|

Getting your Trinity Audio player ready...

|

Sub-Saharan Africa recorded over $200 billion in digital asset value received in the year ending June 2025, a 52% jump from the previous year, a new report has revealed.

In an excerpt from its upcoming 2025 Geography of Cryptocurrency Report, Chainalysis revealed that Africa’s digital asset growth only ranked behind the Asia Pacific and Latin America regions.

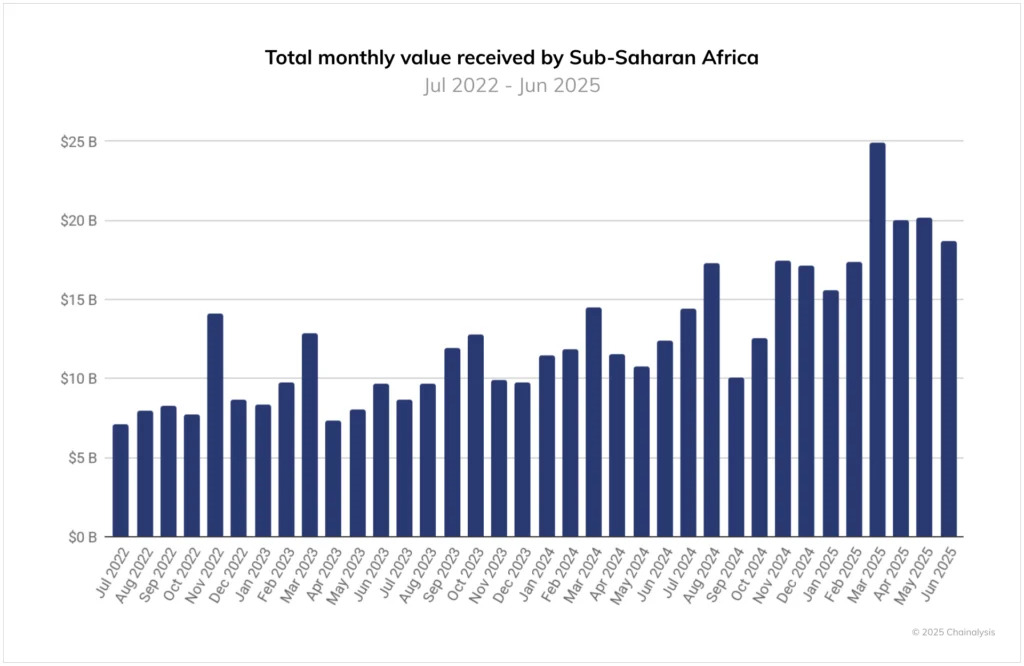

The total value received each quarter has consistently grown for the past three years, with March 2025 setting the record at $25 billion. This was despite a global dip in digital currency activity in March as the momentum sparked by Donald Trump’s assumption of the U.S. presidency waned.

Overall, Sub-Saharan Africa accounted for the smallest global digital asset volume share. However, according to Chainalysis, its adoption patterns shed a spotlight on how digital assets are being increasingly adopted in day-to-day use cases, from payments to cross-border transfers.

The region had the highest share of transactions under $10,000, indicating higher usage in retail use cases.

“Despite significant progress in recent years, particularly around mobile money adoption, a significant amount of adults in Sub-Saharan Africa remains unbanked which creates further fertile ground for alternative financial technologies like cryptocurrencies,” the report says.

