond. This is important for financial types, who commonly complain they don’t know how to calculate what price BitCoin’s should trade. While many have used the market capitalization of the U.S. Dollar or all the fiat currencies to estimate a high-side destination for BitCoin price, that’s the weaker side of valuation work. The stronger side is understanding how to calculate the RISK → what LOW price could BitCoin achieve during these early innings of expected high price volatility. (Uncertainty Principle of Investing [0])

- * Pruning is good — vital for healthy BitCoin Network. (pruning means BitCoin network Node operators delete expired on-chain data) It is hoped that by the end of this article BSV-developers will be more likely to thank their local Node operator for pruning fastidiously and often, than chide them for deleting data-on-chain.

- ** How OP_PUSHDATA will fully replace OP_FALSE OP_RETURN, and you’ll never wish to seriously put data into an unspendable coin again; or, at least not anymore than you’d put an important phone number you received onto a piece of paper in the back pocket of a pair of jeans about to endure a full cycle in the washing machine. Dig? Lastly, a suggestion for how to structure your on-chain data with the proper and responsible amount of economics attached. This is presented for peer review with the hope software engineers and business founders will comment on whether is makes sense to structure their on-chain data with the methodology suggested.

* If feeling lost by talk of pruning or data-on-chain, we hope to make this so clear a 5th grader can get it.

** This part really is for software engineers, but it is hoped non-technical folks might surprise themselves here.

Comprehensively: A clearer idea of the computational revolution about to occur in the next 25 years—thanks to the unleashing of BitCoin with it’s full arsenal of tools in 2020—can hopefully be presented here. Let’s get started. It took a bona fide pantomath to create BitCoin (our next article is on that topic), so why not start off with words right from the stallion’s mouth?

“We’re limiting ourselves in thinking about bitcoin as just money, or as just transactional exchanges. It is so much more. We have to start thinking, not just money, but a full digital rights network, a full transaction network for FILES that link to redeemable contracts. Then we’ll start actually understanding what this is all about.” — Satoshi Nakamoto to Nick Szabo, 2015 [1]

The Bitcoin network provides a commodity marketplace for computation; without computation Bitcoin is a worthless pyramid scheme.

If you disagree with this statement because you think scarcity plus some egghead cryptological hocus pocus called “hashing” makes Bitcoin a replacement for the U.S. Dollar, reread the article linked above the 2nd paragraph of this article. BitCoin is much more similar to the crude oil industry or Hong Kong real estate, than it is like the current U.S. Dollar, or Japanese Yen. In fact, this is precisely why governments won’t shut BitCoin down. Intelligent governments won’t shut BitCoin down anymore than they’d shut down a marketplace for electricity. BitCoins have a price, yes, and MIGHT very well become the global standard for money; BUT, BitCoin is a superior network protocol for information, versus the internet. Any country that shuts down a more efficient internet is a nation putting a gun in its mouth. If there is a historical precedent for countries which outlawed electricity or railroads, please inform.

Understanding the future of BitCoin data isn’t easy if you approach it like an engineer; so, that’s why I’m going to save my engineering energy for where I REALLY need it (BUIDL-ing BitCoin apps like SLictionary & Hilarist) and instead explain the meaning of BitCoin from the sea—read on, you’ll sea.

“I joined the Navy to see the world, and what’d I see? I saw the sea” — Fred Astaire, Irving Berlin [2]

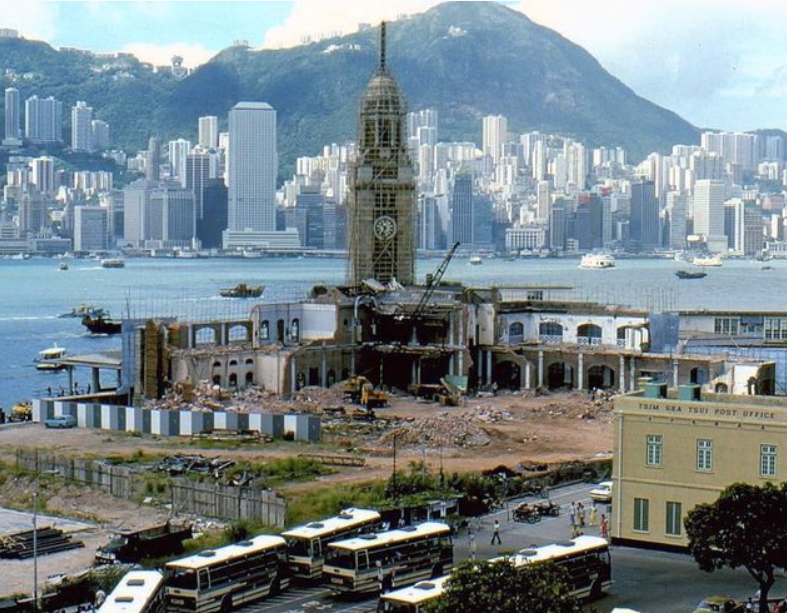

In 1997 I was lucky enough to see Hong Kong, and as someone who’s not a fan of travelling, the visit still was one of the most insightful trips I’ve had. The Hong Kong I visited was the pre-Chinese-takeover version, in all its glory. At that time it was probably the most efficient, most capitalist country in the world. Here’s a little story from that trip, which will frame what BitCoin REALLY is.

If Fred Astaire and Irving Berlin sang those lyrics (above) about the regular Navy, they had NO IDEA how good they had it. The submarine navy was 100x worse. In my first 6 months tour of the Pacific, the USS Houston attack submarine was supposed to pull into exotic Fiji for “shore leave.” “Shore leave” aka mini vacation, is what non-military-type might call a “weekend.” What we got instead, when those 4 days were cancelled, was 2 weeks in Guam to fix problems we had with vital equipment while on patrol. Guam was a “working port”. My favorite restaurant, lifetime, is in Guam (Mariana’s Trench — octopus-ink spaghetti looks like an oil spill on your shoelaces but tastes like your first kiss), but believe me when I tell you Guam is no vacation destination you’d choose willingly.

Cancelling submarine shore leave isn’t out of the ordinary. Submarines cost $2 billion to build, not dissimilar to the expensive price of aircraft carriers. One big difference: Carriers have 5,000 hostages, err…sailors, on board to maintain it, so they have time to make PLENTY of port-of-calls to Fiji, Japan, Australia, and New Zealand when in the Pacific theater. Submarines, on the other hand, are lucky to have 120 people, but arguably just as much equipment as the carrier and therefore make almost no ports of call because all 120 people are working too hard to maintain the sub. The U.S. Navy doesn’t provide overworked submarine crews an extra complement of shore-based workers to keep the nuclear reactor, nuclear armament, or torpedo tubes running smoothly at all times. The 90–120 highly-trained guys on subs do the work of thousands of men, and work like junior investment bankers—on call 24/7/365. So when I pulled into Hong Kong in 1997 and was granted 48 hours of my very first shore-leave [1], it was really special. I did what any tourist would do given Hong Kong’s unique landscape: I got a cheap ticket to ride on the incline-train which climbed up Hong Kong’s “mountain” for the Emperor’s view of the amazing city below.

