|

Getting your Trinity Audio player ready...

|

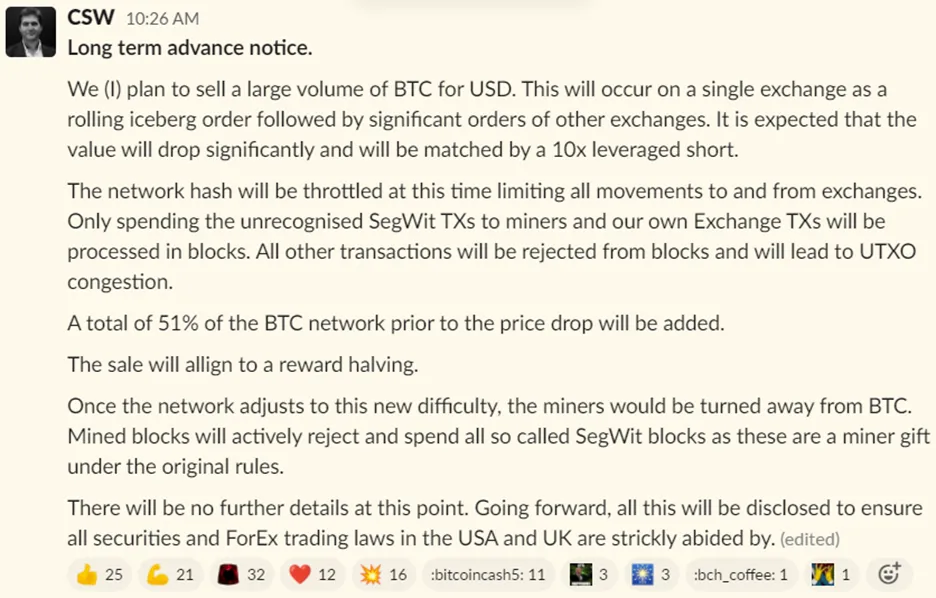

Despite claims from leaders in the Bitcoin SV ecosystem that BSV and BTC “can coexist for years as they do not compete” or the sudden desire to protect BTC HODLer’s “life savings” despite past bodacious claims of “rolling icebergs,” I assert that BSV and BTC (nor BCH) cannot all succeed in the long-term.

Each of the three competing chains implement the same SHA-256 hashing algorithm, which enable miners with the same hardware to switch chains based on current profitability. Again, despite talk from various leaders across the digital currency space, these leaders are hypocritical in the sense that they may publicly decry (or even delist) a coin despite mining it—thus propping up the very networks they claim to despise.

These circumstances were set in stone by Satoshi Nakamoto with the release of the Bitcoin software on January 3, 2009. I do not know if Satoshi foresaw multiple chains existing for a prolonged period with the same hashing algorithm, but the economics of the system work such that only one can survive.

Miners in the space are slaves to the block subsidy and coin price due to the paltry transaction volume on each of the three chains (yes that includes BSV). The subsidy is overwhelmingly the majority of the reward for winning blocks, thus force miners to switch chains when the price spikes on one of the chains to take advantage of the profitability.

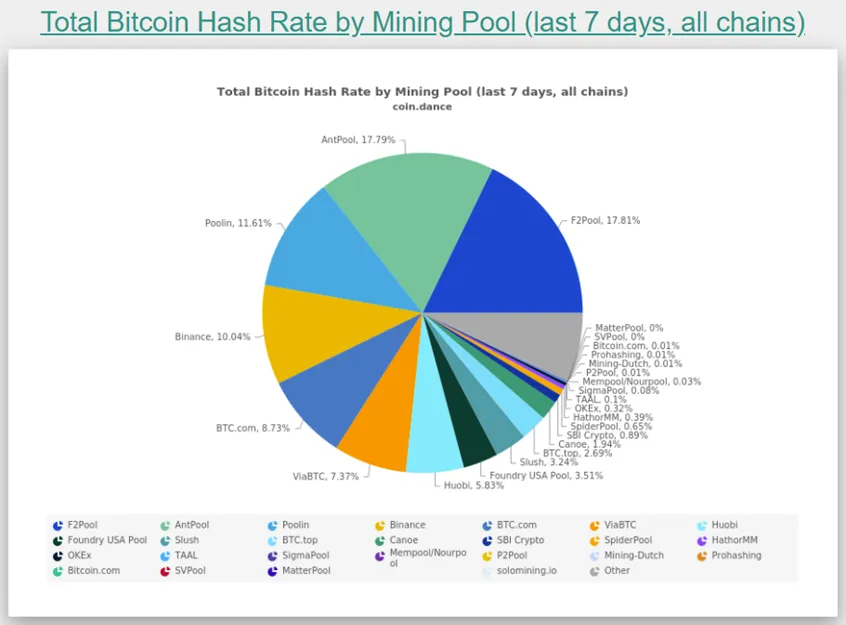

This is why you may see Binance with somewhere between 25%-30% of the current BSV hashrate despite not even supporting the coin on their exchange. Or you may see other BSV & BCH supporters (MatterPool, SVPool, Mempool, TAAL, Bitcoin.com) mining the supposed pet-rock, SegWit altcoin.

Hash rates on the three different chains are not absolute—they are relative. At a given point in time hash rate is distributed proportionally across the chains based on market forces. If one chain scales in price or transaction volume, miners will switch to that chain without hesitation—regardless of their political positioning.

For example, if the BSV price happens to spike to just 10% of BTC, this will have significant implications on the market. Miners must switch their ASICs from BTC to BSV to take advantage of the sudden profitability, reducing those networks hash rate by the same amount, thus increasing block times and fees.

Perhaps this is why BSV is one of the most heavily shorted coins?

1/ Is there evidence that short interests are suppressing #BSV price?

I explored this question and would conclude there is at the very least good evidence for suspicion. @292

BSV Shorts – orange

BTC Longs – blue

BSV Longs – aqua

BTC Shorts – yellow https://t.co/TR17kzgd9c pic.twitter.com/iU0VCQmwHW— Kappy (@happy4kappy) February 28, 2021

A 10% spike will not have the same impact as sustained volume over a long period. Once this happens miners will switch, leaving the other chains to die. Brendan Lee of Elas Digital has done a great video on Streamanity named ‘Chain Death’ on how this could practically play out:

I do not think Chain Death is a viable scenario for BTC because BTC Core developers will ‘hard-fork’ out of it by changing hashing or difficulty algorithms. To quote a friend on this exact scenario, if Core does this “then they’re f%&#ed.”

Why does the doe still try to flee after it is already between the lion’s jaws?

BSV cannot scale without necessarily eating BTC and BCH. The business of mining has huge capital and resource requirements, they simply cannot afford to play politics when it comes to profitability. Just as they are slaves to the subsidy now, they will be forced to mine the chain with sustained transaction volume.

08-09-2025

08-09-2025