|

Getting your Trinity Audio player ready...

|

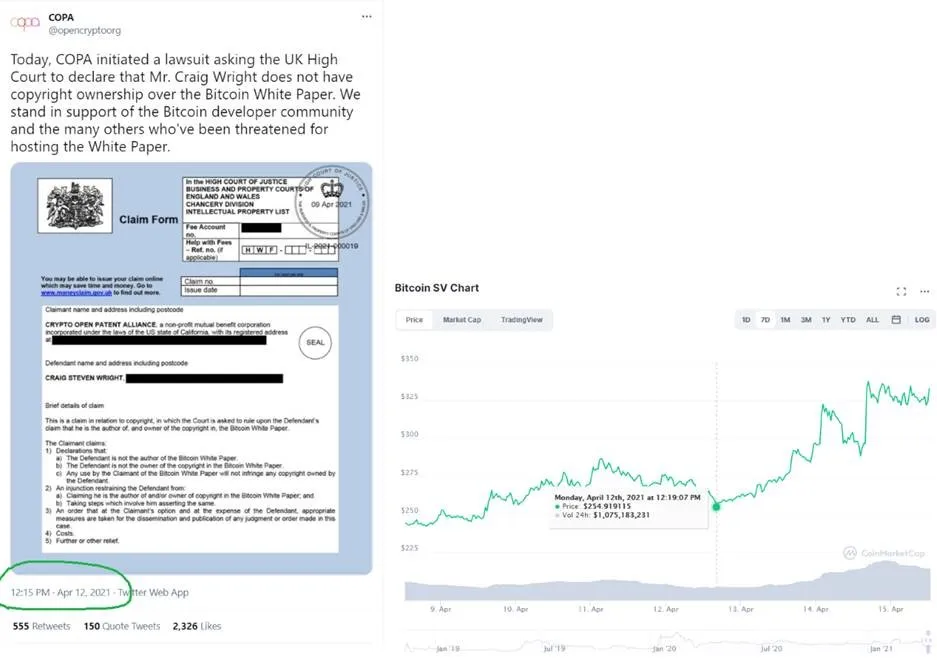

The price of Bitcoin SV (BSV) has been on the rise, and it’s no coincidence that the price rise began on the same day the Crypto Open Patent Alliance (COPA) announced its filing a lawsuit against Dr. Craig Wright.

But isn’t this bad news?

For those who aren’t up to speed on the matter, COPA has filed a lawsuit in the High Court of Justice in England and Wales, to declare that Dr. Wright is not the author of the 2008 Bitcoin white paper. COPA is an organization that was formed to prevent “patent lockup” by companies claiming ownership of key blockchain-related concepts, that “stifle innovation.”

Some people cheered for COPA when this news came out and believed that the lawsuit would be the demise of Dr. Wright and inadvertently, the demise of BSV—but are they right?

The market says otherwise, and the smart money is embracing the COPA lawsuit and seeing it as a positive event.

This is Brilliant. Blockstream submits to jurisdictin through COPA in Craigs home town and gives Craig the benifits of evidence as a defendant and lets Craig get all his evidence in so many ways in front of a judge in the best way he could have dreamed of.

— Calvin Ayre (@CalvinAyre) April 13, 2021

What the market thinks

As of press time, BSV is trading at $372.83, a whopping 45% increase from the price BSV was at before the lawsuit was announced. So why has the market reacted like this even though some individuals think this lawsuit marks the decline of Dr. Wright and the blockchain network that he supports? Because those who think that “this is the end of BSV” are wrong.

The “smart money” might be seeing the COPA lawsuit as a chance for Dr. Wright to prove himself, and they may have the belief that he will be able to successfully prove himself. This would undoubtedly be a positive event for the Bitcoin (BSV) ecosystem and would squash many questions and concerns that some individuals have had related to Dr. Wright for quite some time now.

The action we are seeing in the market may be a result of individuals anticipating the outcome of the COPA vs. Dr. Wright case and making a bet on what they believe will happen in the future.

Why did COPA wait so long?

To answer this question, we are going to have to zoom out a bit. Dr. Wright is the chief scientist at nChain; when it comes to the number of patents a company has for innovative blockchain technologies, nChain is one of the top five companies in the world. That being said, COPA’s mission and goal are at odds with nChain’s patent strategy, and there is a good chance that nChain has patented several blockchain innovations that would help the members of COPA succeed at a faster rate.

Now that we have zoomed out, we can zoom back in. Coinbase (NASDAQ: COIN)is a founding member of COPA. and Interestingly, COPA’s filing aligns with the Coinbase public listing; this may be because the IP that Coinbase owns is factored into its valuation. With that in mind, it would be beneficial if Coinbase had access to IP that could boost its valuation, IP that may be out of its reach because it has been patented by Dr. Wright and nChain.

BSV is a threat to COPA

What all of this tells us is that the original Bitcoin (BSV) is a threat to COPA. What we are seeing is COPA trying to eliminate the threat that could damage the futures of the companies within COPA, and they are trying to do this by going after one of the first and most vocal supporters of the original Bitcoin (BSV), Dr. Craig Wright.

What we are also seeing is the market trying to predict the outcome of the COPA vs. Dr. Craig Wright court case. It is no secret that there is a degree of speculation that takes place in the digital currency markets, and good or bad news tends to have a major effect on the markets. But ever since the COPA lawsuit was announced, BSV has climbed nearly 50% and is fast approaching its all-time high of $420.61

The correlation between the COPA lawsuit and the price action of BSV is something you are going to want to keep your eye on as the case progresses. Because in time, we will see if the bet that the smart money has made on BSV based on Dr. Wright’s ability to provide evidence will pay off.

09-16-2025

09-16-2025