While riding up the incline I was lucky enough to sit next to a local who spoke the King’s English and ended up teaching me a valuable lesson about how cities (should) work.

“You see all that activity at the waterline?” he proffered. “That’s Hong Kong adding LAND to the island, they’re turning the sea into land so new buildings can go up—there’s not enough land in Hong Kong anymore.”

Building on the incline wasn’t much of a foundation for a 100-story building, so construction companies found it more economical to just create more land by filling in the sea! This seemed absurd, until you looked at the skyline in 1997. The downtown part of Hong Kong looked like someone had tried to insert 1,000 pencils into the single leaf of a lily pad. If you’ve been to New York City you probably understand what I’m describing, only Hong Kong was “worse.” But it was what this friendly local said next that REALLY left an impression:

“See that building under construction over there?” He pointed to a section of the city with no less than a DOZEN high rises with construction scaffolding on them; I had no idea which one he meant. The whole CITY looked like this—cranes EVERYWHERE. Boomtown. I’d been to New York City many times, as I had family there, and New York by comparison was like an old rock by comparison; for instance, in NYC it took decades to rename the “Pan Am Building” long after Pan-American Airlines went bankrupt [2].

“The tallest one,” he specified. “I used to live in the previous building, the one they razed a few months ago to make room for the 100 story one they’re building on that spot now.” This was just mildly interesting chatter until he said the next line:

“Yes, my building was 60 stories, and I lived in it about 6 months ago”.

WHAT??

This seemed insane on two levels:

- The building going up before my eyes was already high enough to have been started 2 years ago, not 6 months ago.

- In Manhattan they might raze a 4-story building and put up a 100-story skyscraper apartment building, but raze a SIXTY story building to erect a 100-story building? Madness!

The nice man explained that this wasn’t a new situation, ALL of the cranes about the city were doing the same replacements: 100-story buildings for 60-story buildings, 80-story buildings for 50-story buildings. Big buildings being replaced by even BIGGER buildings, and just a few years after the cement had hardened on the previous edifice.

“How long did you live there, I’m assuming your whole life, so its sentimental?”

“Noooo, I lived there 4 years, and I was one of the original tenants in the 60 story building, it was brand new as far as I was concerned, and it replaced a 40 story building in 1994.” This was capitalism, pure velocity of money stuff out of a THEORETICAL Economics course. And it’s exactly how BitCoin works. Let’s switch cities and do this again.

Compare the island of Manhattan in 1834 to BitCoin in 2020:

While he was killing it in the fur trade from his arrival in 1784 at 20 years old, John Jacob Astor, the richest man in America of his time, took strolls up Broadway, from the hustle and bustle of downtown, to the “country.” He strode past all the farms to the wide open land filled with game and hunting. You know the place Manhattaners: north of Wall Street!

Astor’s nickname is “The Landlord of New York” because he bought up acres and acres of land on his home island with the proceeds from his sale of American Fur Company.

J.J. Astor’s life-long trade, fur trading, is what made him the richest man in the world. But when he saw the “King Cotton” of early NYC textiles industry (Ever hear of Manhattan’s “garment district”?) coming to wipe out his lavish profits with a cheaper way to keep people warm, he sold American Fur to the highest bidder and invested the money into the next best asset he could find—the future of American business—Manhattan real estate.

The great big city’s a wondrous toy;

Made for a girl and a boy.

We’ll turn Manhattan,

Into an isle of joy;

I’ll take Manhattan“– Rodgers & Hart

Don’t be fooled by Astor’s time period in American history, as small as Manhattan was in 1834, he lived in a BOOMTOWN and he knew it. Lower Manhattan was growing like no city in history. With his considerable wealth, in cash, he needed to put it somewhere, so he simply began bidding up all the empty land, and properties with un-economical edifices on it. He then offered construction-contractor-investors 99-year leases to plop down hotels, merchant buildings, apartment buildings or anything else the city needed and would pay to UTILIZE. Astor was America’s best investor, past and present, and he only made a single trade. He traded a declining American Fur stock at the peak, right before King Cotton massacred his company, for Manhattan real estate. Does this remind you of anyone in Bitcoin? It should.

Those 99-year leases kept many generations of his heirs from being able to sell the properties, which, given the rise in value of the land and buildings of Manhattan, ended up being smart scripts! (pun intended) Every man woman and child with the name Astor in New York was filthy rich up thru the 1980s. But what exactly was Astor buying? LAND. Not skyscrapers. Undeveloped and underdeveloped land.

Astor wasn’t buying this land to HODL [6]; he was buying it to DEVELOP it. Astor cleverly didn’t put the bricks down himself, he bought the land rights, and then issued 99-year leases to developers to create business buildings and commercial buildings. In a way, Astor was like a venture capitalist. If he couldn’t build himself, he’d damn well finance OTHERS building. Again, sound like anyone familiar in the BitCoin community?

Why did he know Manhattan real estate was going to be so valuable? He wasn’t buying the bank downtown, or the most profitable general store downtown, or the stock exchange building downtown. He was buying EMPTY LAND UPtown. Why? After all, Iowa farm land was MUCH cheaper than Manhattan farm land, for which he paid a premium.

“The 3 most important properties in Real Estate: LOCATION LOCATION LOCATION” — wise old Real Estate magnate

This old meme of course obvious to us, but only because it’s with the benefit of over 180 years of hind-sight. So let’s explore what gives empty plots of land on islands like Manhattan, or Hong Kong, Bahrain or Singapore much higher value than empty plots of land elsewhere. As we begin to understand, at the micro-level, what makes a square block of Manhattan so valuable, we will understand what BitCoin is to become. On the more technical side, we can also use real estate comparison to understand the age-old big blocks vs small blocks blockchain debate with much more clarity—the clarity of historical perspective.

Each plot Astor bought could, by laws of Physics, only only be subdivided so many times before becoming useless. In New York City, the smallest useful thing would be a newspaper stand, but a plot of land big enough only for a small bodega wouldn’t be able to be the basis for the Empire State Building. For this reason, NYC land plots aren’t ever the size of newspaper stands. You could theoretically divide Manhattan’s land into pieces the size of a sugar cube, but this would lower valuations not raise them. Why? What could anyone build which is useful on top of a sugar-cube sized land area?

