|

Getting your Trinity Audio player ready...

|

Choosing blockchain technology can increase efficiency, security, and transparency. But be sure to choose the right one for your purpose, or the result could end up being the exact opposite. What, then, is the best way to adopt blockchain strategically so it meets all the right needs? Spending six figures or more on consultancy fees is one way. Or you could start by using a free online analysis tool called the Strategic Blockchain Infrastructure Matrix (SBIM).

Once you look past the hype of asset price speculation, blockchain technology makes sense. Tamper-proof ledgers, permanently recorded on accessible networks, provide the kind of information integrity that can’t be bought elsewhere. The one big disadvantage is this: there are so many blockchains. Each one has its advantages and disadvantages: some are open networks for public use and some are private; some are expensive and/or slow, while others run efficiently. Just because a blockchain “brand” is well-known or popular doesn’t always mean it’s the best one for an organization’s particular needs.

Start implementing a blockchain that doesn’t suit your needs, and it could be an expensive mistake that takes additional years to fix. SBIM notes that “selecting a blockchain platform is not a mere technology procurement decision but a strategic commitment to a complex and evolving ecosystem.”

“Market analysis from Gartner predicts that 90% of current enterprise blockchain platform implementations will require replacement within 18 months to remain competitive and avoid obsolecence.”

That’s quite intimidating for anyone tasked with finding a blockchain solution for a large organization, or an individual developer looking for the best career choice. Even asking an “expert” might not be helpful, since the industry is littered with technical and political biases, digital asset bagholders protecting their assets’ value, and outright misinformation.

The beginner needs a neutral information source to get started, and that’s what the Strategic Blockchain Infrastructure Matrix aims to provide.

Using the Strategic Blockchain Infrastructure Matrix to assess your requirements

Firstly, it depends on who you are. The SBIM homepage starts by asking whether you’re a C-level executive, a policymaker, an entrepreneur, or a developer. Once you’re in the right gate, there are sliders to adjust the importance you place on security, stability, and sustainability. The SBIM then plots out a Quadrant Analysis that places the top 10 different blockchain options on scales of “Emerging Contenders” and “Strategic Platforms”, “Legacy Risks,” and “Niche Solutions.”

Once you have the correct chart, a more detailed comparison page lists blockchains suitable for hosting distributed applications (dApps). The makeup and positioning of the Top 10 depend on the users’ choices. These include public (or “permissionless“) blockchain networks like Ethereum, Avalanche, Polygon, BSV, Solana, Polkadot, Cardano, and Algorand—as well as private (or “permissioned”) ones like R3 Corda and Hyperledger Fabric.

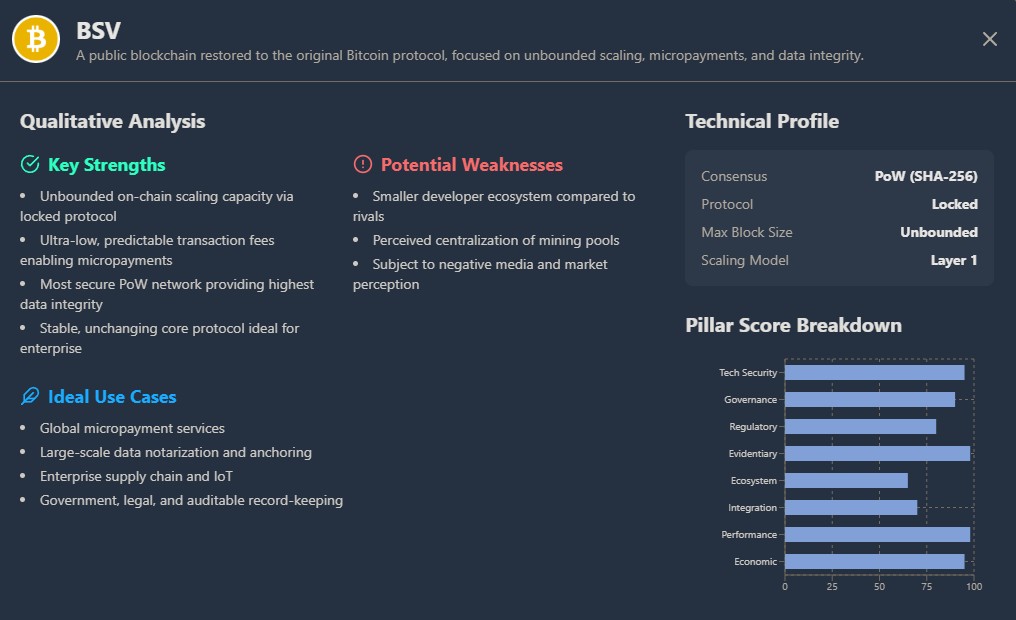

Clicking on a blockchain’s name summarizes the network’s key strengths and potential weaknesses, suggested ideal use cases, its scaling model and consensus protocol, and recommendations for external consultancies specializing in that particular network.

