|

Getting your Trinity Audio player ready...

|

Context: Nassim Nicholas Taleb has a long history of success and influence in finance, economic prediction, management philosophies and authorship of some very influential papers, books and public ideation across mass media. As a respected thinker in the domain of economics, Taleb wrote the original forward to “The Bitcoin Standard,” a book about gold’s role in Cambridge monetary theory disguised as a book about Bitcoin’s role in Austrian economics—but that is a different story. Over time, Taleb came to realize the folly of unpredictable fees, slow settlement time and the absurdity of the “digital gold” narrative because of its lack of economic utility and propensity to spiral into little more than a Ponzi scheme. His criticisms chided the small blocker lasercult, and in this era of Bitcoin, Taleb has been having his own little civil war against economic illiteracy embodied by the BTC commune.

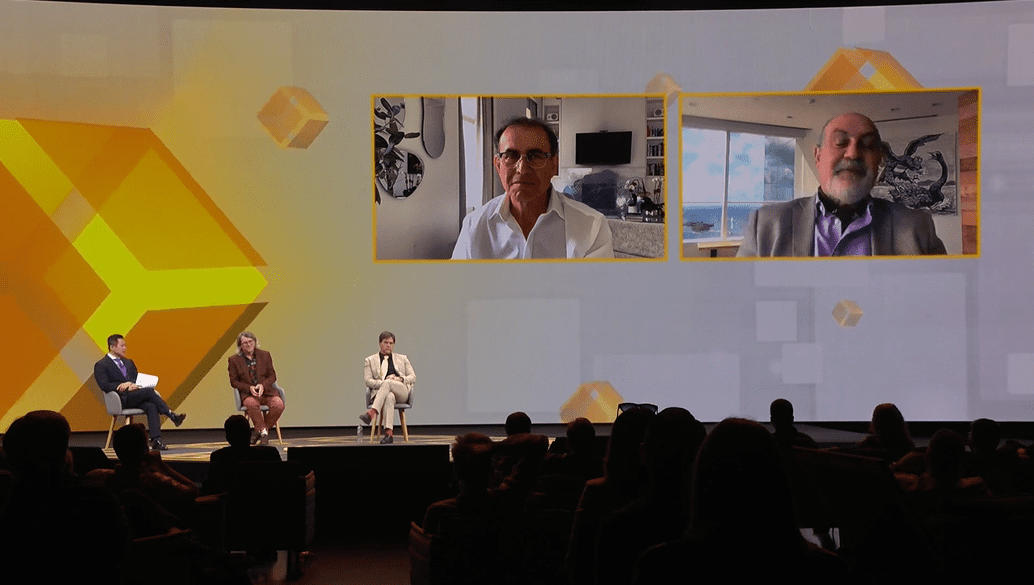

Against that backdrop, Taleb was invited to speak as part of a panel at CoinGeek Zurich. In contrast to Nouriel Roubini who seemed to be impenetrable, Taleb’s time on stage was nuanced, and he showed a real desire to learn about anything he may have missed amid the fog of BTC banter. For that, he deserves credit. About a week later, he released a draft copy of his own thoughts about blockchain-based systems of money, and requested feedback from the Twitterverse.

Respectfully, here is my feedback:

First, let’s establish some swim lanes. BTC is an implementation of a modified version of the Bitcoin protocol—the limits of which are arbitrary and specific to the BTC implementation. A Ferrari can’t be judged fairly if it’s running on wagon wheels, so Bitcoin shouldn’t be judged when it’s been implemented poorly either. As such, when I use the term “Bitcoin,” I will be referring to base protocol, but not necessarily any specific implementation. If I mean to specify an implementation, I’ll use the ticker symbol.

Example:

BTC: Arbitrarily rate-limited to 6 megabytes per hour, globally, which comes out to 5-7 transactions per second depending on how the rate is measured. BTC has a trimmed down stack and very tight limits to the number, size and flexibility of computation allowed to deploy. This limits the usefulness of on-network applications. The most common applications are often called smart contracts, and the most common smart contracts today are tokens. BTC is an impractical system for utilization of any kind of application on top of being an unreliable means of exchange at the base layer.

BSV: A near complete restoration of the original Bitcoin protocol, with no arbitrary rules about the amount of data that users can pay to propagate across the network. In practical terms, 3,000-5,000 transactions per second have been observed. In testing environments and in estimation, 25,000 – 100,000 transactions per second do not appear to be problematic under normal circumstances or most edge cases. Furthermore, the BSV stack is Turing complete when utilized in the complete Bitcoin system, allowing for complex application deployment, distributed public computation, tokens and extremely low friction transactions with fast and predictable settlement time and cost.

Dr. Taleb, in your Introduction/Abstract, you mention “the original protocol.” While BTC is the oldest blockchain that synchronizes back to the genesis block, it has been made to do this with some software trickery called a “soft fork” which allows for drastic changes to the protocol without requiring legacy Bitcoin nodes to validate rules. Instead, these new protocol rules are obfuscated from legacy Bitcoin nodes by wrapping them in a sort of digital envelope. Legacy nodes validate the envelope, but not the invalid transactions within, so changes such as RBF and Segwit are propagated by tricking validator nodes. In any other network environment, such a change would be referred to as Malware, but in BTC, the community has decided that the protocol can be redefined to any extent as long as the chain does not split. As such, no version of Bitcoin has ever made it to four years of unbroken consensus without a protocol change, governance coup d’etat or a chain split. Few discuss this.

