|

Getting your Trinity Audio player ready...

|

Last week, Blockstream CEO Adam Back took to the witness stand in COPA v Wright Satoshi Trial.

On the stand, Back made several fallacious statements, likening changing the rules of Bitcoin to changing the rules of chess and saying blockchains don’t scale.

I'm beginning to feel@adam3us is not Satoshi 😀: he does not know there is no floating point in Bitcoin code https://t.co/2W9Ke7QrWb

— sCrypt Official | OP_CAT 🐱 (@scryptplatform) February 28, 2024

Kurt Wuckert Jr. already wrote a detailed article on why Back is not Satoshi, but his statement that blockchains don’t scale is undoubtedly the end of this myth. Not only does it directly contradict Satoshi Nakamoto himself, who said Bitcoin never hits a scaling ceiling, but it flies in the face of empirical evidence.

Teranode proves Bitcoin does scale, just as Dr. Craig Wright always said it does.

The things Satoshi said about Bitcoin they don’t want you to know

When you first encounter the notion that Bitcoin was hijacked, you could be forgiven for thinking it’s a wacky conspiracy theory. However, when you stop and think about it, the businesses that would stand to lose the most from a peer-to-peer electronic cash system

would respond by doing whatever they could to stop it. It’s a natural response to an existential threat.

However, it all becomes clear when we look at the statements Satoshi Nakamoto made and compare them to the actions taken by corporations like Blockstream.

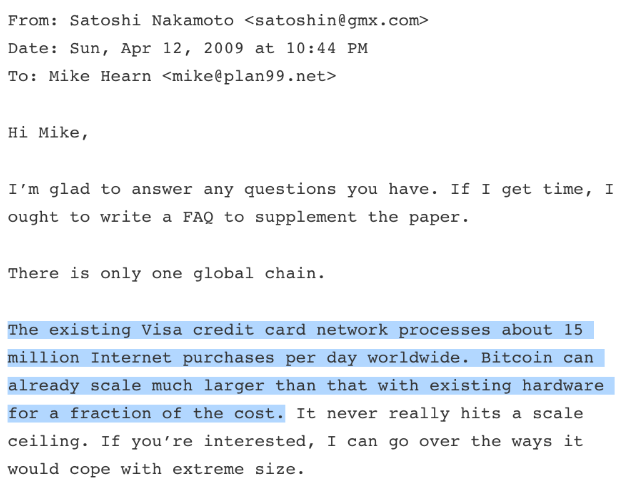

First, Satoshi told Mike Hearn Bitcoin scales past Visa (NASDAQ: V) levels and never really hits a scaling ceiling. This was years before ideas like the Lightning Network were even dreamed up. So clearly, Satoshi didn’t think we needed layer-two solutions.

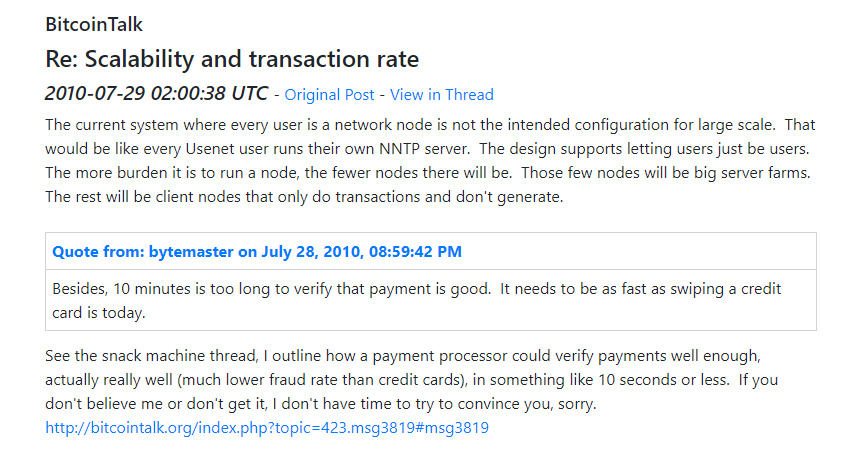

Second, Satoshi said nodes would end up in data centers. He said that every user running a home node was not the intended configuration at scale. This idea that everyone should run a node to maintain decentralization is a fantasy dreamed up by the Gregory Maxwells of the world—Satoshi described Bitcoin as “completely decentralized” in his very first post. Clearly, his idea of decentralization was different than theirs.

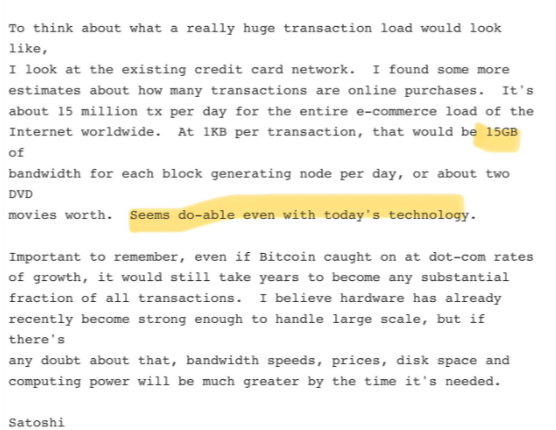

Lastly, we now know Satoshi was a big blocker. In never-before-seen emails released by Martti Malmi, we read that Satoshi supported big blocks (15GB of blocks per day back in the early days). Is it any wonder Maxwell encouraged early Bitcoins to delete emails with Satoshi, likening them to toxic waste?

Adam Back and Blockstream broke Bitcoin

Satoshi Nakamoto said that once Bitcoin version 1.0 was released, the core design was set in stone for its lifetime. Back’s chess analogy was false; you can’t change the rules and still call it Bitcoin. In fact, when you think about it, the analogy itself was laughable. You can’t change the rules of chess and still call it chess, either.

Given the financial gain Back, Maxwell, and other Blockstream bigwigs have to route Bitcoin transactions through their proprietary systems, the picture becomes clear: their worldview is fundamentally at odds with the Bitcoin Satoshi designed and wanted, which is only alive as BSV today. They stand to make a lot of money through butchering Bitcoin, but due to inherent flaws in their designs, they won’t succeed.

2018:

BTC 7tx/s

BSV 210tx/s2024:

BTC 7tx/s

BSV 1,200,000tx/sThey said it couldn't be done.

— Andy (@andyrowe) February 28, 2024

Satoshi’s Bitcoin is back; it’s scaling just as he said it would, and eventually, mining economics will seal BTC’s fate. Big blocks full of microtransactions will become more valuable than small ones with ever-diminishing block rewards and increasing fees. Anyone with the ability to logically think that out will reach the same conclusion. Teranode is another nail in the small blocker coffin.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple, Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

03-01-2026

03-01-2026