“What is this?? A center for ants?” — Derek Zoolander

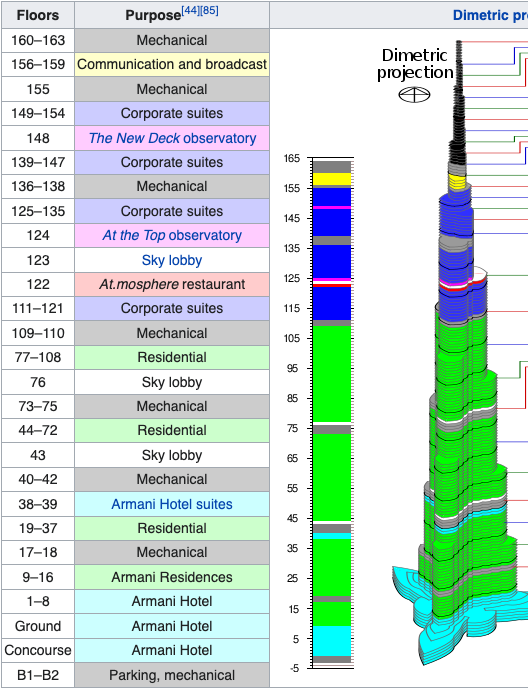

Manhattan is an island, and therefore has a limited land area—just like BitCoin has a limited number of coins. On each reasonably-sized plot of land, a real estate tycoon could realistically plop down something as high as 150 stories [4]. But builders don’t always fill an empty plot of land with the tallest building they can commission, because economics are at play. Demand for office space, residential space, or industrial space must be predicted, and capital would need to be raised in line with the profit expectations of investors analyzing the validity of those forward profit estimates. But as most land on the island of Manhattan became developed by the turn of the 20th century, “building up” became the norm. But we still haven’t answered: why is the price of undeveloped land so dependent on being ON the island of Manhattan? Just buy some land in a cheap Iowa cornfield J.J.!

Astor did not. He chose instead to buy empty land for an expensive relative market price on Manhattan, not Iowa, just like you can buy BitCoin for $150 today instead of paying $2.53 for EOS “cryptocurrency.” Astor’s lessors erected useful buildings atop those leaseholds and improved the value of the property. More importantly, new businesses and bigger apartment buildings with more people increased the value of the NEIGHBORING land! Why?

The Stadium Effect:

When you attend the local city football game, why are beers so pricey? Because they are conveniently close to the football action. Football stadiums are almost never close to anything commercial nearby, so a fan would have to cross a desert of fallow ground to get a reasonably priced beer from a local store. A trip for a 6-pack, even if they let you enter with it, would cost you missing the game. There’s limited space at the stadium too, so a soft pretzel vendor and a souvenir store take spots which could have sold beer, lowering your choices and allowing beer vendors to charge more. What you’re paying is a convenience fee.

Cities are also efficient in a similar way. One giant heater (benefiting from economy-of-scale) keeps thousands of offices warm, instead of one heater per office. Subways eliminate congestion and carry more people per square inch of roadway versus every citizen owning their own car. Cities are tight and commercial and allow its citizens to get things done quickly and efficiently.

Additionally, the land isn’t ALWAYS expensive. We already established Manhattan only has so much land, so how can it EVER be cheap once it fills up? VERTICALITY is one answer. PRUNING is another. Verticality in BitCoin is like allowing each coin to store more than just a small piece of data. Remember, BTC leaders chose to constrain not only block size, but transaction size too. The ignorant devs who ran BTC didn’t realize that BitCoin was to derive 100% of its value from the data ON the tokens, not the tokens themselves as “faith money.”

This is where folks like Nick Szabo went wrong; again, read the linked article at the beginning of this article: money MUST be backed by an asset, and BitCoin’s asset is data. FAITH is the “asset” with which Bernie Madoff’s fund was backed. Pruning in a city, is just our Hong Kong example, razing a 60-story building because office space is so expensive it makes economic sense to replace it with a 100-story building. Pruning in BitCoin is even easier: data which isn’t earning is replaced by data which IS earning. We’ll talk about pruning in more detail towards the end. For now, let’s introduce one more city to demonstrate BitCoin pricing will be cyclical with the overall world economy.

Vega$ baby, VEGA$!

By the late 1970s Las Vega$ was empty due to a depression which began in 1966 and lasted over a decade. Buffets at hotels were free, and hotel owners offered just about anything under the sun at discount prices to get people inside the casinos. This problem was the result of over-building. From 1966 to 1973 NINE hotels were launched: Ceasars, Aladdin, 4 Queens, Circus Circus, International, Bonanza, Bally’s, and Harrah’s. When the economy is bad, it doesn’t matter how big or pretty your hotel is, people just lack the paycheck stability to go around spending.

Structures erected in a hurry because everything is working—start to look like they’d been better off not being built. BitCoin is like this; in BitCoin there’s a division between coins which are utilized for storing valuable information, and empty coins which are used to simply TRANSACT. Open farmland for Astor to buy and develop, and developed land which already had buildings conducting business. Right now, in BitCoin, many are “squatting” on land hoping for it to be bought and developed. This is a game of chicken vs the economy, right? If the economy goes as sour as Las Vega$ tourist traffic, no developers are going to be buying LAND—they’ll be busy figuring out how they can unload their BUILDINGS!

Verticality: Pressure can be relieved in a city by simply building up. What you could accomplish by building 1,000 suburban homes each with their own heating and cooling unit, you can accomplish in a single tall building of 100 floors with 10 residences per floor and a single efficient main heating/cooling unit. All sides of a house have to be insulated, but only the outer edges of the 10-condo floors need insulation.

Know what’s efficient? Walking 4 blocks to work. My commute when I lived in Manhattan for a decade was a walk from 3rd avenue to 5th avenue—it counts as a small workout too, and I used to read SEC documents while I walked (tricky, but with practice…). Never mowed a lawn or picked up a dead branch after a wind storm, for 10 years; in fact, I didn’t own a car and didn’t miss it either—pre-Uber too.

As a BitCoin developer, you’d rather store 1,000 pieces of data into a single 4 gigabyte (computer memory) transaction, rather than create 1,000 transactions. 100 Stevadores moving 1,000 boxes can be replaced by 1 crane moving a shipping container with all 1,000 boxes inside it.

Pruning: Know what’s easy math? Pruning math. It’s profitable. When I first visited Manhattan’s Upper East Side to look for an apartment, on a local corner of 2nd Avenue there stood one of the last single residences on the island. No idea how it lasted so long, it looked old and beaten and was surrounded by massive buildings. I called it affectionately “The Old Lady’s Shoehouse.”