Does a blockchain have technical issues? (e.g., its protocol is unstable, there are security holes, or it has scaling challenges). Is it likely to survive in the longer term? Is it potentially expensive to use, or over-specced for your needs? Does a public chain meet all the proper technical criteria, but using it may cause reputational risk due to external factors? (e.g., other projects on the network, or people associated with it). Could its star fade over time, making it unsuitable for long-term projects?

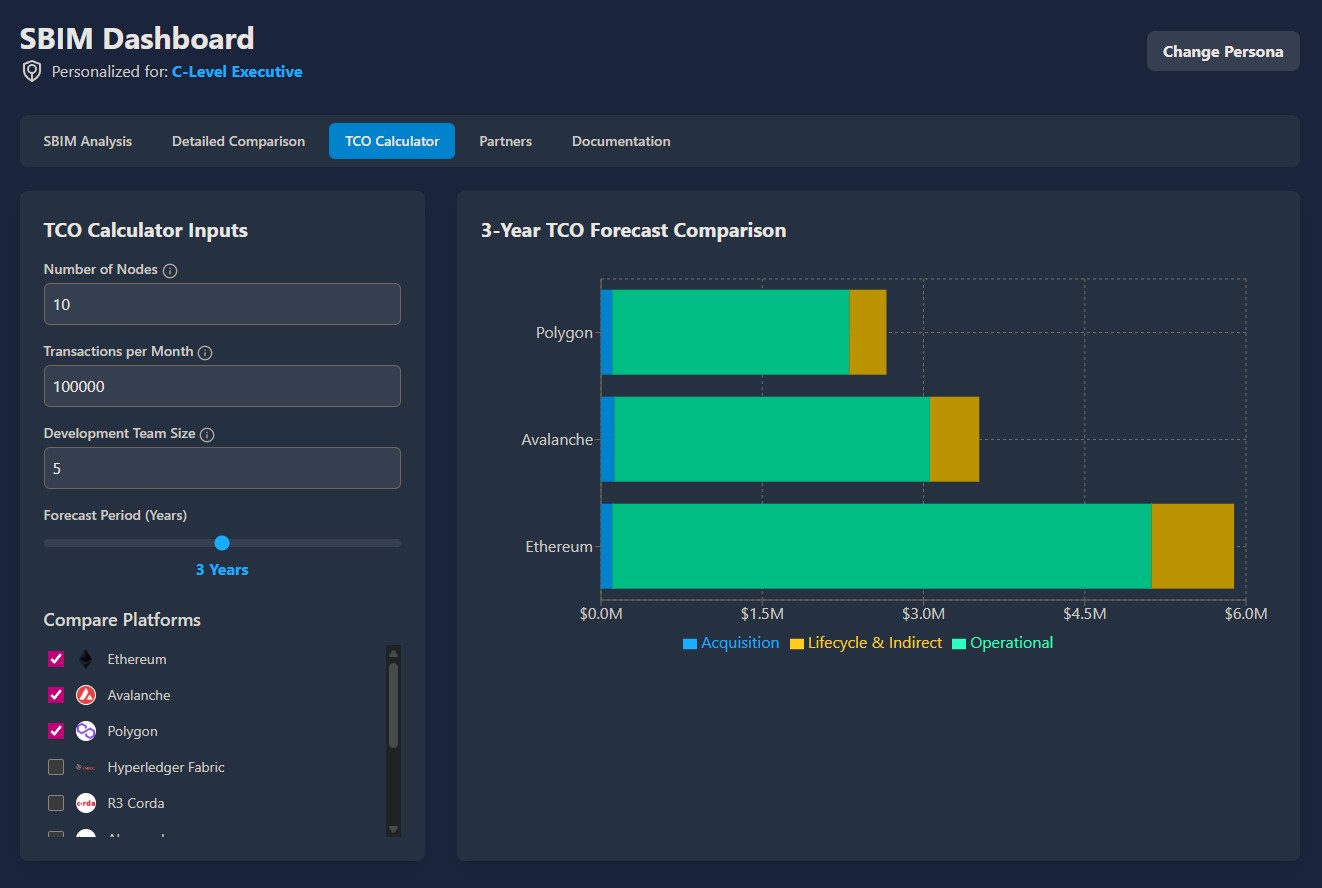

Finally, there’s a TCO (total cost of ownership) calculator that compares expenses associated with acquisition, operating costs, and other miscellaneous/indirect costs. Users can input the number of nodes, likely volume of transactions per month, size of the development team, and the period they expect to use the network.

SBIM judges the viability of each blockchain network by applying its Triadic Framework (e.g., security, stability, sustainability, or quantifiable requirements), depending on the score each user assigns to each aspect. It then compares these to intrinsic (and external) characteristics of each blockchain to produce the matrix chart and estimated costs.

Overall, it’s an objective look at each blockchain network’s potential to suit a purpose, without bias or marketing—something that’s sorely lacking in other online information spaces. SBIM isn’t trying to browbeat you into choosing the network it favors, and prefers to leave that decision to a better-informed you.

Watch | Tech of Tomorrow: Diving into the impact of tech in shaping the future

02-23-2026

02-23-2026