|

Getting your Trinity Audio player ready...

|

An absurdity is playing out in the Florida courts: a man named Ira Kleiman used a company called W&K Info Defence LLC to sue Dr. Craig Wright, alleging that Dr. Wright owed the company hundreds of millions of dollars in connection with Wright’s invention of Bitcoin. After trial, a jury awarded $143 million to W&K—only now it turns out that not only did Ira Kleiman never have any right to use the company, W&K is actually owned by Dr. Wright’s ex-wife and a family trust.

It’s a stunning twist considering Dr. Wright has spent years and untold millions defending the lawsuit, and it raises serious questions around Ira Kleiman and Freedman Normand Friedland (formerly Roche Freedman), the law firm who brought the case on behalf of Kleiman.

What basis did they have for using W&K to sue one of its own founders? Was it Ira’s idea, or part of Freedman Normand Friedland legal strategy? Now the truth is coming to the surface, where does this leave Dr. Wright, who has suffered through a multi-year lawsuit which saw him repeatedly slandered in the public domain? And if they knew that the lawsuit was built on fiction, why did Freedman Normand Friedland advise Kleiman to reject a $3 billion settlement offer before trial?

W&K was never Kleiman’s to use

In truth, W&K’s true owners have been railing against Ira’s lawsuit almost since it was filed. Before trial, Lynn Wright and Ramona Ang on behalf of the Tulip Trust (both members and part-owners of the company) took legal action against Ira Kleiman, hoping to stop him from using their company to sue one of its founders.

Then, after the Kleiman v Wright judgment was handed down, Lynn Wright and the Tulip Trust as the legitimate members of W&K sprang into action: they fired Freedman Normand Friedland, the firm Ira had appointed to represent W&K, and appointed attorney Paul Huck as W&K’s official representative.

Ira Kleiman and his attorneys say that W&K’s new corporate actions are boldly cynical attempts to avoid paying the $143 million judgment. But it was Ira Kleiman who found reference to the dormant Florida company as he picked through his late brother’s estate, and it was Ira Kleiman who improperly resurrected the company in Florida for the sole purpose of stapling it onto his lawsuit against Dr. Wright.

On top of that, Ira Kleiman’s story about W&K, its owners and its role in his lawsuit has repeatedly changed: he initially told the court that the company was 100% owned by his brother Dave, which he then revised to “between 50% and 100%.” Today, Kleiman has settled on characterizing the company’s ownership as ‘unclear’ but that no matter what, Dave Kleiman owned at least 50%. He doesn’t offer any basis for this, but does say that the 50% ownership now belongs to the estate, which Ira is in charge of, and therefore he was entitled to use it to sue Wright.

Dr. Wright’s story on the other hand has been entirely consistent: W&K was formed between him, Dave Kleiman and Lynn Wright in order to submit proposals to the U.S. Department of Homeland Security, which necessitated Dave’s involvement as a U.S. citizen. This is what Dr. Wright said in his pre-trial deposition, and it’s what is contained in the most recent filings arguing against Ira’s attempt to strike the new W&K attorneys. On top of that, W&K was little more than a blot in Dr Wright’s rear-view mirror when Ira Kleiman decided to resurrect the company and instate himself as managing member, and that was done entirely for the purposes of waging his legal battle against Dr. Wright.