Within my first 4 years a gargantuan residential building went up—I used to see Yankees’ Jason Giambi emerge from its doors on my walk to work when it was finished. The developer just did quick math. He calculated expected cash flows from putting a large building down versus how little he’d pay for the Old Lady’s Shoehouse. The old residence if it could be transported to Iowa would probably still be a grand mansion fixer-upper. Add interior design and it would have been a great house — anywhere but Manhattan. From the elevator of an 80 story building, there was probably 50 restaurants within walking distance, all hoping for 800 families to live on that plot of land rather than ONE old lady who refused to sell. The old lady’s house didn’t have ZERO value, it just didn’t stand up to the math of razing it and putting up a much bigger building to add to the community. So the old lady’s house was destroyed — a sacrifice! In this case the value of open land was worth far far more than the land with a house on it. Pruning works! Your body prunes weak or dying cells, so why shouldn’t cities and BitCoin?

“The point is, ladies and gentleman, that pruning, for lack of a better word, is good. Pruning is right, pruning works. Pruning shears clarify, cut through, and capture the essence of the evolutionary spirit. Pruning, in all of its forms: pruning for life, for money, for love, knowledge has marked the upward surge of mankind.” — Gordon Gekko [8]

But what is BitCoin?

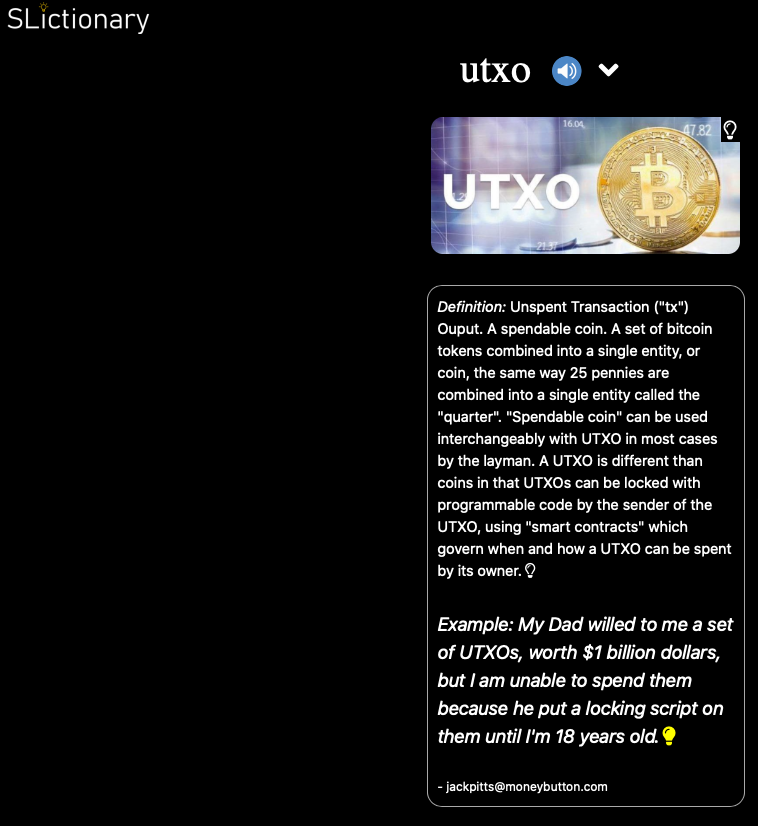

BitCoin UTXOs can be a lot like checks, no matter what nonsense the check-writer/sender may have written in the memo, once the check is cashed no one really cares what was written on the check. The money is now yours to spend freely. It’s like purchasing open land, or land with and old lady & the shoe house on it. The previous owner no longer matters, if she had a sign on the front driveway which proclaimed her great generosity to the community you can burn it to the ground and put up a new sign. What was once a UTXO with 4 gigabytes of memory holding boring old family movies on it, can be erased and the UTXO can be repurposed for shiny NEW data which is valuable to YOU. YOUR data, locked by YOUR private key. How software developers can use BitCoin is to store data ON the coin. It’s a storage locker, just like empty land is a substrate for valuable USEFUL buildings.

Bitcoin are unlike checks, in that Bitcoin UTXOs can have RULES scripted on them which make them unspendable until the conditions set by those rules are met. These scripted rules are written by the sender TO the receiver, and act exactly like a lock wrapped around the coin. A Bitcoin UTXO may be in your wallet, but if you try to give it to an ice cream parlor in exchange for a milkshake when your script says you must be beyond the year 2030 to spend it—the store owner isn’t going to accept your payment.

https://www.youtube.com/watch?v=N6C8vXbJ6ts

You can easily see how Last Wills (Inheritance) can be written onto BitCoins! You could not only will your children specific amounts of Bitcoin money, but you could write ON the money a script (software code written in a language called “BitCoin script” [9]) which determines exactly WHEN and under which conditions your son or daughter is allowed to spend the money. You could write a script onto a coin, give that coin to your son, and the script could query the marriage database for his marriage certificate before being able to spend that BitCoin! Amazing! In fact, a company called Volt is already creating a BitCoin wallet which can do things like this.

What is BitCoin worth?

…using fundamental security analysis?

Before a methodology for storing on-chain data is proposed to software engineers, it’s important to define how BitCoin can be valued. I’ve calculated fundamental valuations for everything from pre-YouTube Google in 2004 to gold mines as part of my career, and a handful of times bet my entire life on the analysis. This is one of those times I’m betting my life, my good name, and even my children’s destiny on a set of research, so it was important to figure out how to value a money system as if it were an equity.

Here I’ll put the math to paper, and pre-warn you that unless you’re view is long and your understanding of markets resolved, you may not like it. The good news is BitCoin is worth far more than you think. The bad news is: it’s going to take far longer than you think for it to get there because BitCoin’s 1 megabyte blocks are tiny and there aren’t very many apps filling up Bitcoin with data quite yet. Chin up tho, BTC is valued at almost $200 billion and isn’t worth anything in the long run; while BSV is $3 billion and has a bright future ahead. Clearly the valuation market understands the future value of an immutable ledger, without even understanding how it works yet! It is for this relative reason, I don’t think BitCoin SV will ever go below $60 again. (but more on that in a later article).

“East bound and down, loaded up and truckin’

Oh, we gonna do what they say can’t be done

We’ve got a long way to go and a short time to get there

I’m east bound, just watch ol’ Bandit runKeep your foot hard on the pedal, son never mind them brakes

Let it all hang out, ’cause we got a run to make

The boys are thirsty in Antigua and there’s coin in del Rey Marina

And we’ll bring it back no matter what it takesEast bound and down, loaded up and transactin’

Oh, we gonna do what they say can’t be done

We’ve got a long way to go and a short time to get there” — Priceless Jerry Reed

Any security is valued by how much money the underlying asset hauls-in for the owners in the future as it grows, applying a growth multiple to the final no-growth state, and then discounting backwards in time to get the price you should pay for it vs a desired investment return. For the sake of simplicity, we’ll cut that last part out as it’s beyond the scope.

