|

Getting your Trinity Audio player ready...

|

Binance recently tried to bulldoze Indian exchange WazirX into publicly retracting statements about its ownership, a new report reveals. One news outlet says Binance threatened WazirX, citing leaked emails between the two exchanges, but the owners of the latter refused to heed the “unethical” orders.

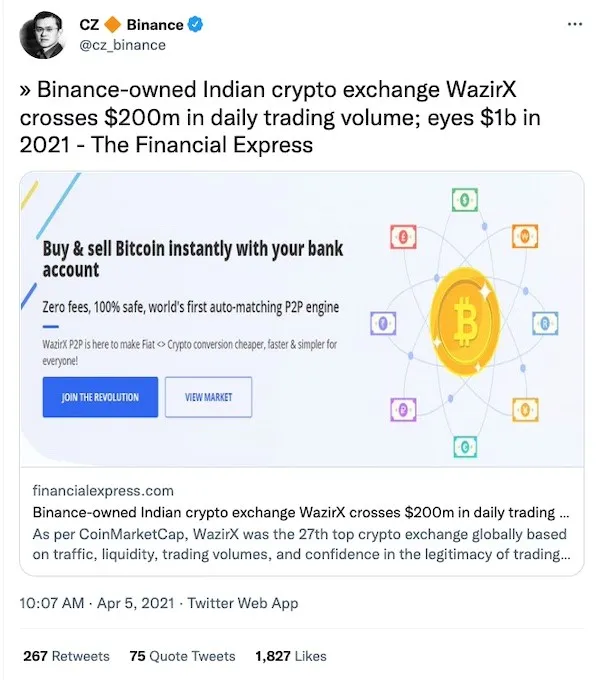

WazirX ownership has remained one of the most intriguing mysteries in the digital asset world. In November 2019, Binance announced in a blog post that it had purchased WazirX. In the three years that would follow, Changpeng Zhao would state how WazirX was doing well and setting new records every other month.

This all changed last year when Indian authorities cracked down on the exchange on allegations of aiding in money laundering. Binance quickly amended the blog post to say the purchase “was limited to an agreement to purchase certain assets and intellectual property.”

Since then, CZ has been involved in a public spat on social media with the management of WazirX, led by CEO Nischal Schetty.

Leaked emails have revealed Binance’s attempts to blackmail WazirX into clearing the former’s name.

In the email, which Binance sent on January 26, it demanded that WazirX issue a “clarificatory statement” retracting all its founders’ statements about Binance’s ownership of the exchange. It also demanded that its name be erased from all mentions in WazirX’s terms of service and branding materials.

Schetty refused to bow down to the threats. In his response, he termed the demands as unethical and accused Binance of attempting to use “media pressure and threats to force Zanmai into issuing false and misleading statements as ‘clarifications.'”

Zanmai is the parent company of WazirX.

WazirX: The exchange no one wants

In his response, Schetty reiterated his long-held statement that Binance owns WazirX and that any statements to the contrary are Binance’s attempt at diverting bad publicity.

“Zanmai has not made any false or misleading statements regarding Binance’s role and responsibility in operating the WazirX platform, and Binance’s control over WazirX’s user assets. Zanmai transferred the control and ownership over the WazirX platform to Binance,” Schetty wrote.

Binance has made tens of millions of dollars from WazirX since the acquisition, Schetty went on. When things were rosy, CZ brag about the Indian exchange’s growth.

“Binance has unilaterally withdrawn significant amount of moneys (over USD 67 million) which has been earned as trading fees on the WazirX platform. Binance transferred these amounts to an internal account solely controlled by it since Binance owned the WazirX wallets,” Schetty noted.

Schetty attached an email chain between WazirX’s vice president of finance, Tushar Patel and Brian Schroder, the Binance.US CEO. While partially redacted, the email chain dictates that WazirX would continue “access[ing] and operat[ing] these accounts for the sole benefit of Binance.” Binance was designated as the sole and absolute owner of these accounts.

While Schetty is putting on a brave fight against CZ, such a move would likely crush the Indian exchange, sources from both exchanges told one outlet. According to its proof of reserves report earlier last month, the exchange stores over 90% of its funds in Binance wallets.

However, in a blog post, Rajagopal Menon, the vice president of WazirX, played down the significance of the Binance links, saying that “while the user assets may be on Binance wallets, WazirX has the API (application programming interface) which gives us control of the tokens.”

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

09-18-2025

09-18-2025