|

Getting your Trinity Audio player ready...

|

Elon Musk’s Department of Government Efficiency (DOGE) has prevailed in a standoff with U.S. Treasury Department officials and now has access to its core payments system.

Musk and his team claim they have already discovered mass-scale fraud. On his X account, the Tesla boss alleged that Treasury approval officers were instructed to always approve payments even to known fraudulent and terrorist organizations.

While the shocking claims have not been proven yet, the highest-ranking Treasury official, David Lebryk, has retired, and a political war has broken out between those who back Musk’s efforts and those who oppose him having access.

Whatever the truth turns out to be, blockchain technology can help create greater transparency and trust in all kinds of payments, including government ones such as those made by the U.S. Treasury.

Scalable blockchain technology was designed for transparent payments

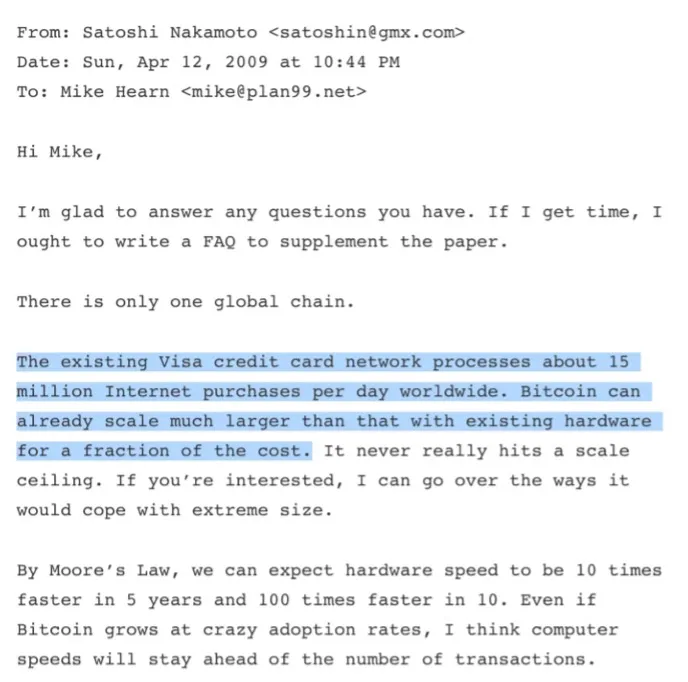

In the age of BTC as a speculative asset, many have forgotten that Bitcoin was designed as a peer-to-peer electronic cash system. Satoshi Nakamoto created it to scale unboundedly, and his whitepaper and writings make clear he had payments in mind.

While there are many public blockchains besides Bitcoin these days, they all share one thing in common: immutable time-stamped records of transactions on a ledger anyone can audit. Block explorers like WhatsOnChain mean anyone can dig into transactions and find out which wallets sent and received them, when, how much the transaction was worth, and more.

There will be some things governments will want to hide from public view, such as payments related to critical military operations. However, with the allegations of fraud made by Musk and other instances, such as the Pentagon’s inability to account for 61% of its $3.5 trillion in assets, using blockchain to track and trace non-critical payments and assets would be a vast improvement.

Imagine a world where any citizen, including journalists, can check up on payments made by the Treasury Department’s wallet and ask questions about them, or anyone with access to internal systems can track tokenized assets to see where it was and who had custody of it last. This would create an incentive for public funds to be managed better and for corrupt behavior to stop. Sunshine, as they say, is the best disinfectant.

This must be done on a scalable public blockchain

Elon Musk is already aware of the potential for blockchain to create unprecedented transparency in government payments. He replied in the affirmative when X influencer Mario Nawfal asked, “Should the treasury be put on the blockchain so this doesn’t happen?”

The significance of this cannot be overstated—the world’s richest man and one of its most influential people, with direct access to the most powerful decision-maker in the world, is in favor of using blockchain technology to create total transparency in the most powerful government in the world. Implementing this would almost certainly put pressure on other governments around the globe to do the same.

However, using layer-two solutions, blockchain bridges, and side chains, as blockchains like BTC and Ethereum have done in attempts to scale, won’t work. These solutions introduce security risks that are unacceptable in such a critical environment. They also muddy the waters by breaking the digital signature chain that connects all transactions to a blockchain’s genesis.

Total transparency requires all transactions to be auditable in an unbroken chain. This, in turn, needs everything to occur on one scalable ledger. Everything must appear on the base layer, and various transaction types must be possible. Needless to say, fees must be negligible, so Ethereum won’t cut it. It will take a public utility blockchain like BSV, capable of one million transactions per second for fees of $0.000001, to achieve such a massive undertaking.

If Musk pulls this off and puts the U.S. Treasury and other government departments’ payments and data on a scalable public blockchain, the world will be much better. These are exciting times for believers in blockchain technology’s true power and purpose!

Watch: Educating the government on potentials of blockchain

08-08-2025

08-08-2025