Many people have valued BitCoin by simply guessing what all the money in the world equals today and work backwards. But this is liberal. It’s far safer and more conservative to value BitCoin as a data network similar to Amazon Web Services, or Apple iCloud. Using this method we can get the more important number: the risk. The risk is how far BitCoin SV price can go down before it no longer makes sense and value-oriented investors will snap it up. So that’s how we’ll attack it, and THEN we can imagine how to value BitCoin as money as a multiplier for the total value of BitCoin.

We start by sequestering the average blocks sizes in 2020 for BitCoin—use 1 MB. Then we litmus the current minimum transaction fee of 1/2 satoshi per byte. A standard money-only transaction (buying banana guacamole) is about 300 Bytes, thus the mining fee generated is 0.5 * 300 => 150 satoshis (tokens). This is 2 or 3 1/100ths of a penny per transaction—negligible for both the buyer (which is good) and Node, but NOT negligible for the Node when adding up millions of these transactions in bigger and bigger blocks as BitCoin usage grows higher and higher!

To get a valuation for a single BitCoin we need a valuation for the entire network. So we will count the transaction fees not for ONE transaction, but for ALL transactions amassed by the entire BitCoin Node network for the year.

BitCoins are packaged into an immutable ledger, called a blockchain, and this is to record in public all the transactions for all to see. It works like a wedding attestation. Why will bride and groom be good to each other over 50 years? Because they made promises in front of all their friends publicly. Shame is a powerful force. We won’t get into why transactions must go into blocks in this article, but we’ll simply say that instead of starting with single transactions we can just count the transactions storage containers called blocks. Currently BitCoin blocks have 1 megabyte of transactions chained together on average, or 1 MB (1×10⁶ Bytes), spread out to 10 minutes each. 10 minute blocks are designed into BitCoin via the protocol, there’s no changing it. We will now just do simple math to get the number of Bytes transacted per year, and then multiply by the standard RATE BitCoin transaction-processors (also known as Nodes, or miners) charge users of the network: 1/2 satoshi per Byte.

1 MB/block * 1×10⁶ bytes/megabyte * 1 block/10 minutes * 60 min/hr * 24 hr/day * 365.25 days/yr = about 50 billion Bytes/yr

50 billion Bytes/yr * 1/2 satoshi/Byte * 1 bitcoin/1×10⁸ satoshis = 250 BSV per year.

250 BSV is how much the entire BitCoin Node network will collect in transaction fees, and at $180 per bitcoin that’s only $45,000 in revenues, and therefore does not count the Node network’s electricity bill nor mining-rig depreciation.

Now that we have the revenues provided by the whole network, we’ll assume financial types know what a price-earnings ratio is and calculate a valuation. If we assume a liberal 20% net profit margin on the $45,000/yr revenues it comes to $9,000 net earnings per year for the BitCoin Network. The Dow Jones Utility Index, which is over 100 years old and therefore quite mature and slow-growing, traded for a PE multiple of 30x last year.

At 30x $9,000 the BitCoin Network COULD be valued as low as $270,000. Helloooo Ari Kuqi!

This compares DIRECTLY with BSV’s current market capitalization of:

21 million bitcoins outstanding x $180/BSV = $3.78 billion

This implies BitCoin is over-valued by over 10,000 times! Folks, let me assure you that when Calvin Ayre has been saying bitcoins mining will be a “bloodbath” after the halvening (which just occured this Spring), he wasn’t joking. But you’d rather be valued at $3 billion than $200 billion! Look out below btc HODLers.

The good news is this valuation is unrealistic on a number of counts:

- A 30x multiple is ridiculous, as BitCoin transactions grew over 5,000% in Q1 2020 over Q1 2019. Wall Streeters will typically assign a PE multiple equal to growth, so 20% growth begets 20x multiple. In this case 6,000% growth would get a 6,000x multiple. This would get us to a valuation for BSV ~$50mm, still a far cry from its current valuation, but only short by < 100x.

- Transaction prices could go up: 1/2 satoshi/Byte is actually about 2/100th of a US penny! Compare this to Visa transactions which charge a minimum of 10–30 cents non-negotiable fees. For example, a Paypal online transaction cost 15 cents minimum, which is 750 TIMES more than BitCoin fee. This means BitCoin could theoretically raise fees by 100x, from 2/100ths to a fully penny, and STILL be miles and miles cheaper per transaction than the competition. This adjustment plus the adjustment above could justify a $5 billion valuation for BSV. Suddenly BSV doesn’t seem so cheap anymore, but btc at $200 billion is looking downright dyspeptic.

- Valuations are FUTURE considerations not PAST considerations: We are only using CURRENT block size of 1 MB per block. This will climb so much higher, than in 2030 you’ll see a chart of BSV block size and the 2020 block size won’t even be readable it will be hugging zero on the chart so closely. The leaders within at the Node software company nChain use the term “TeraNode” as the name for their miner-node software they’ll likely be releasing in 2020. The implication is terabyte sized blocks, or blocks 1 MILLION times as big as current. No don’t multiply 1 million to $5 billion to get a new upwards estimate of $5 quadrillion valuation for BitCoin, that would be nuts. But we can use this to understand that #2 isn’t required; thus, fees will never climb towards 1 penny per transaction so long as BitCoin continues to grow to gigabyte and then terabyte sized blocks. If you do the math, you could actually change 2/100ths of a penny to 2/10,000ths of a penny and still be within the higher bounds of the world’s money-supply valuation (which is CERTAINLY the theoretical upper bound).

We could list more ways we’ve been conservative here with the odds. But there’s a VERY important lesson here in this valuation calculation: It’s not possible to get above a few hundred thousand dollars of valuation without allowing large blocks. In this respect, we’ve provided you with the proof that btc isn’t worth anything.

While there’s a non-zero chance BitCoin doesn’t succeed, there’s a 100% chance “btc”, “eth” & “ripple” don’t succeed in their present forms. The 2011–2017 block-size debates which raged in early BitCoin are over in all but price. btc and eth might have a better chance if they knew enough to begin changing their protocols closer to BSV so they could scale; BUT, I’ll leave it to far superior technical minds in the BSV community (ie: Steve Shadders, Xiaohui Liu, unwriter, Daniel Connolly, Dean Little, Rafa at HandCash, u/@1 Harry at Twetch, etc…) to explain to you why their temporary market capitalization edge won’t help them because their technology cannot be reversed at this point (see P2SH). I won’t give you THAT technical explanation, I’ll give you the psychological reason why you will lose ALL of the money you have in eth and btc and ripple even if they TECHNICALLY could ‘reverse & clone’ BitCoin’s scalability.