Believing that sound money is fundamentally unchanging, BSV broke away from BTC’s (and BCH’s) propensity to tinker and compromise bitcoin’s first principles to enforce the original protocol with honest nodes with the desire to create provenance and Lindy Effect in BSV with a fixed and open protocol that is set in stone longer than the competing “Bitcoin” chains.

Common ground

I will agree with you that precious metals lost their peg over the last generation as futures markets and “paper” metals have muddied the waters of truly “hard” monies, and also that BTC is not a good example of an asymmetric store of value. Since at least 2017, BTC has been closely correlated to other speculative markets, memestocks, and as its utility has been limited simply to speculation, it acts the way a purely speculative asset does: with great volatility. As we have seen stock and commodity trading democratize, BTC and other blockchain tokens have devolved into nothing more than precisely what you have stated: “zero sum asset(s) with massive negative externalities.”

Heading into page two of your draft, your understanding of the system is mostly to be commended. You’re right that the game theoretics of bitcoin make for honest nodes to have an incentive to secure the system in exchange for profits. However, in BTC, the only way to do this is to pool together incredible amounts of hash power in order to mine for block rewards (currently at 6.26 BTC per block). This is why the hash rate is distributed closely to cheap power with poor connectivity around the world. Since transactions are disincentivized both socially and by the limitations built into the network rules, infrastructural profit-seeking stops at that point.

In Bitcoin, there was never meant to be a block size limit, so the incentive to secure the ledger should include the transaction fees of millions or billions of users of the network per day. Somewhere between 2-3 gigabyte block sizes, transaction fees replace block reward subsidies which creates the incentive for miners to compete on value-added services for business-oriented use of the network for payments, tokenization, document management and more. The ability to seek profit from fees in big blocks is limitless, while the ability to seek profit from the block reward subsidy is diminishing by half every four years. All competing chains will need to deal with this economic reality at some point. In BTC, this can only occur by continued growth in fees per transaction. With BSV, fees per block rise while fees per transaction sink, creating economic opportunity for parts of the world where very real economic activity happens around $0.01.

Store of value farce

You are absolutely right about BTC’s intrinsic value being 0. BTC’s price is based on hype while gold, for example, is based on economic usefulness. BTC is claimed to be a store of value, but there are only vague answers as to what value BTC is storing. It’s certainly not future economic activity or business opportunity. BTC gets less useful over time because of increasing cost to redeploy capital, and the inability to predict future fees with any certainty. The lowest amount of BTC which can be respent in the future is growing—censoring out use into the future.

In contrast, the value that is being stored is the data on the ledger itself. Since BTC can only store the state of simple holdings, it is limited in the value of that data that can be stored. However, in BSV, the amount and types of data which can be stored is (practically) unlimited. Imagine storing network intelligence, global climate data, immutable state and changes of state of cybersecurity assets, the state of all global business contracts, etc. The value that can be stored on an unbounded bitcoin ledger and repurposed into the real economy becomes a new type of digital commodity based on the aggregate data of the global economy itself. Turning that new commodity into a new form of money has incalculable value.

Usefulness as ‘currency’ or ‘money’

You’re right that BTC is more expensive and slower than existing payment and settlement rails. But again, that is implementation, not fundamental protocol. On the unbounded Bitcoin protocol (only existing as BSV), special purpose tokenized currencies can be built on the same network as the global commodity ledger, undergirded by the power of the Bitcoin network, and they can be as useful as CBDCs or as simple as Chuck-E-Cheese tokens—or any other internal corporate, tokenized “money.”

With no arbitrary limits in implementation, BSV is capable of cutting costs and settlement times for ACH, Swift, Visa and payments systems like PayPal. In fact, all tests have shown that theories about the protocol are correct. Fees go down as volume goes up, so adding traffic to the network brings fees to the lower side of somewhere between 1/100th and 1/1000th of a penny per transaction at any scale. With instant availability and predictable 10-minute settlement times regardless of transaction volume, Bitcoin (BSV) makes for a fantastic replacement rail for legacy settlement systems.

For direct payments, the base asset works well denominated in “bitcoin” units of account or in fiat. There is also little perceptible friction to utilizing tokens. In fact, the BSV-exclusive “HandCash” wallet has forged a new unit of account for “nanopayments” use cases called “Duro” for anyone looking to ignore fiat valuations altogether across the large ecosystem of interconnected on-chain applications in the BSV economy. 1 Duro (Đ) = 500 satoshis = 0.000005 BSV making for the establishment of “Unit of Account” and “Means of Exchange” facets of money.

Closing

In the interest of time, I will stop here. Black Swan is one of my favorite books, and Bitcoin (the protocol) is one of the greatest inventions in a generation or more. It pains me to no end that BTC is colloquially understood to be Bitcoin when it fails tests of governance, rules enforcement and usefulness in the economy. But we fight to show the world that the unbounded Bitcoin protocol (BSV) is a useful payment tool, commodity, data ledger, computation network and a truly sound money.

We hope that it will become the black swan that Bitcoin was always intended to be. We are certainly working toward it with things like CoinGeek Conference, nChain’s Teranode, Taal’s mAPI and other mining/transaction tools as well as independent tools developed by Twetch, RelayX, Fyx Gaming and hundreds of other independent businesses who see the opportunity to use the only scalable, global, public blockchain that is ready to disrupt worldwide finance and fintech today (and tomorrow).

Watch: Nassim Nicholas Taleb keynote speech at CoinGeek Zurich

02-20-2026

02-20-2026