|

Getting your Trinity Audio player ready...

|

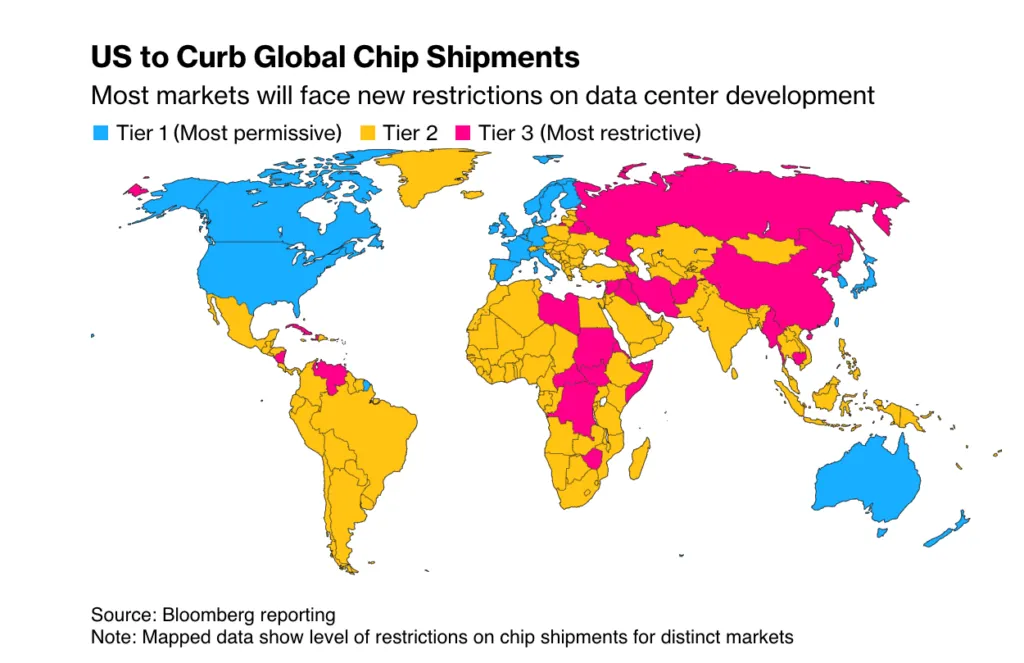

Biden administration proposes tiered restrictions on AI chip exports

The Biden administration is making what looks like a final effort to implement measures that further protect the artificial intelligence (AI) hardware and innovation developed and exported from the United States.

The administration has proposed a new policy that can go into effect as soon as January 10, to limit the distribution of semiconductors specializing in processing AI applications.

The proposal introduces a three-tier ranking system to regulate AI hardware exports. Tier One countries can continue doing business as usual with U.S.-developed AI hardware and do not face any new restrictions. Tier Two countries face restrictions and are limited to a maximum of 50,000 graphics processing units (GPUs) per country between 2025 and 2027, while Tier Three nations like China and Russia are prohibited from receiving AI-related hardware and model weights.

This isn’t the first time the Biden administration has acted to protect AI innovations from the United States. The administration previously placed restrictions on the export of chips and software developed in the United States to certain countries, in addition to other measures they took to bolster the AI industry in the U.S.

These actions seem to be an effort to improve the nation’s security while putting measures in place that give the U.S. the upper hand in maintaining its competitive edge in AI innovation.

Major technology firms, particularly those deeply impacted by the proposed policy, have voiced concerns about this new proposal. Nvidia (NASDAQ: NVDA), which controls roughly 90% of the AI chip market, issued a public statement opposing the restrictions.

“A last-minute rule restricting exports to most of the world would be a major shift in policy that would not reduce the risk of misuse but would threaten economic growth and U.S. leadership,” the company said. “The worldwide interest in accelerated computing for everyday applications is a tremendous opportunity for the US to cultivate, promoting the economy and adding US jobs.”

Nvidia argues that the restrictions could stifle the economic potential of the AI industry and, more importantly to Nvidia, the company’s own revenue. While the U.S. remains a global leader in AI hardware, these limitations could disrupt supply chains and hinder economic growth.

Whether this proposal will be implemented remains uncertain, and even if it does pass, the upcoming shift in the White House, particularly under what is expected to be a more business-friendly Trump administration, could potentially reverse these restrictions.