In my almost 40 years of corporate strategy research, I’ve noticed the companies with a large market caps vs competitors tend to act slowly even when its critical they move quickly. It is the very LEAD itself which causes this—complacency. You see, btc, ethereum and ripple won’t know to change until their market cap is exceeded (by BSV) and by then it will be too late. BSV ALREADY leads them in all the important metrics like block size, real transactions [9], and scalable application development. So the “lead” in market cap is actually yet another bag of sand for “cryptocurrencies” with the largest 4–5 market caps. What SHOULD be a lead, is in fact a drag. Complacency’s a killer!

Now you are armed with the methodology to do your own valuation calculations for BitCoin. Don’t let someone like ME tell you what BitCoin should be worth, just change my numbers to your view of the world. The upper bound for what Bitcoin can reach in valuation isn’t the hard work of valuing BitCoin anyway, it’s just a datapoint necessary to help you know how much capital or effort to devote to the coins themselves. As Craig Wright has pointed out many times, the superior thing to do with your time & money is help build the “buildings”, or applications, which will take advantage of all BitCoin’s advantages over other information/monetary technology. This is the case both from a moralistic standpoint, but even an economic one. Personally, I have pledged to “bleed BitCoin” for the remainder of my days, devoting 100% of my career toward BitCoin, as I believe BitCoin solves a HANDFUL of the biggest problems in the world today. That’s exciting!

BitCoin is an Information Network (or bust):

PROPOSED for peer-review below is a potential best-practice in BitCoin data handling—mainly aimed at BitCoin software/application engineers. There may be a more economic, vs technical, reason why BitCoin application software developers should be writing on-chain data a certain way. The proposal utilizes the example of real estate to help explain. Looking forward to any/all critiques of this proposal, as disagreement can help the community of developers.

1st Law of BitCoin On-chain Datadynamics:

Tokens are neither created nor destroyed, but CAN be entropically burned & lost; give a hoot, don’t waste tokens.

Pruning for Profits

Imagine Alexander Hamilton’s original US mint created 2.1 quadrillion pennies in 1793 instead of 11,178. Then pretend he officially declared those pennies were all there was ever going to be. But this time the pennies were hollow with a storage space inside each one. To see what was locked inside each penny you had to have a key to unlock the little doors. Inside the hollow compartment, you could insert a piece of computer memory, with the biggest one being 4 GB. [11: if you don’t normally read footnotes, read this one]

In BitCoin, a 4 gigabyte chip which fits into the “penny”, or “satoshi”, is called OP_PUSHDATA4. Don’t worry about the odd Forth-like [9] name, just commit it to memory. Hamilton realized that paying for anything with a bunch of pennies was going to be incredibly cumbersome and require lots of wheelbarrows, so he created higher denominations such as 1 ounce silver “Liberty” coins, otherwise known as the dollar, as well as multi-penny denominations such as the half-dollar (50¢ piece). Hamilton struck $5 and $10 coins in gold, called “eagles”.

Craig Wright, inventor of BitCoin, on the other hand chose to make ANY sized coin possible. These are called UTXOs.

One UTXO could have 100,000,000 (100 million) pennies in it, and he called that size a “BitCoin”. Other UTXOs could be created to hold 500 pennies, or 149 pennies, or 20 million pennies. But if you combined a SET of pennies into a “UTXO”, you could still ONLY store 4GB of data in the UTXO SET. But don’t worry, if you needed to store 8 GB of data, you could just split your 400 penny UTXO into two 200 penny UTXOs and each could have 4 GB for a toal of 8 GB. Or you could divide the 400 into 399 and 1, and each split could have 4 GB of memory in it. This IS in fact how Bitcoin is supposed to work, before bitcoinCore (or “btc” or “CoreCoin” or “SEGWIT-coin”) developer-interlopers erased the functionality of data from BitCoin in 2012 because they mistakenly thought BitCoin script was unsecured or meaningless. Boy were they wrong.

It turns out, without BitCoin being able to store data, BitCoin are worthless ponzi-scheme tokens—no more valuable than out-dated losing racetrack stubs. Guys like Adam Back and Gregory Maxwell removed the only thing that’s valuable about BitCoin, OUT of BitCoin and then ran around telling people to NOT spend it!

This company called Blockstream which grabbed the (GitHub) keys to BitCoin’s code out of the weak hands of the mistakenly-trusted Gavin Andresen, took the utility out of BitCoin. Imagine a group of backwards alchemists taking gold and removing it’s excellent conductivity so it was no longer reliable as nuclear warhead circuits. Then they remove gold’s sterility so it can no longer be used as anti-bacterial substance for tooth filings or gold leaf coatings. Blockstream turned gold into pyrite—or poop. Worse than manure actually, because organic excrement is valuable to farmers, but btc segwit-coin is not valuable to anyone not named Madoff or Gregory Maxwell.

Remember our real estate example: BitCoins without scripting language written into them, are empty lots. There’s 2.1 quadrillion (2.1 x 10¹⁵) of them, or 2,100,000,000,000,000 and no more. These empty lots are called tokens.

A BitCoin is defined as 100 million tokens. This is like saying a dollar has 100 cents. BitCoins have 8 places on either side of the decimal point[3]. Thus BitCoin are quantum objects, and by quantum I mean limited in number—bounded. You cannot divide a token further, they are quantum like Planck’s length ħ. [13]

Now before the software engineers get mad at me for taking this long just to explain there’s only 2.1 quadrillion tokens in BitCoin, let me show you how BitCoin is a limited commodity like Manhattan real estate which can hold data like an empty lot can hold a skyscraper, a large store, or a house-in-a-shoe. Let me show you why you’re going to LOVE pruning, and respect Mr Zheming’s knowledge of BitCoin even more for having been up front with you that’s he’s going to prune the shit out of BitCoin! Mempool Inc. KNOWS how BitCoin works, from what we can tell, and that’s why they’re blessing all of us by pruning every damn spent OP_RETURN he can find!

Your BitCoin OP_FALSE OP_RETURN data is Dead; Long Live BitCoin OP_PUSHDATA Data!

Before we talk about OP_FALSE OP_RETURN vs OP_PUSHDATA let’s review why Craig Wright MIGHT (we’ll have to ask him later) have chosen 2.1 quadrillion and not some other higher or lower number?

