|

Getting your Trinity Audio player ready...

|

Enterprises and governments continue to increase their adoption of the BSV blockchain, a rising wave that Ayre Ventures wants to help startups ride all the way to the bank.

The final day of the London Blockchain Conference 2023 saw a presentation by Paul Rajchgod, Ayre Ventures (AV) Managing Director, Private Equity, on “The Wave of Enterprise Adoption” currently underway on the BSV blockchain.

For the uninitiated, Rajchgod informed the audience that AV is led by none other than entrepreneur, philanthropist, and London Blockchain Conference founder Calvin Ayre. AV has a passion for projects based on BSV’s scalability and utility, as well as projects involving unrelated emerging technologies, real estate, and publishing.

Ayre Venture’s goal is to ‘positively disrupt’ the tech space based on BSV blockchain’s ability to reshape the world. Over the years, AV has invested in numerous companies utilizing BSV blockchain to strengthen what Rajchgod joked was their “unfair advantage” over rivals in sectors such as software, Bitcoin infrastructure, fintech, gaming, metaverse, media/publishing, and more.

Rajchgod observed that many of these companies “happen to be the top consumer-facing businesses in the BSV community.” Rajchgod joked, “I’m not just saying that because the CEOs of some of these companies are in the room.”

The reason these companies have managed to outpace the rest of the pack is in part due to BSV blockchain’s unbounded scaling, ultra-low costs as well as its resilience, a strength it has demonstrated time and time again. All of which are key requirements for further adoption by enterprises and governments.

It’s not easy being green (if you’re not on BSV blockchain)

Given the priority that both governments and enterprises are assigning to environmental concerns, Rajchgod was keen to emphasize BSV blockchain’s eco-friendly status, particularly in comparison with some notoriously energy-intensive proof-of-work (PoW) blockchains.

He asked the crowd to imagine a London Underground train traveling on a Sunday morning at 10 a.m. and the same train traveling at 5 p.m. on a Friday. Compared to the Sunday morning coach, the 5 p.m. train will be “very packed, very busy, very uncomfortable, but also very efficient” in terms of getting a large number of people where they need to go. “That’s what a typical block is like on the BSV blockchain versus other chains.”

Rajchgod expanded on this, noting that in the previous week, a single BSV block contained around 3.7 million transactions. “A lot of other blockchains don’t have that kind of activity in a whole week. This kind of activity is very common on the BSV blockchain.”

BSV’s level of activity is, therefore, “very efficient on an energy output per transaction basis.” More transactions and bigger blocks equal more efficiency per block, a metric that Rajchgod emphasized is “continuously improving.”

Zero excuses

BSV blockchain’s ability to cram more commuting transactions into its blocks has given it a well-earned reputation as the most cost-efficient blockchain, but Rajchgod offered some truly eye-opening specifics.

Loading a slide reading ‘Five Zeros, Then An 8,’ Rajchgod related how BSV-based companies like mintBlue are recording per-transaction costs of just $0.0000084, while some large enterprises have since pushed this as low as $0.000001.

Rajchgod cited these figures as evidence of the BSV blockchain demonstrating “economics at work: the more something scales, the lower it tends to cost on a per-unit basis.” While supporters of some other blockchains like to claim ‘that’s not how it works,’ Rajchgod says BSV blockchain “demonstrates that the laws of economics, business and capitalism also apply in the blockchain world, with an ever-declining transaction price on a per-unit basis. This makes it even more advantageous for enterprises and governments to finally adopt blockchain technology at long last.”