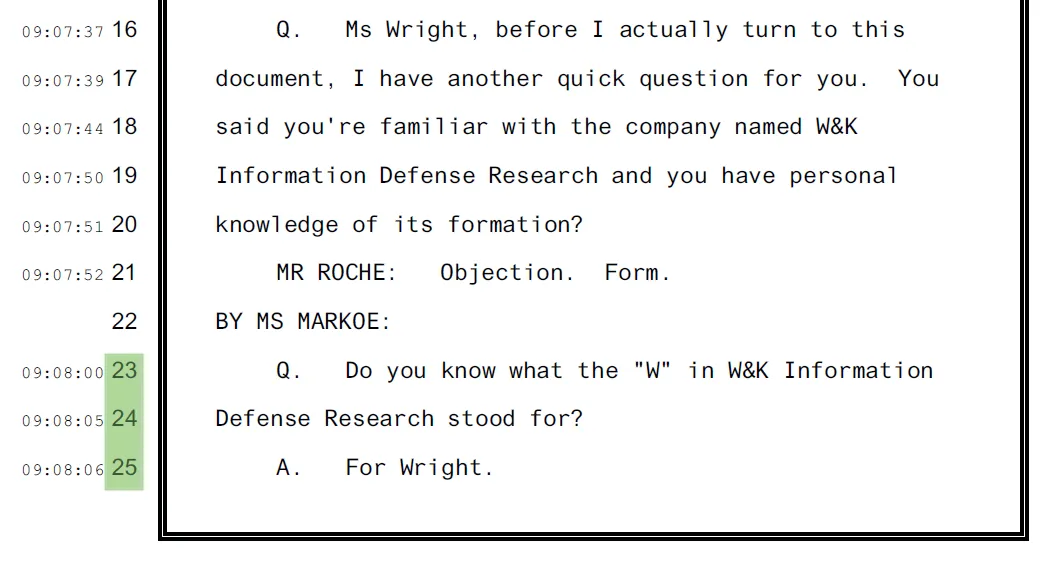

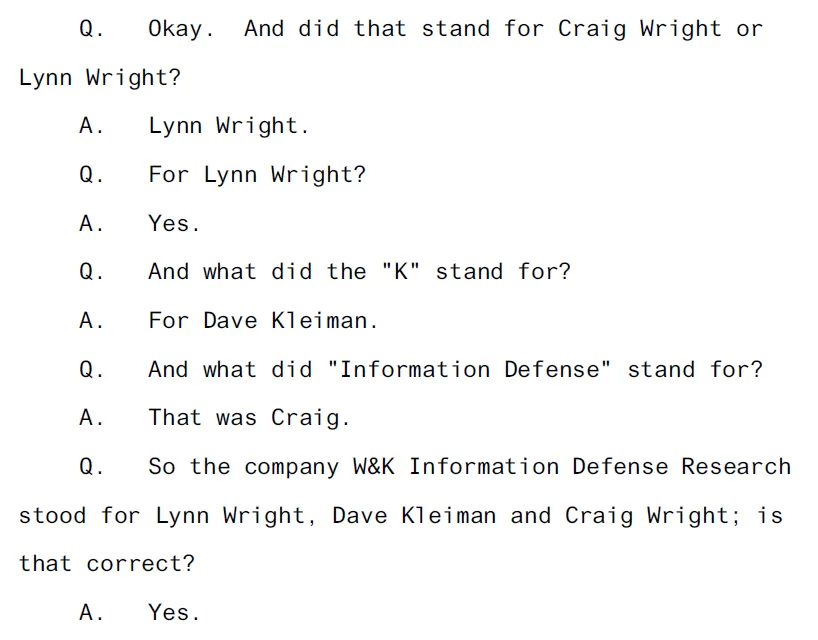

The same can be said of Lynn Wright’s account of W&K’s formation and ownership. Lynn Wright was deposed at the very start of 2020, and she confirmed that the company was formed between her, Dr Wright and Dave Kleiman—which is markedly more context and detail about W&K than Ira Kleiman has ever produced:

But even by Ira’s own version of events, he never would have had authority to take control of W&K. Firstly, under the Florida corporate code, the death of an LLC’s member disassociates that member from the company under § 605.0602(7)(a), and disassociation means that their right to participate as a member in the management and conduct of the company’s activities and affairs terminates (§ 605.0603(1)(a)). What limited rights pass to the Estate of the deceased can only be exercised “for the purpose of settling the member’s estate” under § 604.0504.

In other words, Ira’s probably right that W&K has been cynically exploited for the purposes of his lawsuit: but it was by him and his attorneys.

Since the case concluded in 2021, the folly of Ira’s doomed legal strategy has only become more obvious.

This can be seen in the court’s recognition—contrary to what FNF says—that there is a legitimate issue here. When FNF urgently tried to get the Florida court to rule that the new attorney appointment was invalid the court refused, saying that if there’s a dispute as to W&K’s ownership then the two on-going lawsuits against Kleiman by W&K’s current members is the best place for it to be heard and that as a federal court it had no jurisdiction to adjudicate ‘a single party’s inability to select its own lawyer’ under Article III of the U.S. Constitution.

Even so, this ruling created the unprecedented situation of having two separate and competing sets of attorneys listed as counsel of record for W&K. The absurdity of this was shown in short order when the court ordered Dr. Wright to provide a 1.977 form (a document setting out a person’s assets to aid in collecting legal judgments) to W&K’s attorneys—all of them, FNF and Paul Huck included.