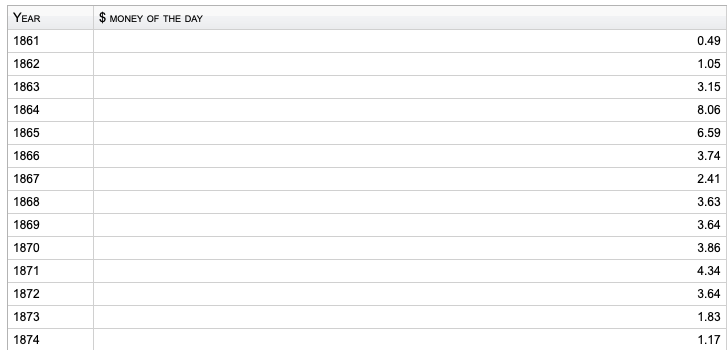

Bitcoin only goes to 2.1 quadrillion, not infinite (∞) like the US Fed’s dollar. But why? Why did Craig only go up to 2.1 quadrillion, won’t we run out? No, we won’t run out George Gilder, you’re just not going back far enough in history to understand how a new commodity market stabilizes such that prices DO get steady. Instead of trying to fish for gold-electrum prices measured in cattle in ancient Crete to see how volatile a market can be in the early days of its discovery 3,000 years ago, just look at oil in it’s first dozen years of discovery…

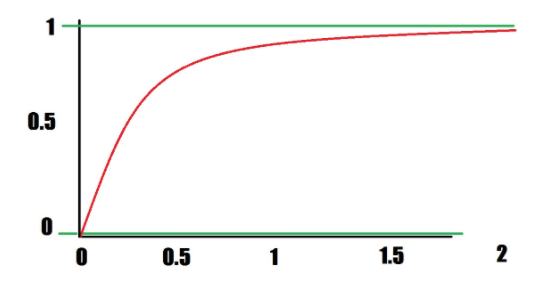

What George Gilder got wrong at the end of the London conference, despite delivering an outstanding speech about BitCoin, was the newness of BitCoin as a competitor to gold or the silver-backed Dollar or Pound Sterling. He’s was worried about price volatility. But he failed to understand the nature of volatility in young asset markets. All he had to do was look at the early days of oil when it was a brand new commodity seeping out of the ground in Pennsylvania and Texas in wild spurts. Young assets markets have trouble matching supply and demand, and thus are HIGHLY volatile. But that volatility gets smaller as the asset market matures. By the time Rockefeller’s Standard Oil got full control of oil after a couple of decades, the oil price swings had ended as supply and demand matched.

“I have a number of units, which are… QUITE LARGE…” — Craig Wright to George Gilder’s question about running out of BitCoin Feb 2020

As Craig correctly pointed out in his answer, there’s no known fair solution for fixing price. Assets fluctuate in price, even gold and silver suffer when big new viens are found which flood the markets. The best you can do is tie your money to SOMETHING, ANYTHING. In BitCoin’s case, the tokens are tied to the utility of computation: Stored data, executable code and transactions. The value of BitCoin is the value of the entire BitCoin network and everything it contains, and it will go UP in time.

The quantum limitation on tokens is important for another reason, it gives BitCoin’s information highway a value. Without limiting the tokens, BitCoin can simply be diluted. Yes, if you’re reading this you already know all the major national currencies are printed and therefore decline in value vs assets. But BitCoin is limited in number because NOT limiting it would be data chaos. With the price to write on-chain being cheap, and zillions of token supply, people and applications would simply write ANYTHING to BitCoin. Lots of data with no value would go on-chain and clog it up, and cost the network money storing it. Bad data on-chain is a TAX on everyone else. Worthless data on-chain is like bad posts on Twitter, it stinks up the joint and lowers the value of using Twitter. If you like bot spam splattered all over your digital newspaper, then you’d love infinite BitCoin the way Gilder would have it. NO. Learn to LOVE pruning, it’s your best friend as a developer.

As Manhattan gentrifies, the value of the land goes up. And as the value of the land goes up, any buildings which aren’t useful get pruned. BitCoin miners do the same for us, they prune data which isn’t carrying its weight. Just because in 2019 people hacked a way to write data on-chain using OP_FALSE OP_RETURN doesn’t mean it was a GOOD thing. Pay attention, because this could be the innovation of Planaria’s powping social network—the difference between it an Twetch. Let me give you an example.

Let’s say Twetch charges me $0.10 to post a picture I like on-chain using OP_FALSE OP_RETURN unspendable transaction. If this picture becomes as popular as the Mona Lisa, and people all over the world want to view it as art, then maybe miners would do well to NOT prune it. But this picture is just 1 of 1,000 I shot while on holiday. It gets zero “likes”, and then gets buried underneath a few years worth of twetches which come after it. Like many of my old photos which aren’t worth a damn, even I don’t remember having it. Why is it on chain then? The BitCoin network, all the nodes, are going to save my shitty picture in quadruplicate? For what? That costs the Nodes money, and therefore prices on the overall network will bloat over time. PRUNE THAT MISERABLE POS!

Let’s imagine powping does NOT use OP_FALSE OP_RETURN but instead stores the worthless picture on their own private database. Later they implement a rule: All non-money-making content must be removed from our private database, as it’s costing Planaria money, OR it will be deleted. This would be a better solution for two reasons:

- Node operators like TAAL and mempool are going to prune ALL worthless data anyway.

- Planaria would be saving your data for a little while, and giving you some time to evaluate and remove it yourself—perhaps with some warning.

But let’s examine one BETTER solution than either of these two examples:

Imagine SLictionary keeps all it’s dictionary definitions written by it’s Word$miths on a private database, same as Planaria is doing. BUT, it offers a “Lloyds of London”-style insurance which allows a Word$mith with a highly profitable definition, which keeps earning money over time because its the best, to store it ON-CHAIN for protection. Thus the valuable & creative definition gets insured like Frank Sinatra’s voice or Betty Grable’s legs for a fee. If the Word$mith is making $50/yr with the word getting LIT-upvoted by millions of traffic per annum, then paying $10 to insure it is not lost is a good policy. SLictionary would then insert the 20 KiloByte definition information into a UTXO set worth $1.00 and put it into a seperate wallet which holds valuables like a safety deposit box. Now do you see our Real Estate example?

The money-making definition is a building atop Astor’s land—it EARNS. What’s INSIDE the $1 UTXO set is worth more than the empty UTXO set (1 dollar or about 500,000 satoshis at today’s prices). But more importantly, it’s stored into a separate wallet which won’t allow the Word$mith nor SLictionary to spend that penny. Importantly, the definition is stored in a UTXO set that has SOME value, the dollar value of the container. This allows an economic decision to be made in the future under the following two conditions:

- The value of BitCoin goes up 1,000x. The dollar value of the container when the Word$mith bought insurance is now worth $1,000. But the definition is arguably only worth about 10x the annual revenues of $50, or $500. In this case, the Word$mith would be wise to give up his UTXO set, and spend it, as the empty BitCoin would be worth more than the $50 per year in revenues.