One big tasty data pie

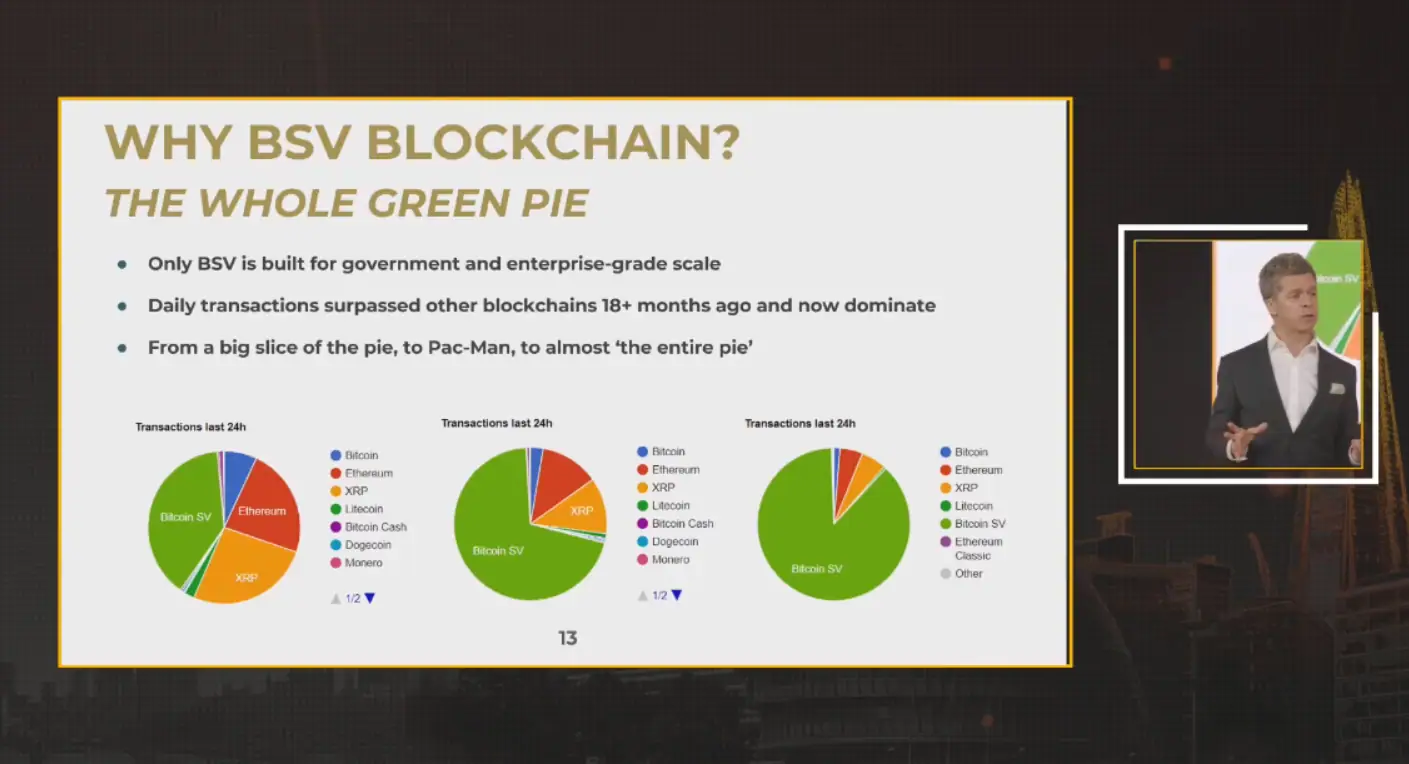

The growth of BSV blockchain’s transaction count over the past 18 months or so can be vividly illustrated in daily transaction pie charts. As Rajchgod put it, BSV blockchain initially represented a small slice of the pie, then a bigger slice, then “the Pac-Man that everyone talks about, to some days the whole damn pie.” BSV blockchain isn’t (yet) the whole pie every day, but the trend is clear. The other chains can’t compete with the BSV blockchain because they cannot scale. “That’s all there is to it.”

BSV blockchain’s demonstrated cost-efficiency and scaling capacity also allows it to serve as an enterprise-level data management and ‘value system.’ BSV blockchain’s micro-/nano-payments enable new and easy ways to pay for data usage, providing tremendous utility for data, digital activities, and services, including the vast requirements of Internet of Things (IoT) platforms.

Enterprises and governments looking to harness IoT capabilities are increasingly aware that BSV is the only blockchain capable of integrating ‘big data solutions’ in tandem with the rollout of IPv6 and Web3 platforms. It’s worth repeating: entities that embrace BSV blockchain will have a clear leg-up on their competition.

Join the party

Rajchgod offered several examples of companies in which Ayre Ventures has chosen to invest, each of which—mintBlue, nChain, Over-C, and Rekord—is succeeding in eclipsing its respective rivals because they possess the secret weapon that others lack.

AV is hardly alone in its support of BSV blockchain-focused companies. To date, the London-based Block Dojo incubator program has helped launch 40 companies that have received funding from over 60 investors. nChain, a 51% shareholder in Block Dojo, is also putting its not insignificant financial heft behind many BSV blockchain-focused projects.

Last but certainly not least, SNGLR Capital’s new SNGLR XTF Fund is targeting high-growth sectors enabled by (but not limited to) AI, IoT, robotics, and blockchain, and will use BSV blockchain where applicable.

Rajchgod summed up AV’s investment themes this way: BSV blockchain’s unique properties are making new ideas and business models possible, and AV is looking for companies that aim to modernize major industries such as computing, gaming, supply chain, fintech, and more. BSV blockchain will also provide the blockchain infrastructure that allows legacy (Web2) companies to incorporate Web3 solutions.

Companies looking to garner AV’s interest will require certain features. These include scalable business models with recurring revenue, high margins, and low fixed costs. It helps to have managers with proven track records in building high-growth companies. Preferably, your project is already in the ‘growth stage’ with a team in place and strong revenue growth, or you can at least demonstrate a growing body of customers using your product/service.

If your project meets the above criteria, Ayre Ventures wants to hear from you. Check out the Ayre Group website, AV’s Twitter feed, or LinkedIn account for more information.

Watch: Block Dojo x BSV Blockchain Association’s Spring Party kicks off London Blockchain Conference 2023

09-12-2025

09-12-2025