|

Getting your Trinity Audio player ready...

|

Most digital currency investors are underwater on their investments, according to the Bank for International Settlements (BIS). In a recent report titled “Crypto shocks and retail losses,” BIS analysts explored why digital currency users participate in the industry, patterns in their market behavior, and how recent events in the digital currency industry lead to certain outcomes for traders.

“This Bulletin addresses three main issues surrounding the crypto market,” the report states. “First, it investigates trading behaviour by large and small investors around the world during the Terra/Luna and FTX meltdowns. Second, it assesses whether users made or lost money on their investments on average. And third, it analyses whether the market turmoil in crypto and DeFi in 2022 had any discernible effects on financial conditions in the broader financial markets outside the crypto universe.”

Here are the key takeaways from the report and what the BIS learned about the digital currency market from the data they collected and analyzed.

The growth in blockchain daily active users

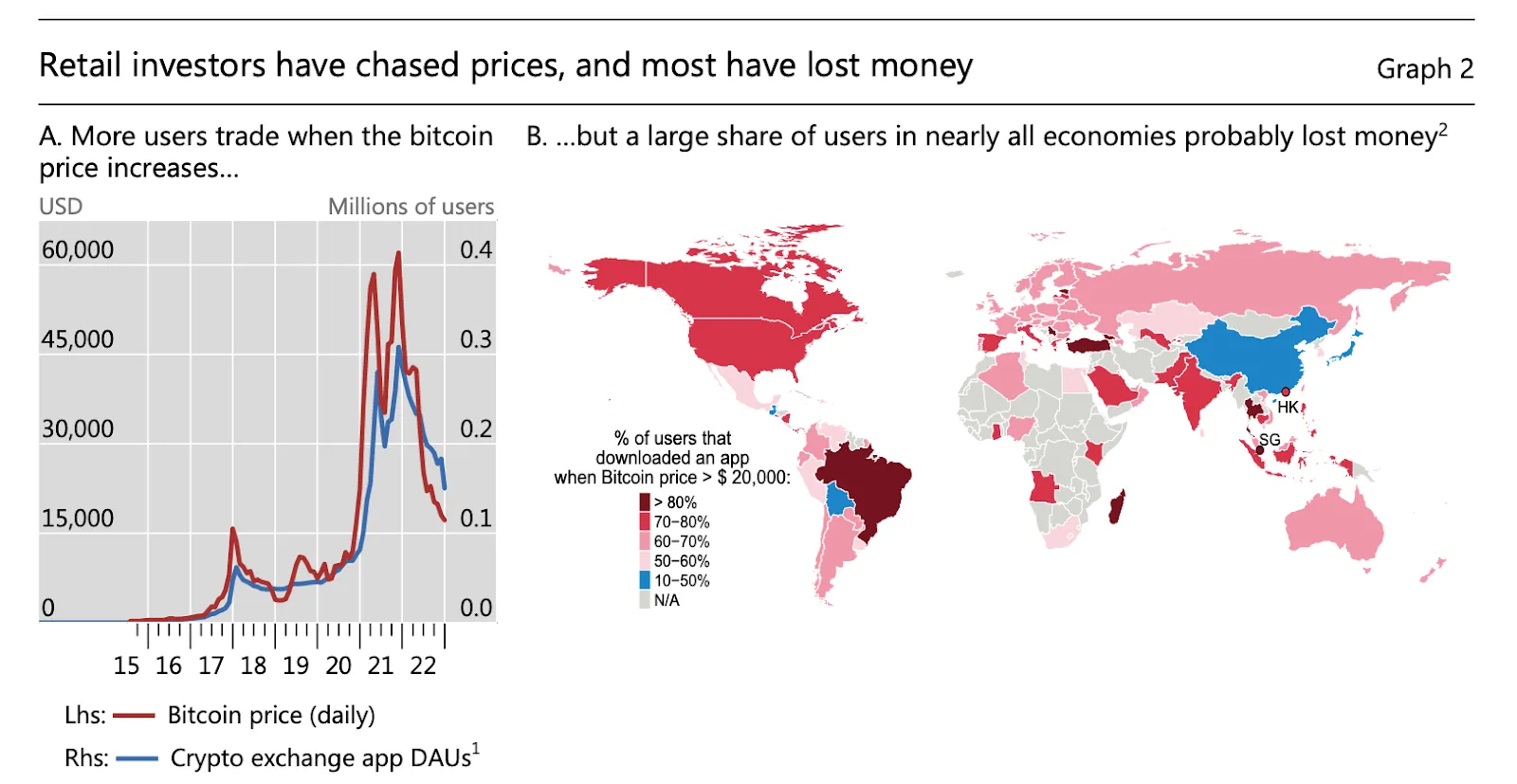

The BIS learned that there is a strong correlation between the price of digital currencies, the number of new people joining the industry, and the amount of trading activity taking place.

“Between August 2015 and its peak in November 2021, the price of bitcoin [BTC] rose from $250 to $69,000. Meanwhile, the monthly average number of daily active users grew from around 100,000 to more than 30 million globally. During the rapid price increases in late 2017 and early 2021, around 100 million and 500 million new users joined,” the report states.

However, the increase in daily active users lagged the rise in price by about two months, which led the BIS to conclude that new users enter the digital currency industry because they are attracted by the high prices and the idea that the prices of digital currencies will continue to rise.

When to buy and when to sell digital currency?