- The earnings of the Word$mith’s definition goes down to nothing, as competing definitions out-compete it into disuse. If the definition no longer gets LIT on SLictionary by searchers, it’s worthless, and the $1.00 container is worth far more than the insured definition.

This is a nearly perfect system for an information database. It’s the island of Manhattan, and razing buildings, or pruning, is VITAL. Razing the Old Lady’s Shoehouse spruces up the neighborhood, and property values go up. That’s efficiency, that’s lack of spam and flimflam.

The point here is that not only should you shun OP_FALSE OP_RETURN as an old pre-Genesis archaic hack from the 2019 days and place every bit of data into OP_PUSHDATAs which are spendable; but FURTHERMORE, you should be steadfast stewards of BitCoin by heeding the First Law of Bitcoin Informationdynamics: DON’T WASTE TOKENS. Part of not wasting tokens is chosing a proper UTXO set for your data. Since BitCoin is deflationary money, you should choose something responsible which allows the value of the empty token to climb to relevance and compete with the value of your information stored inside. This FORCES good decision-making.

Only ignorant “bad guys” would cut down the Tree of Souls; the “good guys”, however, prune the living hell out of it so it produces more fruit for all!

What is BitCoin?

BitCoin is Blacknet

BitCoin is Spyder

BitCoin is Redback

BitCoin is a self-clearning computation network;

BitCoin is THEE information market commodity.

BitCoin is an information society.

BitCoin is the “Tree of Souls”

BitCoin is a:

MORE SECURE

CHEAPER

FASTER

BIGGER

internet.

(Oh yeah, it’s money too)

¢¢¢

Paymail: [email protected]

BAEmail: [email protected]

Twetch: u/462

powping: John

coFounder: SLictionary https://slictionary-fc2a0.web.app/ (www.SLictionary.com in late July after Word Bounty achieves MVP)

coFounder: Hilarist App (Test Flight by invitation only)

BIBLIOGRAPHY:

[0] Pitts Uncertainty Principle of Investing: Price volatility vs investment timing. https://sym.re/LiitQtx

[1] “All-Star Panel” (with just one all-star) with Craig Wright & Nick “Szadtoshi” Szabo: https://www.youtube.com/watch?v=LdvQTwjVmrE

[2] “Follow the Fleet” (1936). https://www.youtube.com/watch?v=gVYxekAaFRU

[3] Hong Kong visual history http://hongwrong.com/hong-kong-skyline-through-the-years/

[4] Burj Khalifa in Dubai has 154 useful floors, and challenges gravity & the elements to remain standing.

[5] Definition…

[6] San Francisco 1928 40 foot height limit: https://www.fastcompany.com/90242388/the-bad-design-that-created-one-of-americas-worst-housing-crises

[8] Greed is Good speech: https://www.youtube.com/watch?v=IhZtyRjiAKk

YottaByte = 2.1 x 10¹⁵ “satoshis” * 4×10⁹ GigaBytes. “A standard terabyte hard drive costs about $100 today. It would cost $100 trillion to buy a yottabyte of storage.” — The Atlantic, circa 2011 (Now you can get 16 TeraBytes for ~$400) https://www.theatlantic.com/technology/archive/2011/05/infographic-how-big-is-a-yottabyte/239034/

Put your life on YouTube: 80 years * 365.25 days/yr * 24 hr/day * 1 GByte/hour = 700 TeraBytes * $300/16 TB = $13,125 upfront or ~$100/year with Moore’s Law at your back. (not counting electricity or equipment depreciation to charge your all-day battery system)

[9] What is BitCoin script? It’s a computer programming language which is like a subset or specific implementation of a 1970s-born computer language called Forth. Forth is a handy language that almost lets the coder WRITE his own computer language. Roll your own cigarettes? No, it’s roll your own computer language! Craig Wright wanted something specific, and he wrote the commands he wanted specifically to keep BitCoin safe AND useful. Furthermore, Craig wisely set it up so BitCoin network could run the script using 2 stacks so he could keep everything as simple as possible. If you dont’ believe that, try using Ethereum with it’s “gas” payments — it’s a nightmare! Importantly, BitCoin scripting language is incredibly robust and lets you do just about anything in Lastly, the BitCoin NETWORK is Turing Complete, as the two stacks create the ability to loop — which is what many modern coders missed about BitCoin’s scripting langauge — ESPECIALLY Vitaly Buterins & Szabos.

[10] “REAL” transactions: This means transactions which don’t involve cryptocurrency trading. Binance, Kraken, Gemini, Coinbase and other fly-by-night exchanges boost the transaction numbers for eth, btc, and others because those large cryptos act as denominators in cryptocurrency-pairs. This artificially boosts the transaction numbers WAY higher than they should be if only application-transactions were measured. In fact, my estimate is BSV transaction are already 10x higher than ethereum and surpassed ethereum in the Spring or Summer of 2019.

[11] How much does 4 GB of memory cost? Purchased in bulk Teranodes in 2020, it would cost about 8 cents. So if each BitCoin token can hold upto 4 GB and we therefore filled them all up with data, the max value of 2.1 quadrillion 4GB tokens would be about 168 trillion dollars. Mad Money!

[12] First American coins: https://www.usmint.gov/learn/history/coin-production#:~:text=In%20March%20of%201793%20the,gold%20coinage%20began%20in%201795.

[13] Integers vs Irrational numbers: In math we call indivisible numbers integers. 1, 2 and 21,000,000, not real numbers like 1.5 or irrational numbers like pi or the square root of 2 and sqrt(3).

[14] Tree of Souls: https://james-camerons-avatar.fandom.com/wiki/Tree_of_Souls#:~:text=Community-,Tree%20of%20Souls,any%20other%20point%20on%20Pandora.

[15] LEGEND/Conventions:

BitCoin = Bitcoin Satoshi Vision, BitcoinSV, BSV (on most exchanges)

satoshi = 1/100,000,000 bitcoins. Think of satoshis like pennies, only in BitCoin they are 0.00000001 bitcoin instead of 0.01 dollars.

btc = SEGWITcoin, or coreCoin, established either 2012 or August 2017 depending on you viewpoint.

bch = ABC coin, or cashCoin, formerly known as Bitcoin Cash.

eth = ethereum

market cap = market capitalization. It’s the valuation obtained by multiplying the number of shares of a company times the stock market price per share. In Bitcoin SV we assume 21 million “shares” (tokens) x $175 = $3.7 billion, for example.

Zen = Stable Energy-Efficient Mindfulness

Yotta = A lot, a big number (of tokens)

Mond = Earth or our loving planet

Data =>

information =>

02-24-2026

02-24-2026