It’s an impractical and untenable situation (the judge could find no precedent for it), the kind that courts usually go to great lengths to avoid. Faced with the reappearance of W&K’s owners, the court had two choices: affirm its own prior mistake in assuming that Ira Kleiman had the right to use W&K by striking the newly appointed attorneys or recognize that it’s an open question and hold fire until Lynn and the Tulip Trust’s aforementioned lawsuits against Ira provide a definitive answer to the ownership question.

If the court truly doubted the legitimacy of Lynn Wright and the Tulip Trust’s ownership of W&K then it would surely have done everything possible to avoid the present situation. Instead, it decided that having two competing attorneys on the docket for one plaintiff was preferential to denying W&K’s new attorney outright. That the court ordered W&K to provide the 1.977 form to both sets of lawyers—Huck included—is itself an indictment on the fact that Kleiman was ever allowed to include W&K in his lawsuit in the first place.

Does Friedman Normand Friedland even care?

Of course, this presupposes that Ira and his lawyers believe what they say in the first place. There’s good reason to believe they don’t.

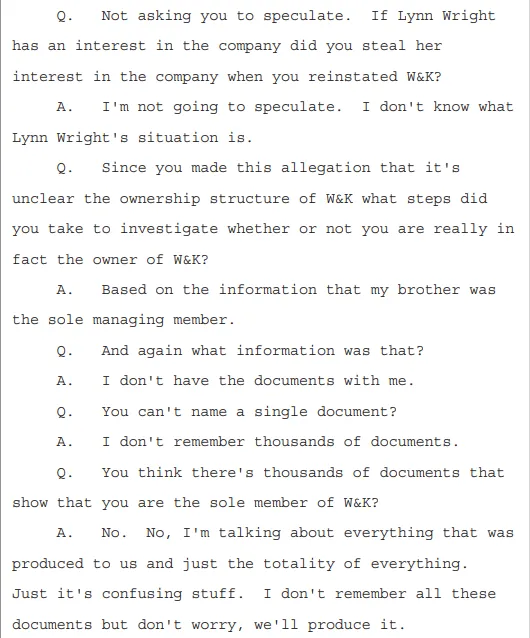

For instance, in light of what we now know about W&K’s formation Ira’s continuously changing narrative around the company makes its inclusion in the lawsuit seem like an awfully opportunistic bit of creative license to fill in the holes in the story that Dave Kleiman helped Wright invent Bitcoin. This becomes even more apparent from Ira Kleiman’s deposition, where he was asked about the circumstances behind W&K and what if any basis he had for thinking he could take control of W&K:

Of course, Kleiman never did produce such documents, and his position now is that he doesn’t know who owns W&K but that his late brother certainly owned half of it. In that context, to call Kleiman and his attorneys opportunistic might just be the most generous interpretation of their behavior possible.

This is particularly true when set against last year’s Crypto Leaks scandal, in which leaked videos of Kyle Roche, the Roche Freedman attorney partly in charge of Ira’s representation at trial, show him brag about using sham plaintiffs to go after ‘crypto’ competitors at the behest of one of the firm’s other clients, Emin Gün Sirer and Ava Labs. The leaked videos led to Roche’s ousting and the firm having to rebrand to Freedman Normand Friedland.

And finally, how about the fact that the question of who gets the $143 million judgment is only surfacing now because Ira’s attorneys waited a full year to do anything at all about it? Even Ira was fed up with his attorney’s total disinterest in pursuing the judgment: he took the extraordinary step of writing to the court directly to complain that he was not receiving adequate representation from Freedman Normand Friedland:

“At this point, I honestly don’t believe they want to recover the W&K judgment.”

Could that be because they know W&K’s $143 million award ultimately has nothing to do with either them or Ira Kleiman, and that the entire exercise has been a commercially driven attack on Dr. Craig Wright, an obvious threat to Freedman Normand Friedland’s crypto clients?

Even more, if it does turn out that Kleiman was fraudulent in reinstating and assuming control of W&K, then Ira’s lawsuit starts to look a lot more like extortion than a genuine dispute and Dr. Wright has ample bases to take action against both Kleiman and the firm. Maybe the fraud was Ira’s decision, in which case he’s more than deserving of whatever consequences—civil or criminal—that may come.

But if Ira was used as a mere pawn—as Kyle Roche himself was filmed saying and as Ira himself has suggested—then his lawyers have baited him into a potentially life-ruining situation using the promise of hundreds of millions of dollars taken from the Satoshi fortune. For that, even Ira Kleiman deserves some sympathy.

08-12-2025

08-12-2025