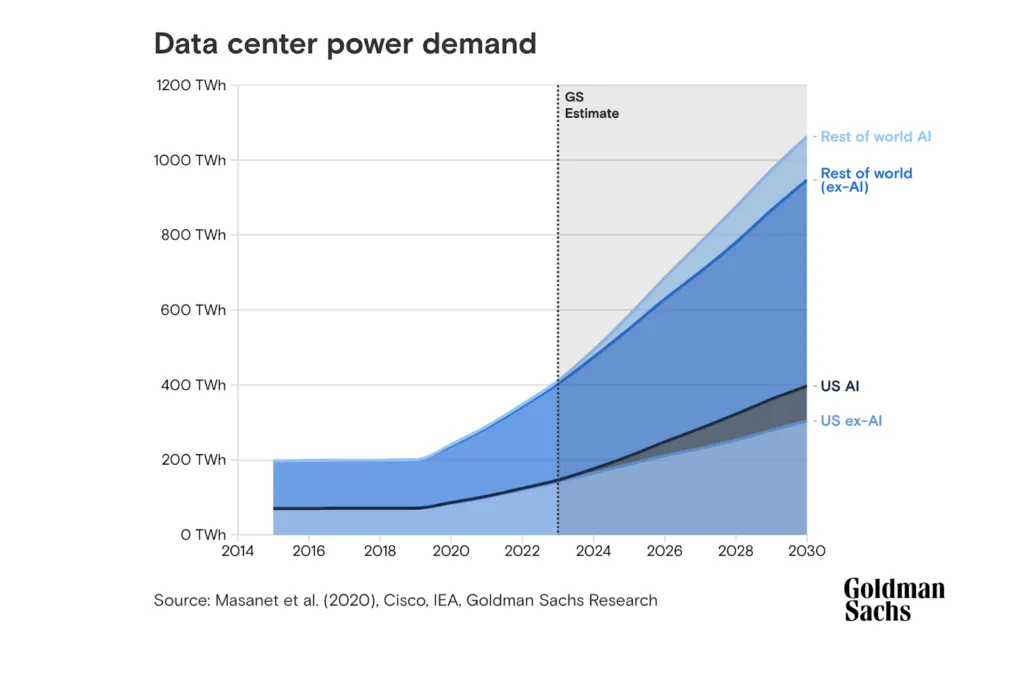

Data center investments surge with AI demand

The race to expand data centers capable of supporting cloud computing and AI operations continue. This week, multiple investment announcements highlighted the growing demand for AI infrastructure in the U.S. Trump announced that Emirati billionaire Hussain Sajwani would be investing $20 billion into the United States so that cloud and AI data centers could be built in Arizona, Illinois, Indiana, Louisiana, Michigan, Ohio, Oklahoma, and Texas. Amazon Web Services (NASDAQ: AMZN) announced they would invest $11 billion to expand their cloud and AI infrastructure in Georgia. At the same time, Microsoft (NASDAQ: MSFT) revealed an $80 billion initiative to build AI-enabled data centers globally, with approximately half of the investment focused on data centers in the United States.

The demand for data centers stems from two primary factors. First, AI operations are extremely computation-intensive, requiring vast amounts of data storage and processing power. As AI models become more sophisticated, the need for infrastructure to train and run these systems continues to grow. Goldman Sachs (NASDAQ: GS) projects that AI will account for approximately 19% of data center power demand by 2028, emphasizing the increasing role AI will play in this space—and quite literally, the physical space AI operations will take up in these data centers.

Second, data centers are seen as a stable investment with a clear revenue model. Despite the uncertainty surrounding profitability in the AI services market, data centers offer a steady demand for storage and computation services, ensuring a reliable return on investment. The persistent demand makes them a strategic asset for investors seeking long-term value.

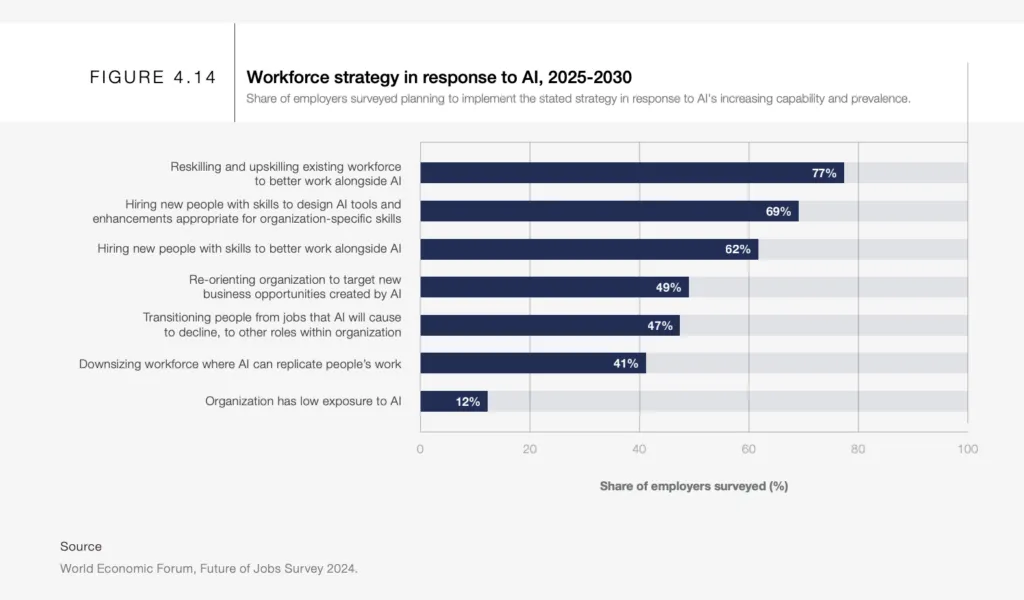

AI and the Job Market: Are the Fears Overblown?

The World Economic Forum (WEF) published its Future of Jobs report this week. Of the surveyed businesses, 41% indicated plans to reduce their workforce, citing AI’s ability to replicate human work as a driving factor.

So, who is most at risk? According to Pew Research, 19% of American workers hold jobs that are “most exposed” to AI. Interestingly, individuals with college degrees are twice as likely to be exposed to AI-driven disruption compared to those without degrees, as their jobs tend to be more cognitive and analytically intensive—an area where AI excels.

However, I don’t think the risk of mass AI-driven layoffs is as severe as the headlines suggest. While businesses are definitely exploring ways to improve efficiency and cut costs using AI, the transition is unlikely to happen as quickly as many people fear. Companies often overestimate how fast they can overhaul their tech stacks—I don’t think I have ever seen a technical project delivered by its original deadline–and even when companies do integrate AI tools, human oversight remains essential, especially in its early stages.

In order for artificial intelligence (AI) to work right within the law and thrive in the face of growing challenges, it needs to integrate an enterprise blockchain system that ensures data input quality and ownership—allowing it to keep data safe while also guaranteeing the immutability of data. Check out CoinGeek’s coverage on this emerging tech to learn more why Enterprise blockchain will be the backbone of AI.

Watch: Micropayments are what are going to allow people to trust AI

08-22-2025

08-22-2025