One metric the BIS examined to pinpoint the number and growth of daily active users was digital currency exchange downloads; subsequently, they assumed that the average user bought $100 worth of BTC the day they downloaded the exchange app on their phone. From that data, the BIS discovered that 75% of digital currency users downloaded a digital currency platform app when the price of BTC was above $20,000. The BIS ran many simulations using that data, and in nearly all scenarios, the average user would have been underwater by December 2022.

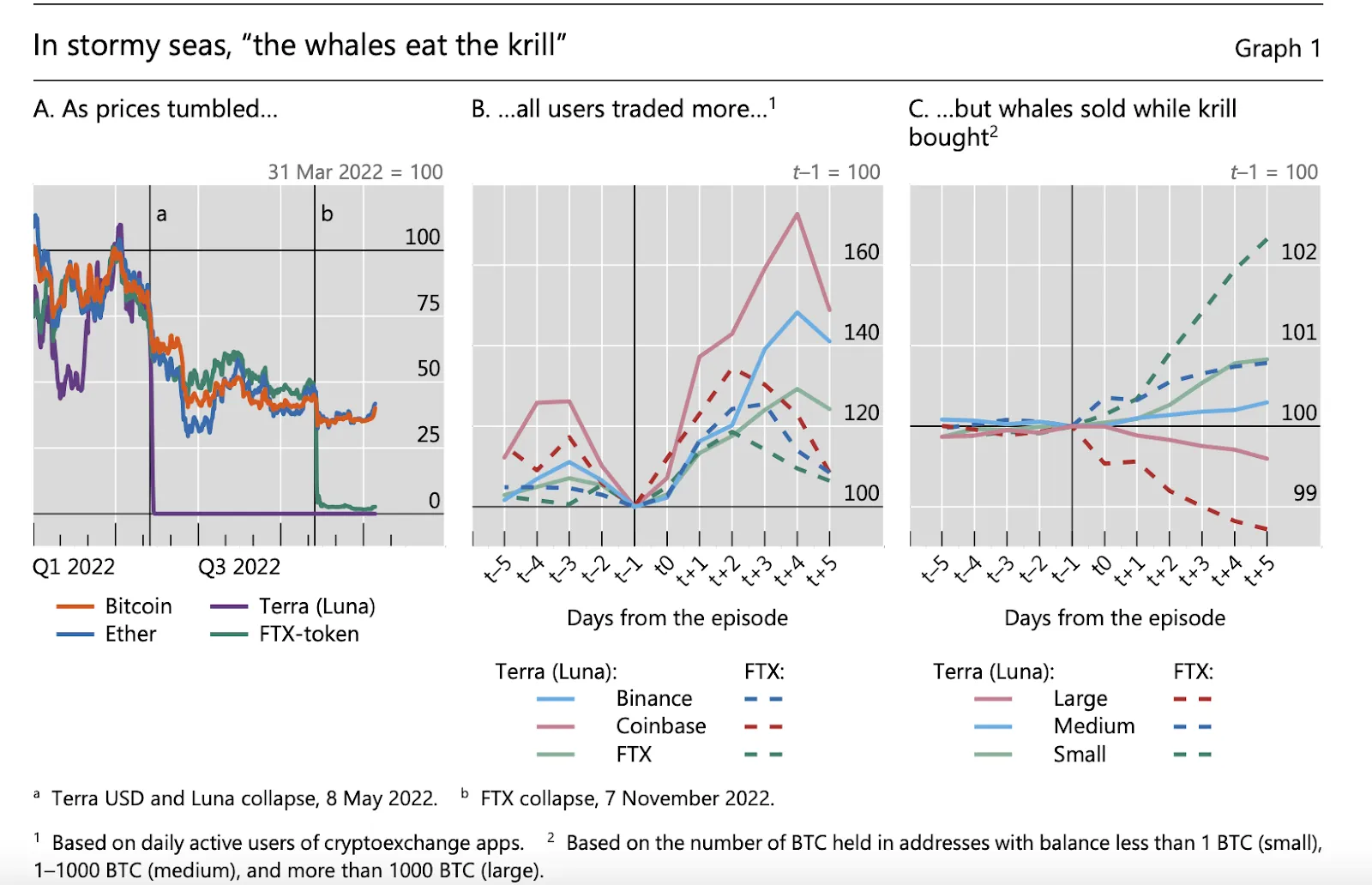

The only group of investors that came out of each scenario in the money were the whales. The data found that individuals that held 1,000+ BTC were reducing their BTC holdings when small to medium-sized investors were ramping up their purchases. The Terra/Luna and FTX collapses were significant factors in that trading equation. The data showed that trading activity increased shortly after each event took place. However, small investors, medium-sized investors, and whales each approached the collapses differently from a trading strategy perspective; while small and medium-sized investors rebalanced their portfolios by selling their high-risk digital currencies that were under duress due to the collapses and buying digital currencies that they believed were lower-risk, whales were selling their digital currencies and reducing the overall amount of BTC that they owned.

In summary

The data BIS collected and analyzed shows that most digital currency market participants are attracted to the industry because they believe they can make significant amounts of money. However, that philosophy has left a majority of the participants that made their first purchase after 2015 underwater, while inexperienced investors chased the potential profits that they could make, especially during volatile periods such as the Terra/Luna and the FTX collapse, experienced investors saw those events as an opportune time to begin selling. As a result, experienced investors—whales—are the only group that invested post-2015 that is most likely in the money.

Watch: Blockchain Venture Investments Driving Utility for a Better World

09-18-2025

09-18-2025