Nigeria leads in retail, South Africa sets pace in regulation

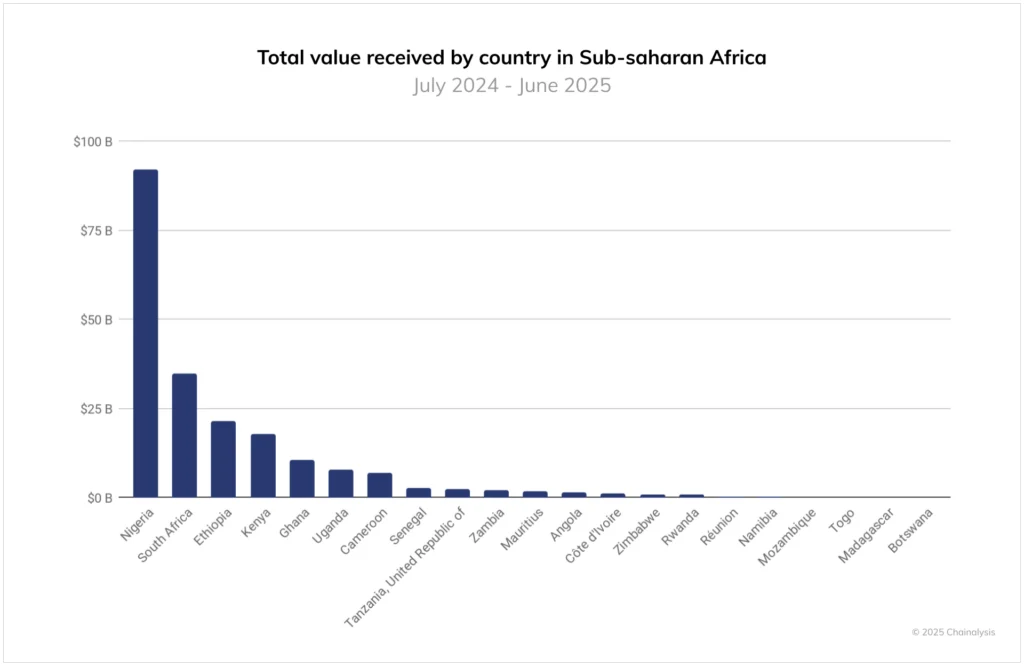

Nigeria maintained its position as Africa’s largest digital asset market, which it has held for over five years. In the 12 months ending June, the West African nation received $92.1 billion, accounting for 45% of the entire region’s total volume.

South Africa was second at around $35 billion, with Ethiopia, Kenya, and Ghana rounding up the top five.

For South Africa, regulatory clarity has catalyzed growth, resulting in hundreds of licenses being issued to VASPs and attracting professional investors and traditional finance.

“[South African] financial institutions are actively exploring crypto-related offerings, from custody to stablecoin issuance, signaling a shift from exploratory interest to active product development,” Chainalysis says.

While Kenya and Ghana have consistently ranked in the top five, Ethiopia’s rapid rise has made it one of the region’s digital asset hubs. The East African country has become the continental leader in block reward mining, with Asian miners investing hundreds of millions in data centers in recent years. However, concerns over power shortages are mounting, and Ethiopia is reportedly phasing out the BTC miners.

Stablecoins have also become a staple of Africa’s digital asset landscape, mirroring a global rise in interest in these fiat-backed tokens. An earlier report from Yellow Card revealed that they accounted for 43% of the region’s volume in the past year.

The latest report says this uptick “reflects the growing role of stablecoins as a dollar substitute in economies where the official exchange rate diverges from the black-market rate, and citizens increasingly rely on crypto rails for informal FX access, payments, and savings.”

Malaysian state explores blockchain to power digital ecosystem

Elsewhere, the state of Sarawak in eastern Malaysia is exploring blockchain technology to enhance its digitalization agenda.

The state, the largest in the country, is exploring the technology through the Sarawak Multimedia Authority (SMA), local media reports.

“Cryptocurrency and non-fungible tokens (NFTs) are just some of the applications of blockchain. It can also be used for the protection of records such as health data and government documents. These are areas that we need to explore,” SMA general manager Anderson Tiong says.

Tiong added that blockchain’s decentralized nature makes it ideal for public services where transparency and security are paramount. It also makes it immutable, enhancing accountability in governance.

Initially, SMA is exploring the use of blockchain in issuing academic certificates, managing health records and government documents. It will also target halal certification, a sector increasingly embracing blockchain. The Malaysian government announced a similar initiative earlier this year, spearheaded by the Department of Religious Affairs.

The renewed focus on blockchain integration will come into focus at the upcoming Borneo Blockchain Conference, set to be held in mid-October in Sarawak.

Tiong says the event will “bring together policymakers, academics, regulators, and industry players to explore practical blockchain applications that support Sarawak’s digital economy initiatives.”

Watch: Emerging Technology In Africa with Becky Liggero

09-16-2025

09-16-2025