|

Getting your Trinity Audio player ready...

|

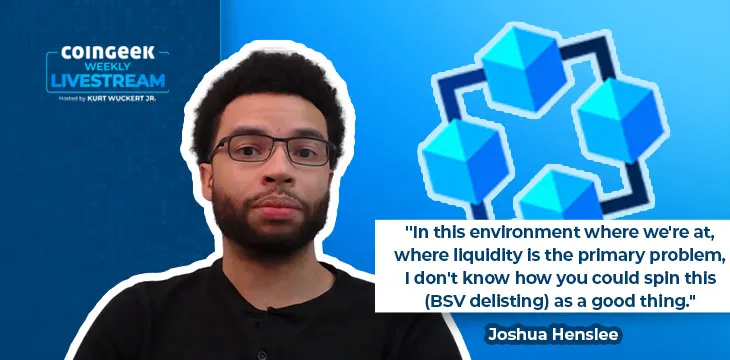

Robinhood (NASDAQ: HOOD) recently became the latest exchange or trading platform to delist Bitcoin SV. Influencer Joshua Henslee released a new YouTube video sharing his thoughts on this event and its implications.

Robinhood delisted BSV – What gives?

Robinhood delisted BSV, and it will come into effect on January 25, 2023. This follows Bitfinex delisting BSV at the end of 2022. Henslee describes it as “just another blow,” although he sees it as short-term.

Henslee always keeps it real and acknowledges that this isn’t a positive event. He scoffs at people who are trying to spin this as a good thing, noting that liquidity is one of the main problems in the immediate term. Robinhood is a major off-ramp, and with the HandCash USDC solution still not active, it’s going to cause problems for some in the BSV ecosystem who need to exchange their tokens for dollars.

“Personally, my only option now is Bittrex,” he says.

Secondarily, Henslee points out that whatever BSV coins Robinhood has will likely now be liquidated. This will likely put more downward pressure on the token price, which fell 7% when the news first broke. While the number of coins Robinhood has is unconfirmed, Henslee says that he has read it’s around 170,000.

Looking at things from a purely business perspective, Henslee says “it makes sense” for Robinhood to delist BSV, given that there probably wasn’t that much usage of it. With economic worries ahead, firms across the board are looking to cut costs and tighten their belts, so the decision was likely based on that.

“They might just need the cash,” he points out, noting that the firm may be financially impacted by the seizure of Sam Bankman-Frieds’ Robinhood stock.

As an entrepreneur in the BSV ecosystem, Henslee says that if Bittrex delists the coin, he’s going to have a significant problem.

“I can’t pay my bills in BSV,” he notes, highlighting the need for dollars until that changes. “We need a native stablecoin on BSV that we can actually redeem for dollars,” he reflects.

Henslee finishes the video by reiterating his bearish stance, including for BSV, in the short term. However, long term, he’s still bullish and continues to build applications on the BSV blockchain.

Key takeaways from this Joshua Henslee video

- Robinhood has announced that it will delist BSV, and this will take effect on January 25, 2023.

- Joshua Henslee sees this as a problem in the short-term, compounding liquidity problems. However, he’s not worried about it in the long run.

- Henslee foresees a significant problem for BSV entrepreneurs if Bittrex delists the coin and the Hand Cash USDC feature is delayed. It will then be difficult for many people to sell the coin for fiat to pay bills.

- Robinhood has likely done this as a business decision rather than as a slight against BSV.

- While it might cause problems in the near term, Henslee is still bullish on BSV in the long run and continues to build apps on the blockchain.

Watch: The Future of Digital Asset Exchanges & Investment

08-20-2025

08-20-2025