|

Getting your Trinity Audio player ready...

|

Finance magnates and tech giants did not solely build the global fintech industry, and while much of the recognition in shaping the sector is credited to them, often overshadowed small players took part in transforming the space, and private-led organization Digital Pilipinas ensured that this year’s fintech festival serves as a platform to showcase their contributions.

The annual Digital Pilipinas Festival kicked off on November 21 at the SMX Aura in Bonifacio Global City, Taguig, drawing hundreds of like-minded individuals aiming to revolutionize the country’s financial landscape.

But unlike last year‘s Digital Pilipinas Festival, this week’s program covers beyond the Philippines, the fintech sector, and the country’s growing ties with neighboring nations to include the evolving industries and technological advancements in the Association of Southeast Asian Nations (ASEAN) region.

Opening the event, Digital Pilipinas lead convenor Amor Maclang stressed that while technologies have evolved over time, only a few have delivered real solutions to common problems faced by humanity, including making efficient energy consumption, managing carbon emissions, and addressing the demand for inclusive social services.

“It is not time for a victory lap,” said Maclang, explaining that while there is no harm in celebrating the development of emerging technologies, such as blockchain and artificial intelligence (AI), there is still a long way to go.

“I question, still, the number of actual technological breakthroughs, especially in the areas that make us money, but must include sustainability and true inclusivity beyond just talking about property porn,” she added.

Undersecretary for e-Government at the Department of Information and Communications Technology (DICT) David Almirol echoed Maclang’s statement, saying that the problem nowadays is that global industries work on beautifying their products and quickly calling it innovation.

“For me, I don’t call that digital transformation; I call that digital pretension,” stressed Almirol. “Because we’re not innovating; we’re just beautifying the frontend so we don’t have to fix the backend.”

Another telltale sign that holds back the Philippines’ digital transformation is the inability of the government to sustain products and services offered to its people, he added.

“It’s the lack of sustainability,” pointed Almirol, who continues to push for e-governance, claiming that this would help achieve the government’s ambition to digitalize the Philippines and help it level with developed nations.

The DICT official said partnering with Digital Pilipinas in this endeavor would help fastrack this initiative.

The budding fintech sector and ASEAN’s stance on blockchain

Industry powerhouses, leaders, and tech giants serve as a big inspiration for many businesses and enterprises across the ASEAN, particularly small- and medium-sized enterprises (SMEs).

From e-wallets that could offer users ease in transacting fiat to better GPUs and chatbots that could almost think like a human, SMEs are there to accelerate what pioneers have successfully created, and in the process, developed something newer and sometimes, even greater one has imagined to be.

SMEs took center stage on the first day of the Digital Pilipinas Festival, with companies like AI Rudder, BayaniChain, and Prosperna pitching their products to an audience eager to learn more about the leading firms spearheading the digital revolution in the ASEAN.

“The ASEAN’s vision for the digital economy revolves around creating a digitally inclusive connection and innovative region that can empower the citizens and position itself as a dynamic player in the global digital landscape,” said Permanent Representative of the Philippines to the ASEAN Hjayceelyn Quintana.

While the six SMEs that kickstarted the fintech festival with their innovative solutions differ in the products they offer, they all had one thing in common—leveraging advanced technologies to their advantage, and blockchain technology is one such example.

