|

Getting your Trinity Audio player ready...

|

The post originally appeared on Medium and we republished with permission from its author, Two Hop Ventures General Partner and CFO Jan Smit.

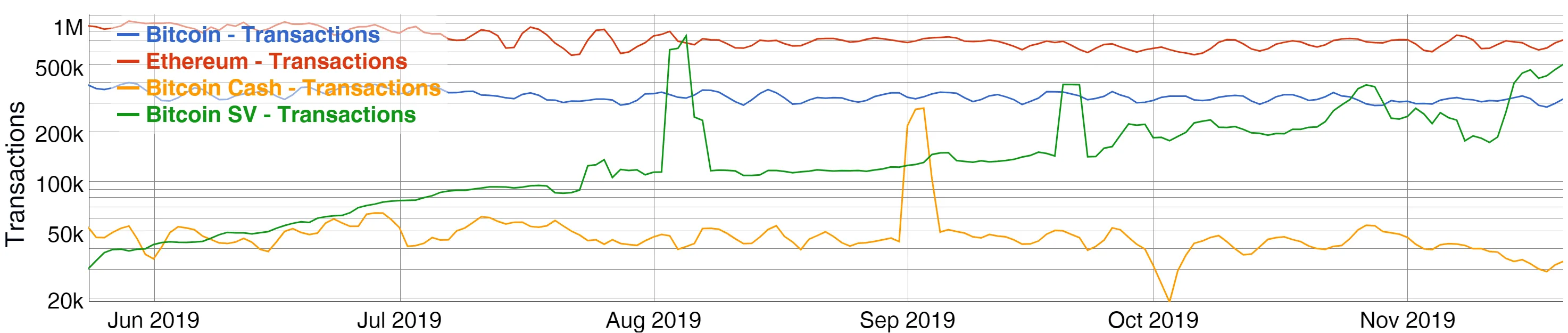

Developments in recent months have made it abundantly clear why Two Hop Ventures invests solely in the Bitcoin SV ecosystem. The number of Bitcoin SV transactions per second (TPS) is doubling every quarter. In the middle of November 2019 Bitcoin SV processed 5 TPS on average. With that it has permanently overtaken BTC (~3.5 TPS) and is likely to permanently overtake Ethereum, currently processing ~8 TPS , in Q1 of 2020.

Lowest unit cost propels innovation, further solidifying Bitcoin SV’s lead

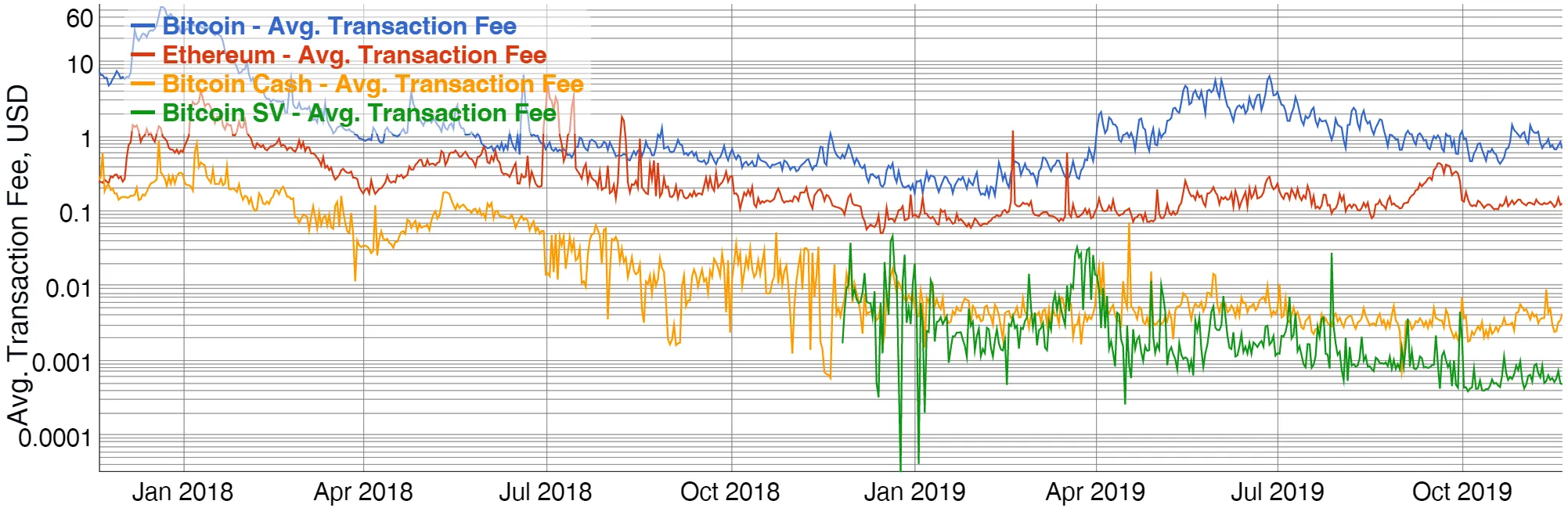

Bitcoin SV’s focus on on-chain (i.e. in plant) scaling through massive blocks allows its unit cost (tx fees) to decrease fastest.

