|

Getting your Trinity Audio player ready...

|

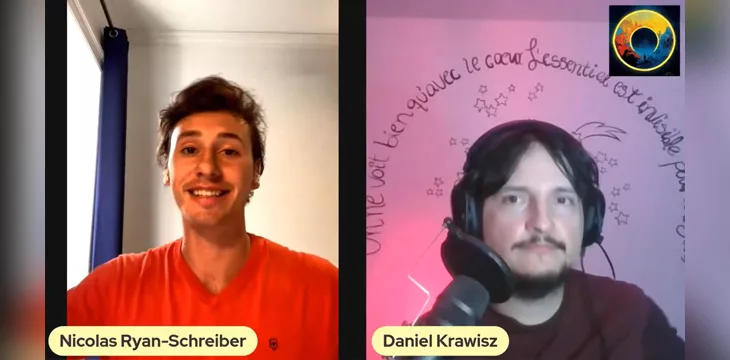

Aym the podcast was back with episode two featuring Bitcoin thought leader Daniel Krawisz. After an informative decision with Jack Liu in the previous episode, Nicolas Ryan-Schreiber dove into proof-of-work, Ordinals, the value of money, and more in this episode.

Aym the Podcast #2 : Jane Austen, the Good Capitalist

Thanks to @DanielKrawisz for joining! Everyone go check out his content, it's endlessly interesting.

We talked about POW, Handicaps, Stupid Geniuses, Money, & Power among other topics

Become Radiant pic.twitter.com/Wjam2S1xIA

— Aym 🟡 Aym (@AymRadiant) June 28, 2023

A proof-of-work upvote system

Those familiar with Krawisz will already know he’s been working on a proof-of-work upvote system for quite some time. Ryan-Schreiber kicks this podcast episode off by asking him to explain more about it.

Krawisz explains that there should be a cost to upvoting something. Right now, we have a problem with distinguishing between and transmitting good/bad information, and proof-of-work can help solve this.

In biology, the only provable system is waste, e.g., the peacock’s tail proving its fitness, and proof-of-work can act as a similar handicap in the world of information. Krawisz intends to ensure that fit ideas reproduce the most by imposing costs (handicaps) on transmitting or upvoting them.

Ryan-Schreiber asks how we can ensure the receiver knows what signal to look for. Krawisz answers, “they either know or they fail.” You use your knowledge to promote your growth and let others fail.

Giving a concrete example of how this might work in practice, Krawisz explains that, as things are today, YouTube commercials, social media ads, and lots of other advertisements are everywhere. With a proof-of-work system like he envisages, you wouldn’t have to look at these unless the demonstrated cost was high enough. E.g., you could have an ad blocker that blocks ads below a certain proof-of-work threshold.

Proof-of-work is not supposed to outright say who or what the fittest is in any given scenario. Instead, it’s supposed to act as a filter or first step. Going back to the peacock’s tail analogy, Krawisz says, “You have the tail that gets you the date. That doesn’t mean she’ll go home with you.”

Ordinals and the nomadic people involved in them

After an interesting conversation about the concept of the “stupid genius,” Ryan-Schreiber pivots the conversation toward Ordinals. He says something he has said before; the people involved in Ordinals are much more willing to move between chains (they’re nomadic), and the animosity from the previous chain splits isn’t present in this movement.

Krawisz describes Ordinals as a “black swan event,” making reference to the concept popularized by author Nassim Nicholas Taleb regarding rare events nobody sees coming. He says that, while he hasn’t done much with them himself, he sees the cross-pollination between chains as positive.

Ryan-Schreiber notes that new protocols are popping up everywhere, unleashing a new era of innovation on proof-of-work chains. He talks a little about BitMap and asks Krawisz if he is familiar with it; he instantly grasps the idea and says it sounds like an early Metaverse, noting that we don’t need 3D graphics to have one.

Both agree that Ordinals and related protocols are positively impacting things, making it clear what the on-chain economy is capable of and bringing lots of much-needed positive energy to the space.

A key concept in Austrian economics—holding cash vs going into the market

Toward the end of the podcast, Ryan-Schreiber asks Krawisz for his thoughts on a popular concept in Austrian economics that says the value of money is tied to future goods that unknown entrepreneurs will produce.

Krawisz expands on this idea with an example, explaining that if you enter the stock market, you can only get stocks for sale today, e.g., ones that already exist. The problem is that most of the future growth may come from stocks that don’t exist yet, so there’s a potential opportunity cost to going in now.

Ryan-Schreiber points out that holding cash subjects you to inflation, but Bitcoin may change the equation. If it continues to gain value over time, it could actually give you access to more goods and services in the future than it would today.

Finishing up, Krawisz says that the basic point here is “if you think the unseen is better than the seen, you have to hold cash.”

This is just a brief taste of a two-hour-long, extremely interesting podcast episode. If you liked this content, be sure to watch Aym the Podcast episode two via the link above.

Watch: CoinGeek Weekly Livestream with Kurt Wuckert Jr. with Daniel Krawisz of Powco

Recommended for you

British lawmakers of the parliamentary national security committee have called for a temporary ban on political parties receiving donations in

Circle (NASDAQ: CRCL) soared in 2025 thanks to U.S. ‘regulatory clarity,’ but can this momentum survive a ban on crypto

02-26-2026

02-26-2026