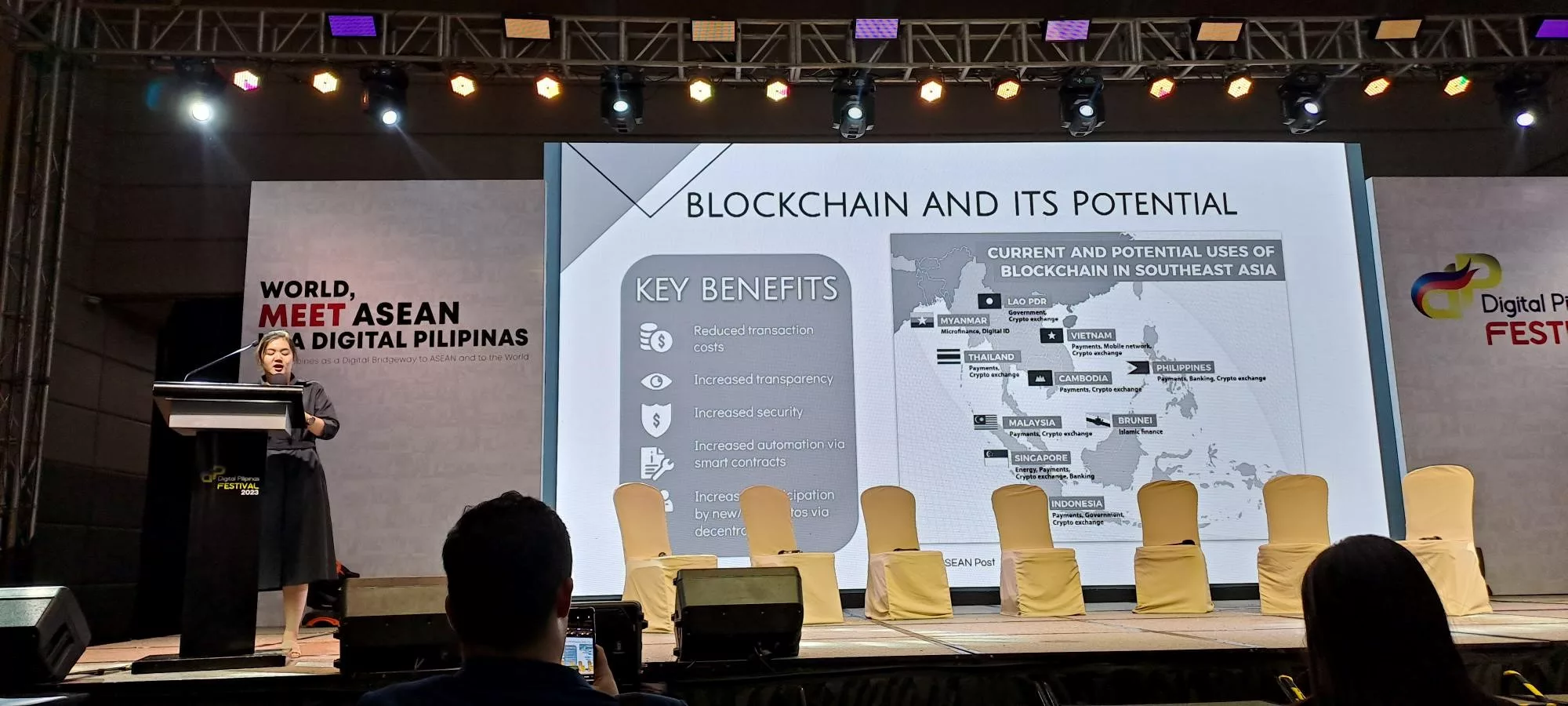

Asih Karnengsih of the Indonesia Blockchain & Crypto Exchange Association tackled the ASEAN’s attitude toward blockchain during her keynote speech, where she enumerated the benefits of the emerging technology to society, including providing greater

transparency and reducing transaction costs.

Citing recent data, Karnengsih said the ASEAN is gradually embracing blockchain, integrating it into various services to encourage mass adoption. In the Philippines, Cambodia, Thailand, and Malaysia, blockchain is being explored and utilized in

payments and digital asset exchange. Meanwhile, countries like Myanmar use it in microfinance and digital ID, while Brunei incorporates it in Islamic finance.

While ASEAN is welcoming blockchain, there remain barriers that make it a challenge for the region to achieve mass adoption, including regulatory uncertainty and the lack of trust among users, said Karnengsih.

Blockchain technology was also a hot topic during panel discussions. One notable dialogue comprising of nChain Chairman Stefan Matthews, Yolo Group COO Steve Tsao, and Creador Managing Director Omar Mahmoud said blockchain could bring several benefits and real-world utilities to the Philippines, the ASEAN, and beyond. They also discussed challenges that lie ahead for fintech firms looking to secure an investment.

The three-man panel all agreed that the Philippines has a massive potential to become a leading nation in the digital world and even a breeding ground for unicorns. Known for her straight-to-the-point answers and sometimes controversial questions, Maclang, who served as the moderator of the panel, asked who among the leading players in the fintech industry they see as the Philippines’ next unicorn.

Matthews, Tsao, and Mahmoud refused to drop any names of their prospective bets, but all emphasized that startups must have a mixture of creativity, the right business plan, and a product or service that could ignite positive change to secure major investments from VCs, allowing them to attain the $1 billion valuation.

Digital Pilipinas beyond fintech

While the Digital Pilipinas Festival is known to be a program heavy on talks regarding fintech, organizers opted to expand the discussions beyond the said sector. Held at the sidelines of the main fintech fest is the Festival of Festivals, where Digital Pilipinas highlighted critical sectors that are also making waves in the digital world.

On the first day of the Festival of Festivals, participants were treated to numerous discussions on gaming, climate and sustainability, and cybersecurity, with the 10-hour program concluding in an engaging talk about the upcoming London Tech Week, which Digital Pilipinas would be a part of, and is slated to take place from June 10-14, 2024, with a projected attendees of at least 30,000 global investors, tech disruptors, enthusiasts, businesses, and enterprises.

Maclang promises that the two-day fintech program in SMX Aura will cover more leading up to the three-day innovation tour in the same week. The second day of the Digital Pilipinas Festival will highlight other critical emerging sectors, including Halal Economy, Healthtech, and Digital Government, among others.

Watch: Philippines needs to create more blockchain use cases

02-25-2026

02-25-2026