This relationship they called the experience curve: the more experience a firm has in producing a particular product, the lower are its costs. Bruce Henderson, the founder of BCG, put it as follows: Costs characteristically decline by 20–30% in real terms each time accumulated experience doubles. —The Economist

Market leading unit costs enable unprecedented use cases / innovation which further increases the amount of units produced (i.e. transactions on a particular blockchain) which further improves unit costs through economies of scale. Bitcoin SV is now visibly reaping the benefits from this virtuous circle.

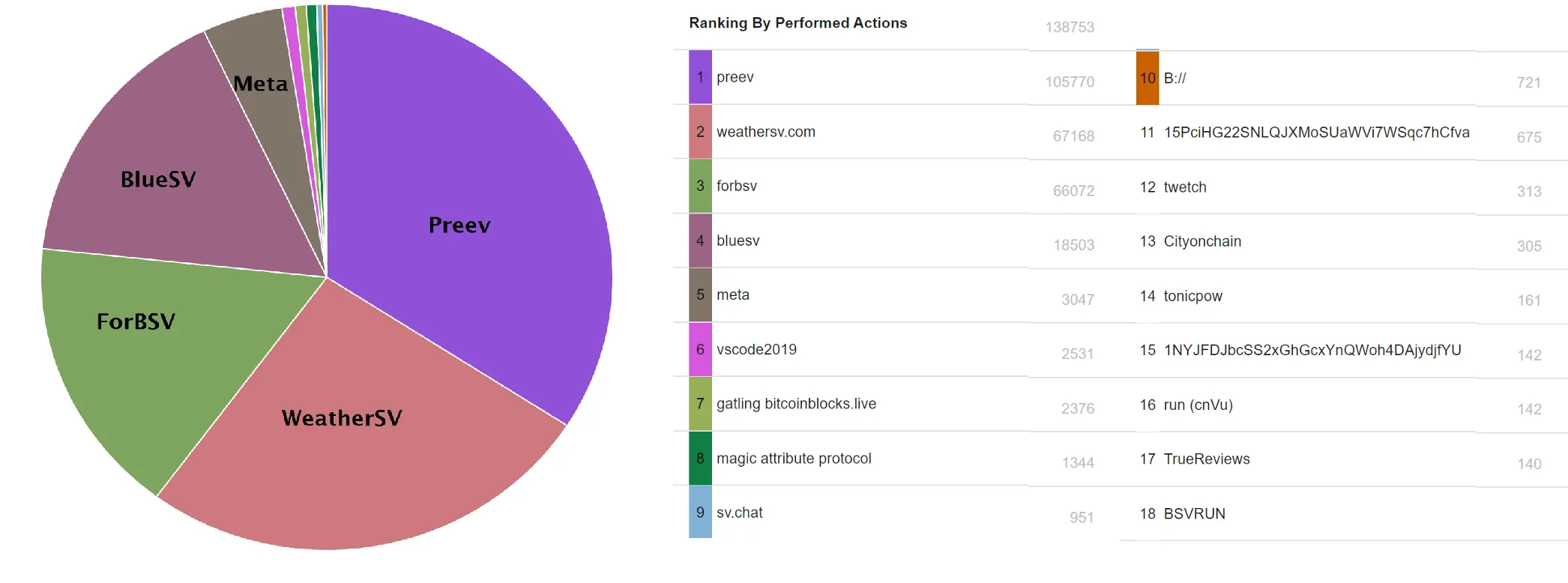

Top transaction sources rapidly diversifying

Last October 80% of all transactions were originating from WeatherSV. Now Preev, ForBSV and Air Quality Index (AQI or BlueSV) have joined the top 80%. Preev records exchange rates of trading pairs. ForBSV is a messaging platform with economic incentives and AQI records air pollution of 3000+ Chinese cities. Bitcoin SV has become the distributed database of choice.

Two Hop Ventures is an Amsterdam based venture fund investing in equity of promising teams building solutions on the Bitcoin SV blockchain.

The original post can be found here.

07-15-2025

07-15-2025